Preamble

A company increases profit by a combination of:

- Increase revenue (selling more (product), takeover competitors, increase selling price)

- Reduce cost

- Increase selling price

This company is Hibiscus Petroleum Bhd, a SPAC. It sells crude oil (and gas). On 31st March 2018, it took over the operation of North Sabah EOR PSC from Shell that currently has a production of about 15,000 bpd. Hibiscus bought Shell’s 50% share of this PSC in 2016 and due to the necessary agreement of PSC partner, Petronas Carigali and other regulatory requirement, only recently took over operation.

Introduction

Oil price (BRENT) had gained about 40% since July 2017.

It is expected to consolidate higher due to the following reasons:

- Strong demand worldwide, especially in US, China and India

- There was a prolong minimal investment in exploration and development of oil reserves

- Collapse of Venezuela oil production due to economic strife brought about by political division

- Rising geo-political tension in Middle East and the possible re-imposition of sanction on Iran

- General natural depletion of oil production of about 3 to 8% per annum

https://klse.i3investor.com/blogs/teoct_blog/154857.jsp

https://klse.i3investor.com/blogs/teoct_blog/158175.jsp

Thus, as it is expected that oil price will appreciate further going forward, company that is in the business of producing oil will benefit most. This is reflected in oil majors share price and recently PETRONAS had reported improved profit too.

Hibiscus current production

A full overview of Hibiscus can be view at http://www.hibiscuspetroleum.com/.

Briefly, the company has two major oil production fields, namely Anasuria (UK-North Sea) and North Sabah EOR PSC (Malaysia).

The financial year ends at 30 June. And the latest (3rd) quarterly reports for the Financial Year 2018 showed the following production:

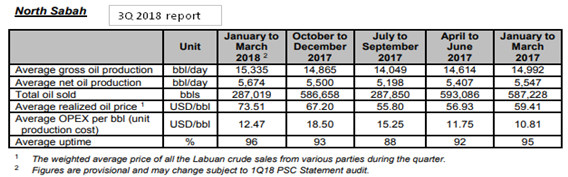

North Sabah EOR PSC was only taken over on 31 March 2018 and thus no production was included in the 3rd Quarter. Based on information provided, the production level for North Sabah is as follow:

Please note that this profit exclude the (net) RM 89.6million negative goodwill recognized in 3rd quarter that, along, provides RM 0.056 per share, i.e. a total earning per share of RM 0.12 for FY2018.

Financial Year 2019

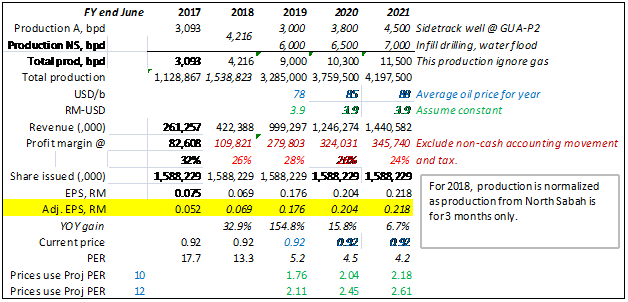

However for FY2019, total production will be more. There is plan to increase production at Anasuria (GUA-P2 side-track already contracted for end June 2018) as well as North Sabah. Let’s be conservative:

- Anasuria +200, to gives 3,000* bpd (*this is an average over the whole financial year & no gas)

- North Sabah +500 to gives 6,000* bpd (*this is an average over the whole financial year)

Oil price is expected to stay firm, so USD 78/barrel would be conservative. Ringgit exchange rate of 3.9 will give revenue of RM 999.3 million. Using profit margin of 25% gives profit after tax of RM 249.8 million, i.e. RM 0.157 per share, a 124% increase from FY2018 (exclude negative goodwill).

So at current price of RM 0.925, the forward PER will be about 6.

The above is tabulated as:

For FY2018, the table excludes the negative goodwill. If included, the EPS would be about RM 0.12. There might be more non-cash movement like impairment, write-back, etc. that will increase or decrease the EPS in the 4th final quarter.

Let say, it would be RM 0.1, then PER is 9.3 instead of 13.9.

So base on purely oil production (gas sales not included), the potential increase of FY2019 would be 140% from FY2018.

All this is achieved without any debt.

Looking at world major oil producers, the average and median PER (based on closing prices on 8/6/18) are as shown in the table.

Most if not all oil majors are vertically integrated. That is they have both upstream and downstream (refining, petrochemical) businesses. Hibiscus is a pure play oil producer currently. Their earlier investment in exploration has been written off.

Assuming price earnings ratio (PER) of just 10 (45% discount to median), the possible price is potentially:

RM 0.157 x 10 = RM 1.57 for FY 2019 (ending June)

There is thus a potential gain of 1.57/0.925 = 70%.Excluding Imperial Oil Ltd PER of 52.63 will gives average and median PER of 14.52 and 13 respectively. A PER of 10 will be 30% discount to the median.

Going further into 2020 and 2021, the estimated revenue and profit is:

The profit margin above is slightly higher than the previous table to allow for the lower operating cost of North Sabah. But going forward into 2020 and 2021, the cost should increase as service providers would be demanding more.

Management has indicated that borrowing, currently nil, will be undertaken to fund projects to enhance production like infill wells, water injection, compression and so on. It is estimated that RM 200 million loans would be comfortable, giving a debt/equity ratio of about 0.2. This should be earnings accretive.

Future oil prices assumed is conservative. Some analyst is forecasting triple figure. Currency exchange rate is assumed constant for simplicity.

So Hibiscus provides not only a near term potential gain but a medium term play too.

Risks

There obviously are many risks involved, some are listed below:

- Trade war – lead to lower demand thus lower oil price

- Recession - same as above

- Reservoir uncertainty – reduced production

- Labour unrest (especially in North Sea) – cannot get product to market

- Equipment breakdown limiting production – reduced production

Please note that this article was written over a span of times and therefore, there might be some changes to PERs quoted. However, it gives a general feel of the valuation.

Disclosure : I and my family own shares in Hibiscus.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

http://klse.i3investor.com/blogs/teoct_blog/166815.jsp