Greetings forumers, this is my first article on i3.

LAYHONG has been on many people’s radars lately as the share price has

fallen more than 40% over the last 2 months. Many have jumped in and

caught the falling knife. After considering all the info and rumours

that’s been circulating in the investment community, I have did some

research and have strong reasons to believe that the market has

overreacted by selling down the stock too much and thus value has

emerged.

I will post my findings in multiple parts. I welcome any constructive feedback and discussions on this idea.

First question to ask:

1) Why was Lay Hong’s recent result so poor?

The reason is simple: It was mainly because of EGG PRICES! Although higher feed cost was highlighted as the main reason in the quarterly report (more on this in my next article).

First, we need to understand the 3 different types of eggs Lay Hong sells:

- Table eggs – normal/cheap eggs that are sold at volatile market prices (low margin)

- Functional eggs – branded eggs with stable prices due to better pricing power (higher margin)

- Liquid eggs – customized pasteurized eggs sold to corporate customers like McDonalds (highest margin)

According to the annual report, Lay Hong currently produces 3 million eggs per day. So how many of these eggs are sold as the low margin table eggs?

Based on information extracted from the annual report, 34.2% of total egg revenue came from functional eggs. Since functional eggs are more expensive, let’s just assume it is only 30% of total eggs produced.

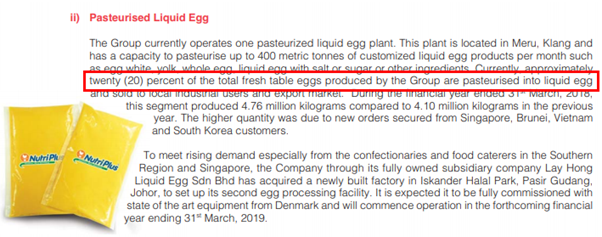

For liquid eggs, management disclosed that 20% of eggs produced were pasteurized into liquid eggs.

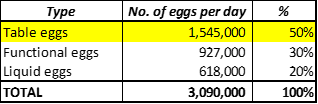

Therefore, the breakdown should be roughly like this:

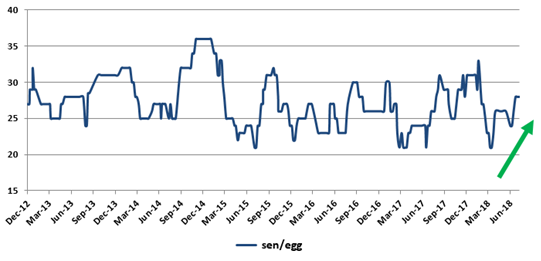

Now let’s take a look at the egg price trend.

I compiled the official egg price data from this website and presented it as a chart below: http://www.dvs.gov.my/index.php/pages/view/1825

We can see that Lay Hong had to sell their table eggs 35% cheaper compared to the last quarter!

The reason for such a large drop in profit from RM11 million to only RM2.3 million is because Lay Hong had to sell their table eggs cheaper while the costs to farm the eggs increased slightly.

To estimate the impact, let’s assume Lay Hong needed to sell their

table eggs cheaper by an average of 9 sen/egg compared to the last

quarter (assuming production costs remain flat to see only the impact

from egg price):

1.545 million eggs x 90 days x -9sen per egg = -RM12.5 million

This means Lay Hong’s 1st quarter profit was reduced by approximately RM12 million due to lower egg prices alone!

Now that we see how Lay Hong’s profit is so sensitive to egg prices, we know that PROFIT SHOULD REBOUND STRONGLY NEXT QUARTER by observing how egg prices have recovered after the Hari Raya low season.

Next question to consider:

2) Should Lay Hong be considered a high risk commodity business with low margins and volatile earnings?

Lay Hong’s management is actually working towards changing this:

They are building a second liquid egg plant which will be fully commissioned by this year! This will allow them to allocate more eggs to be pasteurized, thus reducing the volatility of their earnings in the future.

The conclusion of this article:

1) Lay Hong’s profit should rebound strongly,

2) and profits should become more stable in the future.

After

a 40% fall in share price, the above-mentioned negatives should be more

than adequately priced-in by the market as the stock have de-rated from

16x PER to only 9x PER now! Of course, there are some other

issues surrounding the stock that’s causing more concern. We will

discuss those in my subsequent articles.

Stay tuned for Part 2 where I will share why I think there’s even more EXPLOSIVE upside to Lay Hong’s prospects in the mid-term.

https://klse.i3investor.com/blogs/ckinginvest/172144.jsp