Highlights:

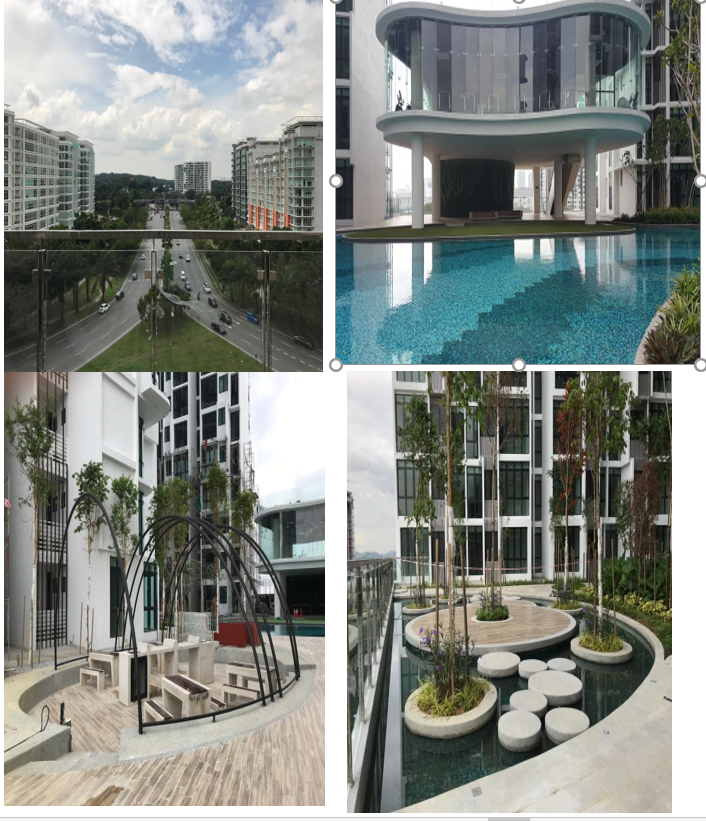

H2O project site PHOTO as per end of July 2018 (look like

completed, online surveys indicate that developer already handover to

unit owners)

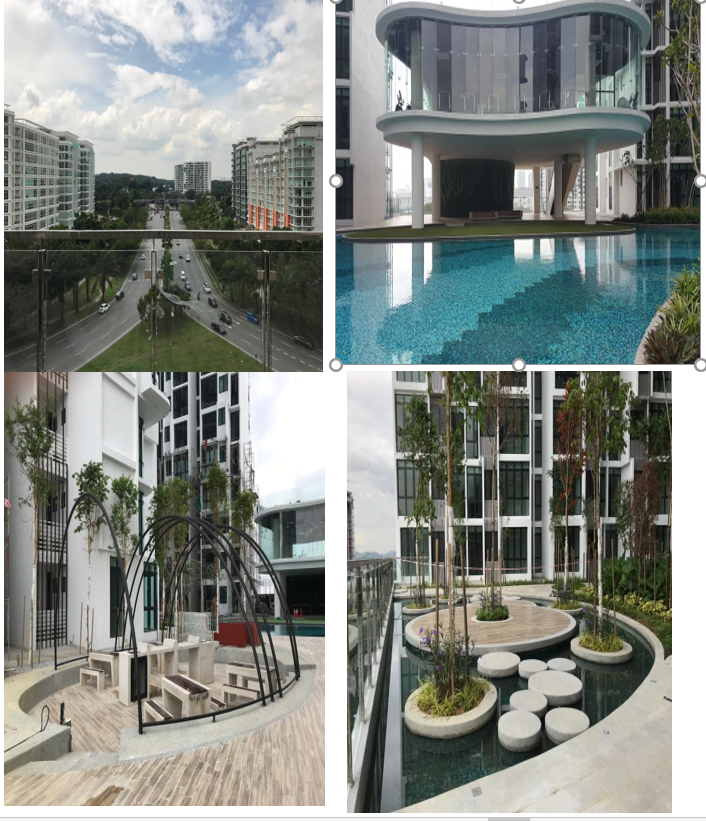

Sabah's Project site PHOTO as per mid and end of August (piling completed & started structure works)

Site photo above of Kota Kinabalu project can exhibit more on the progress and efficiency of Mmode (as they just secured the project in June 2018).

Kota Kinabalu (http://www.theedgemarkets.com/article/mmode-bags-rm26057m-job-mixed-commercial-project-sabah)

Source: Site survey

Piling stage normally more challenging in construction as you may hit rock etc during this stage, once piling works completed, other works like structure build up works can be fast. If construction works can be faster than schedule, it can save labour, equipment rental cost and also early delivery of project which enable it to take another new project.

The prospect and profit of a construction company depends on the ability and timely execution of the project in hand where Mmode has shown excellent progress in both its H2O (early completion) and Sabah KK project.

Prospect and Fair value for 2018 and 2019 (upcoming 12 months)

Let us have a look on the profit forecast (upcoming 12 months) based on its construction orderbook only as below:

*estimated from their qtr reports.

Estimated Total net profit from construction = RM9.4M (12 months)

Mmode currently in the mid of disposing its mobile contents businesses (from recent announcement). Let me assume there are no profit but about 0.3M loss contribution from mobile contents disposal.

Estimated Total net profit from both construction & Mobile contents (disposed) = 9.4M-0.3M = 9.1M

RM9.1M translated to EPS 5.6 sen. With forward 12-month PEx of 8x-10x, the fair value based on EPS of 5.6sen of Mmode is 44.8 to 56 sen. Bear in mind Mmode is still holding 43M cash (cash per share is 26.6 sen excluding 9M performance bond prepayment) with zero borrowing.

With consideration of only 50% of its cash, there are high margin of safety and Mmode has good profit visibility from its Sabah 260M project in coming 2-3 years.

To estimate the possibility of Mmode securing new project, we have to look on Titijaya Berhad new project plan. Titijaya targets to launch a few projects totalling RM826m GDV in FY19 (2H18) which include: a) Damai Suria Phase 1 (GDV of RM168m, b) 3rd Nvenue@KL Phase 2 serviced apartment with (GDV of RM338m, and c) Riveria City@KL Sentral Phase 1 serviced suite (GDV of 320M).

Mmode has shown its capability and efficiency in construction project execution in H2O and Sabah KK project where it has completed H2O project 5 months earlier than its due date (Dec 2018). Based on these track records, it is possible Mmode can secure new project from Titijaya or other developers in future.

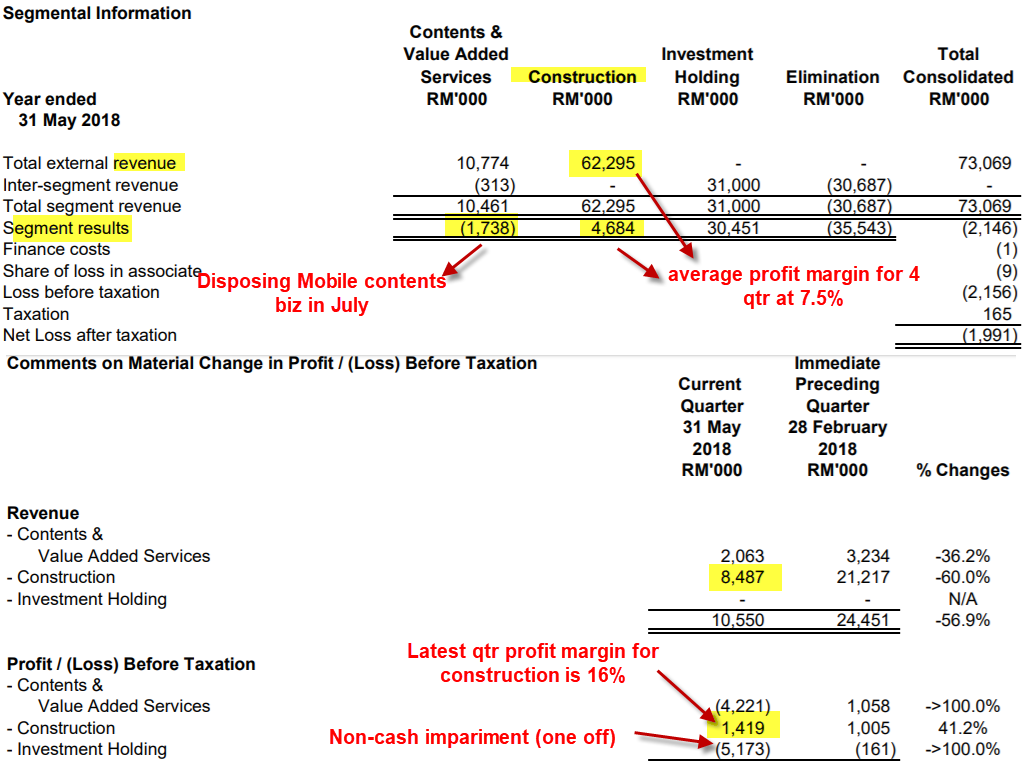

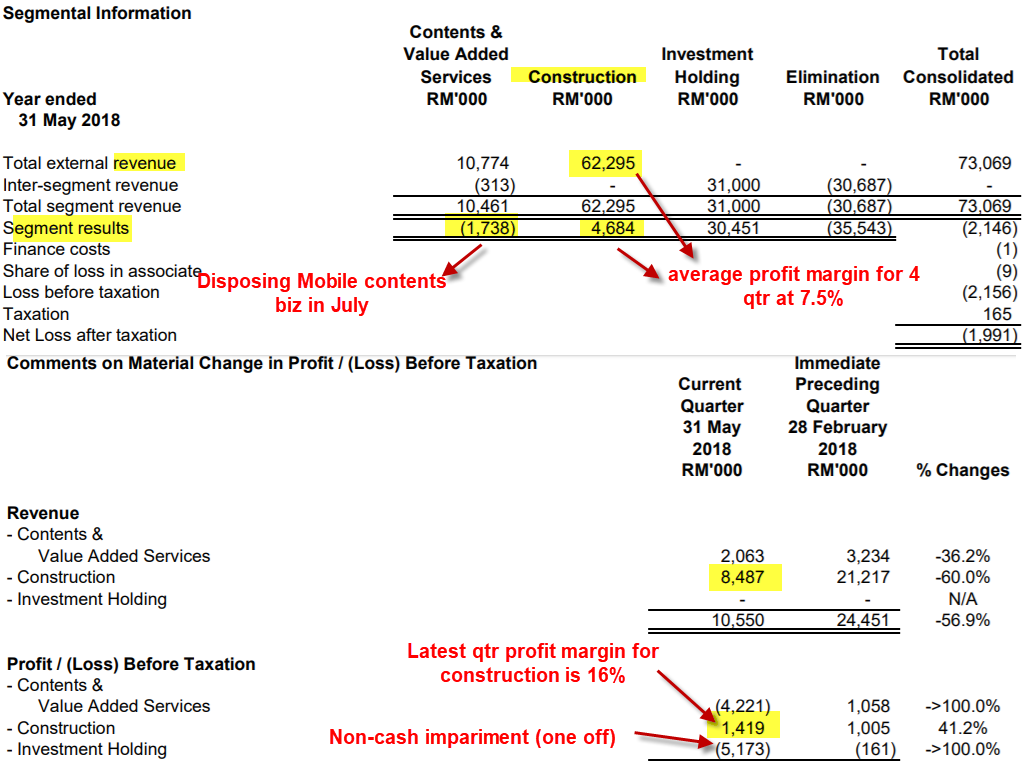

Construction Profit Margin Analysis (based on result ended 31 May 2018)

The following tables show the latest construction revenue and profit margin of Mmode from H20 project.

Source: Q4’18 report

From the tables above, the average construction net profit margin for past 4 quarters is about 7.5%. This is helped by last quarter construction profit which is about 16% (1.419M profit / 8.487M revenue).

Risk

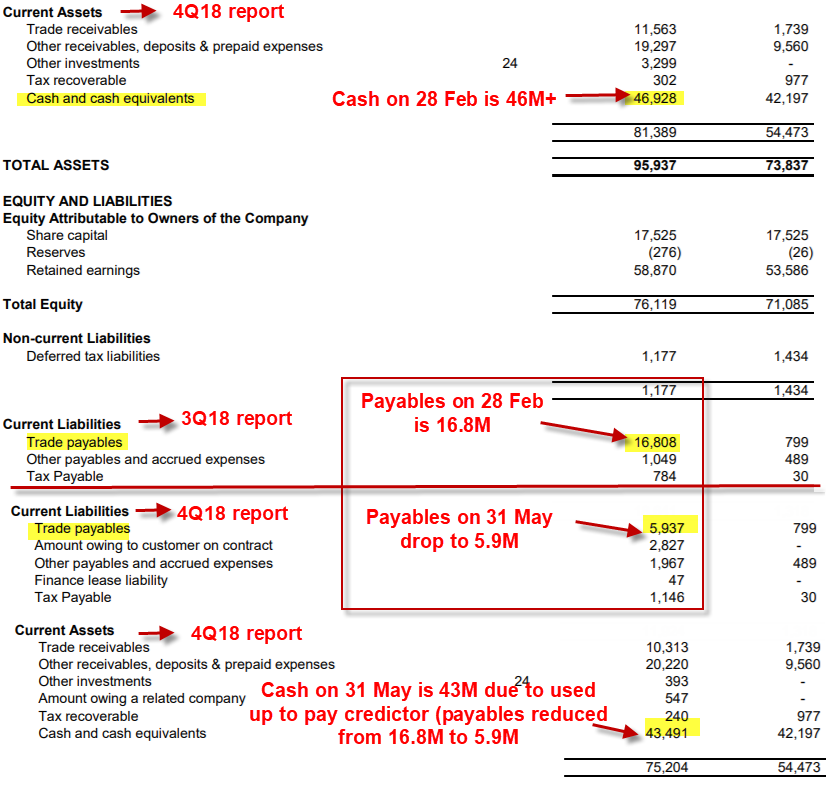

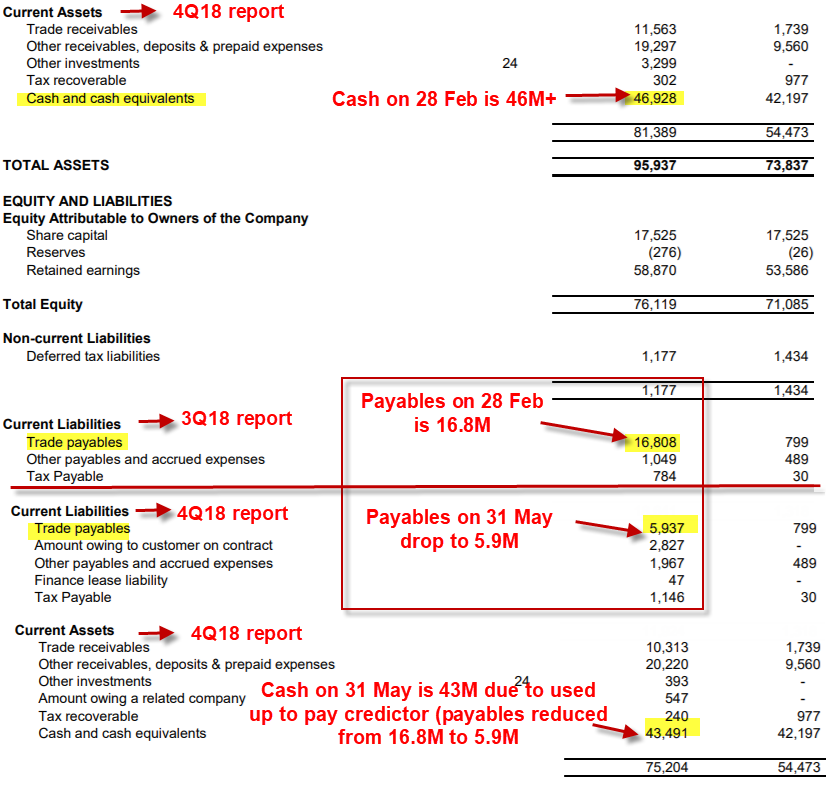

Cash flow analysis (31 May 2018)

Some of you may notice that the cash of the company has fallen to RM43.6M from 46.9M. Don’t worry, the small drop in cash of Mmode is due to it has just paid off some of its creditor. We can notice that ts payables has fallen from RM16.8M last quarter (28 Feb) to RM5.9M (31 May). Let see the following table for your reference on its cash in hand and reduction in payables.

https://klse.i3investor.com/blogs/lionind/174966.jsp

- The reported accounting loss of RM7.2M of 4Q18 result is mainly due to non-cash impairment losses (goodwill and software development cost) of 8.8M. Exclude these impairment losses, its operation actually still generated profit of RM1.6M (vs 1.48M of 3Q18 result).

- After these impairments, Mmode has a very clean non-current assets of just 5.6M, but with a very high level of current asset of 75.2M (mainly consist of cash of 43M and deposit & prepayment of 20M). Mmode actually is a zero-debt company with highly liquid current asset of 75.2M vs market capital of 54.5M (current asset per share is 46.2sen vs market share price of 33.5 sen).

- Up to 31 May 2018, secured orderbook is RM360M (latest outstanding of orderbook is about 298M due to 62M already converted to revenue in past 4 quarters).

- Latest 4 quarters results show the average net profit margin of construction segment increase to 7.5% (refer to Segmental Information of latest report for 4.62M profit from 62.2M revenue). This profit margin is moderate and should improve in coming quarter.

- The two major projects of Mmode are H2O of Ara Damansara and The Shore at Kota Kinabalu. Expect completion date of H2O project is on 31 Dec 2018. Based on my survey from site photo (refer to next section), online and facebook’s contacts, H20 project already completed in July and developer (T company) already started to deliver the vacant procession letter (mean early completion by 5 months) to house owners. This mean Mmode should has billed his client (T developer) for the remaining RM33-35M H2O project value in 1Q’19 (Jun-Aug 2018, going to be released in Oct).

- Another Kota Kinabalu project (Sabah) has good progress from the site photo survey. The photo taken in Aug shows piling works already completed and progressing to build the structure of the building. Remember Mmode just secured this project in June and this progress shows its efficiency and fast progress by completed the piling works within 2 months (expect to claim 7-10% of 260M from T developer).

- Construction materials are waived of SST which may benefit Mmode where it quoted T developer for its Kota Kinabalu project before June 2018.

- New big shareholder, Ong Chee Koen bought 14.15% shares via off-market on 22 June 2018 at 57 sen. Total Direct Business Transaction share is 31% at 57 sen on the same day.

- The estimated EPS for coming 12 months is about 5.6 sen. With forward 12-month PEx of 8x-10x, the fair value based on EPS of 5.6sen of Mmode is 44.8 to 56 sen.. With consideration of 50% of its cash, there are high margin of safety (backed by 26.6 sen cash per share with high earning visibility from Sabah KK project) (refer to appendix 1 for cash flow analysis of 4Q18 result)

- Coming querter result (to be released in Oct) will have contribution from H2O (about 35M revenue) and Sabah KK project (maybe 5-10% of 260M).

- The risk lies in delay in the completion of projects and rising labour cost.

PS: Current asset is cash and any other company asset that

will be turning to cash within one year from the date shown in the

heading of the company’s balance sheet.

Sabah's Project site PHOTO as per mid and end of August (piling completed & started structure works)

Site photo above of Kota Kinabalu project can exhibit more on the progress and efficiency of Mmode (as they just secured the project in June 2018).

Kota Kinabalu (http://www.theedgemarkets.com/article/mmode-bags-rm26057m-job-mixed-commercial-project-sabah)

Source: Site survey

Piling stage normally more challenging in construction as you may hit rock etc during this stage, once piling works completed, other works like structure build up works can be fast. If construction works can be faster than schedule, it can save labour, equipment rental cost and also early delivery of project which enable it to take another new project.

The prospect and profit of a construction company depends on the ability and timely execution of the project in hand where Mmode has shown excellent progress in both its H2O (early completion) and Sabah KK project.

Prospect and Fair value for 2018 and 2019 (upcoming 12 months)

Let us have a look on the profit forecast (upcoming 12 months) based on its construction orderbook only as below:

|

Construction Projects |

Estimated net profit margin |

Net profit |

|

H2O Ara damansara (*about 34M outstanding) |

7% (based on past four qtr reports) |

2.4M (should be recognized in coming Oct result as already completed) (early completion) |

|

The Shore Kota Kinabalu (260M outstanding) |

7% (based on past four qtr reports) |

7M (assume 100M work completed within 12 months as site photo shows fast progress) |

|

RM6.64m of Earthworks and Ancillary Sitework (*completed) |

Completed |

- |

Estimated Total net profit from construction = RM9.4M (12 months)

Mmode currently in the mid of disposing its mobile contents businesses (from recent announcement). Let me assume there are no profit but about 0.3M loss contribution from mobile contents disposal.

|

Mobile contents Subsidairies |

Estimated loss post disposal |

Net loss |

|

Axiata Project |

Refer to announcement on 27 July, 7 Aug, 24 Aug |

0.3M |

Estimated Total net profit from both construction & Mobile contents (disposed) = 9.4M-0.3M = 9.1M

RM9.1M translated to EPS 5.6 sen. With forward 12-month PEx of 8x-10x, the fair value based on EPS of 5.6sen of Mmode is 44.8 to 56 sen. Bear in mind Mmode is still holding 43M cash (cash per share is 26.6 sen excluding 9M performance bond prepayment) with zero borrowing.

With consideration of only 50% of its cash, there are high margin of safety and Mmode has good profit visibility from its Sabah 260M project in coming 2-3 years.

To estimate the possibility of Mmode securing new project, we have to look on Titijaya Berhad new project plan. Titijaya targets to launch a few projects totalling RM826m GDV in FY19 (2H18) which include: a) Damai Suria Phase 1 (GDV of RM168m, b) 3rd Nvenue@KL Phase 2 serviced apartment with (GDV of RM338m, and c) Riveria City@KL Sentral Phase 1 serviced suite (GDV of 320M).

Mmode has shown its capability and efficiency in construction project execution in H2O and Sabah KK project where it has completed H2O project 5 months earlier than its due date (Dec 2018). Based on these track records, it is possible Mmode can secure new project from Titijaya or other developers in future.

Construction Profit Margin Analysis (based on result ended 31 May 2018)

The following tables show the latest construction revenue and profit margin of Mmode from H20 project.

Source: Q4’18 report

From the tables above, the average construction net profit margin for past 4 quarters is about 7.5%. This is helped by last quarter construction profit which is about 16% (1.419M profit / 8.487M revenue).

Risk

- Delay in the completion of the H2O project

- Rising labour cost (min wages increment in the future)

If you interested on my future analysis reports, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is

strictly for sharing purpose, not a buy or sell call of the company.

Appendix 1:Cash flow analysis (31 May 2018)

Some of you may notice that the cash of the company has fallen to RM43.6M from 46.9M. Don’t worry, the small drop in cash of Mmode is due to it has just paid off some of its creditor. We can notice that ts payables has fallen from RM16.8M last quarter (28 Feb) to RM5.9M (31 May). Let see the following table for your reference on its cash in hand and reduction in payables.

https://klse.i3investor.com/blogs/lionind/174966.jsp