There is some introduction of VIS. Extracted from the company website.

VisDynamics was established in early 2003 in Melaka, a small state of Malaysia about 150km south of Kuala Lumpur, the capital city.

The

company name is a clear reflection of the company's key competency in

optimizing the mix of dynamics (a study of motion) and machine vision

technology, plus our relentless belief in R&D (Research and

Development).

The

founding team consists of veterans from semiconductor assembly &

test plant, and highly sought-after individuals that were behind some of

the best sellers in the industry, including inventors of various

worldwide patents in mechantronics & machine vision technology

during their tenure as employees for a major semiconductor equipment

multinational company (MNC).

We

provide equipment solution to the semiconductor assembly & test

industry with standalone or integrated package handling, electrical

test, inspection, tape & reel etc using our own proprietary

technologies. All our equipment are designed and manufactured with

simplicity, cost effectiveness & best-in-class performance as major

objectives that had rewarded us with extensive customer acceptance in a

very short time in this highly competitive market.

Main product & services of the company:

Okay, now is my analysis:

OVERVIEW OF BUSINESS ACTIVITIES, TRENDS, AND OUTLOOKS

The Semiconductor Industry Association (SIA), representing U.S. leadership in semiconductor manufacturing, design, and research announced worldwide sales of semiconductors as per below:

For the month of November 2017: $37.7 billion, (an increase of 21.5% compared to the November 2016)

For the month of November 2016: $31.0 billion (an increase of 7.4% compared to the November 2015)

For the month of November 2015: $28.9 billion

With the overview of Semiconductor Industry above, the business of Semiconductor seems to b high over years, this is reflected in the result of other semiconductor companies in Malaysia eg: Penta, Vitrox, Gtronic, Mi and etc.

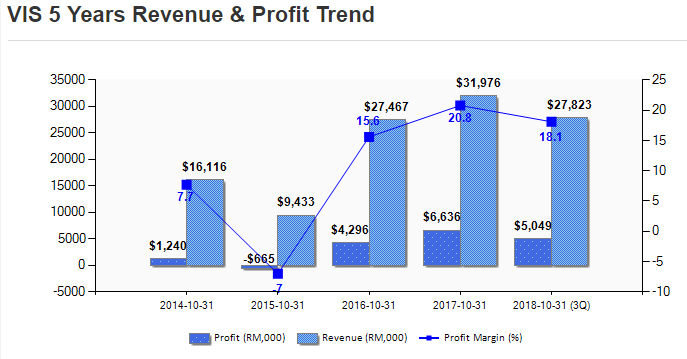

Extracted from the annual report of the company for the financial year 2017, VisDynamics has recorded the highest revenue and net profit recorded since its inception. Stepping into the financial year 2018, based on positive market sentiments and coupled with the anticipation of new product launches, VisDynamics believes it can achieve another good financial performance in the coming financial year.

The trend of the company performance

I have read through the quarterly reports,

The decreased of QoQ in 3Q2017 was mainly due to the product mix where more tray machines, which fetched higher selling prices, were sold during the previous quarter versus current quarter.

The decreased of QoQ in 1Q2018 is due to the sales cycle of the company, based on past trend, quarter one & quarter two is usually lower sales as compared to quarter four. Also, the lower sales were due to a lower USD rate from 4.23 per MYR to 3.9 per MYR as the company is transacted in USD for export sales.

Based on the trend of the company, with higher USD rate as at posted date (24 September 2018), the USD rate is 4.134 per MYR which is higher compared to the rate of the latest quarterly report as at 31 July 2018 which is 4.06 per MYR.

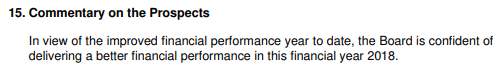

The revenue is expected to be approximate 13 million since the Board is confident of delivering a better financial performance in this financial year 2018 (Stated in the latest quarterly report).

After commenting on revenue, let's look into other income and other expenses which will affect the company profit for the year.

From the extraction of quarterly reports above, the company has a net loss in other income/ expenses.

Most of the expenses were derived from provisions and exchange gain/ loss, which the latest quarterly result, there is an increase of provision for doubtful debt because of the increase in trade receivables to be collected as at quarter end resulted by the increase of sales during the quarter.

The provisions will be reversed when the amount is collected from receivables, thus the provision in coming quarter is not likely as high as current quarter, which mean EPS of coming quarter is unlikely to be lower than the current quarter if the company maintain the performance in sales quantity.

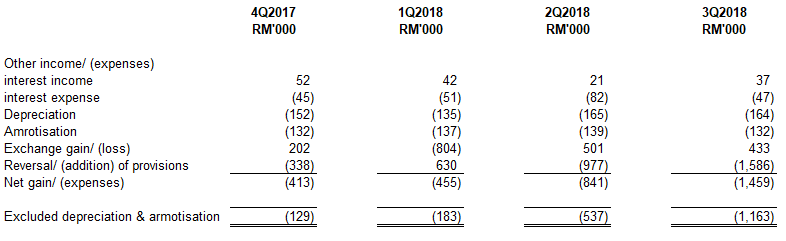

After commenting on revenue & other incomes/expenses, let's look into EPS,

Based on the last 7 quarters, the company's performance is increasing dramatically which is in tandem with the increased in sales.

the decreased of EPS (QoQ) was mainly due to lower sales recorded in the respective quarter as compared to the previous quarter.

In my own view, with the expected increase in sales in the coming quarter, the EPS shall be at least maintained in 1.62.

Based on the point above, with standard PE ratio of semiconductor company (eg: Inari, Gtronic, Vitrox, Mi, Penta) should be around 20. With annualized EPS for FY2018, actual EPS for 3Qs 2018 + 1.62 (estimated minimum EPS for 4Q2018) = 4.67, the reasonable share price shall be above 0.93.

Above are my very 1st sharing on my review.

Hopefully this helps on your review. Buy at own risk, of course, I am holding the stock since I feel it is good.

Wish you guys have a happy trading year!

https://klse.i3investor.com/blogs/VegeBirdAnalysis/175407.jsp