1QFY19 core net profit of RM6.2m (+645.5% QoQ, 16.9% YoY) was in line with ours and consensus expectations, accounting for 20.7% and 23.4% of ours and consensus full year forecast, respectively. BFood will continue growing its top line by opening 25-30 new Starbucks outlets annually and 50 Starbucks kiosks at Petronas petrol stations as part of their partnership with Petronas. We maintain our forecasts and BUY call with an unchanged TP of RM2.05 based on 25x P/E multiple pegged to CY19 EPS.

Broadly in line. 1QFY19 core net profit of RM6.2m (+645.5% QoQ, 16.9% YoY) was in line with ours and consensus expectations, accounting for 20.7% and 23.4% of ours and consensus full year forecast, respectively. We deem this in line as we expect a stronger 2QFY19 due to the sales tax holiday.

Dividends. Declared DPS of 1 sen (1QFY18: 1 sen) going ex on 8/10/18.

QoQ. 1QFY19 core net profit of RM6.2m was significantly higher than the core net profit of RM0.8m recorded in 4QFY18. This was due to narrower losses from KRR Malaysia operations of RM1.7m before tax in 1QFY19 vs RM4.2m losses before tax of RM4.2m in 4QFY18. Note that KRR Malaysia incurred restructuring costs in 4QFY18.

YoY. Increased profitability (core net profit was higher by 16.9%) was attributed to absence of losses from KRR Indonesia (which was disposed in 3QFY18) and increased sales from Starbucks Malaysia operations (SSSG: +2.7%).

Outlook: BFood will continue growing its top line by opening 25-30 new Starbucks outlets annually and 50 Starbucks kiosks at Petronas petrol stations as part of their partnership with Petronas. We expect Starbucks’ top line to grow significantly, buoyed by the absence of sales tax between June and August. Bfood will continue its efforts to turnaround KRR Malaysia with low priced menu options and the opening of five new KRR Malaysia restaurants this year.

Forecast. Maintain as Results Were in Line

Maintain BUY, TP: RM2.05. After rolling over our valuation year from FY19 to CY 19, our TP rises to RM2.05 (from RM1.98), based on an unchanged earnings multiple of 25x. Despite the continued losses at KRR Malaysia, we believe that BFood is a good proxy to higher discretionary spending via Starbucks, fuelled by the GST abolishment (3-month “tax holiday”).

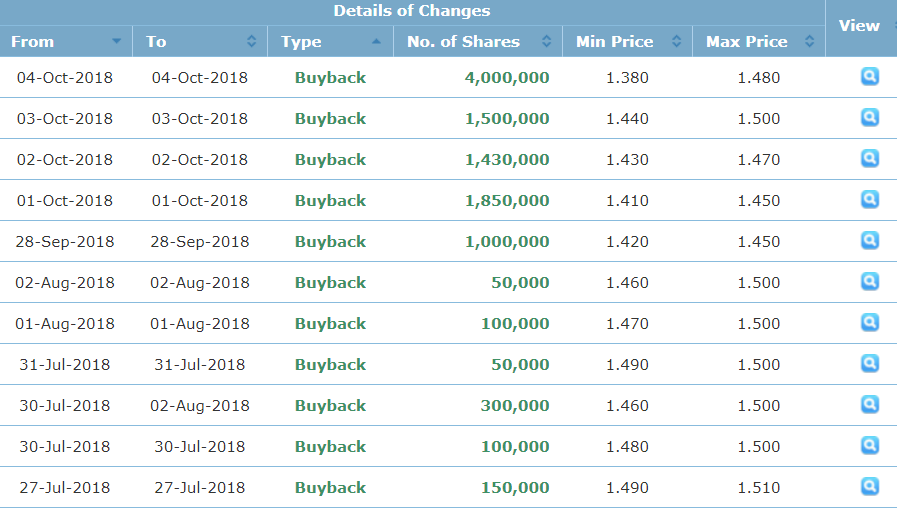

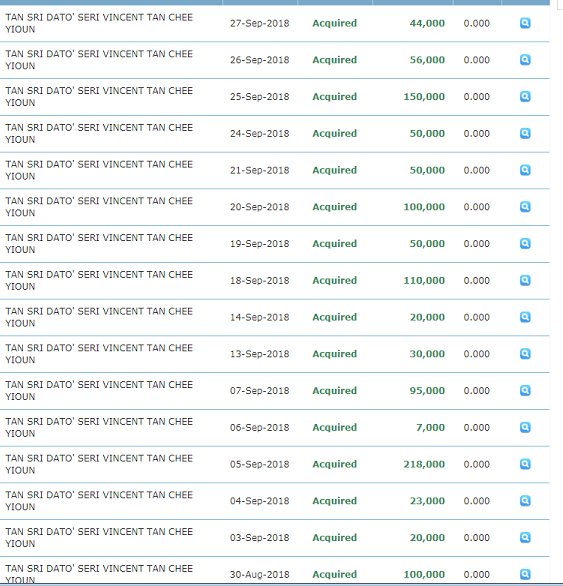

Heavy Share buy back by Company and Tan Sri Vincent Tan

Coffee price has been falling and this will help to boast further profit margin.

https://klse.i3investor.com/blogs/huat8888/176860.jsp