About OpenSys (M) Bhd

OpenSys (M) Bhd (KLSE: OPENSYS - 0040) is a public-listed company in ACE Market with Bursa Malaysia. It is a leading solutions provider for the financial services, telecommunications and utilities industries. OpenSys provides total assisted-service and self-service solutions together with comprehensive professional and support services to these industries. OpenSys also provides end-to-end managed services outsourcing, particularly for self-service terminals, bill payment kiosks and back-office cheque processing services. Its customer base includes mainly blue-chip companies such as AEON Credit, Alliance Bank, AmBank, Bank Islam, CIMB Bank, Hong Leong Bank, Maybank, Public Bank, RHB Bank, Standard Chartered Bank, UOB, Celcom, Maxis, TNB, TM, Sabah Electricity and Sarawak Energy.

80% market share in Malaysia

OpenSys, the ACE-listed company has the largest installed base of cash recycling machines, with close to 80% market share in Malaysia and has to date installed more than 2,600 machines. The latest development further cements its leadership position in the market. The high market share owned by OpenSys is reliant on the fact that the OKI CRMs are reliable, robust, accurate and fast. Of equal importance are the excellent post- sales and solutions support provided by OpenSys’ comprehensive network of 26 centers nationwide and its team of technical consultants.

CAGR of close to 40 percent

CRMs are dual-function machines that merge the cash dispensing functions of ATMs and the cash deposit functions of CDMs. CRMs accept cash from depositors and dispense them to withdrawers, so cash is essentially ‘recycled’. Banks are benefitting from the cost- effectiveness of CRMs in areas of cost of ownership, lower cash holding and reduction in cash handling cost. Banks can typically save between 25 to 30 percent in both capital expenditure and annual operational costs.

These significant savings have been a major driving factor for banks to undertake major fleet replacement and consolidation, resulting in the exponential growth of CRMs. In the last five years, the total number of CRMs in the market has grown exponentially with a Compound Annual Growth Rate (CAGR) of close to 40 percent.

New possibilities for OpenSys with adoption of digital technologies

The emerging and evolving technologies in the marketplace will fuel new possibilities for OpenSys. The versatility of CRMs will see the adoption of digital technologies and the rise of new value-added services using new digital methods of authentication and service fulfilment such as biometrics, contactless and cardless technologies, QR codes and complementary mobile apps.

OpenSys has been working closely with the banks to incorporate new technologies and services. This opens up tremendous new possibilities in banking services.

OpenSys is poised to continue its leadership position in CRMs by continuing to partner with OKI Japan to work closely with the banks in delivering solutions that make a difference.

OpenSys to roll out more than 500 OKI Cash Recycling ATMs worth RM36.0 million in Q3

The Board of Directors of OpenSys (M) Berhad (“OpenSys”) wishes to announce that OpenSys as the leading solutions provider for the financial services and banking industry will be rolling out more than 500 units of OKI Cash Recycling ATMs (CRMs) at Public Bank, Bank Islam, RHB Bank and other major banks in Q3 2018. The units have an estimated market value of RM36.0 million.

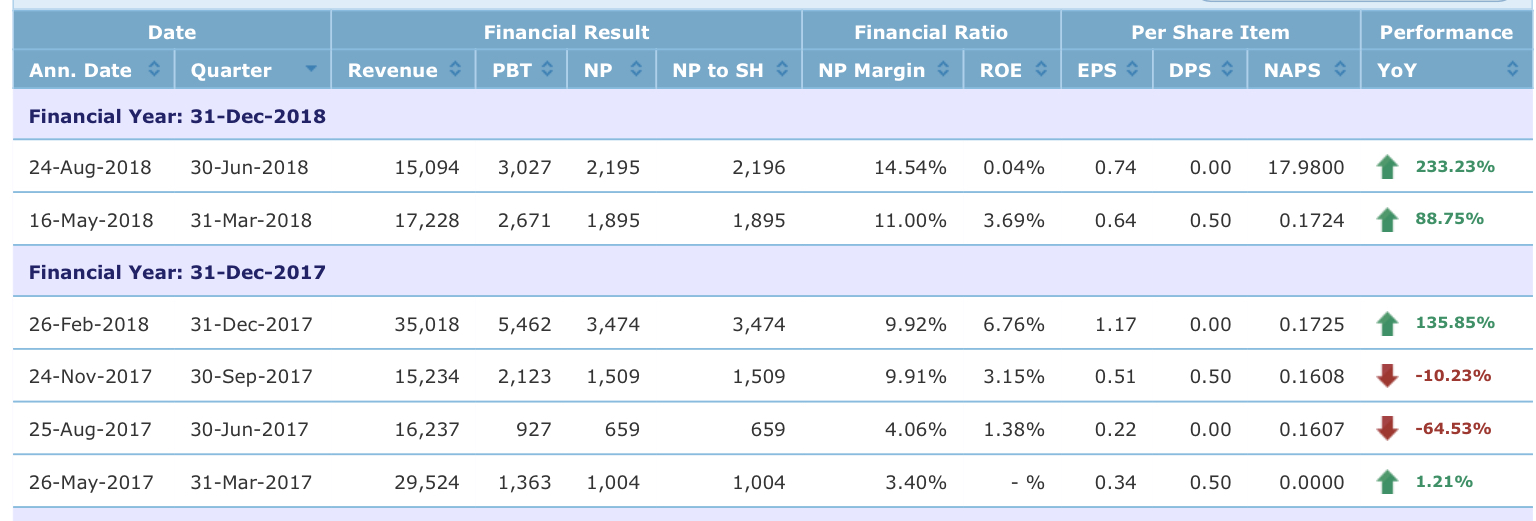

OpenSys posted revenue of RM15 million in Q2.

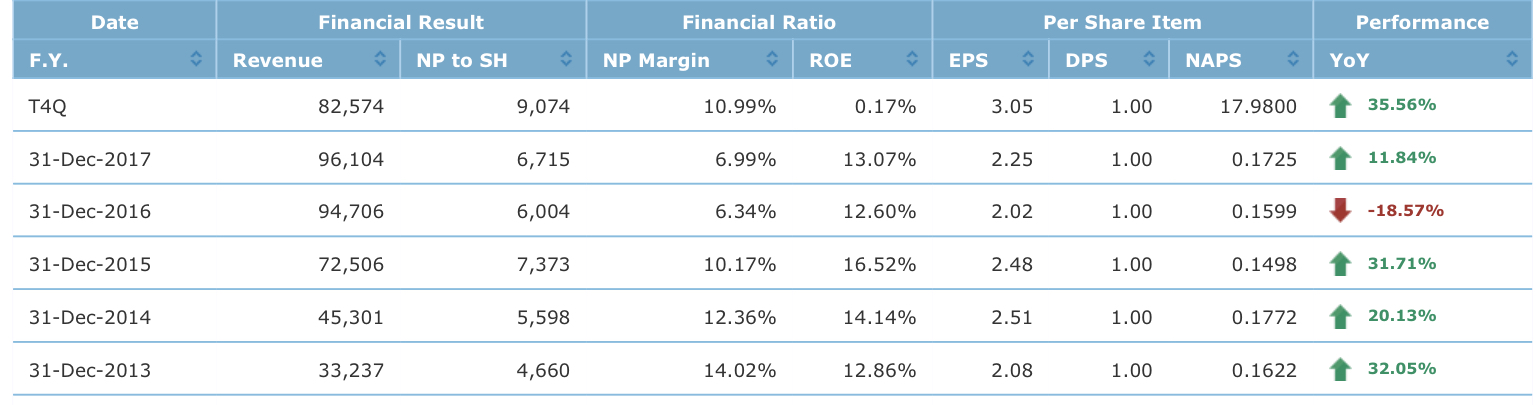

Based on 297 million shares and price of 33.5 sen, Openys has market cap of RM99 million. It reported trailing 4Q net profit of RM9.1 million. As such, historical PER is 11 times.

Source

https://klse.i3investor.com/servlets/stk/fin/0040.jsp

http://www.theedgemarkets.com/article/opensys-roll-out-rm36m-worth-oki-cash-recycling-atms-3q

http://www.bursamalaysia.com/market/listed-companies/company-announcements/#/?category=all&sub_category=all&alphabetical=All&company=0040

https://klse.i3investor.com/blogs/Amazinggrowth/183613.jsp