First

of all, my apology for writing so soon. I mentioned in my previous

article that I will only write again after Jaks turns around. But

yesterday Uncle Koon wrote that he has disposed of 20 mil shares. This

generated a lot of interest among i3 members. So I am tempted to also

chip in.

https://klse.i3investor.com/blogs/koonyewyinblog/184749.jsp

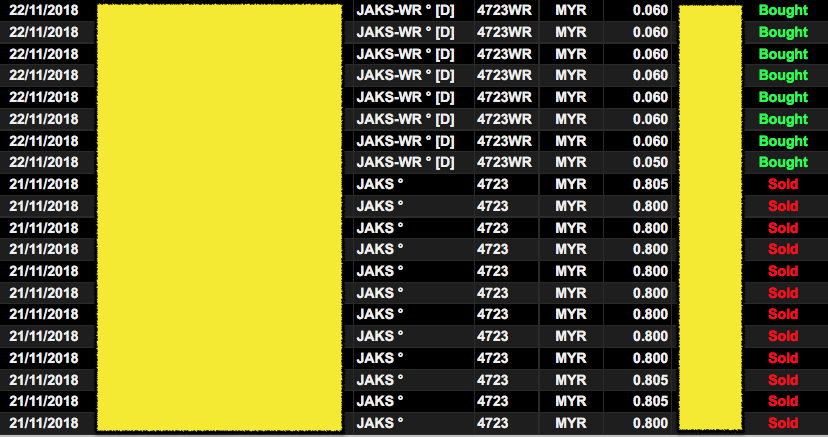

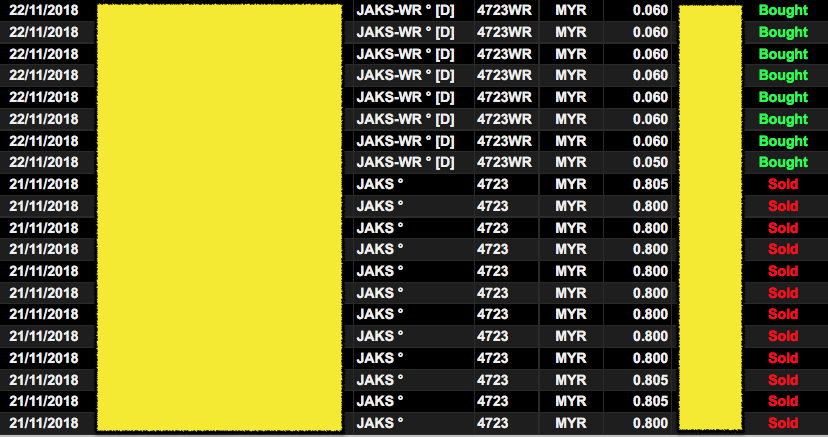

Uncle Koon is not the only one selling his Jaks shares. I did the same on 21 November 2018 after the Rights Issue has gone ex. Subsequently on 22 November 2018, after the rights were listed, I bought more at 6 sen.

Note : The yellow areas above are some details I prefer not to disclose (account code, number of shares transacted, etc).

Why did I sell my shares ? Because that was the right thing to do from risk vs. reward point of view ! Let's look at the mathematics.

By holding Jaks at 80 sen, my maximum downside risk is 80 sen. But by holding warrants, my maximum downside risk over the next five years is only 25 sen (my rights subscription price).

My target price for Jaks is at least RM1.50. If that is achieved, the warrants will register gain of RM0.61, being RM1.50 less RM0.64 exercise price and then less RM0.25 cost of investment (based on conservative assumption of zero conversion premium).

If I hold mother shares at RM0.80, my upside is RM0.70 (being RM1.50 less RM0.80).

A 25 sen Warrant can give me potential gain of RM0.61 while an 80 sen mother share will give me potential gain of RM0.70. The warrants have remaining life span of 5 years. Do you really need to be a genius to figure out that it makes sense to replace mother shares with Warrants ?

Note 1 : Since the rights issue is on 1 for 2 basis. To fully replace my mother shares with warrants, I have to buy additional rights from the open market, which I dutifully did so the next day at 6 sen. Meaning my second batch warrants cost is 31 sen.

Note 2 : the mother shares have since dropped to 50 sen. At 25 sen cost, the warrants will have conversion premium of 78%. I see the relatively high premium as academic. I cannot be having all the right things at all the time. The most important thing is still whether Jaks can go up in the future. Rising water lifts all boats.

Concluding Remarks

I started buying Jaks at RM1.17 (as mentioned in my first article).

Subsequently, I averaged down by buying several more batches. But for sake of simplicity, you can assume my cost is RM1.17. By selling at 80 sen, I incurred a loss of 32%. But Jaks makes up about 15% of my portfolio. So the effective impact is negative 4.8%. Not an insignificant amount, but if I didn't buy Jaks and instead bought some other shares, I might have registered some losses also (in this bearish market). So, as far as I am concerned, my exposure in Jaks is still quite manageable.

Now that I have switched to warrants, my exposure to Jaks has been further scaled down to 4% of my portfolio (being RM0.31 / RM1.17 multiplied by the original 15% exposure). Do I really need to lose sleep over that amount ? The best thing is that if Jaks price goes up, I have the exposure to enjoy the upside.

For me, as long as you manage your risk properly, it is ok to be a bit adventurous. No pain no gain.

https://klse.i3investor.com/blogs/koonyewyinblog/184749.jsp

Uncle Koon is not the only one selling his Jaks shares. I did the same on 21 November 2018 after the Rights Issue has gone ex. Subsequently on 22 November 2018, after the rights were listed, I bought more at 6 sen.

Note : The yellow areas above are some details I prefer not to disclose (account code, number of shares transacted, etc).

Why did I sell my shares ? Because that was the right thing to do from risk vs. reward point of view ! Let's look at the mathematics.

By holding Jaks at 80 sen, my maximum downside risk is 80 sen. But by holding warrants, my maximum downside risk over the next five years is only 25 sen (my rights subscription price).

My target price for Jaks is at least RM1.50. If that is achieved, the warrants will register gain of RM0.61, being RM1.50 less RM0.64 exercise price and then less RM0.25 cost of investment (based on conservative assumption of zero conversion premium).

If I hold mother shares at RM0.80, my upside is RM0.70 (being RM1.50 less RM0.80).

A 25 sen Warrant can give me potential gain of RM0.61 while an 80 sen mother share will give me potential gain of RM0.70. The warrants have remaining life span of 5 years. Do you really need to be a genius to figure out that it makes sense to replace mother shares with Warrants ?

Note 1 : Since the rights issue is on 1 for 2 basis. To fully replace my mother shares with warrants, I have to buy additional rights from the open market, which I dutifully did so the next day at 6 sen. Meaning my second batch warrants cost is 31 sen.

Note 2 : the mother shares have since dropped to 50 sen. At 25 sen cost, the warrants will have conversion premium of 78%. I see the relatively high premium as academic. I cannot be having all the right things at all the time. The most important thing is still whether Jaks can go up in the future. Rising water lifts all boats.

Concluding Remarks

I started buying Jaks at RM1.17 (as mentioned in my first article).

Subsequently, I averaged down by buying several more batches. But for sake of simplicity, you can assume my cost is RM1.17. By selling at 80 sen, I incurred a loss of 32%. But Jaks makes up about 15% of my portfolio. So the effective impact is negative 4.8%. Not an insignificant amount, but if I didn't buy Jaks and instead bought some other shares, I might have registered some losses also (in this bearish market). So, as far as I am concerned, my exposure in Jaks is still quite manageable.

Now that I have switched to warrants, my exposure to Jaks has been further scaled down to 4% of my portfolio (being RM0.31 / RM1.17 multiplied by the original 15% exposure). Do I really need to lose sleep over that amount ? The best thing is that if Jaks price goes up, I have the exposure to enjoy the upside.

For me, as long as you manage your risk properly, it is ok to be a bit adventurous. No pain no gain.

https://klse.i3investor.com/blogs/icon8888/184758.jsp