TECHBOND (TECHBND, 5289)

I understand that the recent stock market has been volatile and many investors have lost their fortune and hard earned savings due to the plunge in share prices in many companies in KLSE. Maybe, this upcoming IPO will help you to reverse some losses or make some gains for your Christmas present if you are able to see the opportunity.

The purpose of this article is not to convince you to buy/sell, but to share with you my views on this company as I believe this company, Techbond Group Berhad has a very good fundamental and prospect, signifying its huge potential upside.

Techbond Group Berhad will be listed on next Wednesday, 5 Dec 2018. The Stock Code is TECHBND and IPO Price at RM0.66. Straight to the point, why Techbond?

1. Listed at PER 11X while its peers are listed at average PER of 25X.

Its most comparable companies include HB Fuller, Henkel AG, Sika AG and 3M are trading at average PER of 25X. Their average Profit After Tax margin was about 8% - 9%. Techbond, it will be listed at PER 11X and it has Profit After Tax margin at 15%. In short, Techbond is much efficient than its peers, and much cheaper.

2. Gigantic Expansion in both Malaysia & Vietnam - 0% Tax in new Vietnam Plant for the first 2 years

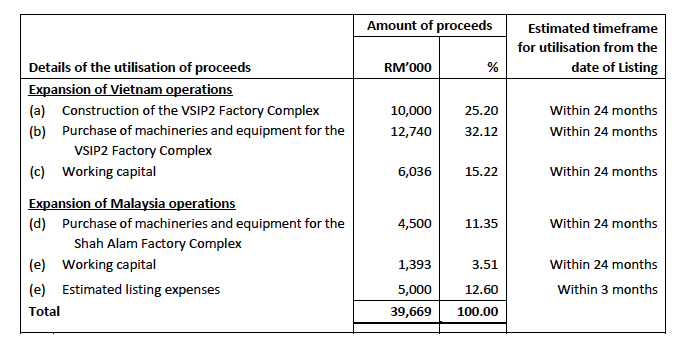

More than 80% of the IPO proceeds will be used for capital expenditure and expansion. In Malaysia, Shah Alam Phase 1 expansion will be commenced by Q1 2019, Phase 2 will be commenced by Q3 2019. In Vietnam, a new factory will be ready by Q1 2020 - and it will enjoy a full tax exemption for the first 2 years, and a 50% reduction of tax amounts in the subsequent 4 years. These are expected to contribute to the revenue and profit significantly.

3. Recession Proof Business Model, Huge Cash in Bank with Zero Borrowings

Techbond is producing adhesives, in simple word, they produce customised glues. For eg. F&B players will need to stick their label into their products. These F&B companies need players like Techbond to provide customised glues for them. Market good or bad, they'll need to buy from Techbond, and the adhesive cost is only 1% -1.5% to F&B's cost of sales, they'll still buy from Techbond even during financial crisis. Over the past 3 years, Techbond has more than 800 customers and there's no concentration risk (please refer to prospectus page 203 for more info.). Their revenue and profit will grow consistently, with expansions, it will grow consistently and rapidly.

Their business is also cash generative, they have zero borrowings and their current ratio is at 7X, that is a lot - signifies a potential dividend distribution after IPO. In short, they generate good cash flows and own a good balance sheet.

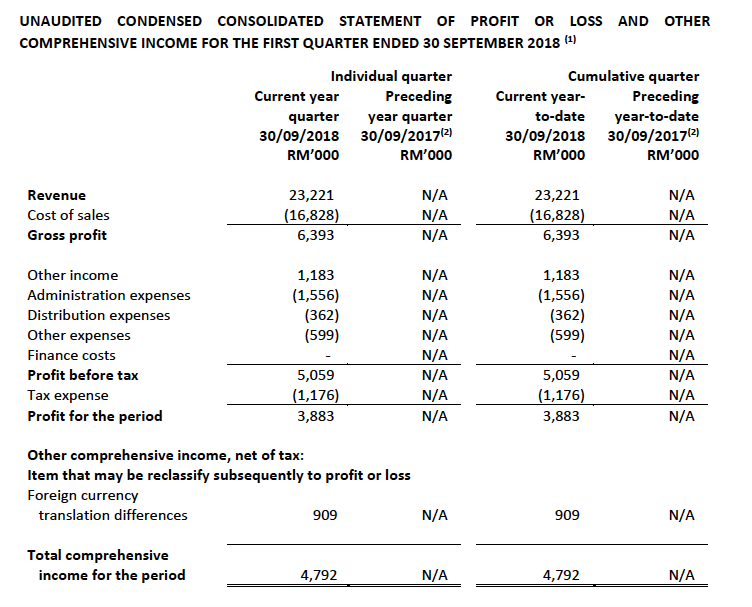

4. New High in Revenue and Profit in their latest Quarterly Report

Many companies reported reducing profits and bad results in this month. However, Techbond posted an excellent results with new high revenue and profit. Their market cap at IPO is about RM150M. Since there's no seasonality in their company, assuming they'll deliver RM3.9 million every quarterly (assumes no growth), one year would be RM15.6 million. The PER will drop to 9.6X. Their peers are listed at PER 25X, even when Techbond has much better margins and more efficient than them.

5. Many Recent IPO Share Prices have Performed Incredibly Well - Techbond is more Solid than Many of Them

Below shows the gains for the recent IPOs - First Day Closing vs Listing Price

1. Securemetric - 114% gain

2. Revenue - 69% gain

3. Nova Wellness - 38% gain

4. Radiant Global - 130% gain

The listing price of TECHBND will be RM0.66. Refers to the 4 recent IPOs, the lowest gain IPO was Nova Wellness at 38% gain. At the worst case scenario of 38% gain, the share price of TECHBHD will go up to RM0.90 on next Wednesday, IPO day.

Comparing to its peers on average PER 25X, TECHBHD IPO at PER 11X. If a re-rating catalyst is given, at PER 20X (20% discount to peers), the share price will be RM1.20.

If you believe in the fundamental, prospect and its recession proof nature of Techbond, I believe it should be priced at a even higher share price, at a more reasonable price. For your information, for adhesive producers, Techbond is the only listed company in KLSE. If fund managers are looking for a defensive and yet a company that will grow consistently in current volatile market condition, the share price might just go beyond RM2.

If you are interested in this company, please do more studies and homework, eg. read their prospectus, visit their website, read the market industry research etc. I believe this is a good IPO opportunity after my thorough study and research. Good luck and hope every of us makes good money from the market, and able to sleep well at night by making the proper and right investment.

https://klse.i3investor.com/blogs/ipogem/184734.jsp