ABOUT HIBISCUS PETROLEUM

Hibiscus Petroleum Berhad (Hibiscus Petroleum) is Malaysia's first

listed independent oil and gas exploration and production company. Our

key activities are focused on monetising producing oilfields and growing

our portfolio of development and production assets in areas of our

geographical focus: United Kingdom, Malaysia and Australia.

As an operator of offshore oil and gas producing fields, our efforts

are concentrated in enhancing operational efficiencies to safely deliver

high-margin production from our assets. Our growth strategy in the

current oil and gas market is to leverage on opportunities that are

present within our existing assets and make quality acquisitions on a

selective basis to achieve consistent earnings, thus delivering

sustainable retums to our shareholders. We are committed towards

upholding high standards of safety management and corporate governance,

whilst expanding our business on strong technical and commercial

foundations.

Hibiscus Petroleum is headquartered in Kuala Lumpur, and our shares are

listed on the Main Market of Bursa Malaysia Securities Berhad (Bursa

Securities). Hibiscus Petroleum shares have been classified as

Shariah-compliant securities by the Shariah Advisory Council of the

Securities Commission of Malaysia.

UNITED KINGDOM

The United Kingdom (UK) continental shelf is home to Hibiscus

Petroleum's first producing asset - the Anasuria Cluster, a group of

producing oil and gas fields and associated infrastructure. Our

jointly-controlled entity, Anasuria Operating Company is joint-operator

of this revenue generating asset. Recently, we have expanded our

footprint by acquiring a 50% participating interest in two discovered

offshore oilfields in Production Licence P.198, located in the UK

Central North Sea.

MALAYSIA

In Financial Year 2018, we successfully completed the acquisition of

the 2011 North Sabah Enhanced Oil Recovery Production Sharing Contract

(North Sabah PSC) - our first Malaysian asset. Our wholly-owned

subsidiary, SEA Hibiscus Sdn Bhd, is the operator of this producing

asset.

AUSTRALIA

As operator of the West Seahorse field with proven and probable

reserves under the VIC/L31 production licence, as well as the additional

exploration opportunities under the VIC/P57 exploration licence,

Australia holds significant potential for Hibiscus Petroleum's future

development plans.

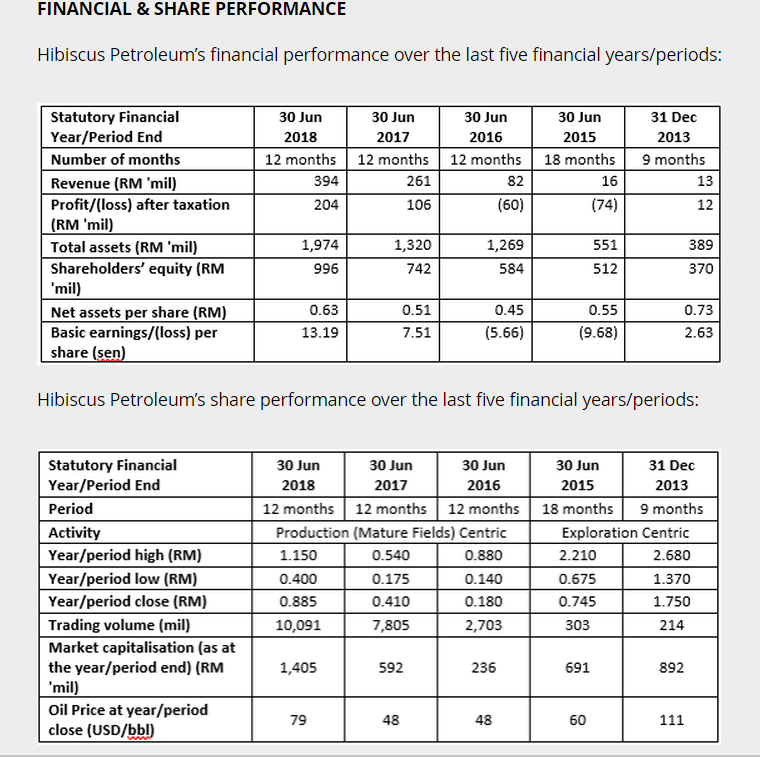

If you examine the above tables closely, you can see its revenue and profit growth in the last 5 years. Moreover, it has Rm 300 million cash.

Mr Ooi Teik Bee has calculated its production cost to be US$ 18 per barrel. Many shareholders who are not aware of its production cost of US$ 18, have been selling because petroleum price has been dropping. As the result, it has dropped from Rm 1.32 to bottom of 78 sen. In the last few weeks it has been going up to close at 89.5 sen and I have been buying its warrant WC.

I am obliged to tell you that I have been buying and I do not need readers to buy to support the price because the daily volume is several tens of millions.

https://klse.i3investor.com/blogs/koonyewyinblog/188912.jsp