One of the biggest myth I encounter throughout my investing and professional career is the nature of associate stake.

There is a widespread belief that associate stake is merely accounting profit. You can't access the cash flow. In other words, can see but cannot eat.

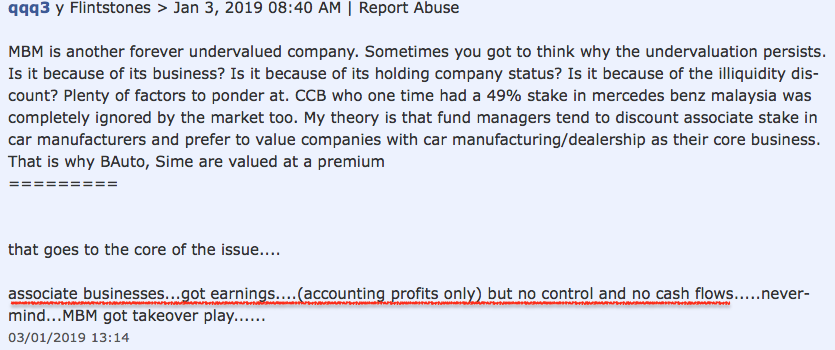

For example, qqq3's comments today :

Is that true ? Before I even go into details to disprove the myth, let me just ask you a simple question :

You buy 1,000 Maybank shares, do you have control ? You don't, right ? But do you get dividend from Maybank ? Yes, you do.

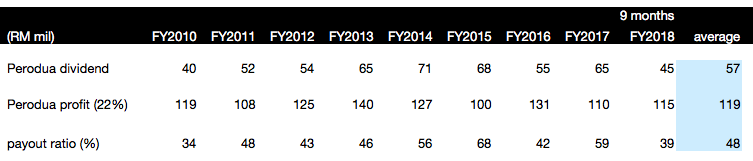

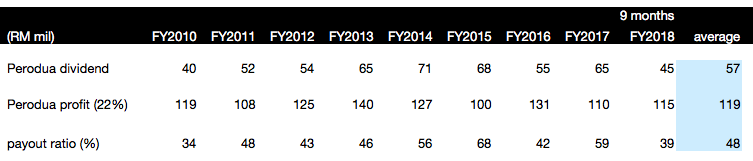

The same is true for associate stake. Between 2010 and 2018, MBM Resources received a total of RM515 mil dividend from its Perodua associate stake, equivalent to RM57 mil per annum.

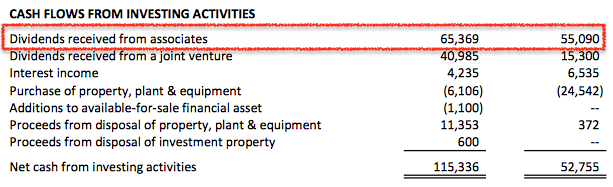

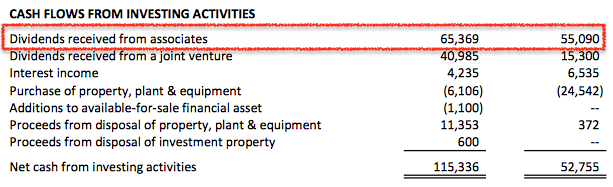

That is how it looked like in the accounts (FY2017 and FY2016, for illustration purpose) :

Based on 391 mil shares, the average dividend of RM57 mil received is equivalent to RM0.15 per share per annum, which could be used to pay dividend to MBM Resources shareholders. (The highest dividend ever paid by MBM Resources is RM0.17 per share in FY2015.)

As for "control", that is a non issue, in my opinion. Perodua has a stable and diversified shareholding structure, held by UMW, MBM, Daihatsu, PNB and Mitsui.

These

are all very strong shareholders. Check and balance is hence not an

issue. There is no need to have dominant stake. Anyway, it is a common

practice to have Shareholders' Agreement to govern the operations. The

Perodua group in its existing structure has been in existence since

1994. So far there is no issue of shareholders conflict.

Concluding Remarks

Far from just accounting profit, MBM's 22% associate stake in Perodua is packed with flesh and blood and generates real economic benefit. Every year it contributes more than RM50 mil cash inflow to MBM Resources, which in turn is distributed to reward loyal shareholders.

https://klse.i3investor.com/blogs/icon8888/188684.jsp

There is a widespread belief that associate stake is merely accounting profit. You can't access the cash flow. In other words, can see but cannot eat.

For example, qqq3's comments today :

Is that true ? Before I even go into details to disprove the myth, let me just ask you a simple question :

You buy 1,000 Maybank shares, do you have control ? You don't, right ? But do you get dividend from Maybank ? Yes, you do.

The same is true for associate stake. Between 2010 and 2018, MBM Resources received a total of RM515 mil dividend from its Perodua associate stake, equivalent to RM57 mil per annum.

That is how it looked like in the accounts (FY2017 and FY2016, for illustration purpose) :

Based on 391 mil shares, the average dividend of RM57 mil received is equivalent to RM0.15 per share per annum, which could be used to pay dividend to MBM Resources shareholders. (The highest dividend ever paid by MBM Resources is RM0.17 per share in FY2015.)

As for "control", that is a non issue, in my opinion. Perodua has a stable and diversified shareholding structure, held by UMW, MBM, Daihatsu, PNB and Mitsui.

Concluding Remarks

Far from just accounting profit, MBM's 22% associate stake in Perodua is packed with flesh and blood and generates real economic benefit. Every year it contributes more than RM50 mil cash inflow to MBM Resources, which in turn is distributed to reward loyal shareholders.

https://klse.i3investor.com/blogs/icon8888/188684.jsp