1. Introduction

First of all, credit given to forum member commonsense. He was the one that gave us the idea for MBM Resources.

MBM Resources distributes Perodua cars, Volvo, Volkswagen, Hino, etc. It owns 20% stake in Perodua, which is its most valuable and profitable asset (the remaining 38%, 25%, 10% and 7% of Perdoua is owned by UMW, Daihatsu, PNB and Mitsui respectively).

MBM Resources also manufactures a portfolio of auto parts (airbags, safety belts, alloy wheels, etc). This division used to be quite profitable before 2015 but now merely breaks even.

MBM Resources used to trade as high as RM3.50 back in 2014. However, in the recent few years, it has not done well. So share price has come down to the current RM2.00 plus.

Based on 391 mil shares and RM2.20, market cap is approximately RM864 mil.

Auto stocks had been out of favour in past few years. So, even after MBM Resources has turned around in the recent few quarters, nobody notices it.

Another possible factor is the perception that recent strong quarter was due to the zero GST from 1 June until 31 August 2018, and hence is not sustainable (which is not the case, please refer to next section).

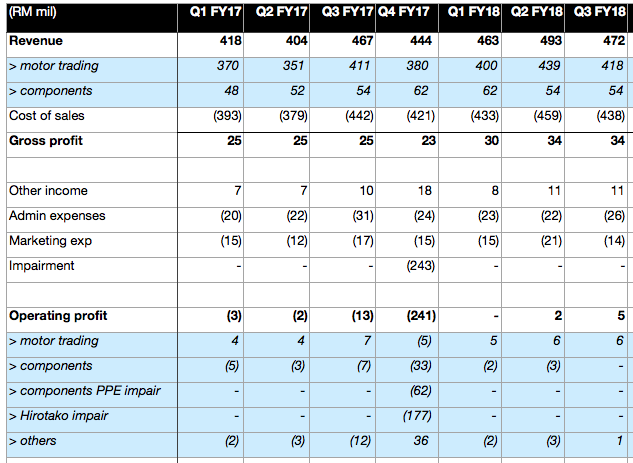

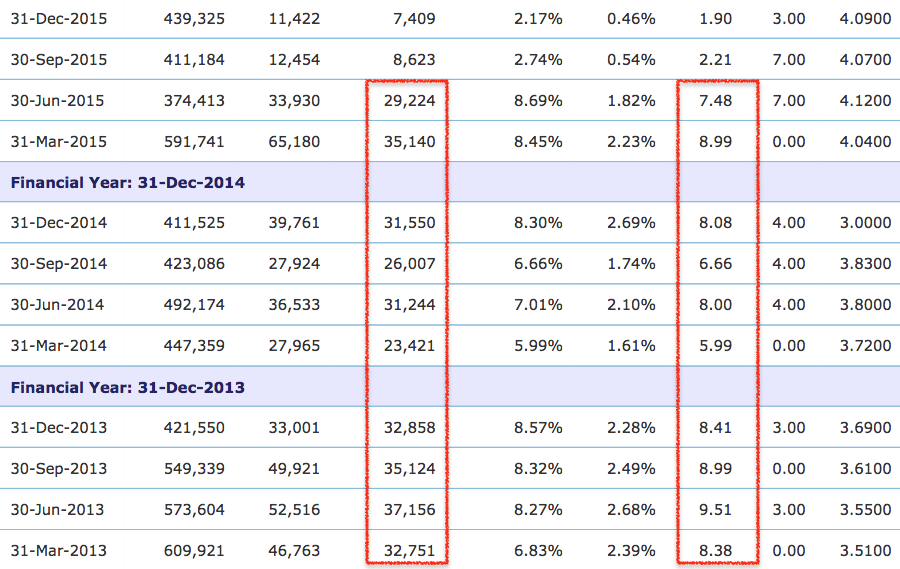

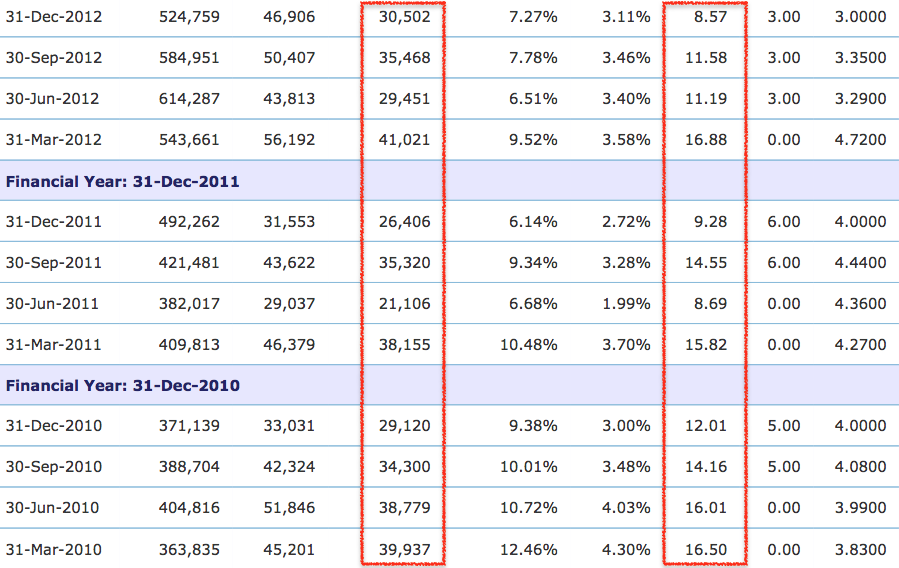

2. Historical Profitability

MBM Resources' financial year end is December.

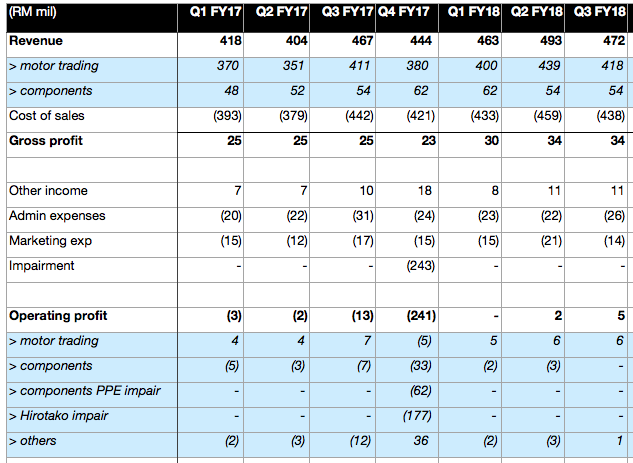

Key observations :

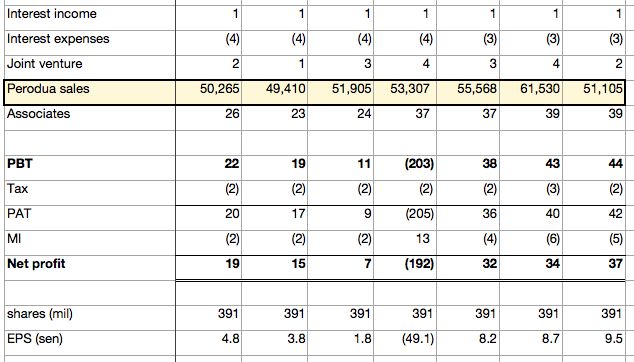

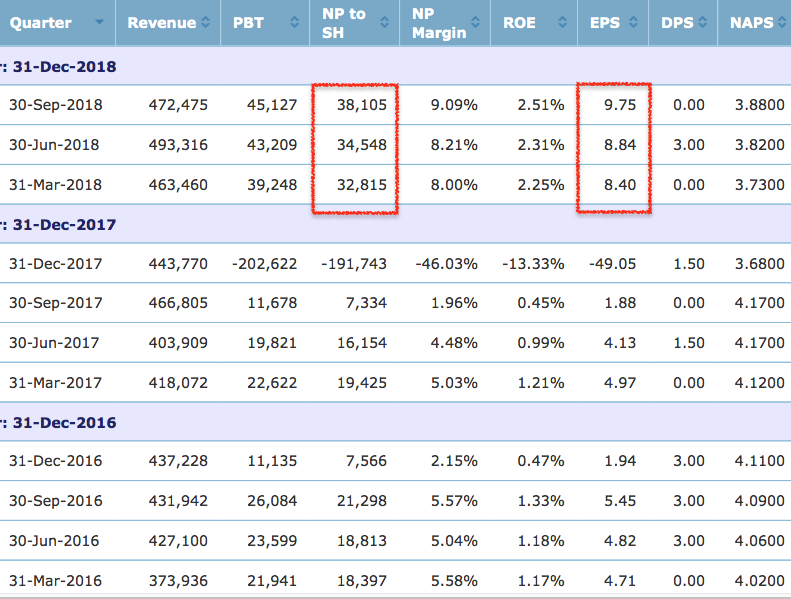

(a) MBM Resources has not done well from Q1 to Q3 of FY2017.

In Q4 of FY2017, the group has turned around. Its 20% stake in Perodua reported a 50% jump in earning from RM25 mil to RM37 mil.

However, in that particular quarter, the group undertook kitchen sinking exercise involving RM177 mil impairment of its Hirotako stake (seat belt manufacturing) and RM62 mil impairment of certain plants and equipment. As a result, the group reported a loss of RM151 mil.

(b) In Q1 of FY2018, MBM Resources reported a 30% jump in gross profit from RM23 mil to RM30 mil. One contributor was auto parts manufacturing division which saw losses narrowed from approximately RM5 mil per quarter to RM3 mil per quarter.

Its 20% stake in Perodua continued its strong profitability of RM37 mil.

The group reported net profit of RM32 mil.

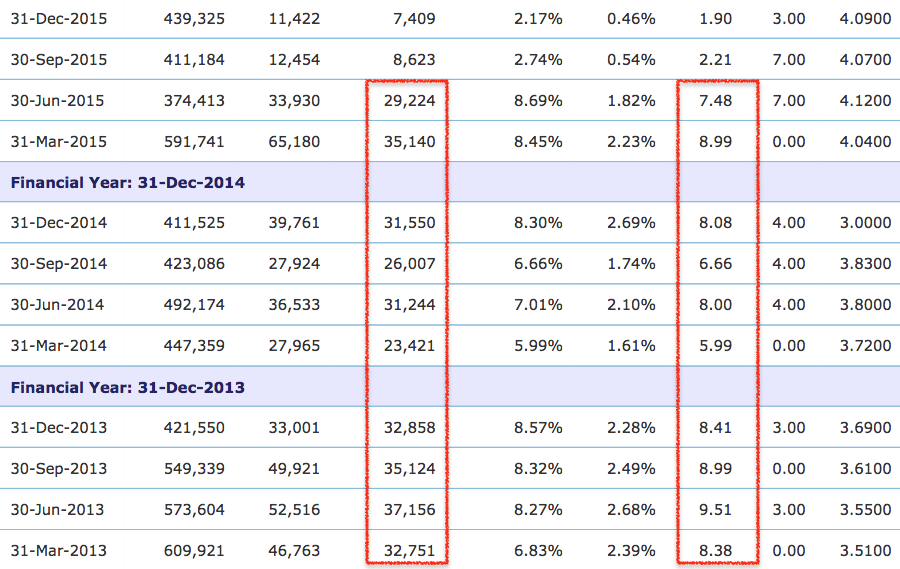

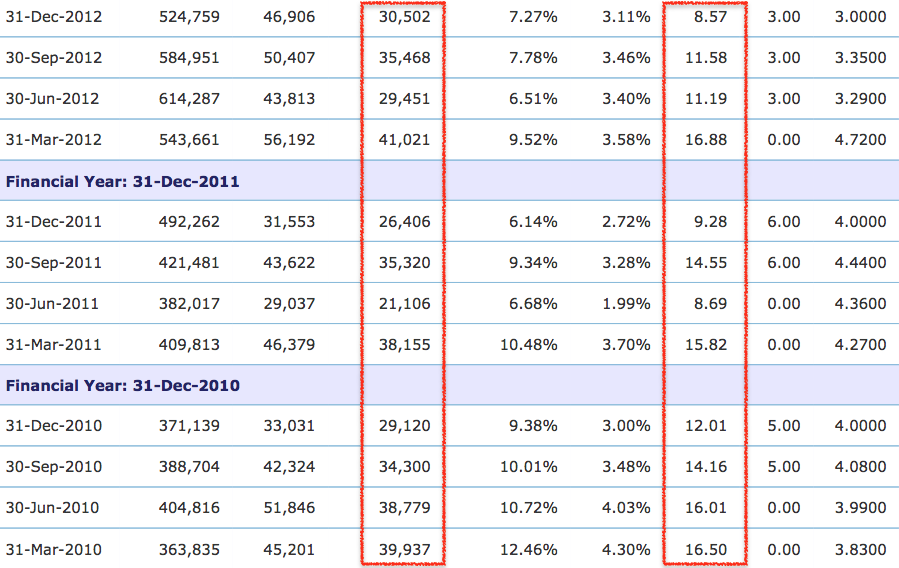

The last time MBM Resources has done so well was back in June 2015.

Market didn't notice.

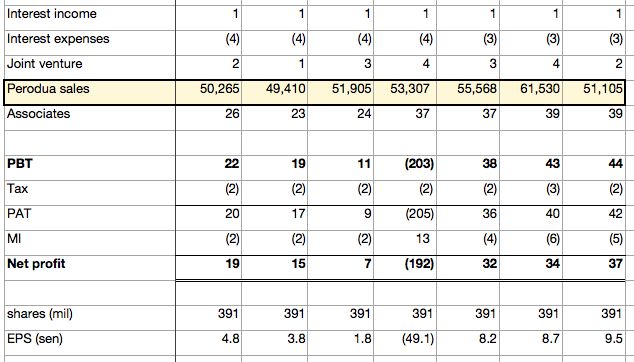

(c) The Group continued to do well in Q2 of FY2018. 20% Perodua stake reported RM39 mil net profit.

Overall group profitability was RM34 mil.

Market still didn't notice.

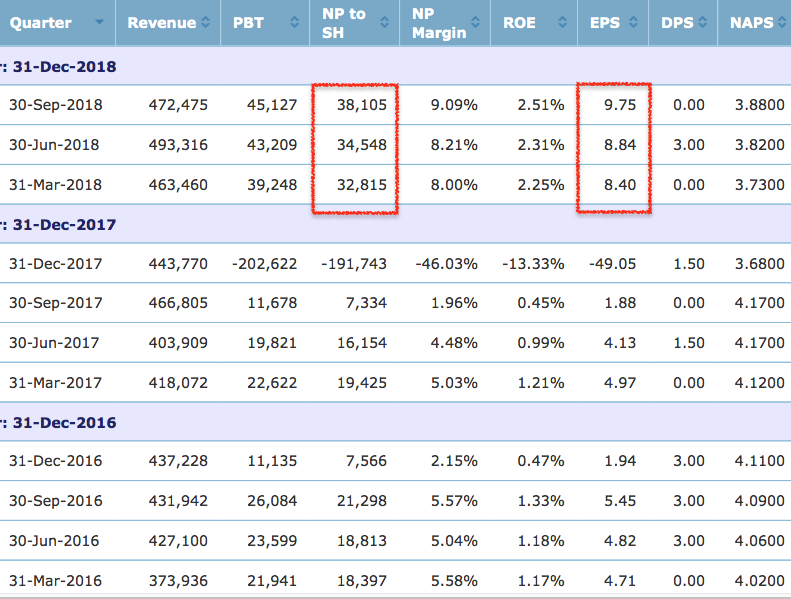

(d) In Q3 of FY2018, the group continued its strong performance. 20% Perodua stake contributed RM39 mil. Overall group profitability was RM37 mil.

Market yawned. Everybody believed that "It must be due to the zero GST which pushed up sales. In coming Q4 of FY2018, you can expect the numbers to plummet".

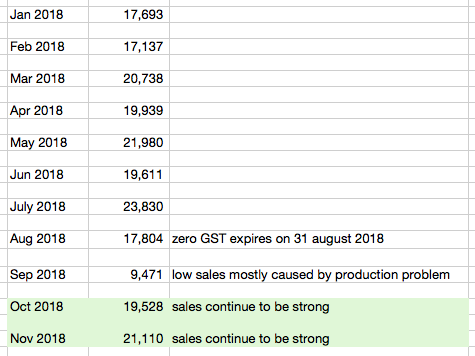

Did the zero GST really cause Q3 earnings to spike ? Nope. Perodua encountered some production problems in the month of September 2018. As a result, its sales in Q3 actually dropped from 61,530 units in previous quarter to 51,105 units, despite the zero GST.

In other words, its strong Q3 has got nothing to do with the zero GST.

3. What To Expect For The Coming Quarters ?

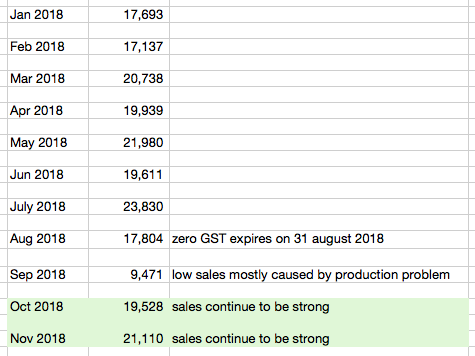

The coming Q4 quarter is expected to be good because Perodua car sales had been strong (despite the introduction of SST). Pease refer to the green cells.

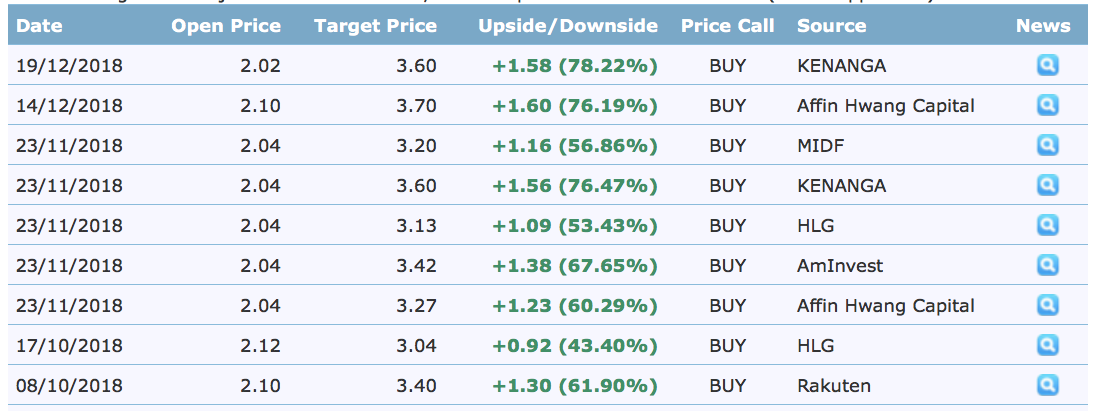

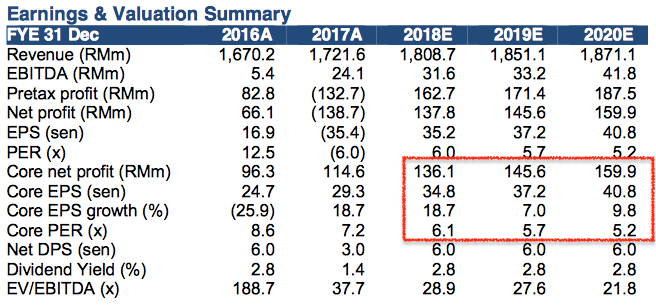

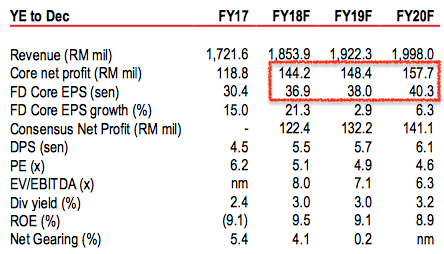

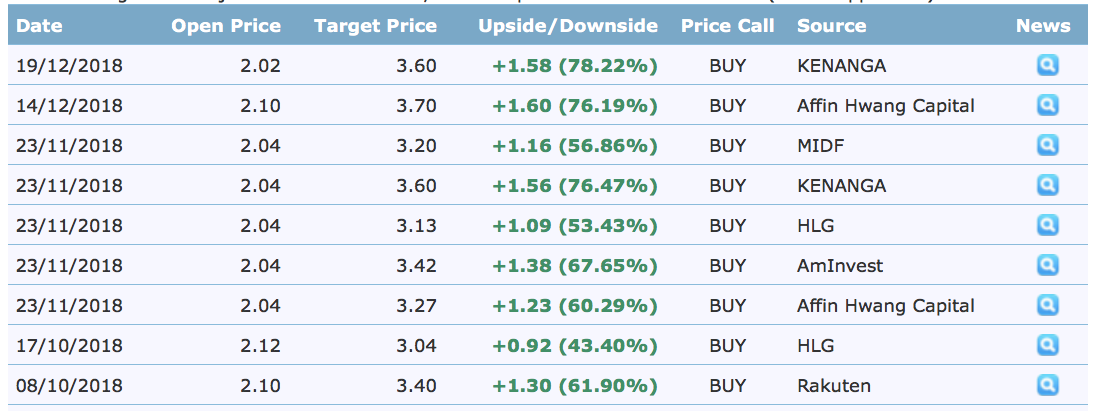

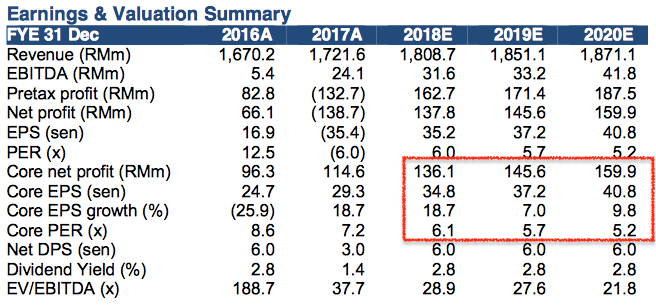

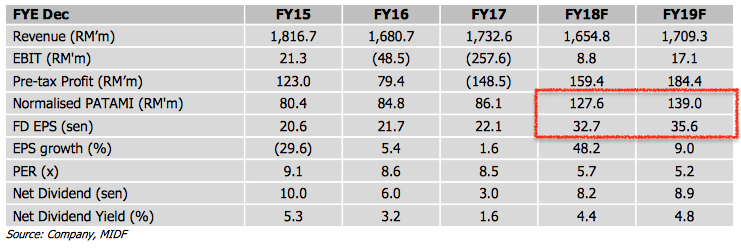

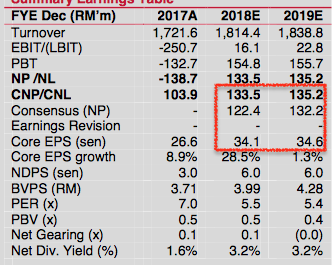

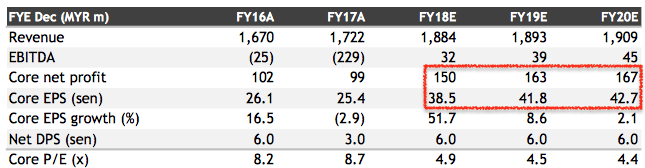

Almost all analysts expect the group to continue to do well in FY2019 and beyond. Please refer below.

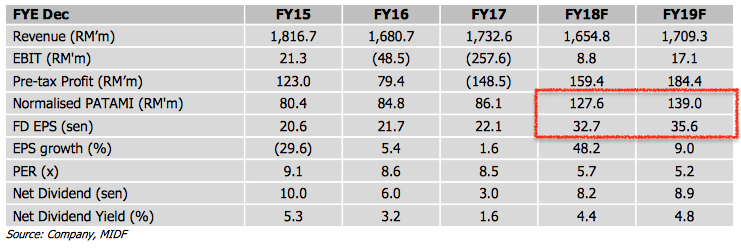

(Source : Affin Hwang report dated 14 December 2018)

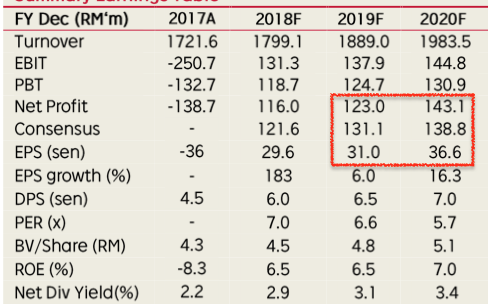

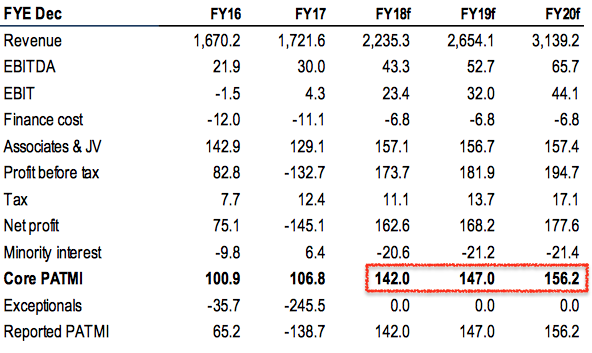

(Source : MIDF report dated 23 November 2018)

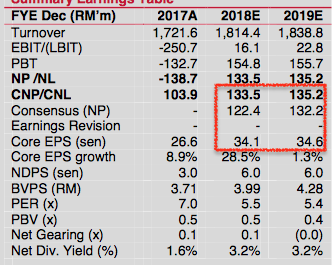

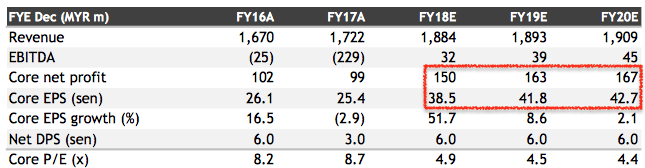

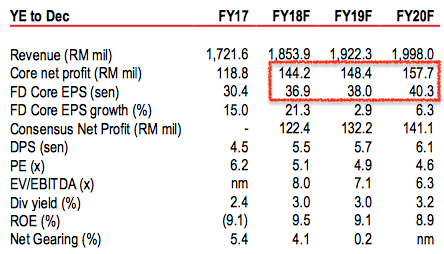

(Source : Kenanga report dated 23 November 2018)

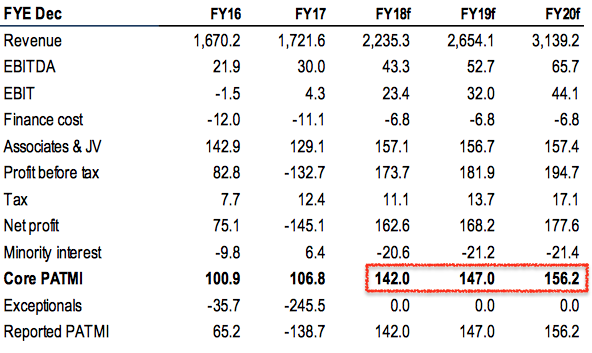

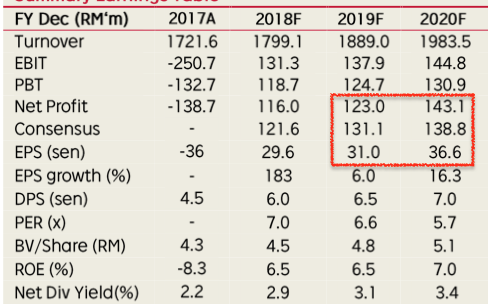

(Source : Maybank report dated 23 November 2018)

(Source : HLIB report dated 23 November 2018)

(Source : AmInvestment Bank report dated 23 November 2018)

(Source : Rakuten report dated 8 October 2018)

The above analyst reports are available in i3's MBM Resources webpage.

https://klse.i3investor.com/blogs/icon8888/188587.jspFirst of all, credit given to forum member commonsense. He was the one that gave us the idea for MBM Resources.

MBM Resources distributes Perodua cars, Volvo, Volkswagen, Hino, etc. It owns 20% stake in Perodua, which is its most valuable and profitable asset (the remaining 38%, 25%, 10% and 7% of Perdoua is owned by UMW, Daihatsu, PNB and Mitsui respectively).

MBM Resources also manufactures a portfolio of auto parts (airbags, safety belts, alloy wheels, etc). This division used to be quite profitable before 2015 but now merely breaks even.

MBM Resources used to trade as high as RM3.50 back in 2014. However, in the recent few years, it has not done well. So share price has come down to the current RM2.00 plus.

Based on 391 mil shares and RM2.20, market cap is approximately RM864 mil.

Auto stocks had been out of favour in past few years. So, even after MBM Resources has turned around in the recent few quarters, nobody notices it.

Another possible factor is the perception that recent strong quarter was due to the zero GST from 1 June until 31 August 2018, and hence is not sustainable (which is not the case, please refer to next section).

2. Historical Profitability

MBM Resources' financial year end is December.

Key observations :

(a) MBM Resources has not done well from Q1 to Q3 of FY2017.

In Q4 of FY2017, the group has turned around. Its 20% stake in Perodua reported a 50% jump in earning from RM25 mil to RM37 mil.

However, in that particular quarter, the group undertook kitchen sinking exercise involving RM177 mil impairment of its Hirotako stake (seat belt manufacturing) and RM62 mil impairment of certain plants and equipment. As a result, the group reported a loss of RM151 mil.

(b) In Q1 of FY2018, MBM Resources reported a 30% jump in gross profit from RM23 mil to RM30 mil. One contributor was auto parts manufacturing division which saw losses narrowed from approximately RM5 mil per quarter to RM3 mil per quarter.

Its 20% stake in Perodua continued its strong profitability of RM37 mil.

The group reported net profit of RM32 mil.

The last time MBM Resources has done so well was back in June 2015.

Market didn't notice.

(c) The Group continued to do well in Q2 of FY2018. 20% Perodua stake reported RM39 mil net profit.

Overall group profitability was RM34 mil.

Market still didn't notice.

(d) In Q3 of FY2018, the group continued its strong performance. 20% Perodua stake contributed RM39 mil. Overall group profitability was RM37 mil.

Market yawned. Everybody believed that "It must be due to the zero GST which pushed up sales. In coming Q4 of FY2018, you can expect the numbers to plummet".

Did the zero GST really cause Q3 earnings to spike ? Nope. Perodua encountered some production problems in the month of September 2018. As a result, its sales in Q3 actually dropped from 61,530 units in previous quarter to 51,105 units, despite the zero GST.

In other words, its strong Q3 has got nothing to do with the zero GST.

3. What To Expect For The Coming Quarters ?

The coming Q4 quarter is expected to be good because Perodua car sales had been strong (despite the introduction of SST). Pease refer to the green cells.

Almost all analysts expect the group to continue to do well in FY2019 and beyond. Please refer below.

(Source : Affin Hwang report dated 14 December 2018)

(Source : MIDF report dated 23 November 2018)

(Source : Kenanga report dated 23 November 2018)

(Source : Maybank report dated 23 November 2018)

(Source : HLIB report dated 23 November 2018)

(Source : AmInvestment Bank report dated 23 November 2018)

(Source : Rakuten report dated 8 October 2018)

The above analyst reports are available in i3's MBM Resources webpage.