Advancecon Holdings Berhad

Company Summary

Advancecon Holdings Berhad is a construction company engaged in civil engineering and infrastructure works with over 25 years of experience. Its construction works include building works, road and pavement construction, bridge and jetty construction, pilling works, soil investigation and so on. They are an ISO certified, CIDB G7, a reputable and trusted establishment with a strong team, comprising managers, engineers, and professionals with significant experience and professional expertise. As a Grade "7" contractor registered with CIDB under SPKK, they are able to tender for Malaysian Government projects with unlimited value and our registered categories are under Category B (Building) and Category CE (Civil Engineering).

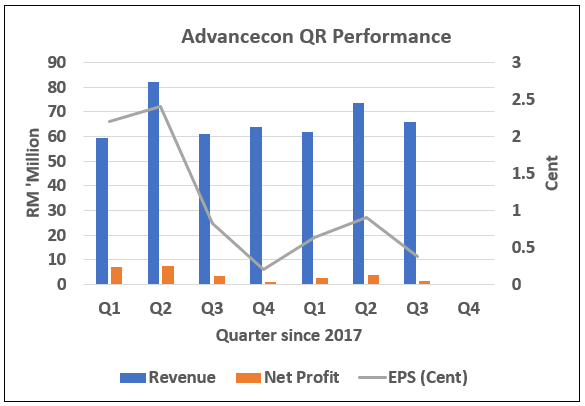

2017 (IPO year) consider a GOOD year to ADVCON as they won 4 jobs in a span of nine months since its listed. No doubt, 2017 was indeed a bullish year to the global and Malaysia market. However, their financial earnings failed to meet the expectation of Investors. The burden of interest, depreciation of machines, low utilization rate (70% from 90%) and high diesel price (10% of cost structure) pushed earnings to a new low in 2018. The share price was slumped with a 78.9% and 59.5% from the 18-months high and IPO price (RM 0.63) respectively and recently its share price potentially bottoms out.

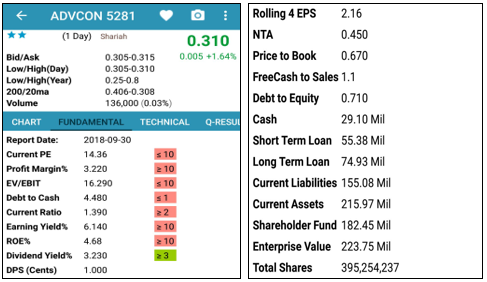

The fundamental and financial ratios of this company remain weak. Most of the investors probably will stay away from this kind of counter: Poor profitability, efficiency, financial leverage, liquidity and asset use (productivity). Despite that, I took the initiatives to study about this company as if you try to look back all my articles, I always do a company analysis when the stock becomes unpopular and share price getting stabilise. This is how and when we can make a handsome profit.

Fundamental Information

Breakdown – Top line

i) Earthworks 65%

ii) Civil Engineering 25%

iii) Support Services and Property Investment 10%

Prospects

As of January 2019, their order book stands at RM870 million, which ensuring earnings visibility for at least two years. In addition, Advcon is looking to make strides forward in Sarawak as new opportunities beckon after the state government indicated major plans for the infrastructure scene there. According to the Group’s CEO, Datuk Phum Ang, they plan to bid for jobs in the state with a combined value in excess of RM2 billion this year. In fact, their Sarawak unit is actively engaging with the tender process in the state. So far, they had submitted bids for seven out of 19 projects under the Public Works Department (JKR) that mainly involve bridges and roadworks. Moreover, they are also getting ready to tender for Sarawak coastal road and second trunk road projects which have an estimated value of RM11 billion. According to Minister of Infrastructure Development and Transportation of Sarawak, the projects were still in the procurement stage by JKR and the physical work will be commenced in the first quarter of next year.

The group is eyeing an order book replenishment of at least RM300 million per year to help boost its top line to RM1 billion in 5 years’ time. Sabah and Sarawak definitely a next place to be, more specifically Sarawak. The job flows for the industry players have slowed down drastically in Peninsular Malaysia following the change in the federal government and tight budget. The Sarawak’s government had allocated circa RM9 billion for development expenditure under state budget 2019 (State reserves circa RM31 billion). FYI, they are holding two mega infrastructure projects (Pan Borneo Highway and West Coast Expressway) in hand. There are many more projects that won by Advcon and these projects ensure earnings visibility for at least 2 years.

Ongoing-projects

1. Setia Ecohill - Site clearance, Earthwork and associated infrastructure works for Setia EcoHill

2. Setia Eco Garden - Site clearance and earthworks for Setia EcoGarden

3. West Coast Expressway - Construction and completion of Section 1 - Banting Interchange to South Klang Valley Interchange

4. Cyberjaya Flagship Zone - Construction and completion of detention pond at Cyberjaya flagship zone

5. Lekas Highway - Construction and completion of Trumpet Interchange at Lekas Highway for Eco Majestic

6. Eco Majestic - Construction and completion of link road and associated infrastructure work from Eco Majestic interchange to housing development of Eco Majestic

7. Bukit Jalil National Sport Complex - Construction and completion of infrastructure and landscape work for existing Bukit Jalil National Sports Complex

8. Tropicana Aman - Site clearance, Earthwork and associated infrastructure works for Tropicana Aman

9. Nilai Impian - Site clearance, earthworks and detention pond for Nilai Impian

10. Desa Park City - Earthworks for 86 blocks & 5 storeys with 2 basement car parks for mixed development at Perdana Park City.

11. Pan Borneo Highway - Earthworks. geotechnical works and drainage works for the development and upgrading of Pan Borneo Highway

12. Bandar Serai Development - Site Clearing, Earthworks & Ancillary Works at Bandar Serai Development

13. Ecohill Link

Technical Analysis

1. Most volume done between 25.5sen to 34sen (after big correction), more specifically around 28.5sen to 31sen, potential bottom out.

2. 3 times double bottom (DB) along the downtrend: DB1 IPO price, DB2 36.5sen and DB3 25.5sen.

3. Share price is supported at 38.2% of Fibonacci retracement. (25.5sen-34sen range)

4. A rebound signal getting solid

5. Potential breakout from sideways and >1-year downtrend

Risk and Reward (Based on TA)

1. Closing price as 8/2/2019 – 31sen

2. Resistance – 34sen (ROI 9.7%), 36.5sen (ROI 17.75%) and 41sen (ROI 32.26%)

3. Support – 29sen (ROI 6.45%) and 25.5sen (ROI 17.75%)

4. IPO Price – 63sen (ROI 103.23%)

5. 18-months high – RM 1.21 (ROI 290.32%)

Disclaimer: Sometimes the smallest step in the right direction ends up being the biggest step of our life. This is not a buy/ sell call, it is just for education purposes.

https://klse.i3investor.com/blogs/ADVCON/192749.jsp