Source: Focus Lumber Company Website

Nature of the Company:

Focus Lumber is a Sabah-based company that manufactures and sells Plywood, Veneer and Laminated Veneer Lumber.

Source: Company Quarterly Report (Bursa Malaysia)

Financial Performance:

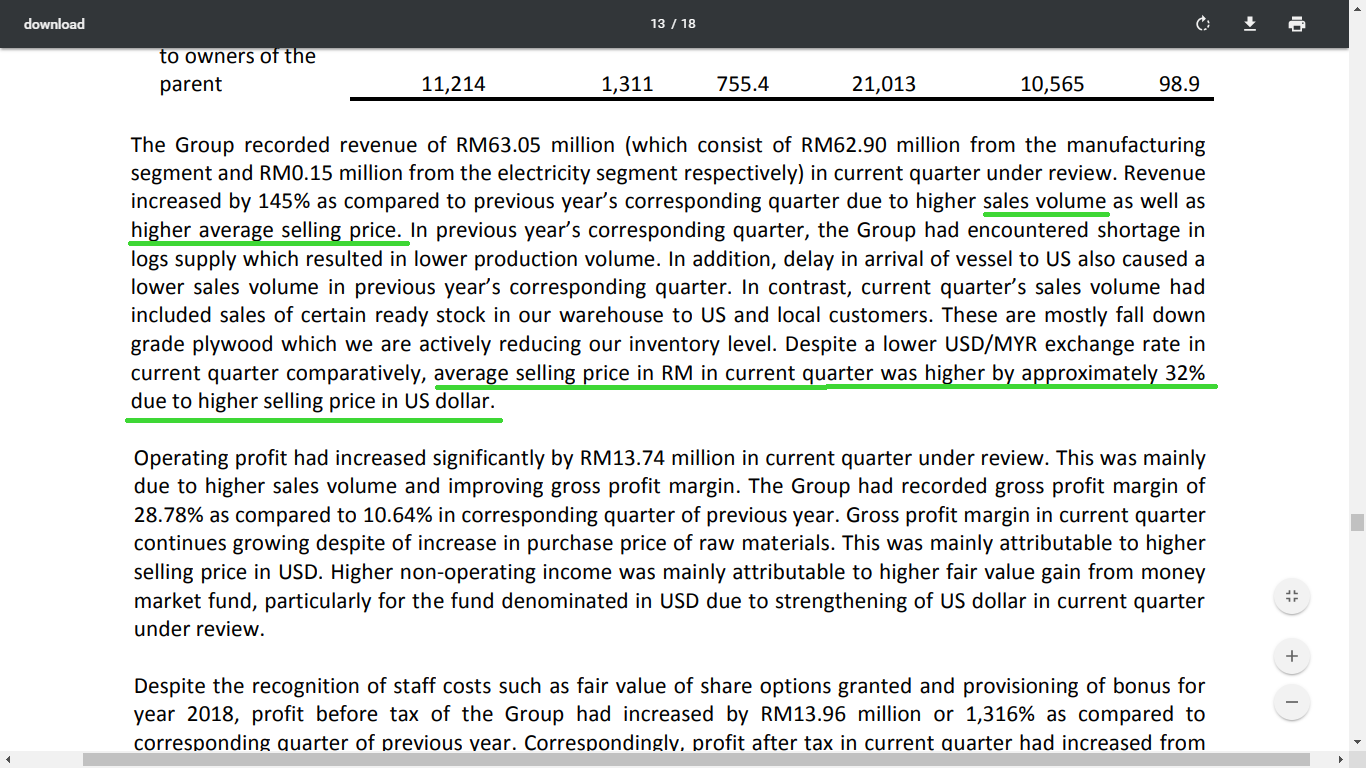

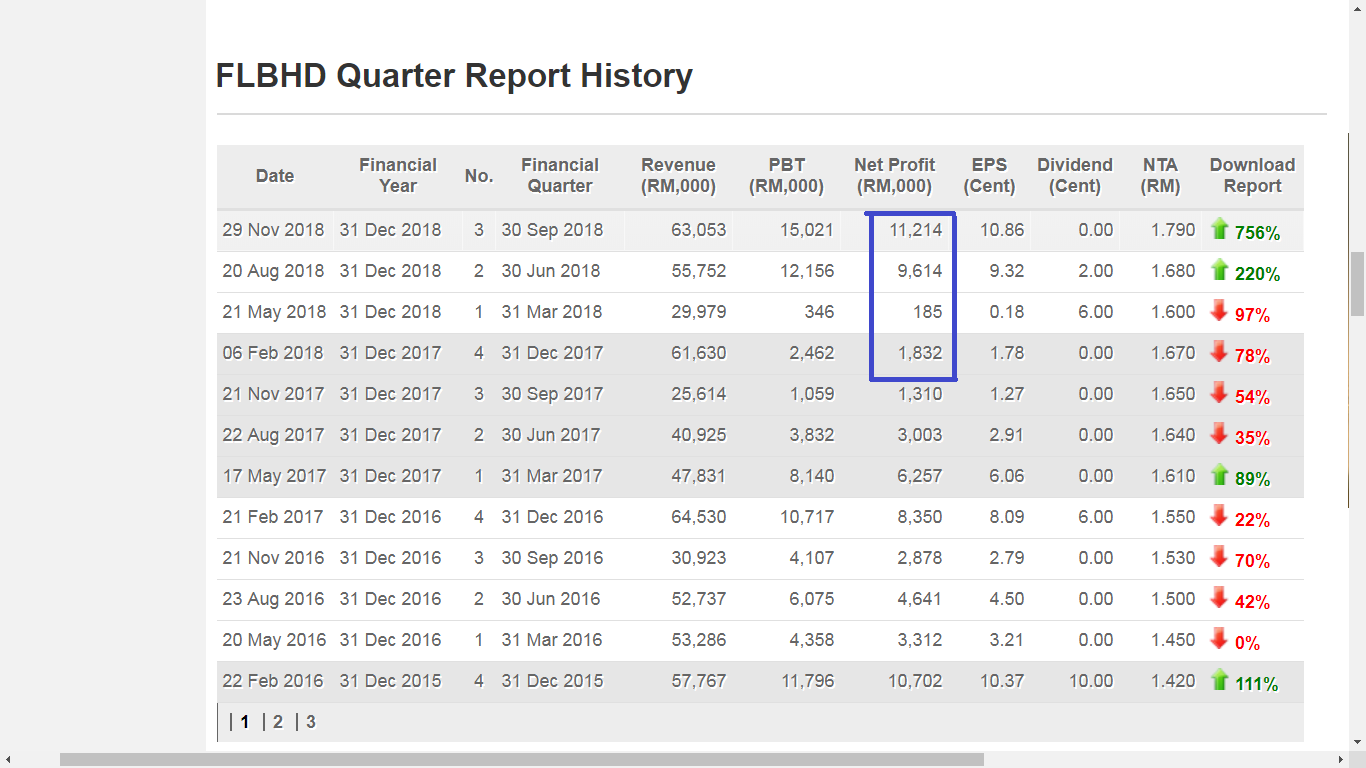

Based on its latest quarterly report (Quarter 3), Focus Lumber:

(a) Revenue: rm25.61 mil to rm63.05 mil.

(a) Revenue: rm25.61 mil to rm63.05 mil.

(b) Net Profits: rm1.31 mil to rm11.21 mil.

The increased in revenue is due to higher sales volume and higher average selling price in USD.

The increased in net profits is due to the increase in revenue (factors mentioned above), higher production volume (sufficient logs supply), strengthening of the USD/MYR exchange rate.

From the above brief analysis, Focus Lumber operation is highly influenced by 2 key factors, namely:

(a) Sufficient logs supply - to ensure higher production volume and lower production cost

(b) USD/MYR exchange rate - to ensure higher gross margins from higher USD average selling price

(a) Sufficient logs supply - to ensure higher production volume and lower production cost

(b) USD/MYR exchange rate - to ensure higher gross margins from higher USD average selling price

Strong Financial Fundamentals:

Source: Company Quarterly Report (Bursa Malaysia)

Source: Company Quarterly Report (Bursa Malaysia)

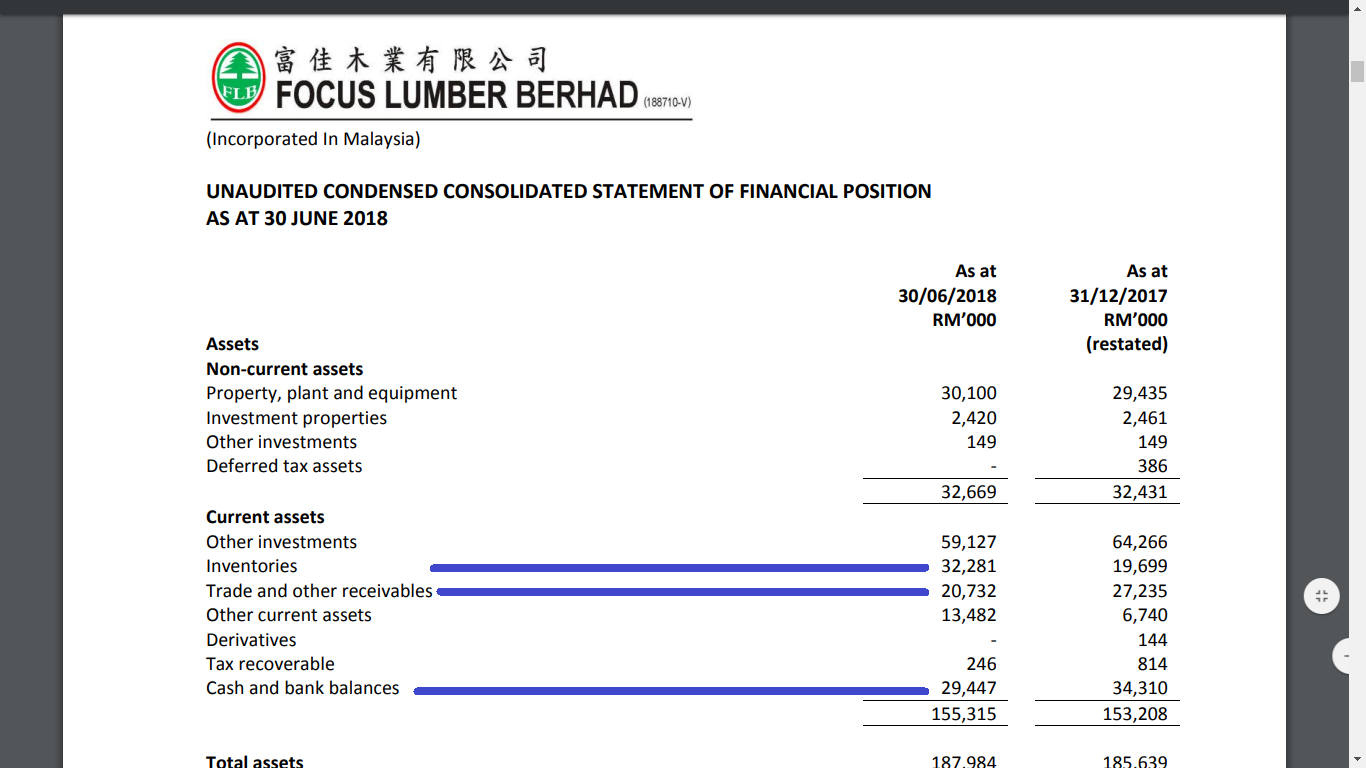

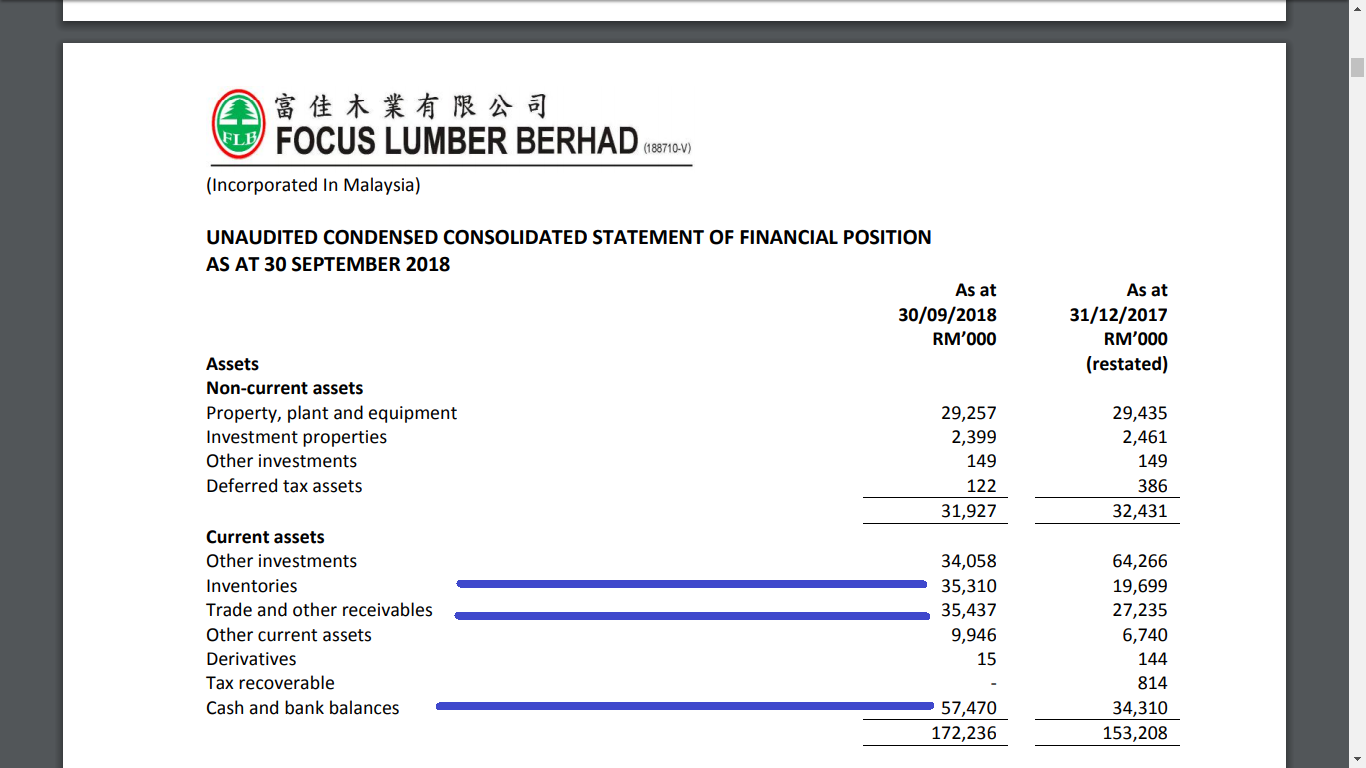

Inventories: Although

it was stated in the report that some of the sales volume was

contributed by the selling of fall down grade plywood to US and other

customers, the inventory level of the company has increased from rm32

mil (Q2) to rm35 mil (Q3). The company's future sales in Q4 looks

promising.

Receivables: The company's trade and other receivables has increased from rm20 mil (Q2) to rm35 mil (Q3).

Cash: The

company's cash and bank balances has increased from rm29 mil to rm57

mil. This was mainly contributed by the withdrawal of money market funds

which is classified as "Other Investments". The reasons for the

withdrawal is for working capital purposes (probably to fund higher

future sales) and to reduce currency risk as the money market funds are

denominated in USD.

Focus Lumber currently has rm57 million cash, and the best of all ZERO DEBTS. The company is cash rich, and therefore can afford to pay dividends. Please refer below:

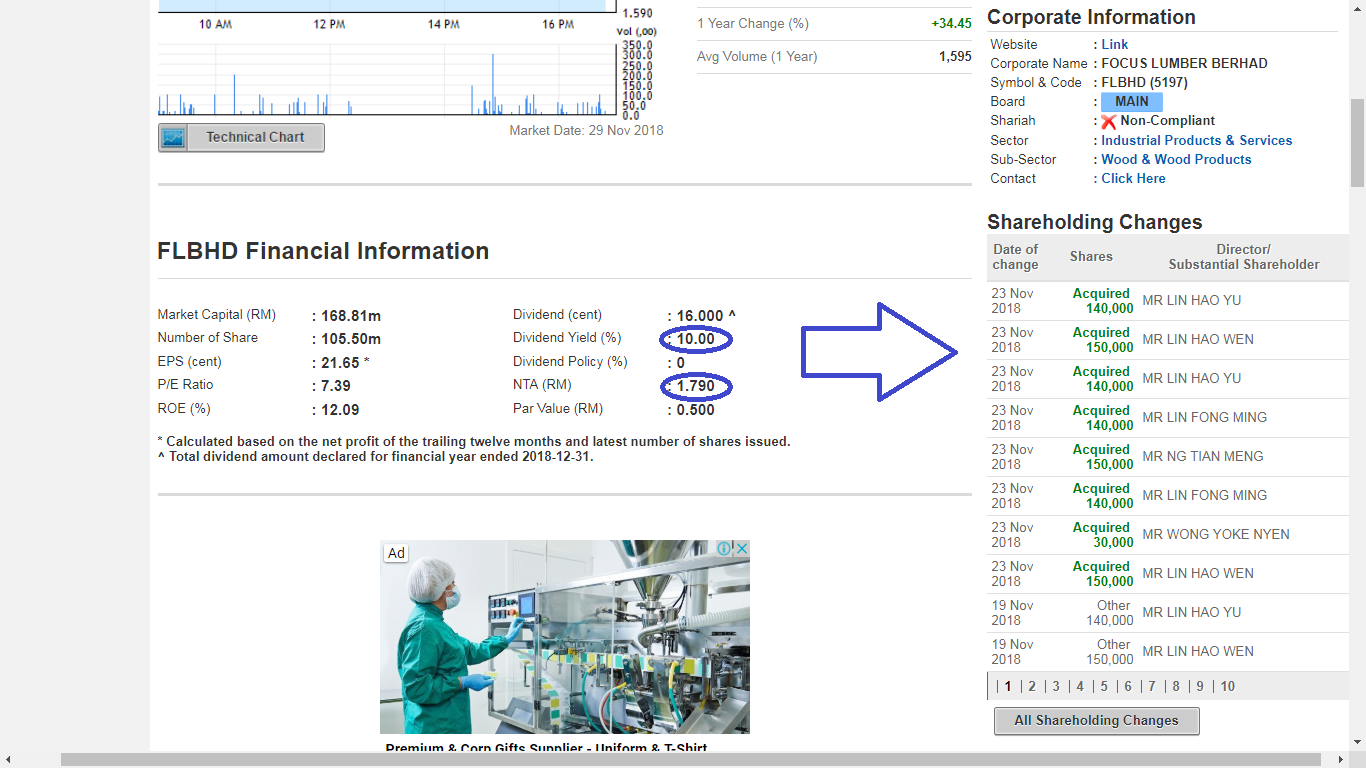

Source: Malaysiastockbiz

The company has a dividend yield of about 10%, after adjustment of 6 cents dividend supposedly to be paid in 2017, the adjusted dividend yield is about 4% to 5%, probably a good stock for dividend investors. In addition, the company is also currently trading slightly above its Net Tangible Asset (NTA) of rm1.79 / share.

Insider is Buying:

Based on the above (on your right), several directors of the company are buying the company's shares for the past few months.

Prospects:

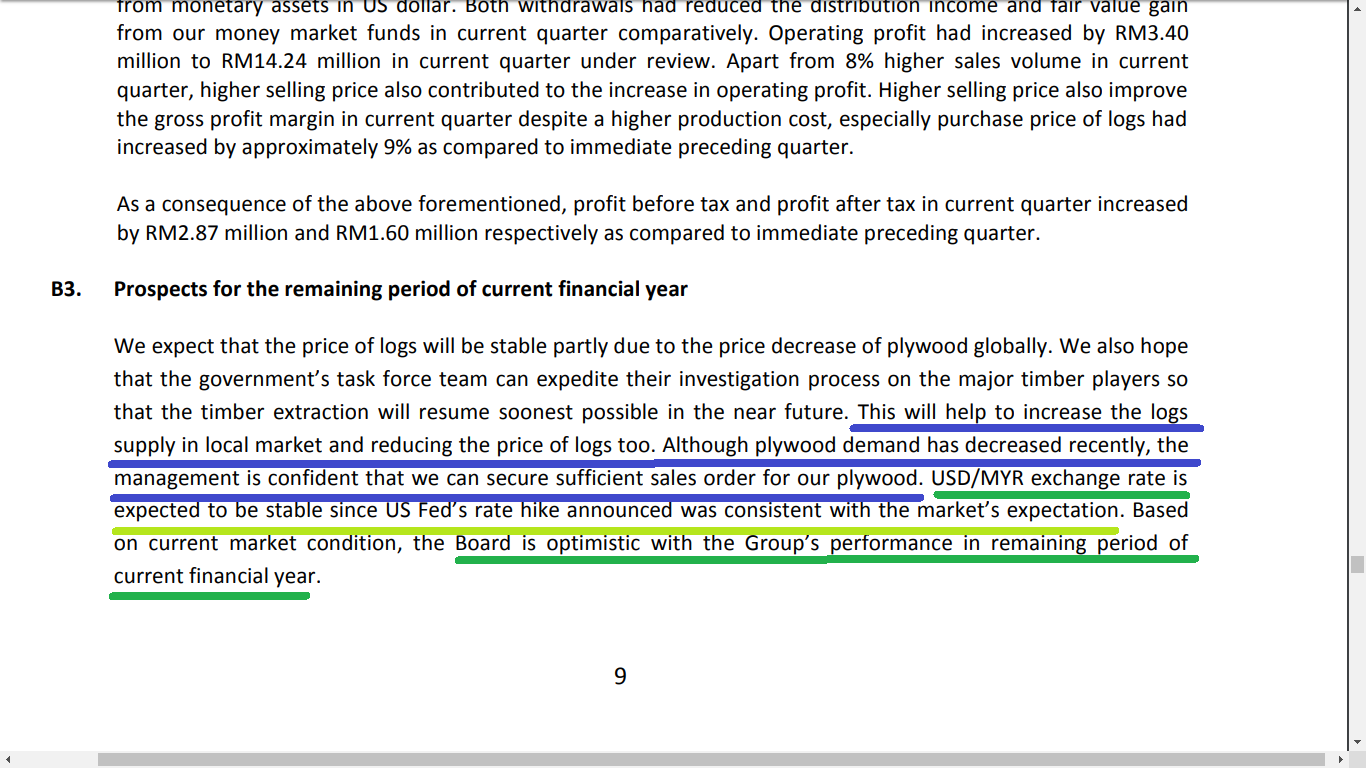

Source: Company Quarterly Report (Bursa Malaysia)

Based on its latest quarterly report

(Quarter 3), the management mentioned that the plywood demand has

decreased recently, however the management is confident that the company

can secure sufficient sales order for its plywood. Moreover with the

strong US economy and Quarter 4 being the festive season in the US, the

demand is likely to be sustainable. In addition, Quarter 4 is usually a

strong quarter for Focus Lumber, based on past results in 2015 &

2016. For 2017, Q4 result is affected by the weakening of the USD, and

insufficient logs supply.

Sufficient Logs Supply:

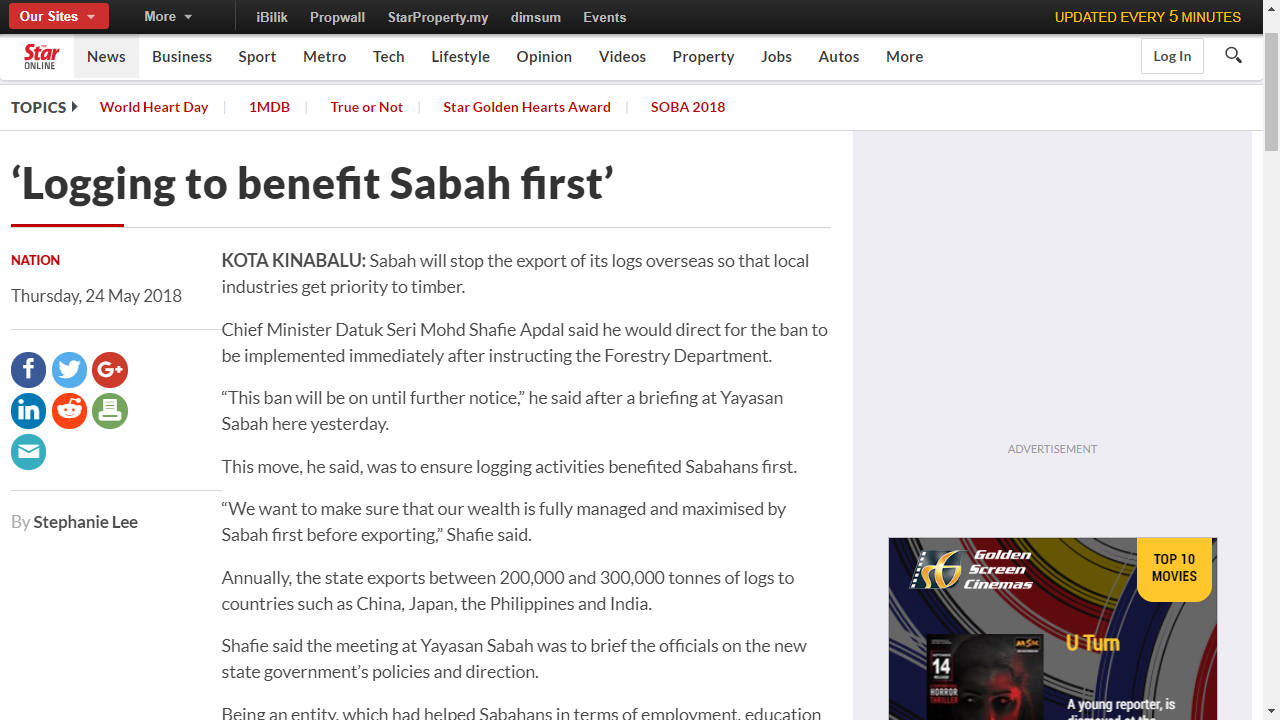

Source: The Star Online

Source: The Star Online

The Sabah government banned log export since May after winning the historic General Election. This should ensure lower log prices going forward and more importantly, a constant stream of logs supply to Focus Lumber and other logs processing mills companies to produce plywood, veneer and LVL.

Moving forward, the company's cost should reduce, supported by Sabah's government ban on logs export. With

the increase in logs supply, its logs prices should reduce which is a

good contributing factor to Focus Lumber operations in the period to

come. With

higher production volume, and the reduction in logs prices, the

company's production cost per m3 should reduce, hence proving the notion

of operational efficiency.

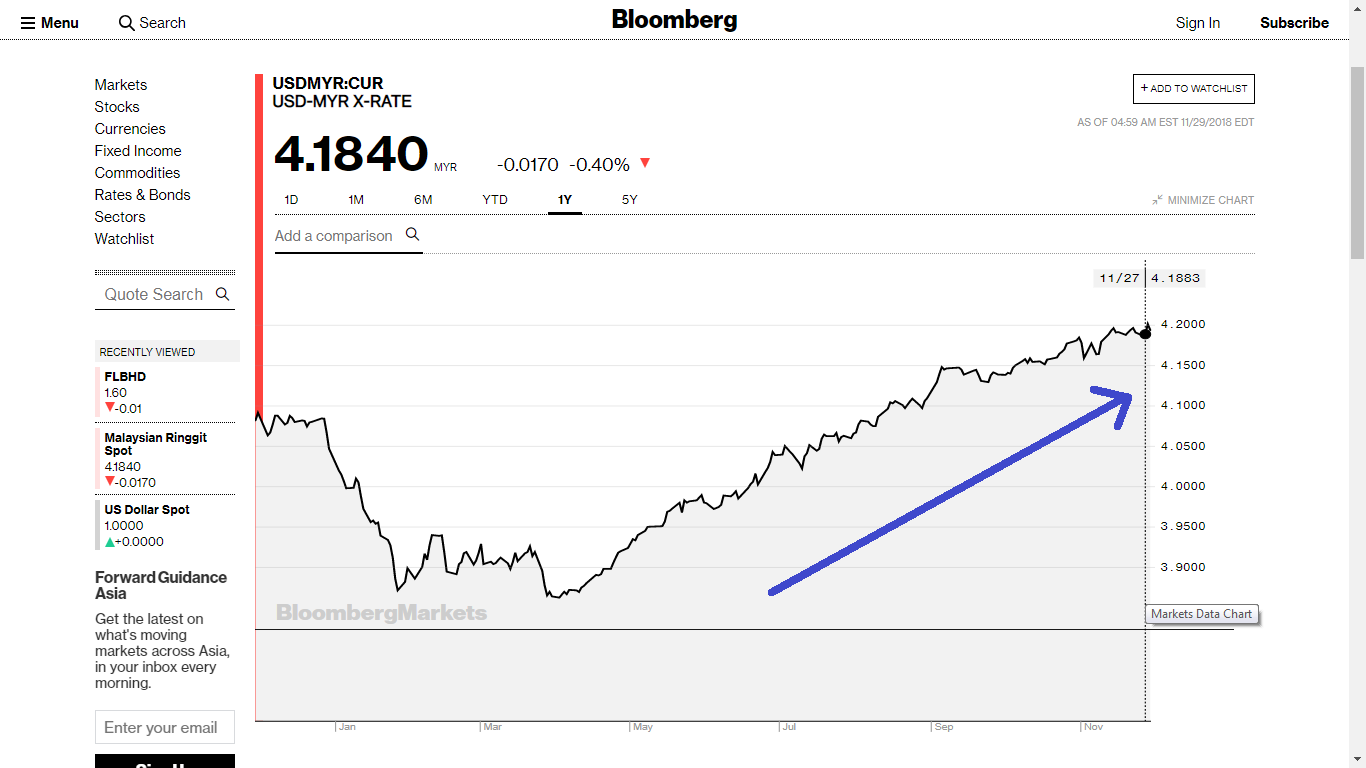

Strengthening of the USD/MYR Exchange Rate:

Source: Bloomberg Online

For the past 8 months, the USD has strengthen against the MYR. Going forward, the USD is more likely to remain its current strength against the MYR supported by the ongoing tit-for-tat trade war between the US and China; and probably the Fed might hike interest rate once in 2019.

Valuations:

Focus Lumber financials:

2017:

Q1: rm 6.26 million

Q2: rm 3.00 million

Q3: rm 1.31 million

Q4: rm 1.83 million

Total: rm12.40 million

2018:

Q1: rm 0.19 million

Q2: rm 9.61 million

Q3: rm 11.21 million

Q4: rm ???

Total: rm???

2019:

Q1: rm ???

Q2: rm???

Q3: rm ???

Q4: rm ???

Total: rm???

In 2015, when logs supply is stable and

USD is strong, Focus Lumber made rm31.72 million. For 2018 & 2019,

with the key factors mentioned above, if Focus Lumber can make rm30 million in 2018 (Projected Q4 net profit of rm9.61 million, any figure higher than this is a Plus Bonus), based on shares outstanding of 105.50 million shares and a Price-Earnings Multiple of 10 times, Focus Lumber is valued at rm2.90 per share.

Based on current share price at rm1.80 per share, the upside potential is 61%, a comfortable margin-of-safety. For some who look further till Q1FY2019, assuming Focus Lumber can make rm9.6 million in Q4FY2018, and rm5.0 million for Q1FY2019, the immediate 4-rolling quarters profits is estimated to be rm 37 million, based on shares outstanding of 105.50 million shares and a Price-Earnings Multiple of 10 times, Focus Lumber is valued at rm3.28 per share.

Based on current share price at rm1.80 per share, the upside potential is 61%, a comfortable margin-of-safety. For some who look further till Q1FY2019, assuming Focus Lumber can make rm9.6 million in Q4FY2018, and rm5.0 million for Q1FY2019, the immediate 4-rolling quarters profits is estimated to be rm 37 million, based on shares outstanding of 105.50 million shares and a Price-Earnings Multiple of 10 times, Focus Lumber is valued at rm3.28 per share.

Of course, please conduct your own research on this company, and have your own cut-loss point just in case if things do not go well as planned. I may make mistakes too.

Disclaimer: The above is for

educational and sharing purpose only. There is no buy or sell call.

Please conduct your own diligence before buying or selling stocks in the

capital market.

Please "LIKE" this page "Financial education 4 youth" to support our financial awareness initiative. https://www.facebook.com/financialeducation4youth/

https://klse.i3investor.com/blogs/investmentopportunity/192863.jsp