To put it briefly, LTKM, one of the largest egg producers in local poultry industry, met all my stock selection criteria. Here I list down merely 5 reasons, why LTKM is a very good buy.

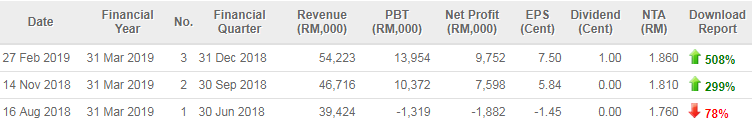

(a) Merely 2 quarters, LTKM became the lowest PER poultry stock.

LTKM had recorded 13.34 sen earnings per share in recent 2 quarters [1]. Since the egg price hit the highest with grade AA chicken eggs are selling at RM0.41 currently [2]. So it’s a better chance that LTKM may record better earnings if compared to previous.

If LTKM records 2 more good quarter results. Based on 10 PER, it should be worth RM2.00 and above. Please be noticed that median PER for poultry stock is 14.6, and there is no poultry stock is trading below 10 PER [3].

(b) Higher selling prices, higher margins — It's all about egg prices.

Not like Lay Hong or CAB Cakaran, LTKM didn’t sell broilers, frozen foods, or marine products. They mainly sell chicken eggs. In FY2018, their daily egg production has achieved an average of 1.57 million eggs per day. With the good selling prices, the revenue more than RM50 mil for next quarter should be achieavable.

For your info, the average price of gred AA chicken eggs are shown below.

01/2018 — 35.4 sen

02/2018 — 31.1 sen

03/2018 — 36.5 sen

04/2018 — 40.3 sen

01/2019 — 41.9 sen (YTD)

(c) LTKM has very good profit margins.

...We are proud that our farm structure is still one of the most well-maintained and efficient. Operating from a single location also helps to keep logistics and management costs in check.

...We have in-house feedmill plant provides the birds with quality feeds for the production of higher quality eggs.

...Centralisation of operation increases efficiency and controls costs of operations particularly logistics and management costs.

If you read their latest annual report [4], you will know why their profit margins better than others. They has only one poultry farm which is located in Melaka, almost 30-year farm but still well-maintained, all chicken eggs produce there, so they no need higher logistics and management costs. In addition, they have own in-house feedmill plant, with the capicity of 8,000 tonnes.

Their major costs came from raw materials, mainly are corn and soybean. The prices of raw materials will effect the profit margins of chicken eggs. Anyway, the raw materials which have mentioned above remained relatively stable recently [5].

(d) Good and healthy balance sheet.

Total borrowings RM80.53 mil with RM25.76 mil cash equivalents in hand [6]. Though LTKM is not a net cash poultry company, but if compared to its competitors, it’s good enough. You no need to worry about the rights issue. They paid reasonable dividend straight for 16 years.

(e) Good quarter results but share price still lagging behind.

The downside risk for LTKM is very very low since it has 2 good quarter results to support the share price at the current level but huge potential upside if they can record 2 more good quarter results. Now the selling price of chicken eggs at the highest, so it has a better chance there.

Look back the tracking record of LTKM, the earnings look quite steady. They only recorded few negative quarter results in 10-year period.

Conclusion

The selling price of chicken eggs is at the historical high but seems like there has no any poultry stock which can stand out from the crowd. So I think LTKM is a good buy since its current PER is the lowest and it may get lower and lower if their PAT can sustain at current level for next 2 quarters.

To be frank, nobody knows how good or bad the next quarter result is. All of us just guessing only. So do your homework properly before buying. Please feel free to comment and thank you for reading.

https://klse.i3investor.com/blogs/ekorharimau/197163.jsp

https://klse.i3investor.com/blogs/ekorharimau/197163.jsp