Master ( 7029 )

Master-Pack Group Berhad (“MPG”) and its subsidiaries are primarily engaged in the business of manufacturing corrugated cartons and providing one-stop packaging solutions to its customers. The Master-Pack Group of companies has over the last 26 years, made a name for itself as an innovative niche market player in the packaging industry. The two main company subsidiaries’ packaging plants are located in Nibong Tebal and Sungai Baong, Penang in the northern region of West Malaysia and Kuching, Sarawak in East Malaysia. In addition, it has an associated company, Richmond Technology Sdn. Bhd. located in Kota Bahru, Kelantan the east coast of West Malaysia. Another associate, Excelfood Pack Sdn. Bhd. is located in Seberang Perai, Penang. The packaging plants are strategically located to service both east and west Malaysia markets. There is a warehouse in Bayan Lepas, Penang for Just-in time delivery to customers as part of our Total Packaging Solutions Services.

Fundamental Analysis

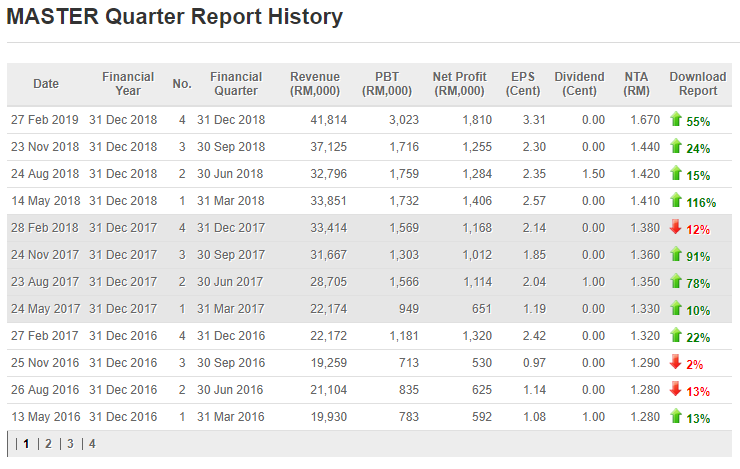

The golden rules by Mr Koon Yew Yin, two consecutive profit growth and it must is selling below P/E 10. Master Pack Group Berhad fullfilled the rules. The company grow exteremely fast with the latest quarter result of 55% increase compare to last year 4th quarter. Not to forget that if you notice their company's Revenue, Profit before Tax & Net Profit have been increasing non stop for FY18.

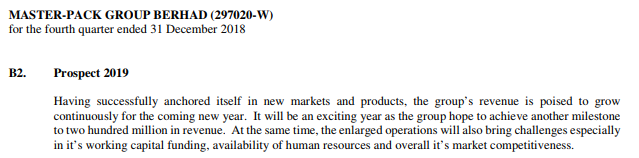

Company Prospect 2019

If you read through the latest quarter report, you will notice that the company aim to achieve 200mil revenue for FY19. That's means 50mil revenue per quarter. Extremely strong growth if compare with other companies. Their latest result shows 43mil revenue only. If the next 4 quarters for FY19 based on the latest quarter EPS 3.31, the annual EPS for FY19 will be 13.24. Not many companies will write such positive prospect for their FY19. The company management have proven themselves that they are able to achieve 100mil mark of revenue in FY18.

Based on P/E 8, it will be RM1.05

Based on P/E 10, it will be RM 1.32.

Recently everyone talks about NTA, look at Master NTA it have been increasing from 1.38 to 1.67. However, the stock price discounted around more than 55% compare with the NTA. Their share based is relatively low as a result to increase their share based in future if the stock price continue to sky rocket. The company might propose bonus issue too with such a good growth for FY19. FY19 will be an exciting year for Master Pack Group Berhad.

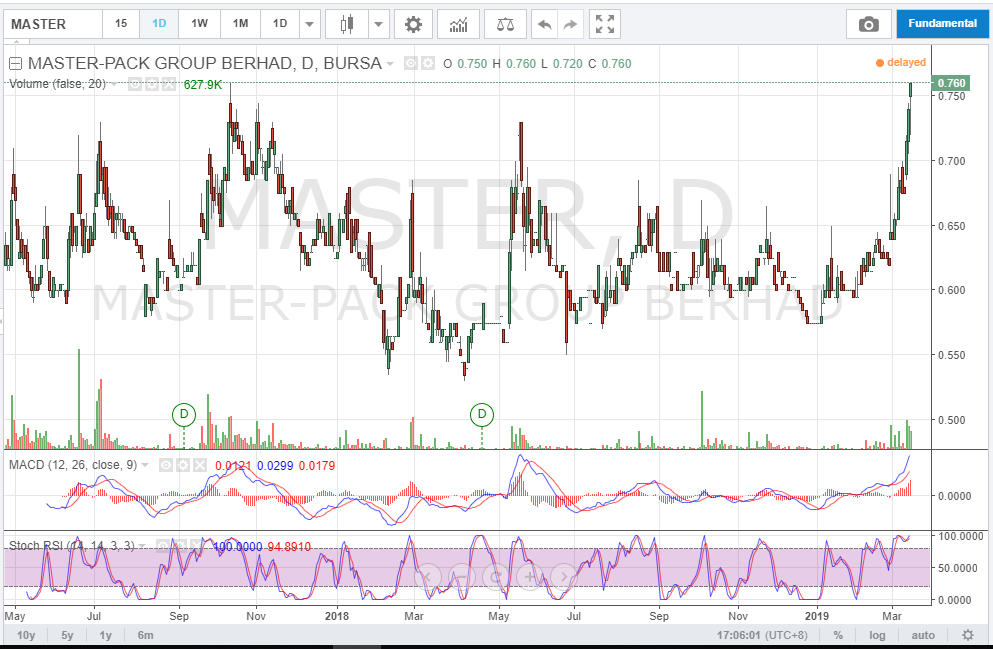

Technical Analysis

Based on the latest technical chart, Master Pack Group berhad already breakout from 0.74 previous high. Today closed at new 52 weeks high 0.76. The volume for these three days have been increasing seems to see that people found out this company. Not to forget this stock only rise up less than 20% compare with others companies that have already up 50% to 100% return. Support level for this stock will be 0.70. Only fundamental stocks will support the share price keep on go upwards.

As conclusion, Master is a good company that you should remember to look at it when come to value investing. Companies that can grow and continously profit for so many quarters in market is very less already. So good companies will slowly shine out like Dayang, Ifcamsc & Danco. Too many people promoted rubbish stocks with bad intention. Please bear in mind some of the companies might have one off gain thats makes their PE seems look low. Look at Master with solid profit growth and no one off gain in it for FY18.

Disclaimer: Please buy at your own risk. This is just for case study. This is not a buy/sell call, Information given above are purely educational purpose. We will not be responsible for any decision made.

https://klse.i3investor.com/blogs/Roger1001/197923.jsp