The problem with a No-Brainer Investment (NBI) is that most people

won’t agree with you. That is also the reason why it is a No-Brainer in

the first place. You must be comfortable and confident about it.

A NBI is one which provides you with a cash yield of double, triple,

or more the cash you can get from a bank fixed deposit interest, in a

consistent manner. Kcchongnz

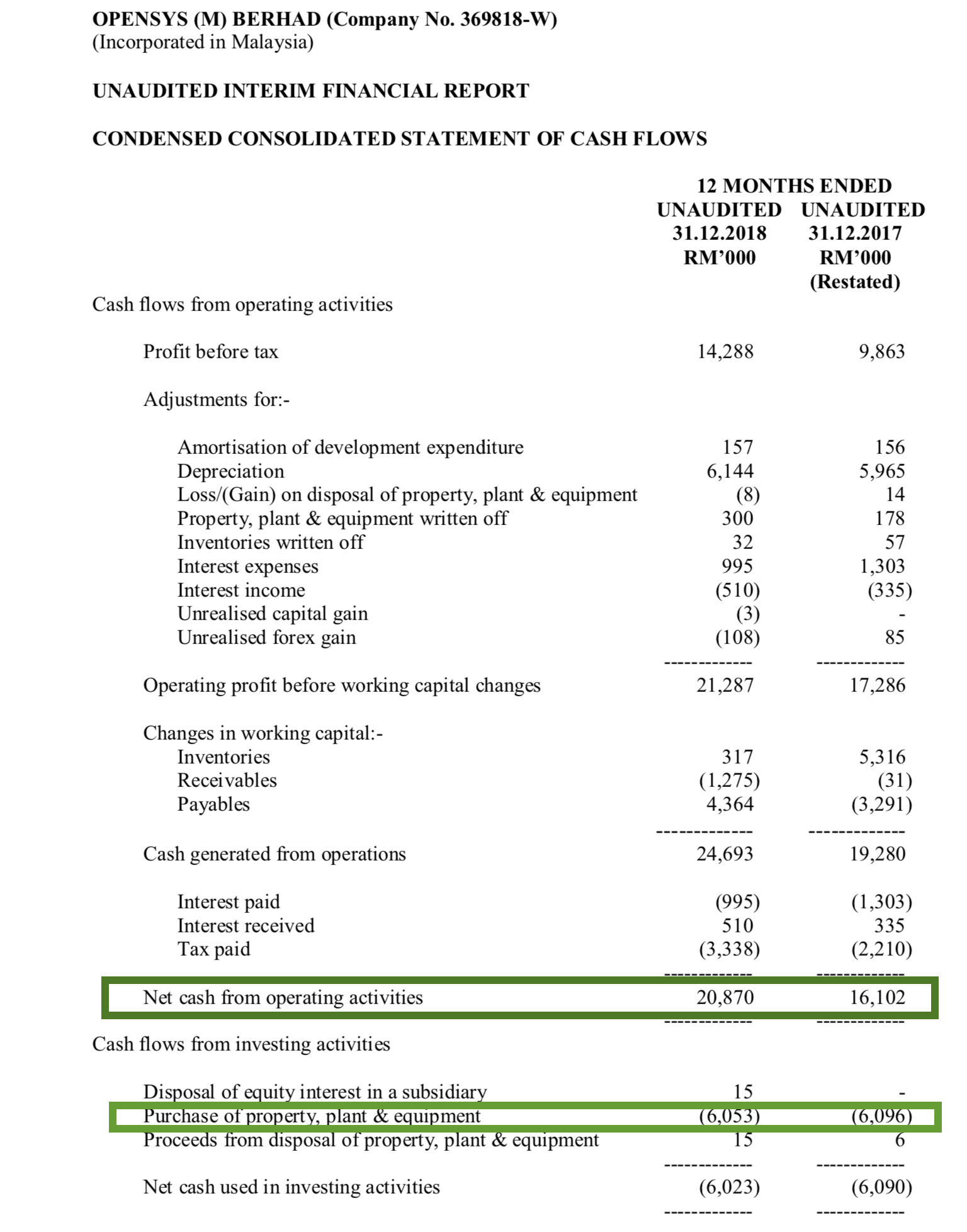

The screenshot below shows the latest cash flows statement for Opensys,

an undervalued market leader with high ROE that is off the radar screen

of most investors. Appendix 1 is the background of Opensys.

FCF is whatever cash is left after all operating expenses, including

capital expenses for growth, like buying new plant and machineries. FCF

is like the end all goal of companies. The point is to do so well that

you make so much money that even after all the checks written to expand

the business you still have a lot of cash. With this FCF a company can

pay out dividend consistently, buy back its shares when they are selling

cheap, pare down loans, or invest in other profitable ventures, all

done without assuming more debts, or issuing more shares.

Thanks to kcchongnz, I had look past PE ratio. Appendix 2 shows the definitions and explanations of the key terms.

Opensys’ free cash flow and cash yield

FCF = CFFO – Net Capex

Cash flows from operations (CFFO) was RM20.9 million last year, way

much higher than the net profit of RM10 million. Net capex remained the

same at RM6 million.

CY = Free cash flow (FCF) / Price

FCF for Opensys surged 48% to RM14.8 million last year as compared to

RM10 million in the previous year. At 33 sen, the cash yield (CY) is

15.1%.

Based on the CY of 15.1%, is Opensys a No-Brainer Investments?

A CY of more than 5% investing in a stock is good as it is more than

the return from the fixed deposit in banks, and it is in cash too. A CY

of 10% and above would be excellent investment. ” Kcchongnz

Appendix 1

OpenSys

(M) Bhd is a micro-cap company with a still small but rapidly growing

revenue base that is off the radar screen of most institutional

investors.

Since

listed in 2004, its net profit has been on a tear while revenue more

than quadrupled from RM20.3 million to RM95.4 million over 14 years. The

better economies of scale, coupled with improving margins, also helped

propel its return on equity (ROE) by an impressive 16 percentage points

to 18%.

Today,

the company counts among its clients all major banks in the country,

such as Maybank, Public Bank, Hong Leong Bank and United Overseas Bank,

and insurance and telecommunications companies.

OpenSys

has the largest installed base of cash recycling machines, with close

to 80% market share in Malaysia and has to date installed more than

2,600 machines. Currently the total number of ATMs andCDMs in Malaysia

is 17,500 units with annual growth of about 5%.

CRMs

are dual-function machines that merge the cash dispensing functions of

ATMs and the cash deposit functions of CDMs. Banks are benefitting from

the cost- effectiveness of CRMs in areas of cost of ownership, lower

cash holding and reduction in cash handling cost. These significant

savings have been a major driving factor for banks to undertake major

fleet replacement and consolidation, resulting in the exponential growth

of CRMs. In the last five years, the total number of CRMs in the market

has grown exponentially with a Compound Annual Growth Rate (CAGR) of

close to 40 percent.

The

emerging and evolving technologies in the marketplace will fuel new

possibilities for OpenSys. The versatility of CRMs will see the adoption

of digital technologies and the rise of new value-added services using

new digital methods of authentication and service fulfilment such as

biometrics, contactless and cardless technologies, QR codes and

complementary mobile apps.

OpenSys

has been working closely with the banks to incorporate new technologies

and services. This opens up tremendous new possibilities in banking

services.

Appendix 2

Move over Earnings, make way for Cash

Most investors use, if they ever use at all, the price-to-earnings ratio (P/E) to measure the value of a company. Even almost all investment bankers and analysts do the same. By dividing the market price by earnings,

you can get an easy-to-understand measure of a firm's value and a

simple way to compare different companies to each other. Flip the ratio

over, you get E/P, or what is termed earnings yield. This you can use

to compare with the return of alternative investments such as bank

interest rate.

But

there are hell lots of problems with the “E”, the accounting earnings.

As you all know, accountants are some of the most creative people on

earth. This “E” can mean anything. The link below explains some of the

problems with this “E”, and the associated P/E ratio.

What is Free Cash Flow Yield or Cash Yield?

Like interest rate, cash yield (CY) for investing in a stock is simply

CY = Free cash flow (FCF) / Price,

Price is the market capitalization (MC) of a company, P = share price * no. of shares outstandingA CY of more than 5% investing in a stock is good as it is more than the return from the fixed deposit in banks, and it is in cash too. A CY of 10% and above would be excellent investment.

Free

cash flow (FCF) is what is left from CFFO after spending capital

expenses (Capex) for maintaining the ongoing business, or expenses for

growth of the ordinary business such as building new or upgrading the

production lines, open up more similar shops for business etc.

FCF = CFFO – Net Capex

FCF

is whatever cash is left after all operating expenses, including

capital expenses for growth, like buying new plant and machineries. FCF

is like the end all goal of companies. The point is to do so well that

you make so much money that even after all the checks written to expand

the business you still have a lot of cash. With this FCF a company can

pay out dividend consistently, buy back its shares when they are selling

cheap, pare down loans, or invest in other profitable ventures, all

done without assuming more debts, or issuing more shares

Based

on CY, we could generally conclude that high CY companies, i.e. buying

companies cheap in term of cash return, is a No-Brain Investment (NBI).

Source

Disclaimer: The article above does not represent a recommendation to buy or sell.

https://klse.i3investor.com/blogs/Amazinggrowth/197164.jsp