KYY Golden rule for share selection:

The

company must report profit growth for 2 consecutive quarters before I

decide to buy it. Moreover, it must be selling below PE 10.

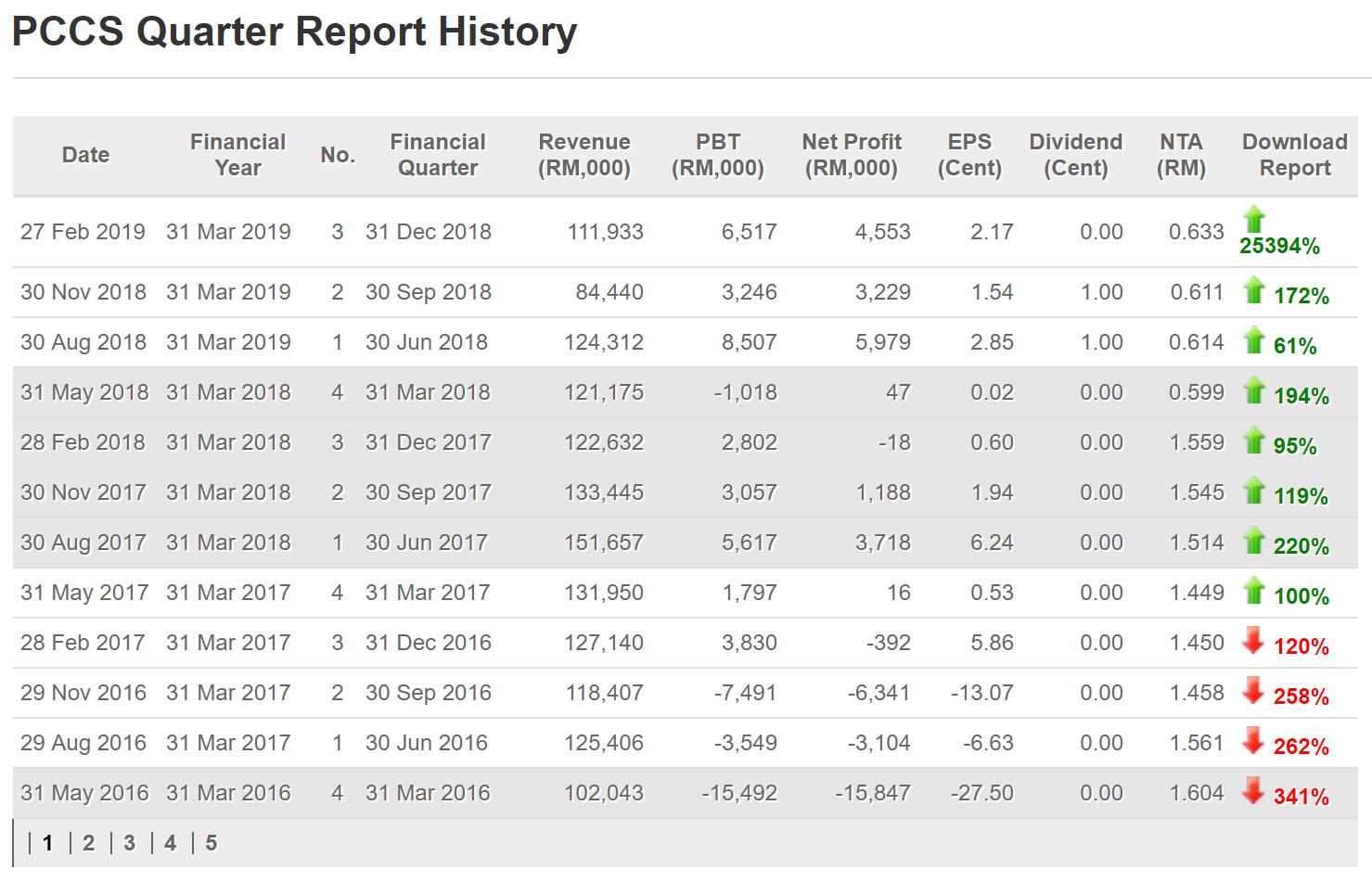

PCCS meet all fundamental stock selection criteria set by Mr Koon Yew

Yin. PCCS profit keep growing every quarter. For the lastest 3 Quarter

results, PCCS EPS(Earning Per Share) already 6.56sen. If PCCS at Quarter

4 can conservatively achieve EPS 2sen, then full year EPS will be

8.56sen. Based on today closing price 33.5sen, PCCS P/E ratio only 3.9x.

Compared to same sector company such as PADINI which traded at P/E 15x,

PRLEXUS traded at 15x and Bonia traded at 13x. PCCS is highly

undervalued !

If PCCS traded at reasonable P/E ration such as between 10x-15x, PCCS

share price will worth around 86sen-RM1.28 ! PCCS got huge upside !!

Will PCCS be next DAYANG ?

https://klse.i3investor.com/blogs/KYY/197412.jsp