Warning: This is a very long “Management Discussion & Analysis” but well worth the time. Great management is rare.

Rare indeed.

Management

is great. Just read the management analysis you know d. Alot of what

you need to know is actually in there, which is rare.

The march towards a cashless society, it seems, is unstoppable.

Virtual payments are fast displacing

cash. Fewer Nordic banks are using cash in their branches. India

recently scrapped 86 percent of its banknotes. South Korea plans to stop

minting coins by 2020. Young people especially, as well as the better

off and better educated, are increasingly at ease in making payments via

cards or mobile phones.

Perhaps the most famous example is that

of beggars in China’s big cities holding up signs with quick response

(QR) codes to collect alms. With loose change becoming a rarity,

charitable passers-by can make donations with their mobile phones

through Alipay or WeChat Pay.

But wait!

In other advanced economies, including Austria, Germany, Japan, Singapore and Switzerland, cash

is still king and shows no sign of abdicating. Globally, 85 percent of

all payments are still made in cash. “The cashless society, as appealing

as it may sound, is probably just as elusive as the much vaunted

paperless office”, according to Yves Mersch, a member of the European Central Bank’s executive board.

In tech-savvy Singapore, where almost

everyone has a mobile phone, nine out of 10 people, still prefer to pay

for everyday transactions the old-fashioned way – with cash. According

to interviews conducted by Bloomberg in September 2017, some of the

reasons why Singaporeans prefer cash are because it is more convenient

than swiping a bank card or in case when they can use digital devices,

machines sometimes break down and cannot process a payment.

In Japan, cash in circulation as a

percentage of GDP increased to 20 percent in 2017 from 13.5 percent in

2000 and in the United States, it gained to 8.1 percent from 6.0

percent. In the Eurozone, it rose to 10.7 percent from 5.1 percent in

2002.

Similarly in Malaysia, most people have a

relatively high dependence on cash for payment transactions. Last year,

cash in circulation (CIC) grew 11.5 percent year on year to RM85.46

billion. Meanwhile, CIC per GDP, a measure of a country’s reliance on

cash for transactions, expanded from 6.62 percent to 6.95 percent.

One of main reasons why cash remains

hugely popular is because cash is the only legal tender in every country

in the world, with the exception of Sweden. Cash is accepted

practicably by all traders, whereas there is no obligation to accept

electronic payments. As interest rates fall – and even go negative in

some places – cash is increasingly used as a store of value. Cash is the

only payment instrument that guarantees the user’s privacy and

anonymity, while all electronic transactions are traceable.

In OpenSys, we believe that the

migration of cash to digital payments will be a gradual process – an

evolution rather than a revolution. We also believe that cash, cards and

mobile payments will continue to coexist for many years to come

although we will see more and more micro payments being made by mobile

phones.

Based on our big data of approximately

500 bill payment kiosks deployed at the branches of six major telcos and

utility companies nationwide over the last 18 months, we noticed that cash booked over 65 percent or 11.0 million of the total number of payment transactions worth RM1.86 billion.

In contrast, credit and debit cards managed 21 percent or 3.7 million

transactions worth RM1.24 billion, while cheques recorded 14 percent or

2.3 million transactions worth RM13.43 billion. It is pertinent to note

that payment by cheques are mostly made by corporate customers hence the

absolute amount collected via cheques significantly dwarfed that of

cash or credit and debit cards.

Due to the complementary relationship

between cash and digital payments, the ubiquitous automated teller

machine (ATM) – which celebrated its golden 50th anniversary last year –

is still ranked as the No. 1 self-service channel and interactive

touchpoint with a bank, even among millennials and smartphone users.

From its inaugural installation at Barclays Bank in North London in June

1967, the ATM can now be found everywhere – from the most modern cities

to the loneliest outposts, including a mountaintop in the Himalayas.

As the number of ATMs increase, they

have also stepped up in sophistication to keep up with modern times.

Today’s ATMs are a far cry from that first installed ATM at Barclays

Bank. In addition to dispensing cash, today’s advanced machines can

accept cash and cheques; issue prepaid cards, stamps and lottery

tickets; grant loans and take payments of almost any kind; calculate and

convert one nation’s currency into another; remit money to a relative

halfway around the world; and most impressively, perform these functions

with better than 99 percent reliability.

In the foreseeable future, ATMs will

continue to evolve and remain relevant by adopting mobile technologies

to cater to millenials and Gen Z. There are already ATMs today that

allow customers to perform cardless ATM withdrawals using their mobile

phones. Not long from now, customers will sign into ATMs using their

fingerprints, pictures of eyes or faces, or voice recognition that are

stored on their mobile phones, which will then transmit a code to the

ATMs to do the necessary banking transactions.

It would not be inaccurate to consider

the ATM as the original “Fintech” disruptor because before it came

along, the banks were very traditional and dependent on a lot of human

resource to operate. The ATM basically transformed the

“brick-and-mortar” bank branch by automating cash withdrawals so that

human resources can be redeployed more efficiently to assist and educate

customers on the banks’ products and services.

While the ATM provides many upsides to

banks as well as their customers, the downside is that it is expensive

to set up and operate an ATM infrastructure. In addition to high capital

expenditure in hardware, software and network, the cost of cash

represents the largest single segment of operating expenses for ATMs.

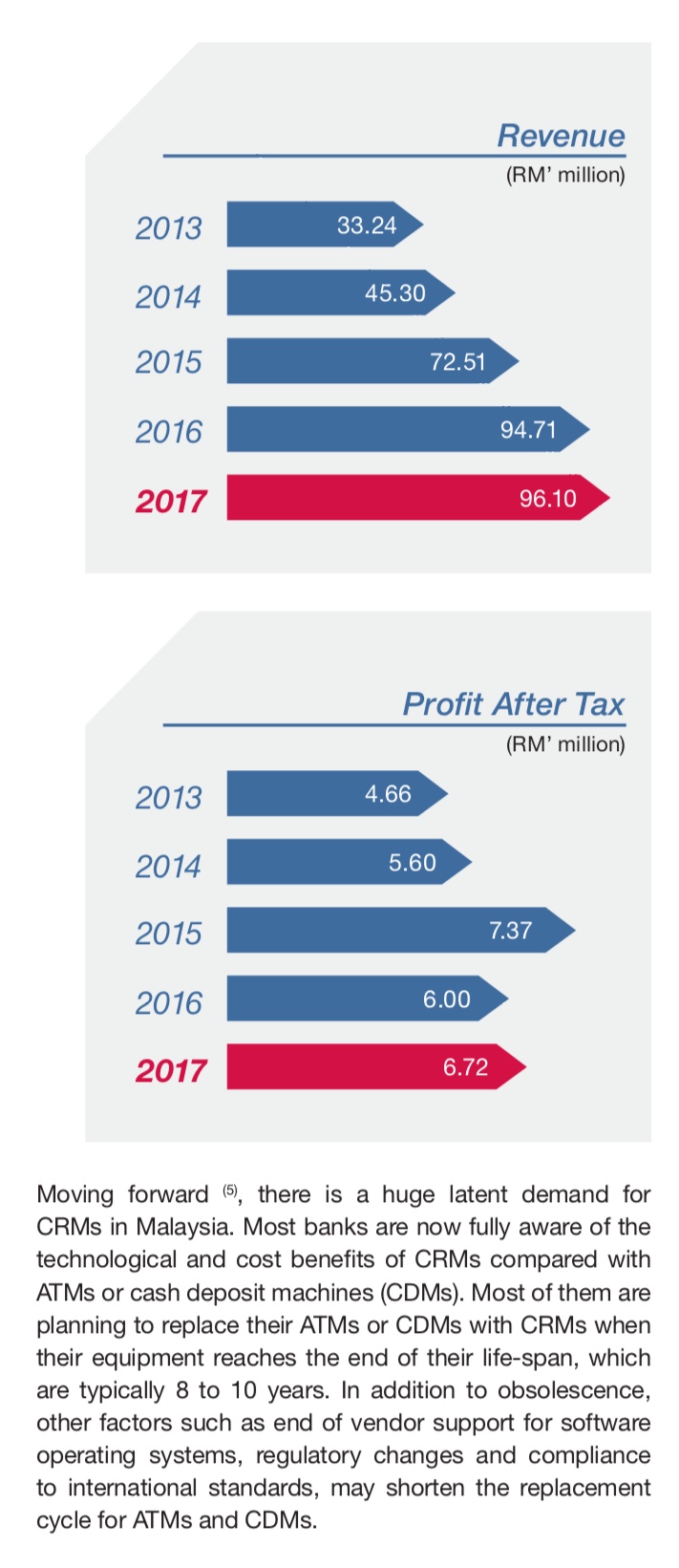

Cash Recycling Machines (CRM)

To mitigate the high cost of cash, the

technology trend in recent years is to merge the separate functions of

cash- dispensing or cash-deposit into dual-function machines called cash

recycling machines (CRM). CRMs can accept cash from depositors and

dispense them to withdrawers so that the cash is essentially “recycled” –

resulting in lower cost of ownership in the area of unused cash float,

cash maintenance, cash handling and space rental. Besides savings of

25-30 percent in capital expenditure and operational cost, CRMs also

provide better service levels to the banks’ customers because they have

higher uptimes due to the automatic replenishment of cash in the

machines.

OpenSys technology partner in the CRM

market is OKI Electric Japan. OKI invented and pioneered the use of cash

recycling technology more than thirty years’ ago in 1982. Due to its

first mover advantage, OKI is currently one of the leading suppliers of

CRMs in Japan, China, India, Indonesia, Russia, South Korea, Taiwan and

Brazil.

Besides our CRM success, OpenSys provides

business process outsourcing (BPO) for bill payment kiosks to utility,

insurance and telecommunication companies in Malaysia. Our bill payment

kiosks allow customers to use cash, cheques, credit or debit cards to

pay for bills, reload prepaid cards and renew insurance policies.

OpenSys is also the leading supplier of

cheque-deposit machines and image-based cheque processing systems in

Malaysia. Our image-based cheque processing system uses cheque scanners

and software applications to capture cheque images and data at bank

branches and send them to the central bank for cheque clearing and

settlement. This paperless process saves the banking industry hundreds

of millions of ringgit per year.

Business models

OpenSys has four business revenue models,

namely (i) outright sales, (ii) software services, (iii) outsourcing

services and (iv) maintenance services. In outright sales, our CRMs and

cheque deposit machines are sold directly to the financial institutions.

In software services, we provide software development services to our

customers when they need modification to their application software due

to changes in their business or regulatory requirements. In outsourcing

services, we provide bill payment kiosks to utility, insurance and

telecommunication companies over a contract period of 3-5 years. The

customers pay a rental for the machines plus a click charge for each

transaction.

In maintenance services, the banks pay us

an annual maintenance fee of 10-12 percent based on the selling price

of the machines that we sold to them. In return, we service and repair

the machines to ensure high availability and optimum uptime. It is

important to note that all our customers are blue chip companies. Due to

the size of these companies, the collection risk for our trade

receivables is very low.

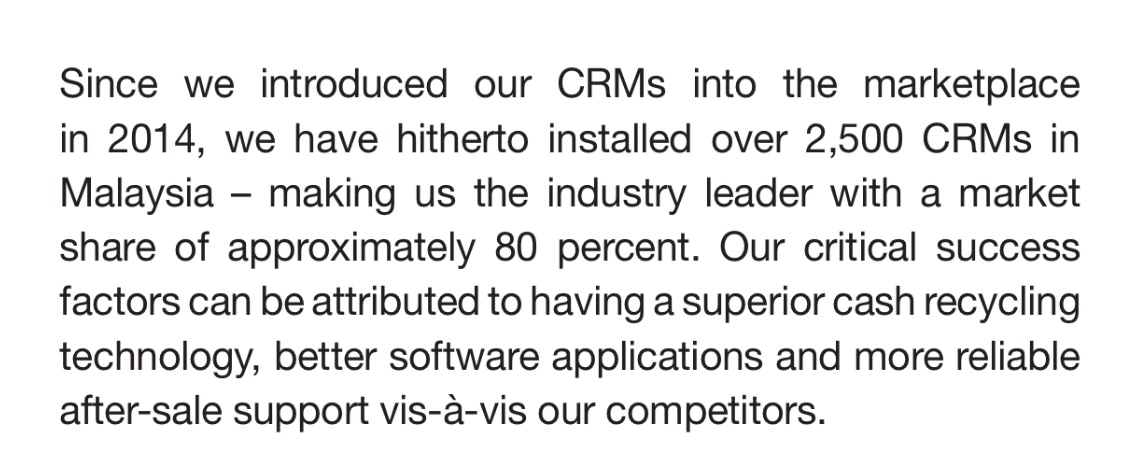

For the financial year ended 31 December

2017, our revenue marginally increased 1.5 percent to RM96.10 million

from a corresponding period in 2016 largely due to robust sales of CRMs

and more transaction volume from our outsourcing business. Meanwhile,

our profit after tax rose 11.8 percent to RM6.72 million as compared to

the year before.

Our outsourcing business in providing

bill payment kiosks to utility, insurance and telecommunication

companies continues to remain strong. Not unlike banks, these

institutions are transforming their branches to be leaner, friendlier

and more efficient by pushing mundane tasks to self-service kiosks. In

doing so, they can free up their valuable human resources to perform

more sales and marketing related activities with their customers. The

companies that are currently using our bill payment kiosks are

progressively installing more machines as time progresses.

Our Fintech strategy is to work closely

with financial institutions to “disrupt” themselves before they get

disrupted and to navigate the dreaded “tipping point” of business

cycles. It is our belief that despite the scaremongering, Fintech would

eventually be just another product(s) that will be offered by your

favourite bank that leverages modern technology. An Uber-like or

Airbnb-like disruption by startup companies is unlikely to happen

because the banking industry is ultimately based on trust, and requires

regulatory oversight to protect the consumer.

Our continued commitment to new product

development allows us to be more responsive to changes in technology,

industry standards and customer expectations while mitigating any

effects of product obsolescence. The carrying book value of our

development expenditure for the year ended 31 December 2017 is

RM0.18million.

We currently own one floor of office

property at Pinnacle PJ and another three-storey shop office property at

Putra Heights with an estimated value of RM10.0 million and RM3.0

million respectively. The property at Pinnacle PJ is used as our

corporate headquarters whereas the property at Putra Heights is mainly

used for the assembly of our cheque deposit machines and CRMs.

With regard to creating value for our

esteemed shareholders, we have consistently paid semi-annual dividends

to our shareholders for the last 7.5 years since July 2010. In October

2015, we gave a bonus issue of 74.47 million new ordinary shares on the

basis of one bonus share for every three existing OpenSys shares to our

shareholders. The next dividend payment is on 18 April 2018. As our

cashflow is particularly healthy, we are confident that our dividend

plan is sustainable subject to unforeseen circumstances that might be

beyond our control.

The Board of Directors would like take

this opportunity to extend our gratitude and appreciation to our

shareholders, customers, suppliers and business partners for the

invaluable support that you give to OpenSys.

We would also like to thank each and

every member of our management and staff for their dedication and

commitment to grow with our Company, without which our success would not

be possible.

Source

Annual report 2017

https://klse.i3investor.com/blogs/Amazinggrowth/198168.jsp