AHB - A SLEEPING BEAUTY AWAKENS !!!!! (PERSONAL TP 0.25-0.35),

AHB WB - PERSONAL TP 0.07-0.12

This

week, BSKL has seen rising interest in the EXPORT based counters as the

MYR had significantly weakened against the USD this week alone.

Recently I had spotted this small cap company; an investment grade, which have been underlooked and undercovered - AHB HOLDINGS BERHAD or AHB (Code 7315), listed on MAIN BOARD, CONSUMER PRODUCTS/SERVICES.

In

summary, AHB is an international leading office interiors company,

which has been recognised for design, innovation, and a range of

products known as system MX that provides a fully integrated and highly

flexible office interior solutions.

I

noticed considerable interest starts to build in on Friday where the

volume registered a sizeable increase to 8.8 million units which is the

year 2019 highest volume registered so far.

This

positive momentum should carry forward next week ( forbearing instances

of the adversity/ negativity of the regional markets sentiment

affecting Bursa Malaysia) since it was able to close Friday conclusively

at 0.16. I forsee it trending to the next resistance of 0.20 before heading to my personal TP between 0.25 (short term) to 0.35 on the intermediate term.

WHY I THINK THIS STOCK IS UNDERLOOKED AND COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

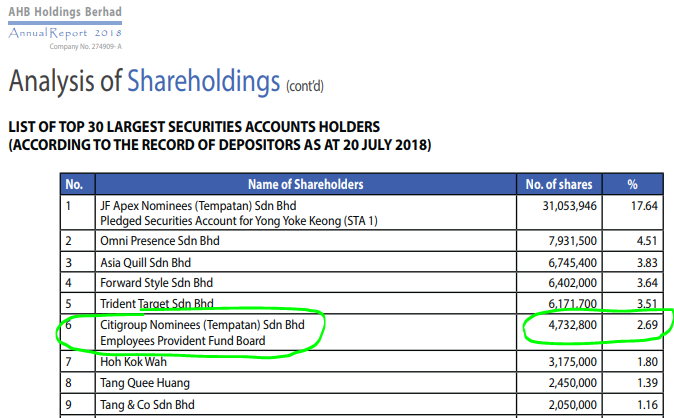

1. Lack of Coverage on Entry of EPF as Shareholder in FY 2018 (4,732,800 units, 2.69%)

I think the above factor has been widely missed by media/IBs/analysts

as a whole. Check the below comparison of FY2017 and FY2018 Annual

Reports (link below). You will find that in FY2017, EPF did not appear

as a shareholder but in FY18 report, EPF is listed as number 6 major shareholder at 4,732,800 units (2.69%).

As per procedure, a purchase above 5% has to be announced publicly,

however since EPF acquired 2.69%, there was no need for public

announcement on this matter.

I truly believe that this company has very big potential to grow, due

to the fact that even EPF known for their strict investment choice, is

also believing in the long term prospects of this company. EPF must have

done their due diligence before buying into AHB, and possibly should

the future look brighter, be adding more shares this year.

This is reflective of EPF recognition of the company's future direction.

This is reflective of EPF recognition of the company's future direction.

FY2018 report: https://www.malaysiastock.biz/GetReport.aspx?file=AR/2017/7/31/7315%20-%201314381570795.pdf&name=AHB%20Annual%20Report%20FY2017.pdf

FY 2017 report: https://www.malaysiastock.biz/GetReport.aspx?file=AR/2018/7/31/7315%20-%201721153309238.pdf&name=AHB%20Annual%20Report%20FY2018.pdf

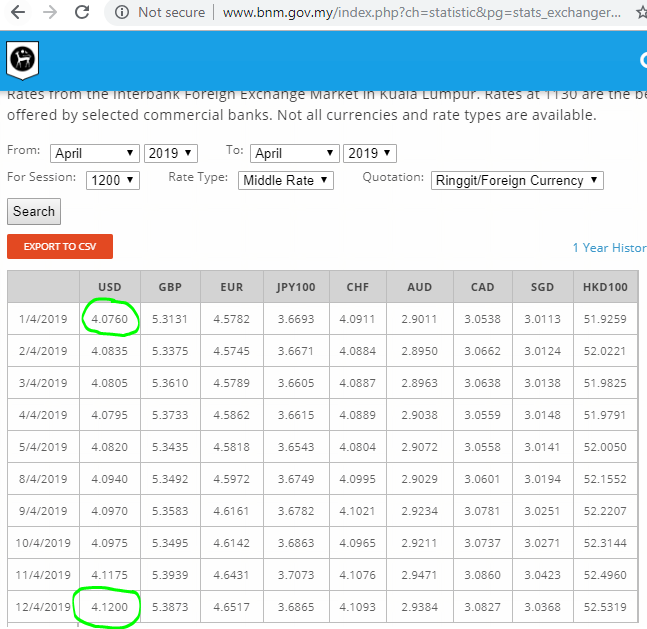

2. Weakening of MYR against USD - Good for Export Based Counters

Refer to below image on the exchange rates for USD/MYR taken directly

from BNM website. We can see that MYR had started at 4.076 against the

USD on 1st April, however started to weaken consistently until 12th

April today which stood at 4.120, which is a significant weakening in

the span of 2 weeks.

From recent quarter report, AHB clients are in the South Eastern Asia,

South Central Asia and Middle East. Majority of dealings are

international, therefore with the weakening of MYR against USD, AHB

should benefit from gaining higher revenue and profit from the currency

conversion.

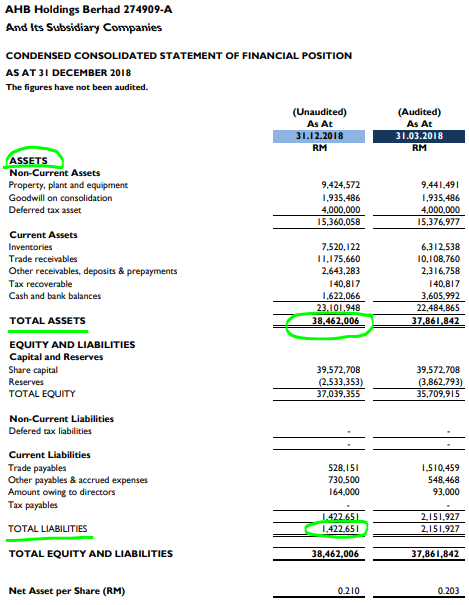

3. Financial Analysis Point of View - A Potential Takeover Target

Refer to link below for latest AHB Quarter Report published on 22th Feb

2019. AHB had been making consistent revenue and profits for the last 3

quarters. However this is not the part which I want to highlight.

What I wish to highlight is that AHB is a debt free company (except

small amount owing to directors). Section B7 of the latest QR mentions

that "There were no outstanding borrowings and debt securities as at 31

December 2018.'.

We can refer below that the total assets of the company is RM 38.462

million (translating into NTA of 0.21) and liabilities stood at RM 1.422

million. Difference of assets and liabilities is a whopping RM 37.04

million ! From this alone, we can judge that AHB has very low gearing,

and could be a potential target of a company wanting to list in BSKL.

Therefore, as long as the current stock price is under the NTA of 0.21,

it could anytime be a potential takeover target by companies wanting to

do Reverse Take Over (RTO).

4. Technical Analysis Point of View - Strong Bullish Bias

Refer below daily chart of AHB. A few indicators of strong bullish bias can be seen:

a. it had broken the downtrend since it had hit a peak of 0.435 in July

2017, with significant and conclusive volume demonstrated

b. currently trading above the ICHIMOKU Cloud, indicating activity in bullish region

c. MACD is seen crossing the signal upwards indicated by the green arrow

Should the price be able to breach 0.20 level, I foresee it testing the

first resistance at 0.25 in the near term, and test 0.35 in the longer

term.

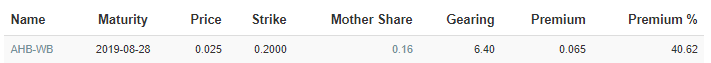

5. Alternative Entry Into AHB via AHB Warrant B (AHB WB)

Refer below AHB WB profile captured from KLSE SCREENER website (link

given) for those looking at alternate cheaper entry, to consider the

warrant due to below:

a. Considerably low total float of 71.1 million units

b. There is sufficient time for mother share to move above strike price

of 0.20, as maturity is end August of 2019 which is about 5 months from

now

c. Strike price of 0.20 is considerably reasonable and achieveable within short to mid term duration

Special Note: If you noticed recently EKOVEST WB had moved more than

100%, this was because EKOVEST mother share had started moving fast

causing the premium of the warrant to be low (within 0-10%), hence

causing the warrant to play fast catchup with the mother shares.

Therefore for AHB WB, theoretically, as the mother share price rises

above 0.20, the WB will move 1 bid in response to movement of 1 bid in

mother share

I foresee that if AHB is able to break 0.20 conclusively, AHB WB should

be trading at above 0.04 range. Should the mother share hit 0.25, AHB

WB should be trading at 0.07-0.12.

CONCLUSION

Considering all the above, my personal TP for AHB is set between RM 0.25 - 0.35, and for AHB WB is set between 0.07-0.12

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

I WILL PLACE AHB INTO MY INVESTMENT PORTFOLIO BEFORE FUNDS START BUYING INTO IT.

I ANTICIPATE A GOOD RETURN ON THIS INVESTMENT.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

I ANTICIPATE A GOOD RETURN ON THIS INVESTMENT.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/202081.jsp