Focus Lumber Berhad 5197

The company was incorporated in Malaysia on 30 October 1989 as a private limited liability company and was subsequently listed on the Main Board of Bursa Securities on 28 April 2011. The company's principall activities are manufacturing and sale of plywood, veneer and Laminated Veneer Lumber (“LVL”), and investment holding. Plywood is the core product, generating the bulk of the Group’s revenue.

Fundamental Analysis

|

Year (RM ,000)

|

2015

|

2016

|

2017

|

2018

|

|

Inventories

|

25,912

|

27,692

|

19,700

|

42,293

|

|

Total Asset

|

146,776

|

159,764

|

171,485

|

182,811

|

|

Total Liabilities

|

12,459

|

23,301

|

14,153

|

14,308

|

|

Total Equity

|

159,235

|

183,065

|

185,638

|

197,119

|

|

Net Cash

|

46,200

|

35,568

|

33,924

|

51,417

|

From the graph above, it can be seen that the Net Cash is improving and had recorded a 42 million worth of inventories in Financial year 2018.

|

Year (RM ,000)

|

2015

|

2016

|

2017

|

2018

|

|

Revenue

|

180,733

|

201,476

|

176,000

|

203,427

|

|

Cost of Sales

|

124,571

|

148,218

|

156,695

|

159,877

|

|

Net Profit

|

31,722

|

19,181

|

12,402

|

28,416

|

|

Profit Margin

|

17.6%

|

9.5%

|

7.0%

|

14.0%

|

|

Dividend (Cent)

|

15

|

6

|

-

|

16

|

|

Dividend Yield (%)

|

9.43%

|

3.77%

|

0.00%

|

10.06%

|

|

EPS (Cent)

|

29.93

|

18.10

|

11.70

|

26.81

|

|

PE Ratio

|

5.313

|

8.787

|

13.590

|

5.931

|

|

Net Asset per share

|

1.38

|

1.51

|

1.62

|

1.72

|

From the income statement of Focus Lumber Berhad, the net profit of financial year has been improved as compare to financial year end 2016 and 2017. A total of 16 cent dividend which is the highest among 2015 to 2016 which prove the strength of the cash flow of Focus Lumber Berhad.

|

Segmental Revenue Informatiion

|

|||||

|

Year (RM,000)

|

2018

|

% of Total Revenue

|

2017

|

% of Total Revenue

|

|

|

USA

|

154,983

|

77%

|

129,180

|

73%

|

|

|

Korea

|

20,569

|

10%

|

26,409

|

15%

|

|

|

Thailand

|

6,012

|

3%

|

3,383

|

2%

|

|

|

Taiwan

|

6,209

|

3%

|

12,214

|

7%

|

|

Based on the segmental revenue information, 77% of the total revenue in the financial year 2018 are comes from USA, 10% from Korea, followed by Thailand and Taiwan where both contribute around 3%.

As compare to financial year 2017, the percentage of revenue contributed from USA have increased to 77% (RM 154 million) from 73% (RM 129 million) while the revenue from Korea have decreased from 15% (RM 26 million) of the total revenue to 10% (RM20 million)

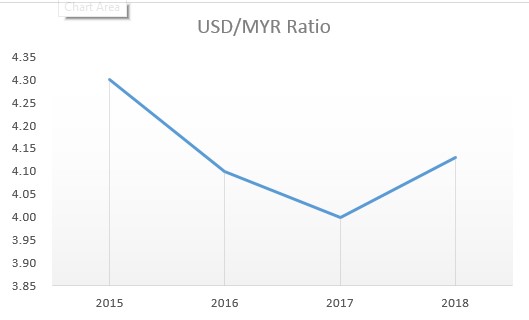

From the USD/MYR currency exchange rate, 2015 is a year where the USD

to MYR conversion rate has hit 1 USD= RM 4.30 which is good for

furniture export counter like Focus Lumber Berhad. During 2015 financial

year, Focus Lumber Berhad has recorded a highest net profit where the

USD is strong. Based on the USD/MYR chart attached above, USD is getting

stronger which is good for a export counter like Focus Lumber.

In the B3. Prospect for the financial year in 2018 Q4, the concerns of the management due to the weakening of US dollar can be solved as US dollar has been strengthen recently. The profit margin of the company should be better as a result of this.

Technical Analysis

From technical analysis wise, Focus Lumber Berhad have developed an uptrend channel, based on the chart attached. You can notice that Focus Lumber Berhad have been forming several Higher High and also Higher Low and currently it stayed on the uptrend support line which indicated on L4 circled in the chart shown above.

Moreover, Focus Lumber Berhad have been standing strong above Moving Average 200 proving some strength in the price movement.

Conclusion

Focus Lumber Berhad ,a net cash company which gives high dividend to the investor. With the recent strengthening of US Dollar which will improve the profit margin of the company. In addition of the uptrend of the stock price of Focus Lumber Berhad, it’s definitely a good time to monitor this hidden gem.

Telegram public group : https://t.me/newbietradingchannel

Disclaimer: The stock discussed is just for research purpose and no buy call/ sell call are recommended. All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. Any loss/profit will not be responsible by any person.

https://klse.i3investor.com/blogs/newbietradingchannel/205100.jsp

In the B3. Prospect for the financial year in 2018 Q4, the concerns of the management due to the weakening of US dollar can be solved as US dollar has been strengthen recently. The profit margin of the company should be better as a result of this.

Technical Analysis

From technical analysis wise, Focus Lumber Berhad have developed an uptrend channel, based on the chart attached. You can notice that Focus Lumber Berhad have been forming several Higher High and also Higher Low and currently it stayed on the uptrend support line which indicated on L4 circled in the chart shown above.

Moreover, Focus Lumber Berhad have been standing strong above Moving Average 200 proving some strength in the price movement.

Conclusion

Focus Lumber Berhad ,a net cash company which gives high dividend to the investor. With the recent strengthening of US Dollar which will improve the profit margin of the company. In addition of the uptrend of the stock price of Focus Lumber Berhad, it’s definitely a good time to monitor this hidden gem.

Telegram public group : https://t.me/newbietradingchannel

Disclaimer: The stock discussed is just for research purpose and no buy call/ sell call are recommended. All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. Any loss/profit will not be responsible by any person.

https://klse.i3investor.com/blogs/newbietradingchannel/205100.jsp