Dear all,

After some screening, it has come to my attention of this wonderful company that grinds cocoa into powder to be made into chocolate. The name of this company is none other than Guan Chong Berhad. Come I show you all the picture of this company.

Principal operating activities of this company is to grind cocoa beans into cocoa powder to be made into chocolate etc...

GCB has a grinding capacity of 250,000 metric tonnes (MT) per annum.... A huge increase from the previous year...

Okay so much grinding capacity, got demand or not first? According to ICCO - International Cocoa Organization ah, grinding of cocoa increased by 3.9% (173,000 tonnes), means got demand lah okay! Additionally, global chocolate market is poised to grow at a CAGR of 7% from 2018 - 2024 (not bad all all, almost double of Malaysia's GDP growth). People these days are more health conscious, they tend to opt for lower sugar content chocolate which is dark chocolate. Dark chocolate needs the most amount of cocoa to make. Good thing! Actually very simple, you tell me who don't like chocolate, then you know about the demand pattern already!

The business is very sensitive to cocoa bean prices, obviously - cocoa bean grinder.... Annual production of cocoa bean is around 4.7 million metric tonnes per year... So cocoa bean price fluctuations have major impacts to GCB's earnings. Which is why, GCB usually hedge the cost of the cocoa beans to reduce exposure to margins fluctuations. It's just like how airlines hedged their jet fuel prices okay?

Okay lah let's look at the financial highlights, most interesting part of any analysis.

wah Really impressive, look at the earnings growth, from 2014 to 2018.... Unbelievable! Well 2014, they made a loss because of an oversupply of cocoa ingredients in the market... However based on the looks of it, ever since 2014, the demand for cocoa ingredients have begun to pick up... As of today's price it's current trading at ~10 PER...

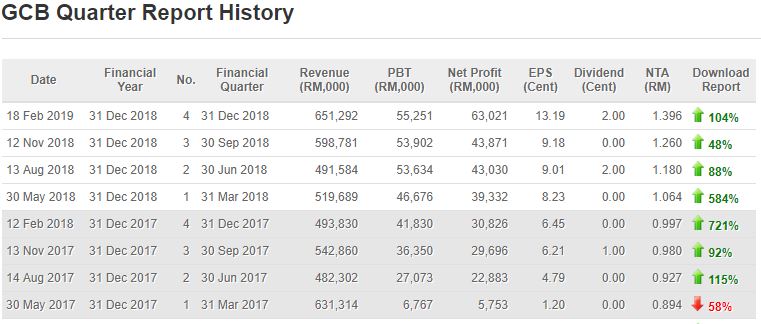

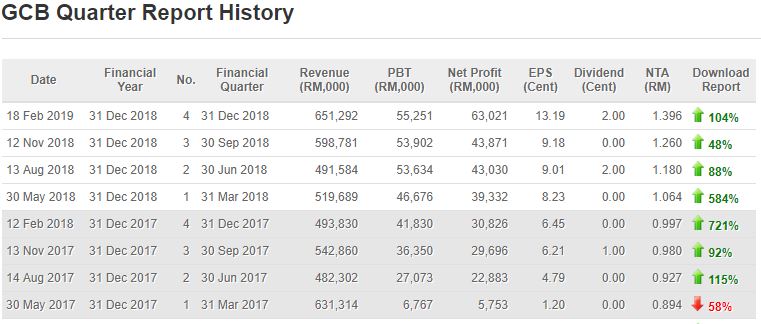

Recent quarterly results performance are quite outstanding as well.

Okay now for the most important part, KEY RISKS.

Very important to understand the risks associated with the business operation of GCB.

1. Cocoa Bean Price Risk - cocoa beans production worldwide is quite limited, so any surge in demand of chocolates will cause cocoa bean shortages, meaning cocoa bean price will go up, if they can't pass on the costs to their customers = margin errosion = less profit - no good at all! They hedge with forward contracts for cocoa bean though, so I guess no need to worry so much.

2. Foreign Currency Risk - Okay majority of GCB's transactions is in USD or GBP, so if MYR strenghthen then it will be bad for the company's profitability. But no need to worry yeah, Bank Negara cut Overnight Policy Rate (OPR) by 25 basis points, so it's all good, MYR will weaken more, unless the RHB IB guy is right that USD 1 = MYR 3.8, then my GCB go Holland liao. Don't worry, I think the RHB IB guy is drunk. MYR will continue to weaken.

3. High Borrowings Level - One key point to note is that GCB is operating in a very capital intensive industry as such their borrowings are very high, in fact their gearing stands at 0.84 as at FY18. Very very high... But a look at the company's balance sheet indicates that cash reserves is quite sufficient to service their debts for at least few years, won't go PN17 don't worry. Actually one thing can be noted is that, in FY 2014 the gearing is at 2.57x, and it has been decreasing ever since, so based on the information gathered, I assume the management is working hard to pare down the debt levels - very good effort and has been quite successful I say! Would be great if they could push it down even more, but for now it's fine for me.

Conclusion

GCB's can be seen to be investing heavily in their Plant, Property and Equipment, from here I would say they are trying to increase their grinding capacity even more, good thing! More products = more revenue = and possibly higher earnings. I just sharing what I found out to be a company that's probably worth investing, I eat chocolate every week, so I will contribute to the demand, and this company looks good to me, fundamental wise, management seems decent, just the gearing a bit but acceptable since their balance sheet indicates they have quite many cash balances.

If you have any questions, please do not hesitate to comment below.

For additional reference: The Edge - GCB

That's all from me,

Heavenly PUNTER IB

https://klse.i3investor.com/blogs/punterIB/207062.jsp

After some screening, it has come to my attention of this wonderful company that grinds cocoa into powder to be made into chocolate. The name of this company is none other than Guan Chong Berhad. Come I show you all the picture of this company.

Principal operating activities of this company is to grind cocoa beans into cocoa powder to be made into chocolate etc...

GCB has a grinding capacity of 250,000 metric tonnes (MT) per annum.... A huge increase from the previous year...

Okay so much grinding capacity, got demand or not first? According to ICCO - International Cocoa Organization ah, grinding of cocoa increased by 3.9% (173,000 tonnes), means got demand lah okay! Additionally, global chocolate market is poised to grow at a CAGR of 7% from 2018 - 2024 (not bad all all, almost double of Malaysia's GDP growth). People these days are more health conscious, they tend to opt for lower sugar content chocolate which is dark chocolate. Dark chocolate needs the most amount of cocoa to make. Good thing! Actually very simple, you tell me who don't like chocolate, then you know about the demand pattern already!

The business is very sensitive to cocoa bean prices, obviously - cocoa bean grinder.... Annual production of cocoa bean is around 4.7 million metric tonnes per year... So cocoa bean price fluctuations have major impacts to GCB's earnings. Which is why, GCB usually hedge the cost of the cocoa beans to reduce exposure to margins fluctuations. It's just like how airlines hedged their jet fuel prices okay?

Okay lah let's look at the financial highlights, most interesting part of any analysis.

wah Really impressive, look at the earnings growth, from 2014 to 2018.... Unbelievable! Well 2014, they made a loss because of an oversupply of cocoa ingredients in the market... However based on the looks of it, ever since 2014, the demand for cocoa ingredients have begun to pick up... As of today's price it's current trading at ~10 PER...

Recent quarterly results performance are quite outstanding as well.

Okay now for the most important part, KEY RISKS.

Very important to understand the risks associated with the business operation of GCB.

1. Cocoa Bean Price Risk - cocoa beans production worldwide is quite limited, so any surge in demand of chocolates will cause cocoa bean shortages, meaning cocoa bean price will go up, if they can't pass on the costs to their customers = margin errosion = less profit - no good at all! They hedge with forward contracts for cocoa bean though, so I guess no need to worry so much.

2. Foreign Currency Risk - Okay majority of GCB's transactions is in USD or GBP, so if MYR strenghthen then it will be bad for the company's profitability. But no need to worry yeah, Bank Negara cut Overnight Policy Rate (OPR) by 25 basis points, so it's all good, MYR will weaken more, unless the RHB IB guy is right that USD 1 = MYR 3.8, then my GCB go Holland liao. Don't worry, I think the RHB IB guy is drunk. MYR will continue to weaken.

3. High Borrowings Level - One key point to note is that GCB is operating in a very capital intensive industry as such their borrowings are very high, in fact their gearing stands at 0.84 as at FY18. Very very high... But a look at the company's balance sheet indicates that cash reserves is quite sufficient to service their debts for at least few years, won't go PN17 don't worry. Actually one thing can be noted is that, in FY 2014 the gearing is at 2.57x, and it has been decreasing ever since, so based on the information gathered, I assume the management is working hard to pare down the debt levels - very good effort and has been quite successful I say! Would be great if they could push it down even more, but for now it's fine for me.

Conclusion

GCB's can be seen to be investing heavily in their Plant, Property and Equipment, from here I would say they are trying to increase their grinding capacity even more, good thing! More products = more revenue = and possibly higher earnings. I just sharing what I found out to be a company that's probably worth investing, I eat chocolate every week, so I will contribute to the demand, and this company looks good to me, fundamental wise, management seems decent, just the gearing a bit but acceptable since their balance sheet indicates they have quite many cash balances.

If you have any questions, please do not hesitate to comment below.

For additional reference: The Edge - GCB

That's all from me,

Heavenly PUNTER IB

https://klse.i3investor.com/blogs/punterIB/207062.jsp