首先来重温一下官有缘(KYY)选股黄金法则:

1. 良好生意模式的公司

2. 连续2个季度盈利增长

3. 本益比(PE)少于10

PCCS

是一家非常低调的公司,所以没有什么人注意。从2017年开始,PCCS 每个季度都取得非常傲人的成长。2019财政年的首三个季度,PCCS

每股收益(EPS)是6.56SEN。假如在第四季度也取得非常保守的盈利如每股收益 2SEN。哪 PCCS

在2019财政年的将取得每股收益(EPS)8.56SEN。以今天 PCCS

股票闭市价33.5SEN来计算,PCCS的本益比(P/E)只有区区的3。9倍!比起 PADINI 的15倍,PRLEXUS 的15倍 和

BONIA 的13倍, PCCS 的股价严重被低估了!

如果 PCCS 以合理的10倍-15倍本益比(P/E)交易,哪 PCCS 的合理股价将会是86SEN-RM1.28。以今天的闭市价33.5SEN,PCCS 将有非常巨大的上升空间。它会不会是下一个 DAYANG ?

Hi to all fellow investors and traders !

Today I would

like to highlight a stock which I think might be posting a

superb/consistent quarter result in May 2019. That stock is PCCS GROUP BERHAD or PCCS (Code 6068, Main Board, Consumer Products/Services).

PCCS (BSKL Code 6068)

Personal TP Short To Mid Term : 57c, Long Term : 81c

Here are my thoughts :

1. Study of Latest 4 Quarter Results - Important Findings !!!

Please bear with me while I explain my findings on the latest 4 Quarter Results analysis:

i. Undervalued Counter - Currently Trading at PE Ratio of 5.2 of Forward PE

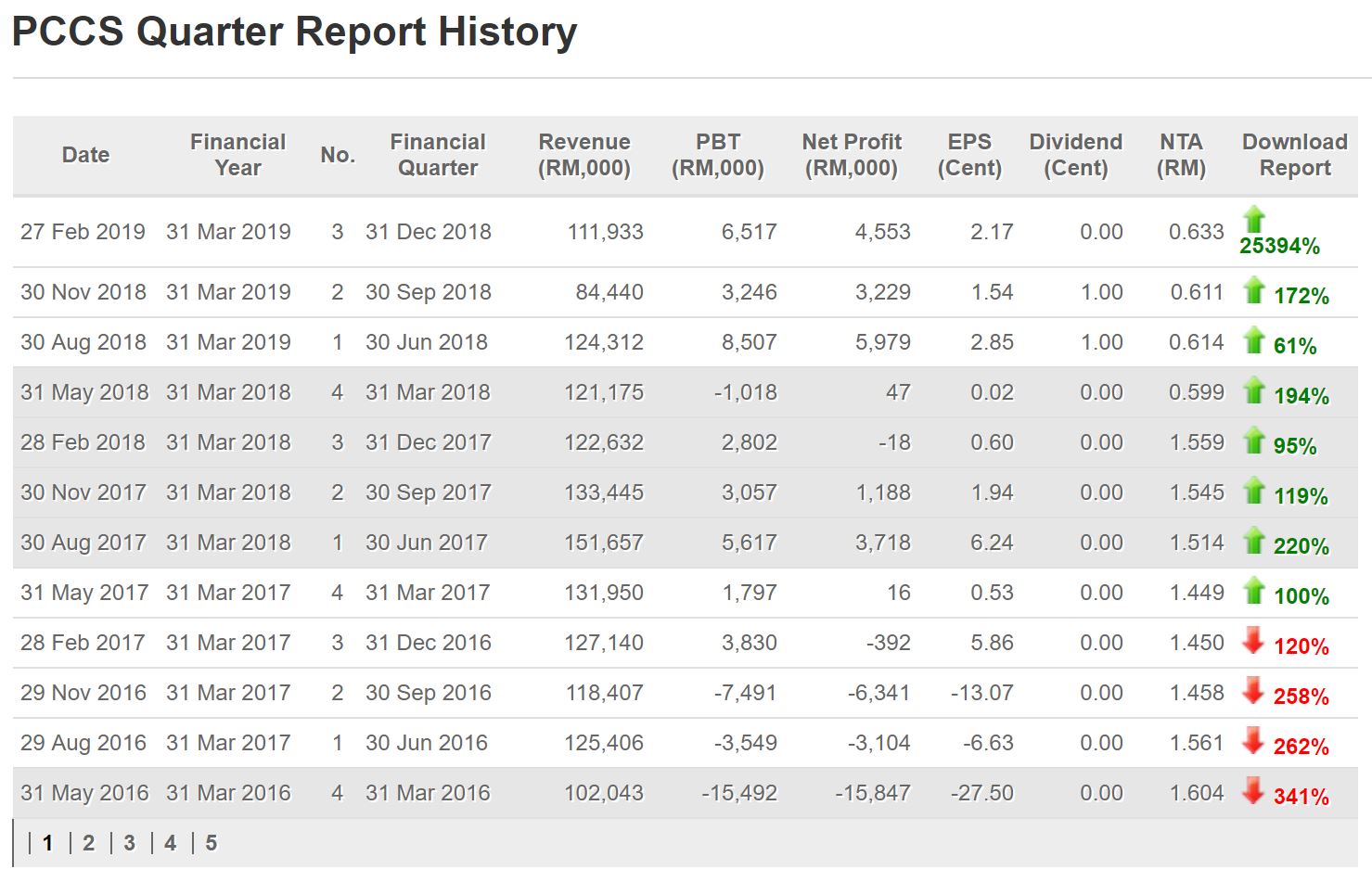

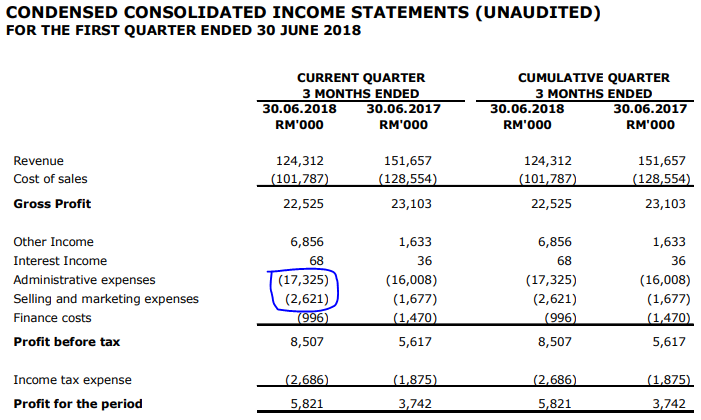

Refer below

screenshot for PCCS QR summary. Latest 3 quarter results shows total EPS

of 6.56 cents. NTA of company remains at 63.3 cents as of recent

quarter.

Last year May

2018 report, PCCS has recorded a small net profit of RM 47,000 on the

back of revenue of RM 121 million. This was mainly due to the high

administrative & selling/marketing expenses incurred.

If we take a

conservative 2 cents EPS for May 2019 target, the full year EPS will be

at 8.56 cents. This means at current price of 44.5 cents, the company is merely trading at 5.2 ratio of forward PE !!!

Taking a reasonable 9-10 PE Ratio as TP, the stock should be worth around 77 - 86 cents in the longer term !!

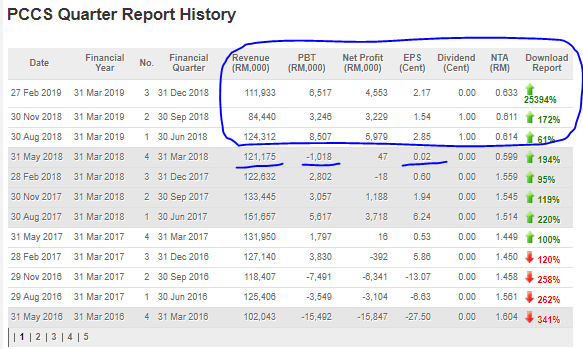

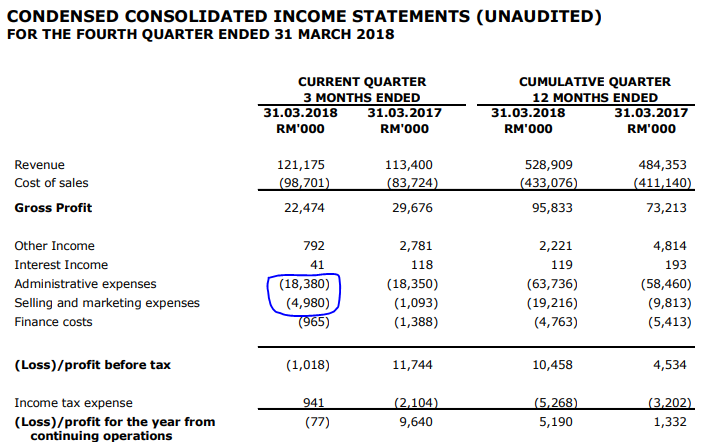

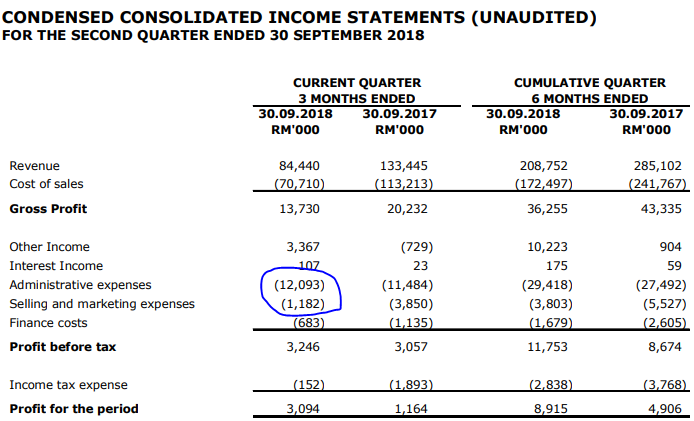

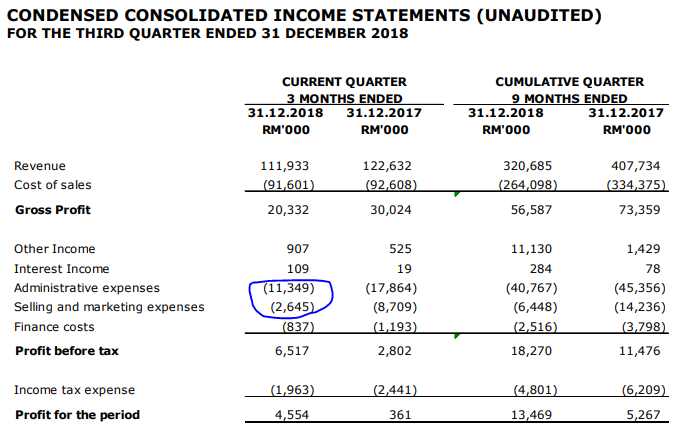

ii. Reduction of Expenses - Company Commitment to Improve Bottom Line

Refer below the

latest 4 quarters income statements. I had circled the issue which I

wish to highlight here, which is the Administrative &

Selling/Marketing Expenses.

We can see, that

the Company has SIGNIFICANTLY reduced its administrative &

selling/marketing expenses in the latest 2 quarters (from 23.4 m, to

19.6 m, to 13.2 m and 13.9 m). Cost savings of roughly RM 6-10 million (30-50%) to

improve company bottom line. I foresee that this improvement shall

carry on to the latest QR of May 2019, indicating the company's

commitment and consistency in reducing costs to improve profit for its

shareholders.

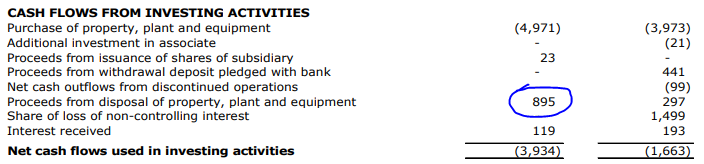

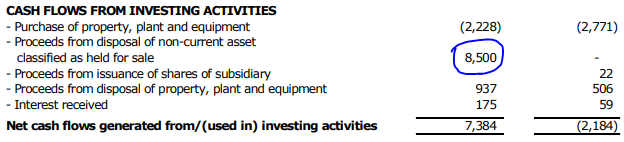

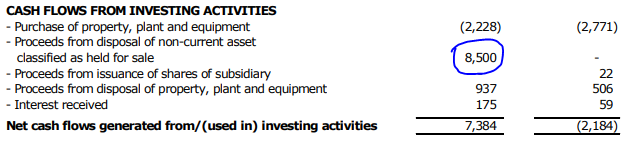

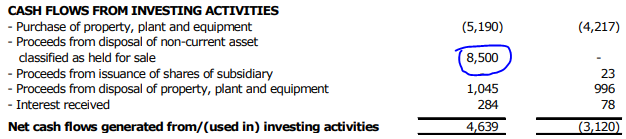

iii. Disposal of Asset Worth RM 8.5 million, Yet to Be Captured as Profit ???

Refer again the latest 4 quarters Cash Flow Statement as below. I will circle the part which I wish to highlight.

If you notice,

there was no disposal of RM 8.5 million captured in the May 2018 QR.

However, this item started to appear in Aug 2018, Nov 2018 and again in

Feb 2019 report. I believe this disposal was still in progress and

therefore has not yet been reflected as a gain in the income statement.

There

is a high possibility that this RM 8.5 million disposal might appear as

a realized gain, whether in May 2019 or August 2019 QR,

as usually assets take about 6-9 months for disposal and realization of

gains. Should this gain appear in May 2019, this would positively boost

up the EPS of this counter and reflect a higher target price.

May 2018 QR:

Aug 2018 QR:

Nov 2018 QR:

Feb 2019 QR:

2. Technical Analysis - Consolidation in Bullish Flag Formation About to End

Refer below

daily chart of PCCS. Price had peaked to 56.5 cents on 9 April 2019 and

had since then been in retracement along the bullish flag pattern.

As we can see, the 42-43 cents area had become an RTS (Resistance Turned Support) Area,

which buyers had been supporting lately. There had been 5 times where

this counter had stepped into this RTS band, and price has rebounded

from the lows.

MACD is

consolidating towards a crossing soon, whilst stochastics indicated that

the counter is oversold and starting to buck the trend.

I foresee, that a breakout

of this flag pattern shall allow this counter to trend back towards its

recent high of 57 cents, then move towards its long term target of 81

cents.

CONCLUSION

Based on my

opinion, PCCS should be reporting a good/consistent May 2019 QR which

will support its uptrend continuation, based on below:

i. Total anticipated EPS full year at 8.56 cents. Taking 9-10 PE Ratio, the stock should be worth around 77 - 86 cents.

ii. SIGNIFICANT reduction of RM 6-10 million (30-50%) in its administrative & selling/marketing expenses in the latest 2 quarters, indicating company commitment to improve bottom line.

iii. Asset Disposal of RM 8.5 million, pending to be captured in the income statement

iv. Ending Its Bullish Flag Consolidation - Potential Uptrend To Recent High of 57 cents, and long term TP of 81 cents

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

https://klse.i3investor.com/blogs/ddtan123/208229.jsp

https://klse.i3investor.com/blogs/ddtan123/208229.jsp