Telekom Malaysia (TM) is a telecommunications company that began as the national telco of Malaysia. 2018 was a challenging year for the company as it faced regulatory pressure to provide broadband services at ‘double the speed, half the price‘.

Amidst declining market capitalisation, it was removed from the FTSE Bursa Malaysia KLCI in December 2018. Will TM continue to be paying a steady dividend to shareholders? I attended its recent annual general meeting to find out.

Here are nine things I learned from the 2019 TM AGM:

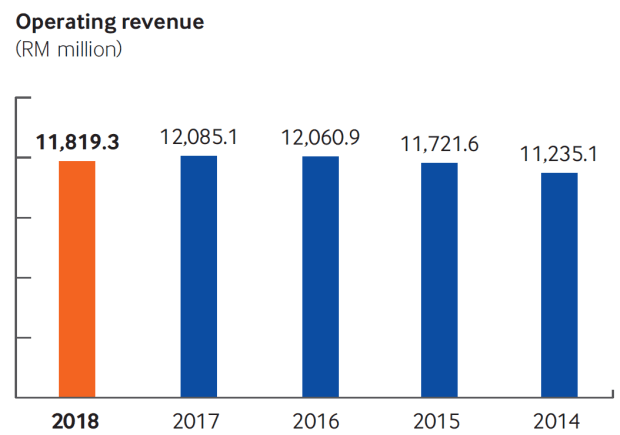

1. Revenue lowered by 2.2% year-on-year to RM11.8 billion in 2018. TM was particularly hit by the implementation of Mandatory Standard of Access Pricing (MSAP) in June 2018 that required telecommunications companies to double their broadband speed at half the price. Acting group CEO Imri Mokhtar does not foresee any further price reductions in 2019 which was reinforced by the Minister of Communications and Multimedia in February this year. Over the past five years, revenue has grown at a compound annual growth rate of just 1.3%. The management is expecting a low-to-mid-single-digit decline in its revenue in 2019.

4. TM comprises three business segments: unifi, TM ONE, and TM GLOBAL. While TM has primarily been a fixed line business and has not been successful in the mobile business, Imri said he sees an opportunity in the mobile business under unifi and eperienced candidates would be brought in to lead the mobile business. Under the other two segments, TM One provides services to corporate and government agencies, and TM Global provides services to domestic and international telecommunications companies. Chairman Rosli Bin Man also mentioned that TM would address some of the cost factors that made them lose contracts and to participate in tenders more aggressively.

5. The number of unifi customers grew by 15.3% in 2018 while the number of Streamyx customers dropped by 22.5%. More than 266,000 Streamyx customers in unifi areas were upgraded to unifi. Minority Shareholder Watch Group (MSWG) highlighted that the unifi segment recorded a loss of RM618.3 million for the year which the management attributed to the decline in Streamyx customers which outpaced unifi home broadband growth, higher operating costs, and an impairment on network assets in 3Q 2018. TM is looking to improve its customer satisfaction while a number of shareholders also shared about their unpleasant customer experiences with the company at the AGM.

7. TM was without a permanent CEO from June 2018. The Ministry of Finance is a special shareholder of TM and indirectly owns a 26.2% stake via Khazanah Nasional Berhad. The chairman said that the ministry agreed to appoint Imri as the permanent group CEO in February 2019, but the Prime Minister’s Office (PMO) subsequently instructed the company to hold back the appointment. A few days after the AGM, TM issued a statement publicly stating: ‘It is good corporate governance to engage key stakeholders including the PMO’. However, the prime minister also serves as the chairman of Khazanah and the conflicting statements raised concerns over political interference. As of 13 June 2019, former Axiata senior executive Datuk Noor Kamarul Anuar Nuruddin was appointed as TM’s new CEO and Imri would resume his position as COO.

8. A shareholder pointed out that TM’s profit before tax was significantly lower in 2018 at RM17.4 million compared to RM1.0 billion in 2017, yet total tax paid in 2018 was only 10% lower at RM271.4 million. The CFO explained that the total tax paid is aggregated at the group level. Subsidiaries that are individual entities still pay taxes. In 2018, no tax credit was offset from the losses incurred from the investment in Webe Digital Sdn Bhd. The subsidiary was acquired in 2014 and rebranded as unifi Mobile that provides mobile telecommunications services.

9. TM will spend about 18% of its revenue as capital expenditure in 2019, the same proportion as the year before. The capex will be spent on investments for broadband access and data, mobile services, and digital solutions and services for customers. A shareholder wondered if the company would sell off some of its properties to obtain better cash flow. Imri replied that they would only sell assets that are no longer strategic to the business.

https://fifthperson.com/2019-telekom-malaysia-agm/