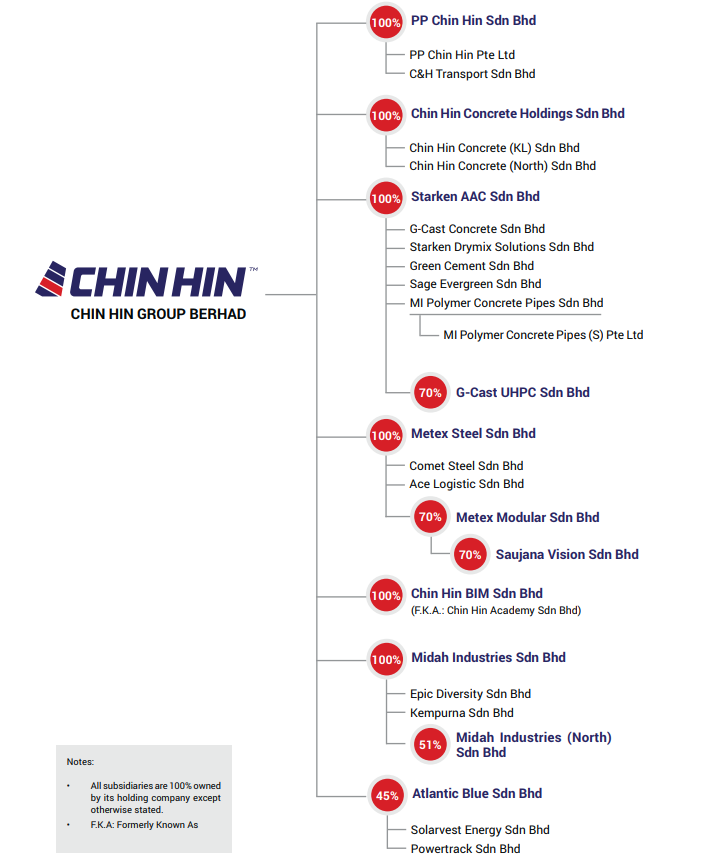

Business Overview

Founded by Datuk Chiau Beng Teik in 1974, Chinhin was merely a small

building materials trader with limited capital and credentials.

Throughout the years, thick and thin under the guidance of Datuk Chiau,

Chin Hin Group has successfully undergo a thorough transformation and

now, Chinhin is proudly one of the biggest Integrated Builders

Conglomerate that provides building material and services to the

construction and building industries. With sound fundamentals, Chinhin

serves as an integrated group with a diversified business portfolio

comprising of the distribution of Building Materials with an annual

turnover of exceeding RM1.1 Billion, one of the largest in the Malaysia.

Business Segment

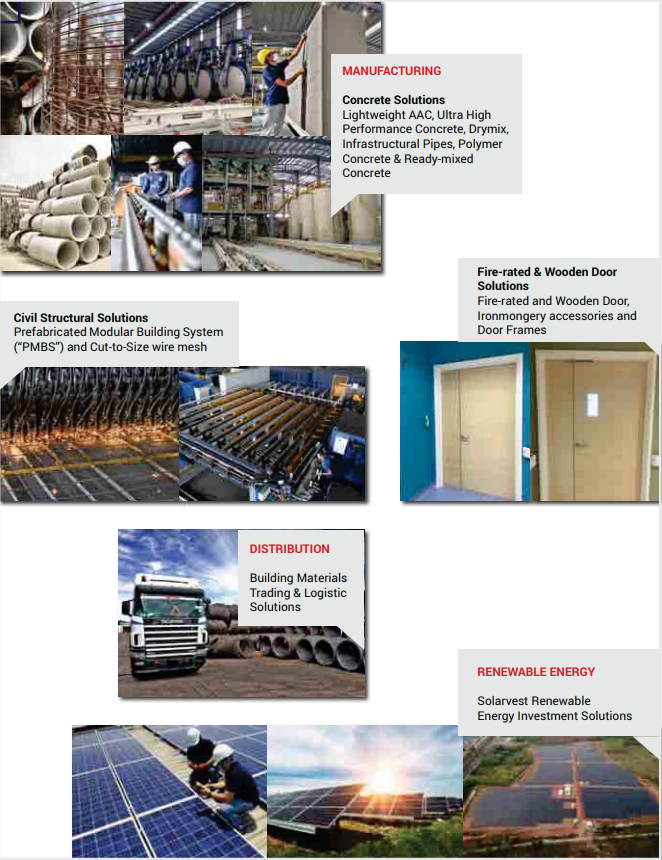

Chinhin Group has expanded its business to cover not only trading but also manufacturing and services across:- Fire-Rated and Wooden Door

- Concrete Drymix

- Wire Mesh Products

- Ready-Mix Concrete

- Provision of Logistic

- Modular Building Solutions

- Pre-Cast Concrete Products

- Autoclaved Aerated Concrete (“AAC”)

- Ultra-High Performance Concrete (“UHPC”),

- Renewable energy (Under Atlantic Blue Sdn Bhd)

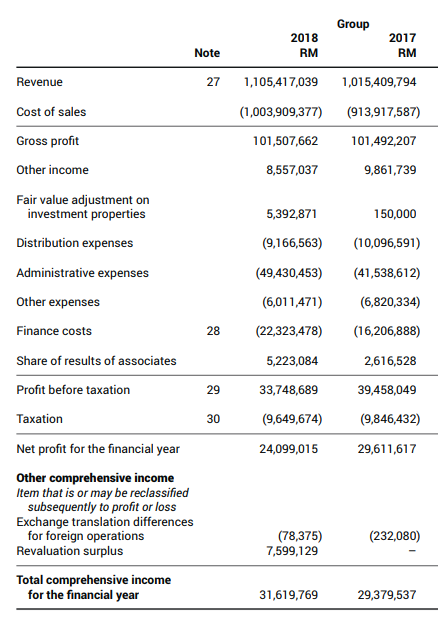

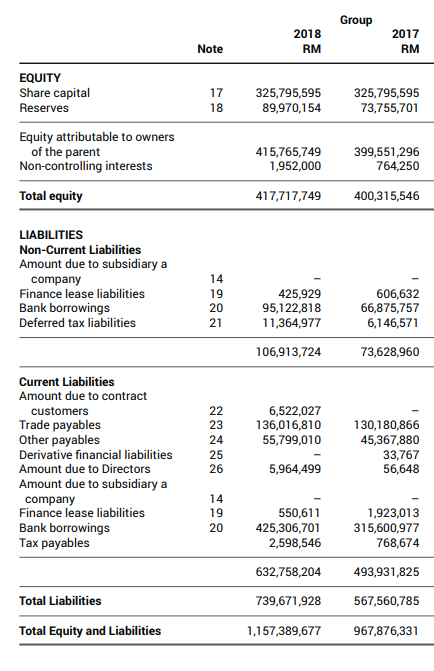

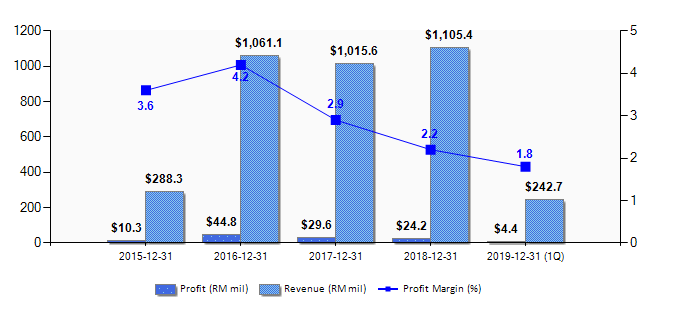

Audited 2018 Financial Statement

- Note that Chinhin Revenue hit RM 1.1billion in 2018 despite lower Net Profit margin, due to competition and higher financing cost

- Note that there was also one off gain on fair value adjustment on its properties in 2018

Chinhin, Jumping Into the Bandwagon of Booming Mega Infrastructure

Do note on the keyword of the company prospect stating that- The Company has started to supply pre-stressed and reinforce concrete beam, crosshead, cable trough and emergency walkway to the mega infrastructure projects in town i.e. Duke Highway, Mass Rapid Transit (“MRT”), Light Rapid Transit (“LRT”), Gemas-Johor Bahru (JB) Electrified Double Track Project (“EDTP”) and West Coast Expressway (“WCE”)

- The revival of the East Coast Rail Link (“ECRL”) and Bandar Malaysia projects is expected to have a positive impact on the country’s economic growth in the medium term. The Bandar Malaysia project, which will include offices, a park and 10,000 units of affordable homes, is expected to stimulate the demand for construction materials which Chinhin are specialised in.

- The ECRL, mega public transport initiative, involving a 640-kilometre track, is expected to have a huge urbanisation impact on the states which will be in the path of the ECRL, namely Kelantan, Terengganu, Pahang, Negeri Sembilan, Federal Territory of Putrajaya and Selangor where our building material warehouse already develop a strong footing

- The government of Malaysia has undertaken an open tender in 2019 for an estimated RM2 billion worth of projects under the third cycle of the Large Scale Solar 3 (“LSS3”) scheme, to increase electricity generation from renewable energy (“RE”). The tender for the development of the RM2 billion Large Scale Solar 3 (LSS3) scheme projects is opened from Feb 27 to Aug 19. Our associate company is confident to secure some of the subcontract projects from the said LSS3 scheme.

- We expect our associate companies to continue delivering a better results due to its strong order books. Besides, mega projects will also stimulate a sturdy demand for the infrastructure products we are focussing on.

Is Chinhin Laggard behind its immediate peers (Humeind, Lafarge)? Are they mirroring each other performance?

Disclaimers: Information and comments presented does not represent the opinions whether to buy, sell or hold shares of a particular stock. Information shared above shall be treated solely for educational purpose only. The author may have positions in some of these instruments. The author shall not be responsible for any losses or lost profits resulting from investment decisions based on the use of the information contained herein.

https://klse.i3investor.com/blogs/infoanalytics/215013.jsp