Dayang – what exactly is its value

If you are an investor (holding a counter for at least 2 years) intending to invest in Dayang, I urge you go read the three Petronas Activity Outlook (PAO) – 2017-2019; 2018-2020 & 2019-2021. There is a wealth of information and very professionally presented focusing on what is relevant ONLY, very good.

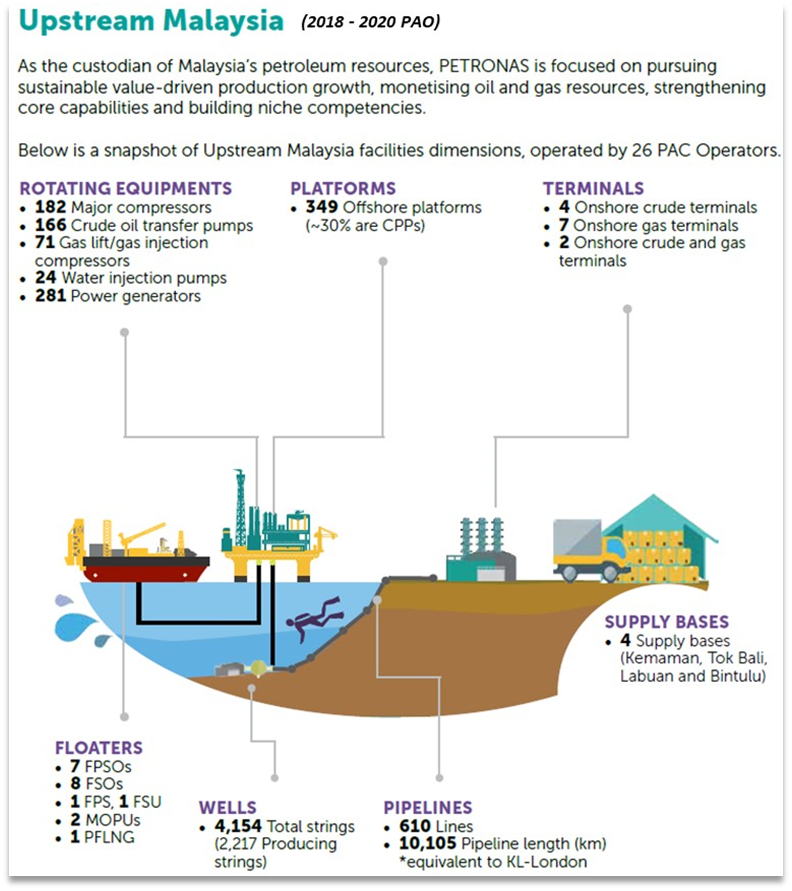

An example:

In one picture / infographic, the whole upstream in Malaysia is shown, wonderful.

Note – there are 349 offshore platforms!

I return to the ENTROPHY theory – these platforms need maintenance, ALWAYS (5 – 8 years cycle).

Sydney harbour bridge, San Francisco golden gate bridge, forth bridges in Edinburgh and many other such bridges – the fact is when the contractors finished painting this end, they must return to the other end and start all over again.

So, WORK is always there, 349 platforms!!! And growing.

Unfortunately, it is not clear from the PAO what is that one critical equipment required to carry out this maintenance work. This is, the Accommodation Work Barge or Work Boat.

Dayang Opal (left) built in 2012, WORK BOAT (WB) accommodate 197 persons with lifting capacity of 45 tonnes at 41.2m boom length. Dayang Pertama (right) built in 2005 – 189 persons, 25MT at 43m.

This is OFFSHORE; no home to go back to, or just drive down the road to the hardware shops to buy material that is missing, etc. These vessels are a MUST.

Having these vessels will be the edge, some call it MOAT, some, the barrier to entry.

Vessels not in used (in anchorage) is as good as scrape metal the longer they are not used. Read ICON article by Capt. Hassan Ali (https://www.theedgemarkets.com/article/icon-offshore-set-sign-debtrevamp-deal-month).

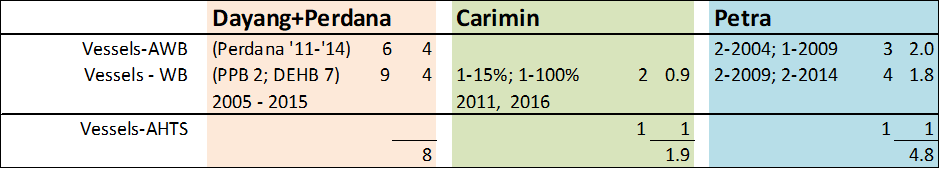

It is obvious Dayang (with Perdana) is miles away where AWB and WB is concern. For either Carmin or Petra to compete on par with Dayang, they will need to “plant up” with AWB/WB.

In February 2014 (https://www.theedgemarkets.com/article/petra-energy-sell-vessel-perdana-petroleum) there were talks between Petra and Perdana to sell / buy Petra Endeavour for US 25M. Ignoring inflation, one unit 300 pax AWB will cost about RM 104M today. And if you order one today, you will only get it about three years later. The odd is stack against you as all the necessary maintenance contracts has already been awarded. Next round will be in 2024. Who will lend you the money to build the AWB under current climate (with so many companies still under water) and without a contract too? Buy one in anchorage but need to drydock and refurbish, say RM 50M (guesstimate)?

(A rich man tried with FPSO and see where that got him albeit it is different sphere but similar, service to oil majors, one Company tried, also FPSO, almost went bust, taken over by the other Malaysian FPSO company –it is not easy to get in regardless one got money or otherwise.)

Furthermore, the age of Dayang (+ Perdana) AWB vessels are younger than Petra’s.

Carimin does not have one unit (AWB) so they will have a tough time muscling in for more job.

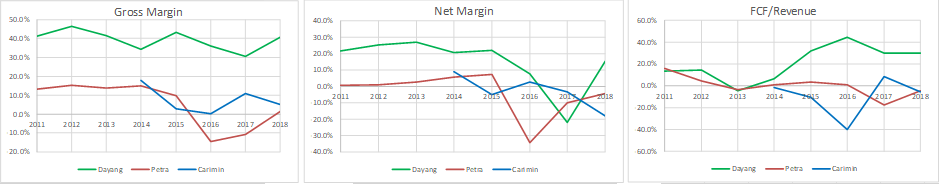

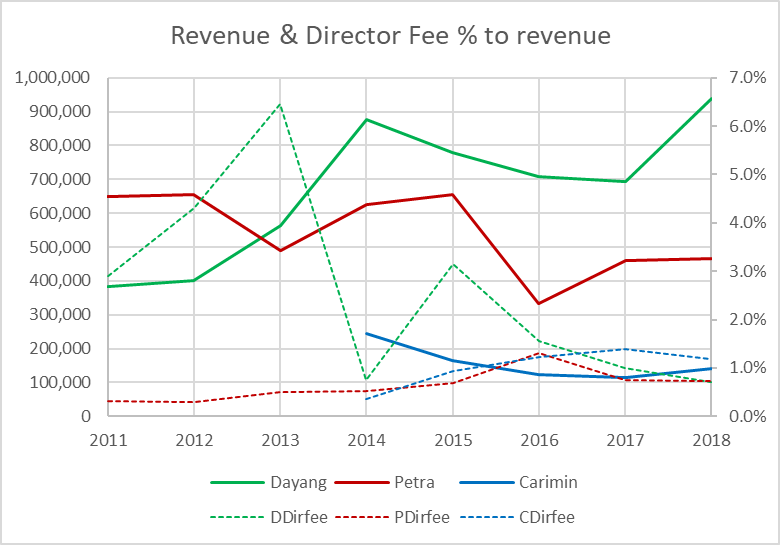

Still not convince, here are the profit margins (gross and net) plus free cash flow for consideration.

And Dayang (green line) can generate cash for future (new vessels) capex compare to the other two.

Thus, the next cycle (2024-2028) of maintenance contracts, Dayang will again win the major bulk of them, sure, no guarantees, but highly likely.

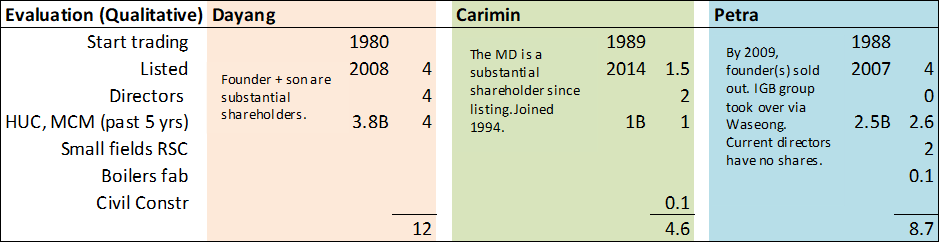

Directors

Among the three companies, only Dayang still has founder in the mix. Carimin MD (join 1994) and one other director hold substantial share in the company. Petra directors do not even hold a single share (2018 AR), they have no skin in the game.

Moreover, Carimin and Petra are both involved in other businesses; while Petra’s are all in the oil & gas sphere, Carimin is outside (civil construction). This potentially dilute Board’s attention and focus on the HUC /MCM work and there is no synergy at all.

The closet rival, Petra, with directors having no skin in the game, I do not think there is much "drive", how to replace aging marine fleet to compete and FCF is so low?

Nonetheless, the directors pay, and fees are reasonable, Dayang and Petra coming in at 0.7% of revenue while Carimin is 1.2%. Dayang's revenue is also a quantum leap from the other two, Carimin is the lowest.

I think Dayang directors, especially the founder, have been very competent and know exactly where they want the company to be in the next 5 years, next 10 years and further. Yes, they underestimated the cost to get into Perdana, in hindsight, everything is crystal clear. Who predicted that oil price stayed low for that long?

But as argued above, Dayang requires Perdana, it is symbiotic, management control of the AWBs is important. This provided Dayang with price setting influence, and flexibility in pricing to the various clients. Do not forget, 60.48% of whatever price set by Perdana goes back to Dayang.

Still not convince, another way to look at the situation:

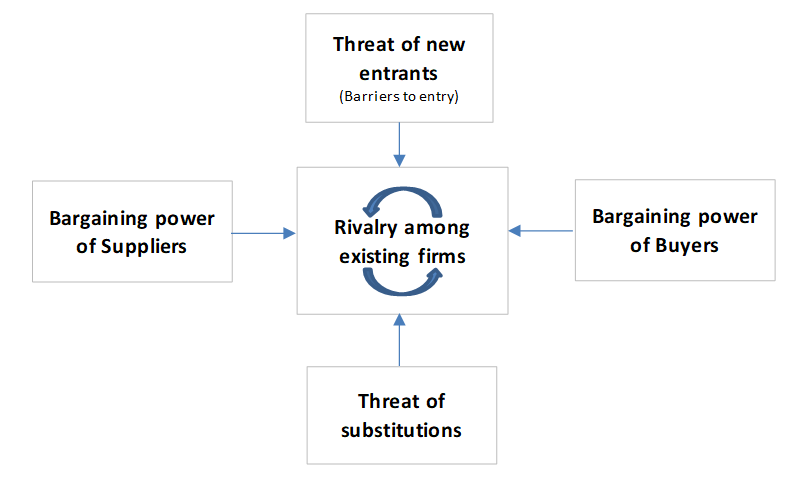

- Threat of new entrants – the need for AWB and or WB will dissuade, of course some will try but I just do not see how they can replace Dayang or even “chip” into the market.

- Threat of substitutions – newer platforms may come with components that requires lower maintenance; but the current 349 platforms will continue to require maintenance between 5 to 8 years until they are de-commissioned (when – ahh, easily for next 25 years, more later)

- Suppliers bargaining power – only Dayang with 65% to 70% of work can resist

- Buyers bargaining power – currently Carigali has the power as it has the higher number of platforms, the rest, of course will be based on open tender value. However, due to size of Dayang, it can dictate price that Carimin and Petra will find hard to make good money.

- Rivalry among Carimin, Petra and Dayang – the market is curved out for the next 5 years, so there should be no to minimal rivalry. Besides, due to Dayang (+ Perdana) size, Cariman and Petra just could not compete in price.

This question, future of oil as a source of energy to the world, the fear that it is coming to an end soon, well I cannot tell what the oil price would be, but I can tell you oil will continue to play a big part as a source of energy to the world at least until 2050. Please read all 15 pages of the following report from: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/07/The-Energy-Transition-and-Oil-Companies-Hard-Choices-Energy-Insight-51.pdf?v=f5c3020d846f

When I finished Form 5 in mid 70s, there were talk that oil will run out in 10 years (in Malaysia). Then when I had my first kid in late 80s, again oil will run out in 20 years, today, oil is still being produce in Malaysia.

Extraction technology does not stand still, now we are talking about enhanced oil recovery, in the future, the above report provides some glimpse. And, new fields are being found.

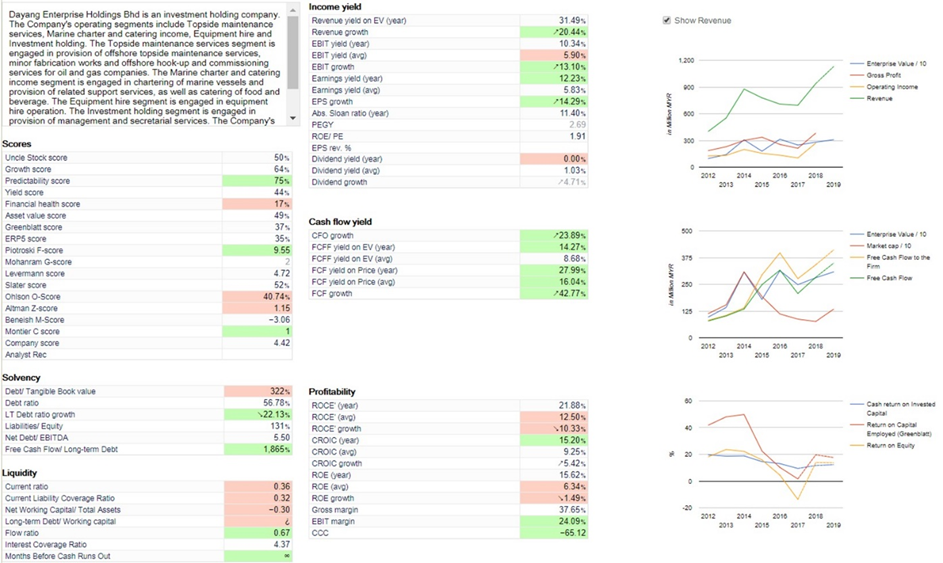

I will now attempt to determine the intrinsic value of Dayang, in fact I will not. There is this website – Unclestock (https://www.unclestock.com/#!s=5141.KL) does it all. ROC, ROCE, ROIC and more. (Thanks US for internet.)

Unclestock did not stop there, it went on to cash flows in various metrics and intrinsic value (IV) based on so many different methods – DCF, Warren Buffet, Graham, Lynch, etc., all in all 10 methods giving results of 0.54 to 5.71 RM/share. And it averages the IV to one figure – 1.82 RM/share.

There is no need to further throw in these returns, that per shares and so on, everything is at this unclestock. All these metrics are all very well. It uses current data and spew them out (garbage in garbage out). One can pick and choose the metric to justify one’s view. Who is right who is wrong, well it is all relative?

The question that an investor needs to ask is the future. Next 5 years – 10 years, will DAYANG continue to dominate, make more money, will it continue to have so much business? Answer is yes, yes and YES.

The closest rival – Carimin and Petra, their cash flows will not allow them to plant up (check unclestock if you do not like my charts above). Dayang can easily!

This dominant position should be worth something that I think, the many IV methods did not account for, +18%, gives Dayang intrinsic value as RM 2.15 per share.

Conclusion

- Dayang has a wide moat – ownership & control of newer 6 units AWBs & 9 units WBs

- Work is always there – 349 platforms and counting, just more or less, depending on the oil price. During lower for longer period, Dayang’s revenues, 2015-778M; 2016-708M; 2017-695M is still respectable plus excellent FCF.

- This 5-year cycle – 2019 to 2023 MCM is all firmed, done deal, all RM 3.5B to RM 4B of it, now waiting for results of I-HUC tender.

- Next cycle – 2024 to 2028 (and future cycles to come), highly likely Dayang will win similar (contract) value if not more.

- Intrinsic value is RM 1.82 to 2.15 per share.

A man is dating 3 women and is trying to decide which to marry. He gives each of them $5,000 to see what they do with the money.

The first has a total makeover. She goes to fancy salon, gets her hair, nails and face done and buys several new outfits. She tells him she has done this to be more attractive to him because she loves him so much.

The second buys the man a number of gifts. She gets him a new set of golf clubs, some accessories for his computer and some expensive clothes. She tells him that she spent all the money on him because she loves him so much.

The third woman invests the money in the stock market. She earns several times the $5,000. She gives him back his $5,000 and reinvest the remainder in a joint account. She tells him she wants to invest in their future because she loves him so much.

Which one does he choose?

Answer: the one with the biggest boobs.

Thank you all for reading. It has been a most interesting journey for me, learning, understand how to assess, value and understand the business of Dayang.

Also, thanks for the insights provided by so many readers and forum contributors. Hope we all learnt something.

Further thoughts:

Eventually, Dayang will gives dividend again (maybe 2 years down the road) once debt is parred down somewhat.

There is not much R&D apparent in (public) information so far. I am sure Dayang (now considered including Perdana) is doing plenty (plus digitalization) to maintain their No.1 position in the HUC & MCM sector. This is in term of delivery (execution of work, completing timely and within budget).

Doing de-commissioning (of platforms) will be a natural extension and again, Dayang, will be front and central in any tender/contract.

With Petronas support, Dayang (& others) are going oversea – this is positive.

The I-HUC tenders, intense lobbying, may follow the distribution of the MCM contracts if work is distributed like MCM, else, maybe 50% Petra, 50% Dayang (or less as it is in the interest of Petronas to avoid too reliant on one contractor ONLY). Heck, if RM4B is true, 30% will be whooping RM1.2B, spread normally over 3 to 5 years.

Recent changes in substantial shareholders is intriguing to say the least. On balance, should be more positive than negative.

Have a pleasant weekend and Happy investing all.

https://klse.i3investor.com/blogs/teoct_blog/216002.jsp