Mr Wong is back with glory! Once 0.80 is break. We will see EFORCE at RM1 to fill the gap!

While MYEG is forming cup and handle!

Both Mr. Wong linked shares are very UPTREND!

But we still prefer EFORCE! Because EFORCE shares issues lesser than MYEG :)

We strongly believe greater digitalization will boost the business of Eforce,

EForce organises its business activities into three (3) segments. They are:

- Application Solutions (“AS”) – Sales of software applications and product on outright purchase basis.

- Maintenance Services (“MS”) – Provision of maintenance services.

- Application Services Provider (“ASP”) – Provision of application services on monthly recurring fixed and variable charges.

We believe eforce will rebound strong due to few factors:

-Migration to T+2 will add vibrancy to local bourse : https://themalaysianreserve.com/2019/02/15/bursa-malaysia-to-implement-t2-on-april-29-this-year/

-the edge Malaysia weekly reported more public companies are expected to undertakeright issue in 2019

-Finance minister encouraging broker to adopt greater digitalisation

-Maybxxk and some other brokers might want to upgrade to more powerful system due to recent congested issue

-current core clients are demanding for big data analysis (mentioned during 30th May 2018 16th AGM)

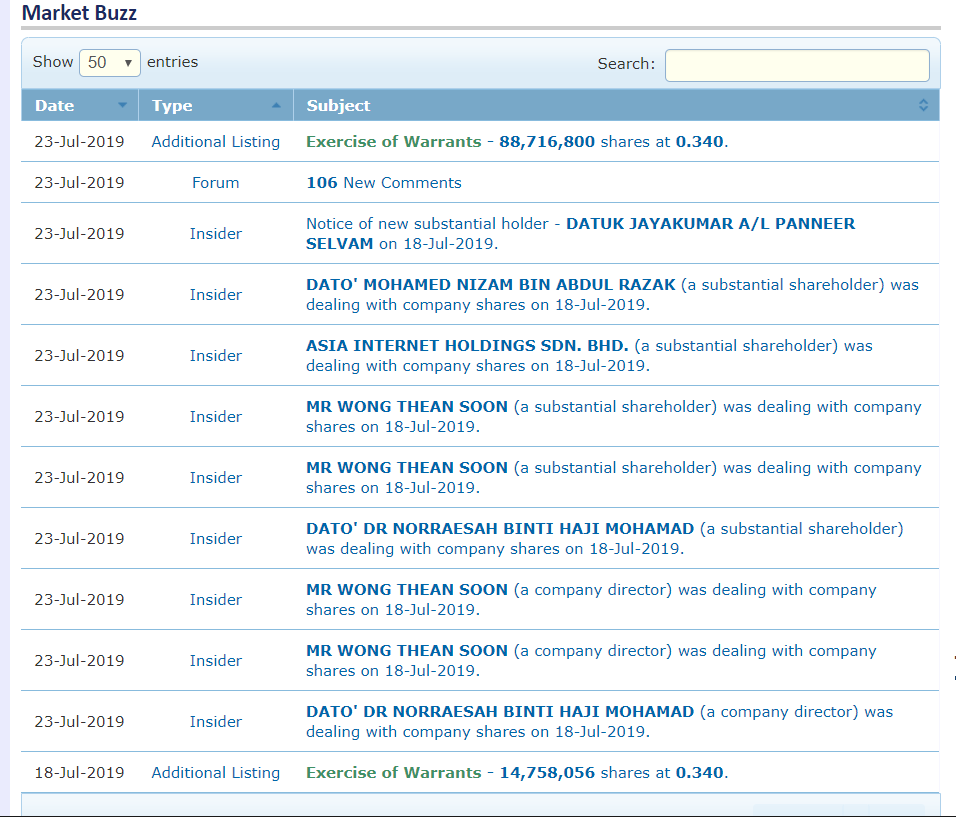

Last year, Excel Force share price has dropped substantially after the change in Malaysia government. This is due to Excel Force Chairman being Executive Chairman of MYEG.

During AGM, a few shareholders have raised their concern on whether new

government will have impact on Excel Force existing business. As

described by Chairman:

Excel

Force’s core businesses provide services to stock broking, consumer

banks and insurance clients. Some of their clients are Maybank, Kenanga,

Hong Leong, Public bank and UOY Kay Hian.

There are no government concessions in their existing client portfolio and their businesses are not government related.