We

observed that volumes have been picking up on immigration-related

stocks such as Heitech Padu, SCICOM, IRIS and DSONIC. Hence, we believe

this could be due to the upcoming open tender for the new Integrated

Immigration System (IIS) after government scrapped the previous Sistem

Kawalan Imigresen Nasional (SKIN) project, which worth RM3.5bn. The due

date for submission is Aug-Sep 2019. There are four core modules, namely

(i) Visa and permit system, (ii) passport system, (iii) border control –

check points, auto gate with biometric system and (iv) enforcement – to

support the immigration. Hence, we expect trading activities to pick up

on the above mentioned stocks.

HTPADU: After

the recent symmetrical triangle formation breakout, accompanied by

strong volumes, HTPADU has retraced significantly towards the trendline

and rebounded to close at RM1.10 on Friday. We believe this could be a

decent accumulation phase along the RM1.00-1.10 levels. The ADX

indicator is still positive, which may point to further retest of

RM1.28-RM1.39, followed by a LT target of RM1.77. Support will be at

RM0.97-0.98, with a cut loss below RM0.96.

SCICOM: It has experienced a strong breakout above RM0.90 on 22nd July and pulled back towards the RM0.875 last Friday. With the higher high and higher low formed recently, we opine that the recent pullback formation could be due for a potential technical rebound in the near term. Resistance will be set around RM0.96, RM1.03, followed by a LT target of RM1.15. Support will be RM0.835-0.845 with a cut loss set around RM0.825.

IRIS:

Price has stabilised between the RM0.145-0.16 over the past month and

IRIS’s positive momentum is picking up on the daily chart as shown in

the ADX indicator. Should the price successfully close above RM0.16,

next target will be at RM0.17-0.18 and RM0.195. Support will be pegged

around RM0.145-0.15 and the cut loss point stood at RM0.14.

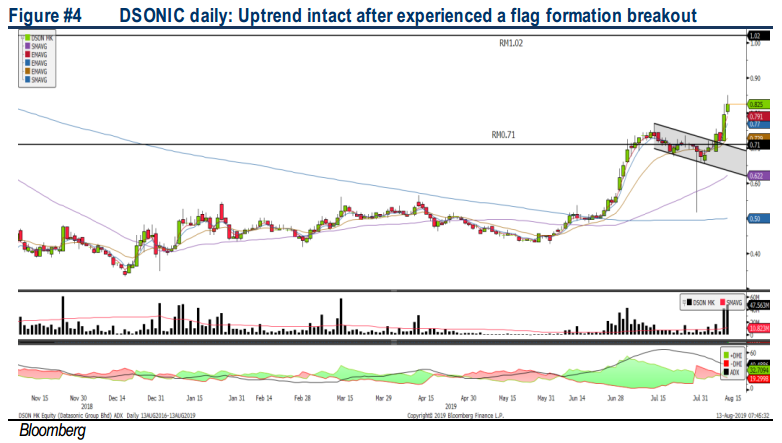

DSONIC:

After a strong rally above the RM0.55 during end-June, it has marked a

52W high of RM0.85 last Friday following a flag formation breakout early

August 2019. The ADX is still suggesting that DSONIC’s momentum and

trend is positive. Hence, the next target is envisaged RM0.92-0.95 and

RM1.02. Support will be anchored at RM0.74-77 and the cut loss level is

set at RM0.71.

SCICOM: It has experienced a strong breakout above RM0.90 on 22nd July and pulled back towards the RM0.875 last Friday. With the higher high and higher low formed recently, we opine that the recent pullback formation could be due for a potential technical rebound in the near term. Resistance will be set around RM0.96, RM1.03, followed by a LT target of RM1.15. Support will be RM0.835-0.845 with a cut loss set around RM0.825.

Source: Hong Leong Investment Bank Research - 13 Aug 2019

https://klse.i3investor.com/blogs/hleresearch/219111.jsp

https://klse.i3investor.com/blogs/hleresearch/219111.jsp