Formerly known as Aturmaju Resources Berhad

ARRB is rebuilding the business to diversify from Timber to Technology services. It was a difficult decision to start up a new business line of developing the customised Enterprise Resource Planning (ERP) System, but it was an important step in repositioning the finances of the Group to take a significant step forward on our priority of strengthening the balance sheet.

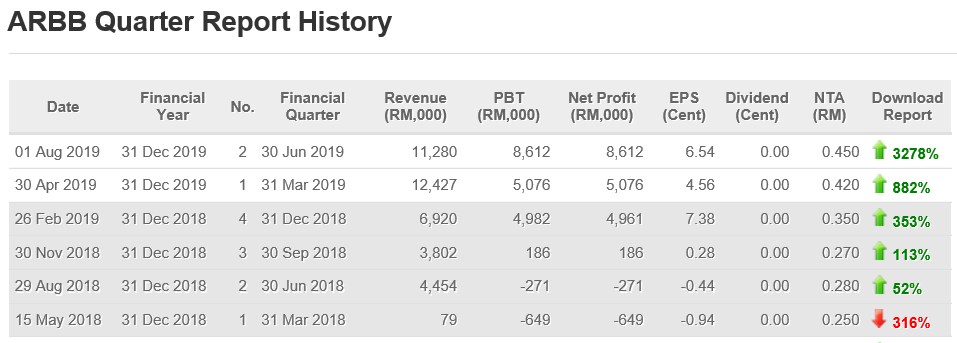

ARBB is a good example. When KYY saw its profit growth for its 2 consecutive quarters 2nd and 3rd quarter which complied with his golden rule, he might start to buy it.

When he will sell?

He will start to sell as soon as he sees the company report less or reduce profit for 2 consecutive quarters. You must bear in mind that many company’s product or services are seasonal. He will not simply sell when he sees the company reported a reduced profit for 1 quarter because its product or services may be seasonal.

He will also sell if he can find a share which has a better profit growth prospect.

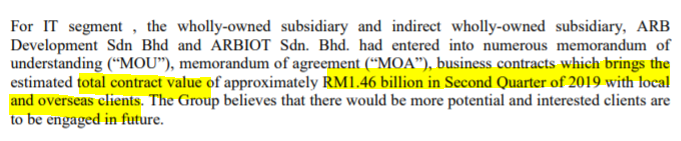

Healthy Pipeline with RM1.46Bil Sales Going Forward

Note: No share can go up or come down continuously for whatever reason. After some time, it will correct itself as some investors will start to sell to take profit. After it has dropped for some time, some cash-rich investors will start to buy to push the price up again.

To be really successful, investors must also have some knowledge of financial and technical analysis, understanding of human nature and business sense.

In any case, I believe ARBB has a long way more to go.

Reference:

https://www.theedgemarkets.com/article/arb-banks-iot

https://klse.i3investor.com/blogs/ARBB/218348.jsp