POS MSIA BHD - STORMING FORWARD VIA STRATEGIC

ALLIANCES !!!

(INVESTMENT GRADE - MY PERSONAL TP 3.00 Mid to

Long Term)

Recently I had written about this big cap company; which I believe has an interesting future ahead -POS

MALAYSIA BERHAD (Stock Code 4634, listed on MAIN BOARD, TRANSPORTATION

& LOGISTICS, market cap RM 1.362 Bil as at writing)

Refer my previous write up here:

I noticed considerable interest starts to build in on 2nd August Friday when the volume registered a sizeable increase to 2.8 million, when the overall KLCI was in a bearish sentiment.

AN UPDATE - FORGING NEW STRATEGIC ALLIANCES

1. POS teams up with STO EXPRESS INTERNATIONAL CO LTD

Refer latest article on 2nd August from The Edge online. The

Collaboration Agreement was signed to explore cross border cooperation.

https://www.theedgemarkets.com/article/pos-malaysia-teams-china-firm-explore-crossborder-cooperation

They will be targeting businesses in South East Asia (SEA), especially

SMEs, for an end-to-end logistics platform with improved efficiency in

international courier services at an affordable rate, positioning

Malaysia as a gateway to the ASEAN region.

The above agreement is seen positive to both parties, due to below:

i. Exchange of best practices and technology

ii. Providing a one stop solution platform for ASEAN businesses, hence speeding up their growth

iii. Cross leveraging on each other infrastructure and assets to minimize cost in providing the services

iv. Cross promotion of products into home country (Malaysia to China, China to Malaysia)

POS said that the project kick-off will start with integration of information technology system between both companies, and the launch of pilot delivery model plan by mid August 2019.

Hence, we can expect more interesting announcements to come as both parties work towards achieving this collaboration.

2. Potential for POS to substatially grow its INTERNATIONAL segment

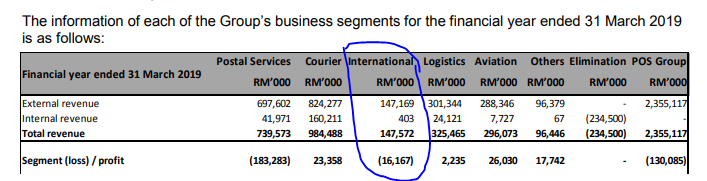

Refer below latest segmental information of POS business as of latest quarter report.

The INTERNATIONAL segment had only contributed to RM 147.2 million of revenue from a total of RM 2.355 billion recorded. This represents only 6.2% of the total revenue.

Also the segment had recorded a loss of RM 16.2 million.

With the above collaboration, POS will be able to potentially grow further the size of its international business and turn around the segment into profitability.

3. A brief introduction on STO EXPRESS INTERNATIONAL CO LTD

Refer below brief business overview of STO :

STO EXPRESS CO LTD is a China based company, principally engaged

in the integrated logistics services, with expess business as the core

business. The Company and its subsidiaries are mainly engage in the

provision of fast delivery of municipal items, inter-provincial and

international items, and information inquiry services. The Company also

provides envelopes, paper bags, cartons and other express packaging sale

services. The Company operates its business in China, Korea, the USA,

Australia, Canada, the UK and Japan.

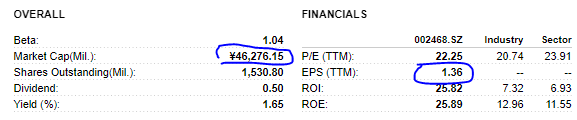

Refer below website for basic financials and info on STO. As we can see the market cap of STO is RMB 46.27615 million (which translates to RM 27.786 billion. POS current market cap is RM 1.362 billion. The market cap of STO is about 20 times that of POS.

Also, take note that STO is a profit making company with EPS of 1.36, whereas POS has been making loss for 3 consecutive quarters.

From the profile above, also we see that STO has business presence in

major countries outside China such as USA, UK, Japan and Canada, as

compared to POS which mainly focuses on Malaysia domestic business.

Therefore,

I see that the collaboration would provide more upside and benefit for

POS as POS would be able to maximize its potential gain from working

together with STO which is a big logistics profit making giant in China.

Also, we take note that recently, ALIBABA had invested USD 693 million to take a 14% stake in STO. ALIBABA had commented that its investment made in "one of the top 5 express delivery companies in China".

4. TA Point of View - Inverted Head & Shoulders Pattern, and Pending Breakout of Bull Flag Pattern

Let's look at daily chart of POS below from November 2018 to August 2019. Below observations:

1. Current price is well supported at RM 1.68 - 1.70 area

2. Forming an inverted head and shoulders pattern with long term break-out above RM 2.00 area

3. Stochastics oversold now, and turning upwards indicating buying momentum entering

4. Price is currently near the lower Bollinger Band area, indicating a low risk entry

5. Price is above ICHIMOKU cloud, indicating a bullish region activity

Let's look closer at the daily chart from June 2019 to latest. We notice a few things:

1. During its recent down days, the volume was very low, indicating long hands are still inside and waiting for higher prices

2. Candles had formed a bullish flag pattern, and nearing the end of consolidation phase

3. Significant volume increase

on 2nd August 2019, when the news on collaboration with STO was released

(even though overall market sentiment was bearish)

CONCLUSION

Considering all the above, my personal TP for POS is maintained at RM 3.00 (Mid

to Long Term) pending the official rate hike announcement &

beneficiary of the collaboration with STO. Funds & Investors should

consider POS to add to their long term portfolio.

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is

never intended to be a BUY CALL whatsoever. I am sharing my observations

ONLY based on fundamental; past history; current trading pattern;

charts etc. Please make your own informed decision before buying this

share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/217902.jsp