Comment what stock you like us to cover below for the next article....

KNM Group Bhd (7164.KL) listed in the Bursa Malaysia

Background of KNM Group Bhd

KNM Group Bhd (KNM) was listed on the former Second Board of Bursa Malaysia on August 2003 before being promoted to the Main Market on September 2005. KNM is a world class process equipment manufacturer and is a worldwide turnkey storage facilities provider. The Company's segments include Asia and Oceania, Europe and AmericaKNM Group Berhad is engaged in investment holding and provision of management services with core business activities can be divided into 5 main divisions:

- Systems Design & Engineering

- International Procurement

- Process Equipment

- Testing Capabilities

- Site Assembly, Commissioning and Maintenance.

KNM Group subsidiaries are engaged in design, manufacture, assembly and commissioning of process equipment, pressure vessels, heat exchangers, skid mounted assemblies, process pipe systems, storage tanks, specialized structural assemblies and module assemblies for the oil, gas and petrochemical industries; provision of management, technical advisory, license and trademark services to international related companies and related international investments, and provision of funding and treasury services.

For the six months ended 30 June 2019, KNM Group gained earnings of RM25.94m as compared to loss of RM52.07m in 1H18 on the back of a 3% rise in revenues to RM738.41m. The improved performance was mainly attributed by Europe segment with increased on 4%.

The 1H19 Basic Earning Per Share increased from -RM0.02 to RM0.01

Recent Insider Report for KNM (Bursa Malaysia)

In this Insider Report, do notice on 19 July 2019, Inter Merger S/B, biggest shareholder of KNM increased position to 18.5% or 8.3% outstanding. We all known what happened when owner of KNM confidently buy more of their own shares KNM. Ir Lee Swee Eng is also the Group Chief Executive Officer/Executive Director

Ir. Lee Swee Eng has over 28 years of experience in the oil and gas industry in engineering, manufacturing, construction and commissioning of oil and gas facilities. He was the founder and the Group Managing Director of the KNM Company since inception.

Could it be possible that in TradeVSA below detected the first buy indicator way back in mid May 2019 before this Insider Report of KNM ? Likewise, there’s a support now KNM @ RM0.35 will provide a longer term support. In mind with higher crude oil prices due to escalation of Middle East tension since the Saudi oil field drone attack, there maybe more upside from the Insider Report of KNM.

Known Insiders in Insider Report

Known Major Shareholder(s)

(As at 29th Mar 2019)

13.87 % Ir Lee Swee Eng (Direct & Indirect Interest)

+Note: + held mainly through Inter Merger Sdn Bhd (8.22%).

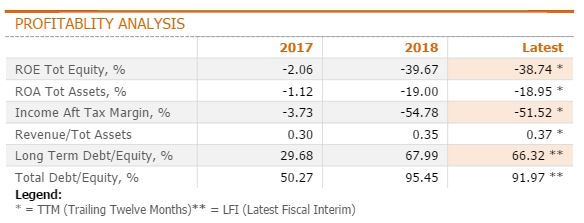

Profitability Analysis of KNM Group

From the Profitability of KNM, its continual loss making maybe deceiving the public that KNM will eventually turn black as now the owner of KNM is buying more. Insiders know more than the public, a common cliché in investing with insiders.

The profit and loss statement and balance sheet cannot be truly discounted as loss making company like KNM is making a turnaround story right now and very soon announced a KNM AGM returning to the black aka “Profitability”. Perhaps relying on non-financial indicators like Volume Spread Analysis plus Insider Report can detect Smart Money/Insider movement will help you.

Weekly & Daily Chart VSA (Volume Spread Analysis) Review

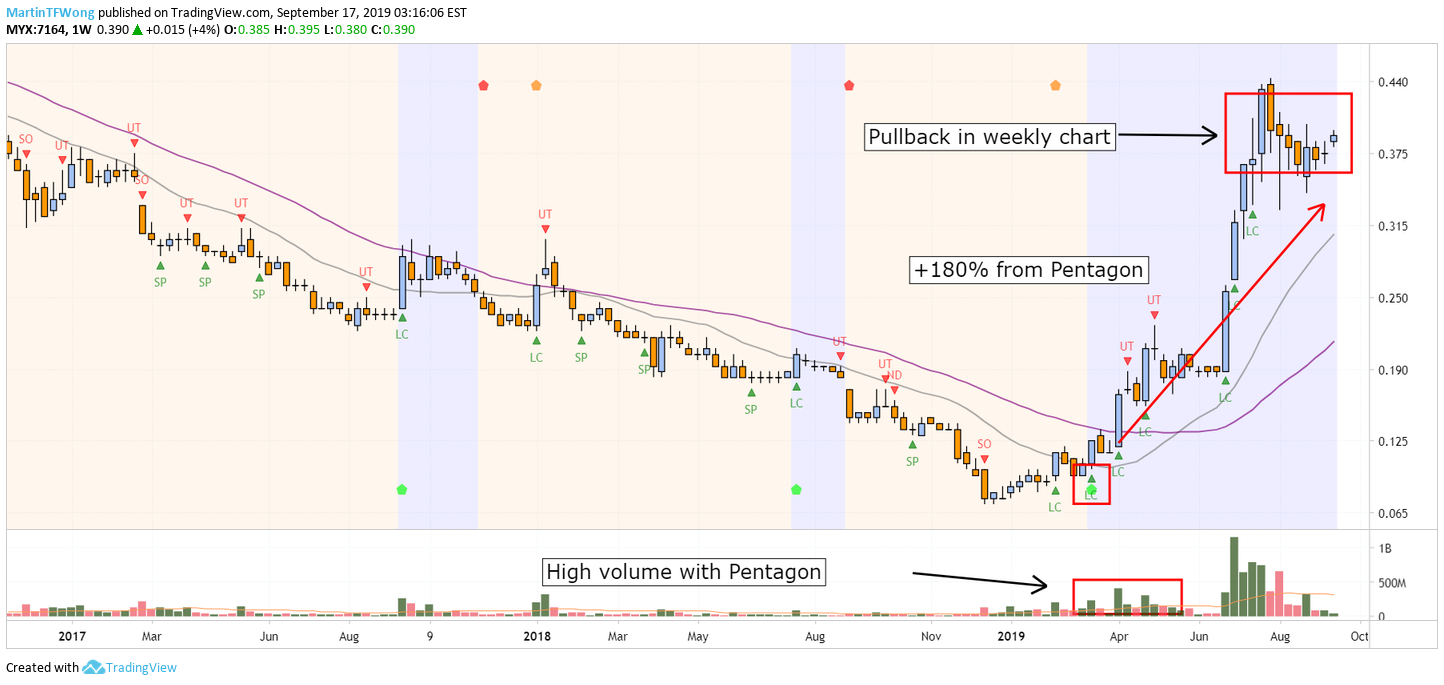

Based on TradeVSA weekly chart, we spotted the change in trend with green pentagon on 11 Mar 2019. Volume increased with Line Change shown the interested by the Smart Money to accumulation KNM Group at the low price. Pullback pattern showing the chart overall still in a healthy trend and likely to break the resistance at RM0.435.

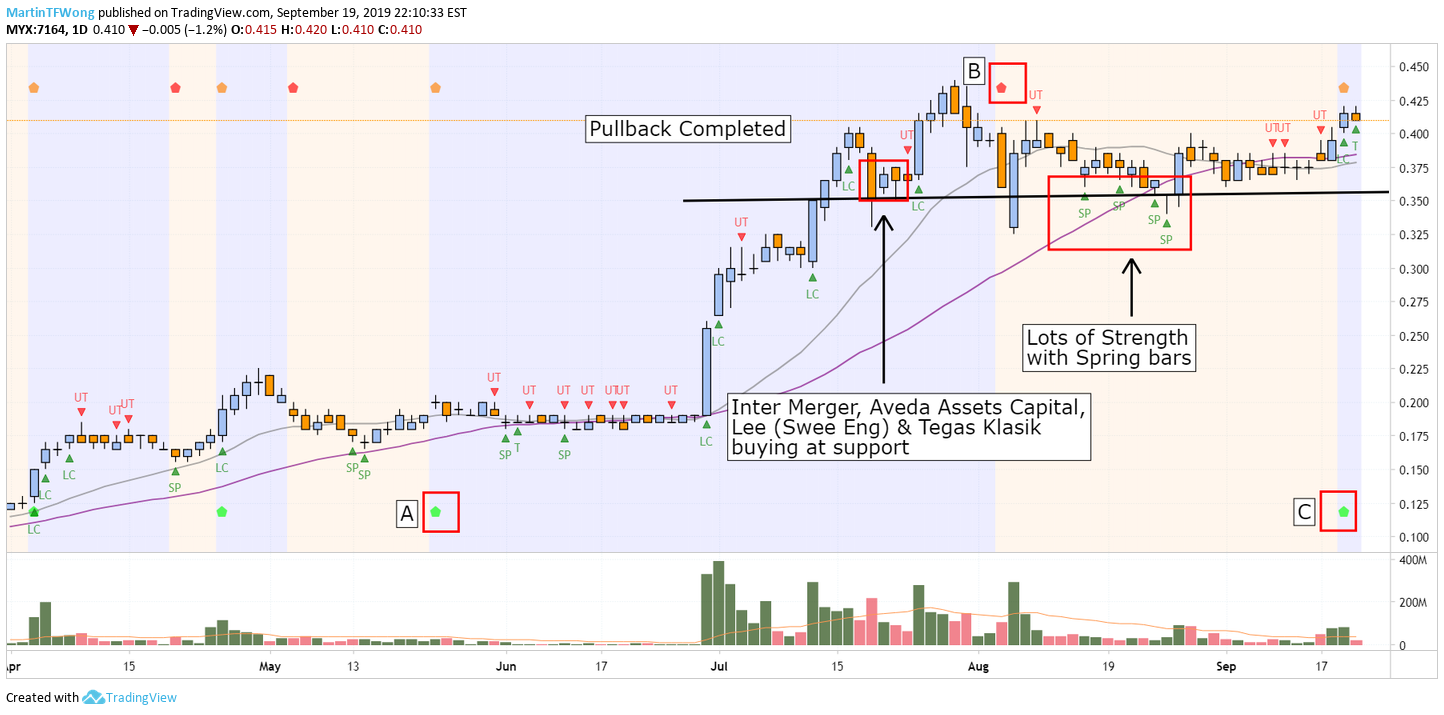

Daily KNM Group chart based on TradeVSA shown lots of hidden potential buying by the Smart Money near the support level. Spring bars or removal of weak-hand holders can be easily spotted around RM0.355 – RM0.37. Price immediately formed a good support at the Spring bars area after the buying from Inter Merger, Aveda Assets Capital, Lee & Tegas Klasik as stated in the Insider Report.

Point A = Potential entry for KNM as detected by Pentagon Screener

Point B = Potential exit / profit for KNM +67%. Is also interesting to know our Pentagon exit at point B is after Inter Merger, Aveda Assests Capital, Lee (Swee Eng) and Tegas Klasik buying KNM at 19 September 2019 as per insider report of KNM

Point C = Potential entry for KNM as per our Pentagon Screener for KNM after sign of strength which is supported after Inter Merger, Aveda Assests Capital, Lee (Swee Eng) and Tegas Klasik buying KNM at 19 September 2019

Is also good to take some profit from KNM between Point A to Point B that is Green Pentagon to Red Pentagon,...do you agreed?

*Pentagon Guider System has Buy or Sell Indicator indicated by Green Pentagon Icon and Red Pentagon Guider Icon in the field of Volume Spread Analysis. However, we advised reader that not all pentagons are buy or sell taken literally 100% of the time in Volume Spread Analysis method.

Contact us via: email at support@tradevsa.com or Call/WhatsApp at +6010 266 9761 if you have any queries about this KNM Group and its Insider Report article or opinion to clarify.

Interested to learn more “How to put Simple Fundamental Analysis with Volume Spread Analysis (VSA) in 3 easy steps”

TradeVSA System, a Volume Spread Analysis (VSA) Malaysia Premier Education Provider in Malaysia

· Free Workshop, 21 September 2019 (Sat), Petaling Jaya, 2pm: http://bit.ly/2kHvCij

· FREE Education via Telegram Channel: https://t.me/tradevsatradingideas

https://klse.i3investor.com/blogs/tradevsa_case_study/225620.jsp