SUNSURIA - OVERLOOKED GEM - BENEFICIARY OF

BUDGET 2020 !!!

(INVESTMENT GRADE - MY PERSONAL TP 0.80 Short to

Mid Term, 1.00 Long Term)

I would like to highlight about this mid cap company; which I believe has an interesting future ahead -SUNSURIA BERHAD (Stock Code 3743, listed on MAIN BOARD, PROPERTY, market cap RM 573.79 million as at writing)

1. Budget 2020 - Property Sector Upgraded to Overweight by TA Securities and Kenanga IB

Refer newspaper articles by The Edge Markets where TA Securities & Kenanga IB had upgraded Property Sector to Overweight and clear winners from Budget 2020. SUNSURIA being among company in Property sector will directly benefit from the budget as well.

Few key summary from the Budget 2020 which positively affects Property Sector:

i. Lowering threshold on high-rise property prices in urban areas for foreign ownership from RM 1,000,000 to RM 600,000

ii. RM 10 billion Rent-To-Own (RTS) Financing Scheme provided by financial institutions for first home purchase up to RM 500,000

iii. Extension on the Youth Housing Scheme

iv. Real Property Gains Tax (RPGT) valuation on property would only be calculated from the year 2013 onwards (previous base year of 2000)

2. Undervalued -

Trading at Very Low PE Ratio of 4.7 Times 9 Months Earnings (EPS 14.32c,

9 months FY2019) & 40c Discount to NTA

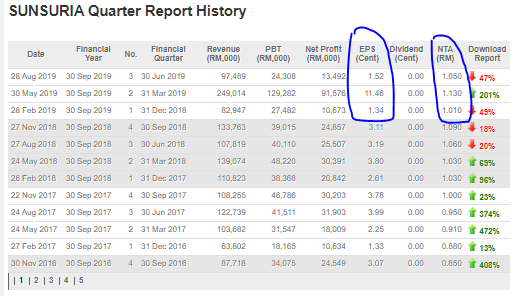

Refer below summary of latest SUNSURIA QR. We see that the total 9 months EPS amounts up to 14.32 cents. Therefore at current price, they are trading at a mere PE Ratio of 4.7 times the 9 months earnings !!! (not even full 1 year earnings !!! ).

Let us say that the company makes similar earnings next quarter result, then the total full year EPS should be around 16 cts.

Looking at a few similar peers around this market cap, we see that they are traded between PE Ratio 9-12. Examples:

i. TITIJAYA - market cap RM 397 million, PE Ratio 11.35

ii. IDEAL - market cap RM 640 million, PE Ratio 12.48

iii. LBS - market cap RM 775.7 million, PE Ratio 10.6

vi. PARAMON - market cap RM 758 million, PE Ratio 9.45

Taking a 9-12X PE Ratio for this company would yield a fair value of between RM 1.40 - 1.90 in the longer term !!!

Also to be highlighted that they have NTA worth of RM 1.05. Therefore, current price is about 40c discount to its NTA value.

In The Edge Markets news, earlier it was highlighted during the May

2019 quarter result that the net profit of the company surges almost 15

times, translating into EPS of 11.46 cts. I have checked every quarter

since 2008 and turns out that this EPS is the historic largest that they

have recorded so far.

3.

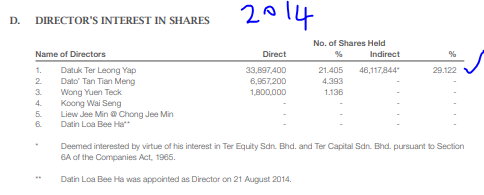

Confidence By Chairman - Tan Sri Datuk Ter Leong Yap - Acquired 65.08

Mil Shares More in April 2019 - Holding a Total of 62.3%, up from 50.5%

in FY2014 - Possible Privatization ???

Refer below latest major addition of shares by Chairman (who is also a

substantial shareholder) Tan Sri Datuk Ter Leong Yap. He had undertaken

65.08 million shares more in April 2019 (via private placement), which

now brings his shareholdings total to 538.3 million shares (62.3%).

Based on the latest annual report, another major shareholder is Ruby

Technique Sdn Bhd which holds 45.3 million shares (5.67%). Therefore if

we total up these 2 major shareholders, we have a 68% total shareholding

among these 2, which leaves about 32% effective public float in the market.

However, another interesting fact that I would like to share with you,

is that Tan Sri Datuk Ter Leong Yap, was a 50.5% owner in SUNSURIA as at

2014 Annual Report. DESPITE

the share price moving from 80 cts in early 2014 to a high of RM 1.56

in Juy 2017, record shows that he never sold a single unit of shares,

and in fact kept buying more until today having a total of 62.3%

shareholding in the company !!!

Will there be an attempt to privatize the company by him? No one knows except him or his close allies. Only time will tell.

4.

Email Update by SUNSURIA Assistant Marketing Manager on the Two (2)

Memorandum of Understandings (MoU) signed in April 2019 - Expansion Into

Logistics and Automotive Sectors

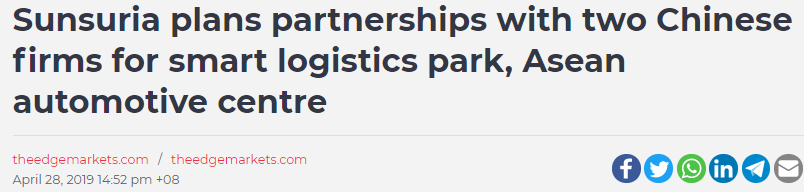

Refer below article in April 2019 which highlighted that Sunsuria had signed 2 MoUs to explore partnership in 2 new areas:

i. MoU between SUNSURIA & SINOTRANS Ltd (listed on HK Stock Exchange & Shanghai A-Share Market, one of China's largest third party logistics providers) - possible JV into logistics business in line with China's Belt and Road Initiative

ii. MoU between SUNSURIA & IAT Automobile Technology Co Ltd (one of China's leading independent automotive design & engineering entities) - JV into automotive business - to establish ASEAN Automotive Design and Innovation Centre (AADIC)

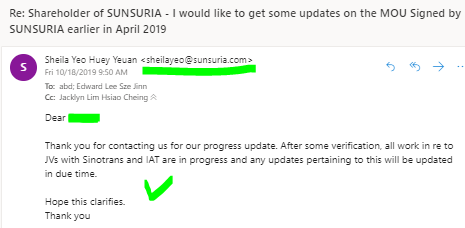

Recently, we have been in contact with SUNSURIA Assistant Marketing Manager and as

per update on Friday 18th October 2019 (refer below image, the email

received), all works are in progress and they will be updating more

details in due time. At the very least, it is glad to know that

the MoUs are still in tact and that they are working to make it happen.

Really look forward to this interesting journey ahead !!!

5. TA Point of View - Rounding Bottom Pattern - Limited Downside, Humongous Upside Potential

Let's look at daily chart of SUNSURIA below from January 2017 to October 2019. Below observations:

1. Hit a high of RM 1.56 in July 2017 (as mentioned before, no selling by substantial shareholder Tan Sri Datuk Ter Leong Yap)

2. Went on downtrend since July 2017 until hit a low of 58 cents in early January 2019.

3.

Volume surged on 29 April 2019, when price had hit a high of 92 cents,

to test the EMA365. Formation of rounding bottom is starting to be

noticed at this time.

4. Recent healthy retracement seen and now sitting close to EMA60 at 68.5 cents

5.

Downside risk seen limited to 58 cents year low, whilst upside

potential seen around RM 1.00 in the mid term, and RM 1.50 in the longer

term

6. EMA200 at 72 cents, EMA365 at 80 cents seen as important points to break to confirm bullish trend

CONCLUSION

Considering all the above, my personal TP for SUNSURIA is maintained at RM0.80 (Short to Mid Term) and RM 1.00 (Long Term). Funds & Investors should consider SUNSURIA to add to their long term portfolio.

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is

never intended to be a BUY CALL whatsoever. I am sharing my observations

ONLY based on fundamental; past history; current trading pattern;

charts etc. Please make your own informed decision before buying this

share or whatever share for that matter.

BURSAMASTER