https://klse.i3investor.com/blogs/gambler/197801.jsp

Please make reference to the above my post published on 14th March 2019.

The mother share and WA were RM0.340 and RM0.110 respectively.

Then 3 days after that on 17th March, I wrote a comment to the post that we should take profit as both mother share and WA had gone up so much.

7 months has passed, let us check again what happen to SAPNRG and SAPNRG-WA now.

Surprisingly, they are RM0.270 and RM0.125 now.

Mother share has gone down 7 cents or 21%!

But WA is RM0.125, still 1.5 cents higher than the then RM0.110!

This is crazy.

Anyway, let the calculation tells.

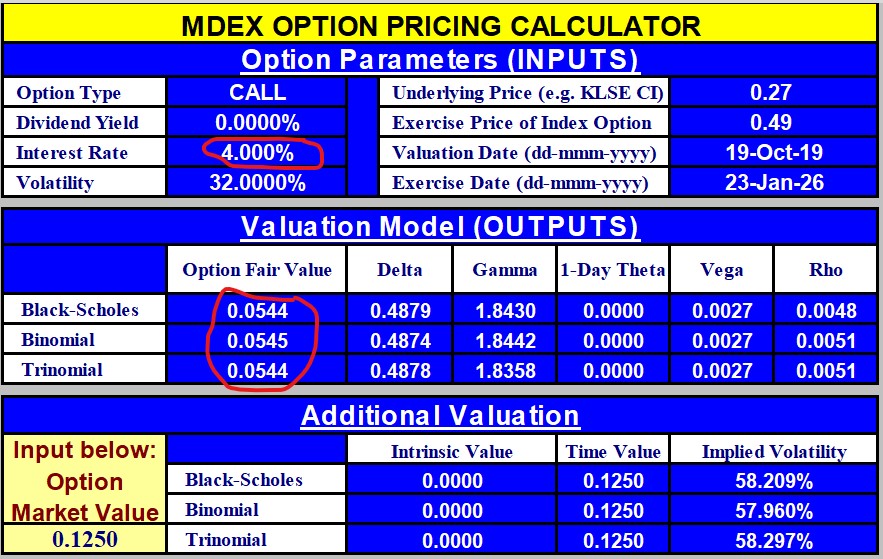

Inputs:

1) The mother share volatility, calculated from the last 90 trading days was 32%, significant drop from last March's 45%.

2) For the interest rate, last March I input 4%, so now also key-in 4% lor.

Outputs:

3) Aiya, the fair value for SAPNRG-WA is only RM0.055 now, the market price of RM0.125 is very very expensive lei.

But wait, wait a moment,

I always say that the interest rate is actually used as the average return per year in the calculation.

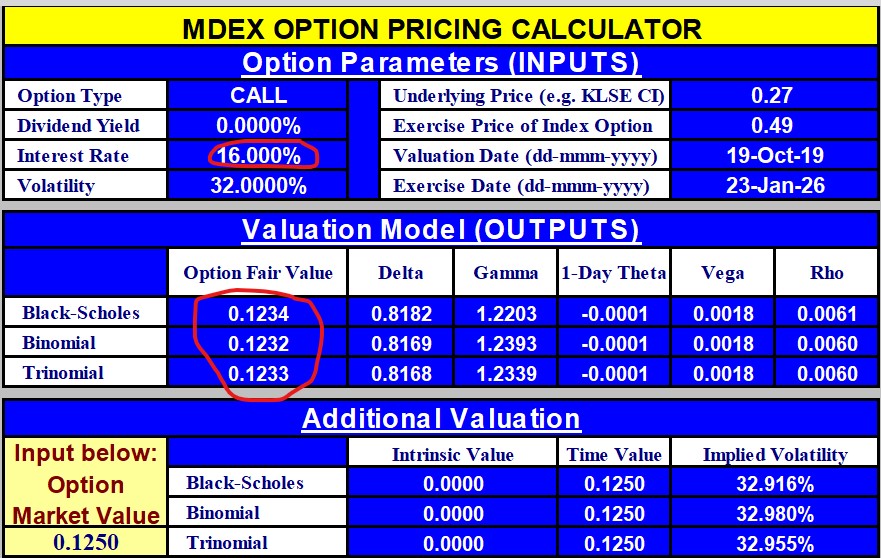

Why not put a higher %? May be the market is believing SAPNRG could provide high return to the shareholders lei?

OK, OK, I trial and error lor, until the fair value approaching the market price of RM0.125.

Wow, the interest rate has to be as high as 16% lei.

For your info, for the purpose of evaluating whether to buy or not a structured / company warrant, I never input interest rate higher than 8%.

So, after talking so much, what is my conclusion?

At the moment I dun have any SAPNRG or SAPNRG-WA.

I might want to buy SAPNRG-WA again if I find the market price is very much lower than the fair value.

For your info, for this company SAPNRG, I will key-in interest rate of maximum 4% only.

https://klse.i3investor.com/blogs/gambler/230904.jsp

Trade at your own Risk!