Tekseng (7200): Potential turnaround in the making

Syariah: Yes

Market Listing: Main

Current Price: 0.25

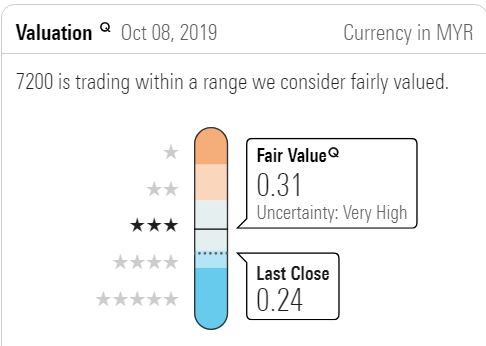

Fair Value: 0.31 (based on Morning Star)

Company Background

Tek Seng Holdings Bhd is an investment holding company. It operates through two segments: polyvinyl chloride (PVC) segment and Photovoltaic Solar segment. The PVC segment is engaged in manufacturing and trading of PVC sheeting, PolyPropylene (PP) Non-Woven, PVC leather related products. Whereas Solar segment is engaged in the manufacturing and trading solar cells, solar panels, solar modules and solar-related product.

Reasons to look at Tekseng

1. The group had decided to temporarily cease the operation of the photovoltaic solar business mainly due to unforeseen market uncertainties as well as the demand as this is a positive step towards improving their business by cutting out the loss-making sector from their business.

2. Improved sales of polyvinyl-chloride (PVC) sheets to Indonesia, Africa, the Middle-East, and Italy were instrumental in helping the group to remain profitable as this year they will ramp up our exports to Africa, the Middle-East, and Italy.

3. Expecting contribution from Indonesia to increase to about 50% this year.

4. PVC flooring sheet production capacity would be raised by about 10% this year in which PVC production floor is about 80% utilized.

5. Tek Seng will start production of polypropylene (PP) sheets in the third quarter 2019 for the stationery market in Europe as they have invested in four machines to produce PP sheets.

6. The group plans to introduce PVC and PP luxury vinyl tiles (LVT) for the renovation industry in the third quarter as they plan to sell the LVT products in Malaysia and Europe.

7. The new products will be contributing to the revenue in 2020 as this is a positive signal towards returning to the black for Tekseng.

Point 1-7 Source: https://www.thestar.com.my/business/business-news/2019/06/24/tek-seng-to-return-to-the-black-this-year

8. Fundamentally Tekseng has showed some big improvement in terms of their Operating Cash flow which was negative last year and YTD its sitting at a healthy level 14.25 million and their free cash flow is positive sitting at 12.47 million compared to -2.39 million last year.

Source: Morning Star report

Technical Analysis

Minimal risk for Tekseng as seen support is quite strong at 0.235/0.24. Once the Downtrend Line (DTL) is broken which is currently at 0.25 we could anticipate Tekseng to further go to 0.265/0.28 then to the fair value of 0.31 in the near future.

Conclusion

We strongly believe Tekseng could do a strong turnaround because the group has decided to get rid of their cancerous solar segment which was dragging them down for a while and now once they had get rid off this loss making segment Tekseng has showed a strong improvement in their fundamentals and also their prospect in the near future looks bright with all the expected new business contributing towards their turnaround.

Disclaimer

Disclaimer: Any content provided only for education learning purposes and NOT recommendation for buying or selling any stock. Please consult your remisier /dealer before making any decision.

https://klse.i3investor.com/blogs/teksengpotentialturnaround/229168.jsp