Experienced investors should always understand that the share price of construction stocks is usually news flow/ rumors driven, hence there is no surprise when we see huge selling pressure in EKOVEST after Bandar Malaysia project officially reinstated on 17 December. (Dont tell me you dont know what is Buy on rumors Sell on news)

However, we shall not ignore the strong fundamental of this new "crony" company which have good relationship to current government. Although share price has more than double from its year-low RM0.42 prior to first Bandar Malaysia news announcement in April 2019, there are still FIVE CATALYSTS that I believe market have yet to factored in:

CATALYST #1: BANDAR MALAYSIA JOB

Frankly speaking this is not a very promising point, as most of the investors already expecting EKOVEST to get significant amount of construction jobs from Bandar Malaysia development, due to their partnership with CREC and as sister company IWH. However, the official announcement of contract award (likely happen in early next year) will definitely boost up the sentiment again, and I believe management will start promoting to institutional investors and analysts once they have better contracts on hand.

CATALYST #2: HSR INVOLVEMENT

The revived Bandar Malaysia development also indicating the revive of Kuala Lumpur-Singapore High Speed Rail (HSR) project, which GAMUDA & YTL no doubt will be the shortlisted candidates as PDP partner. But according to industry source, none of any local contractor (including top-notch GAMUDA) have capability to build the HSR, so the potential winner might have to team up with a strong foreign partner (China) for tender. Same as #1, CREC’s partnership & strong relationship with government will be an advantage for EKOVEST to join the party this time, as we all know what’s the “key” to win government jobs in Malaysia. You may say EKOVEST dont have any track record for rail project before, but neither they had any highway expetise before they started DUKE projects in year 2006.

CATALYST #3: DUKE REIT IPO

The construction of DUKE 3 highway will be completed in early next year, and the highway users may need to pass as much as total 4 tolls by paying RM10, this can be deemed as a strong cash cow for EKOVEST stakeholders. There’s no secret EKOVEST are planning to list DUKE as REIT on Bursa Malaysia, for a potential Special Dividend and also increase the valuation of its concession segment. The IPO won’t be happening in near term due to political concern, but it just matters of time as EPF (40% holdings of DUKE) will eventually looking for exit. EPF bought their stake in 2016 for RM1.13 billion, valued the DUKE highway at RM2.83 billion, and there’s no way the REIT can be listed without certain premium on top of that.

CATALYST #4: THE PH ERA CONGLOMERATE GIANT

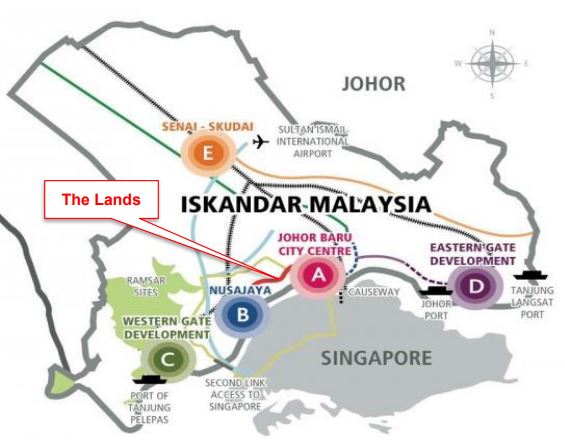

When the company announced Iskandar land deal with IWH, market views it negatively because this is sort of funding for IWH’s Bandar Malaysia development. But think carefully, the land selling to EKOVEST isn’t crap at all, especially after HSR projects revived. There will be a HSR station based in Iskandar Puteri, and I strongly believe that EKOVEST will propose to the government for the station to build on their landbank. Of course, the value of their property arm wouldn't emerge in near term taking into consideration of current challenging property market, but the strategic location of their landbank is promising for strong growth in next decade ( also in underdeveloped KL Setapak area). Adding up core construction arm and DUKE highway, and newly injected durian planter - PLS Plantaions, we shall witness a new conglomerate giant in Malaysia, under Pakatan Harapan (PH) era.

CATALYSTS #5: IWH IPO

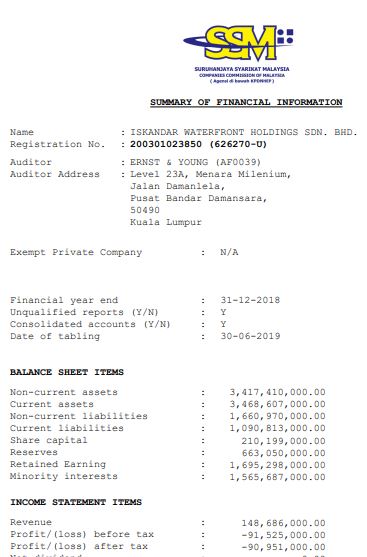

According to Bloomberg, IWH are planning for a RM30 billion listing (which I think impossible to fetch such high valuation). If the listing plan successful in next year, the sentiment in EKOVEST (and also IWC) will be positive but only in short term. Nonetheless, as per checking in SSM, IWH still loss making (RM90 million net loss in 2018) which could be a hurdle for listing. Not to mention property companies are tougher to get approval for IPO, hence we cannot deny the possibility of merger between IWH with EKOVEST, especially IWH will owns a 24% stake in EKOVEST after converting all the preference shares. Recall that IWH-IWC merger plan in 2017 has resulted the latter share price more than triple in few weeks. The proposal was rejected by shareholders that time due to termination of Bandar Malaysia project, but this time we expect EKOVEST is at a much better position.

VERDICTS:

A quick search of a news report back in 2016, when the EKOVEST’s MD committed to achieve RM10 BILLION (market cap) company in 2022, as most of their infrastructure ( ie DUKE highway/ River of Life) and property development (EkoTitiwangsa) will be completed by that time. This is yet to factor in upcoming Bandar Malaysia projects and the potential HSR jobs. The targeted market cap will translate into share price of RM3.77 (current 2.6B share base), or RM2.86 (3.5B share based, fully diluted if IWH converted all the preference shares).

EKOVEST are so lucky after Hishammuddin’s proxy exit the company few months prior to the 2018 general election. The company are really “quick enough” to switch themselves from BN-related to PH-related company, and apparently they are in the smooth progress to achieve their RM10 billion targeted milestone. Any price below RM0.83 (the recent placement price) likely a safe entry.

DISCLAIMER: THIS IS NOT A BUY CALL OR RECOMMENDATION!!!

https://klse.i3investor.com/blogs/TheCatalysts/2019-12-22-story-h1481887655-EKOVEST_10_BILLION_COMPANY_in_making.jsp