[LIONIND (4235) - AGM 2019 Details]

Lion Industries Corp. Bhd. Is a company primarily engaged in the steel business. In addition to the steel industry, LIONIND also conducting other businesses. Here is the summary of the business.

Steel Business:

Klang (Amsteel Mills Sdn Bhd)

Banting (Amsteel Mills Sdn Bhd)

Johor (Antara Steel Mills Sdn Bhd)

Labuan (Antara Steel Mills Sdn Bhd)

Building Materials Business:

Lion Forest Industries Berhad (74%)

Other Business:

Petroleum Lubricants and Automotive Products (74%)

Parkson Holding Berhad (28%)

Q&A Time:

Q1: On page 61 of the annual report, the company's turnover has fallen.

Why did other expenses increase from RM 85mil to RM 127mil last year?

A1: In 2019, steel prices have fallen by 20%, hence the company's needs

to be adjusted appropriately. And we have Stock Written Down of about

RM 50mil last year.

Q2: I see Trade Receivable has RM 721mil impairment. What happened? Can the amount of RM 721mil be recovered?

A2: This is about MegaSteel. Currently MegaSteel has been doing debt

restructuring. After the debt restructuring, we will receive a part of

the fund.

Q3: Do you think company will perform better on next year?

A3: Most steel companies are not doing well, mainly because of the

economic and real estate downturn. We hope that real estate and

infrastructure projects will continue to improve in the future. And on

top of that, we are also facing many fierce competition, such as

Alliance Steel.

We have also discussed the state of the steel industry with the

government, and the government knows the steel industry situation. At

present, Malaysia's steel production is 12mil mt, but in fact the steel

utilisation rate is about 4.4mil mt. The excessive output has led to low

steel prices.

Q4: Why does Sales go down, but Purchase goes up? Does the company do any hedging?

A4: We purchase the same amount of raw materials as previous year, but

the material price has increased, moreover it is in USD. USD

appreciation has a certain cost impact on us. The company did not do any

hedging.

Q5: The company has cash in hand, why not pay dividends?

A5: Under the Companies Act 2016, we are unable to pay dividends. This is because the company is not making money.

Q6: Since Parkson has been losing money, why not sell it?

A6: As far as we know, Parkson is already in transition. Their business

in China has grown a lot. We believe there is hope in the future.

Team Opinion:

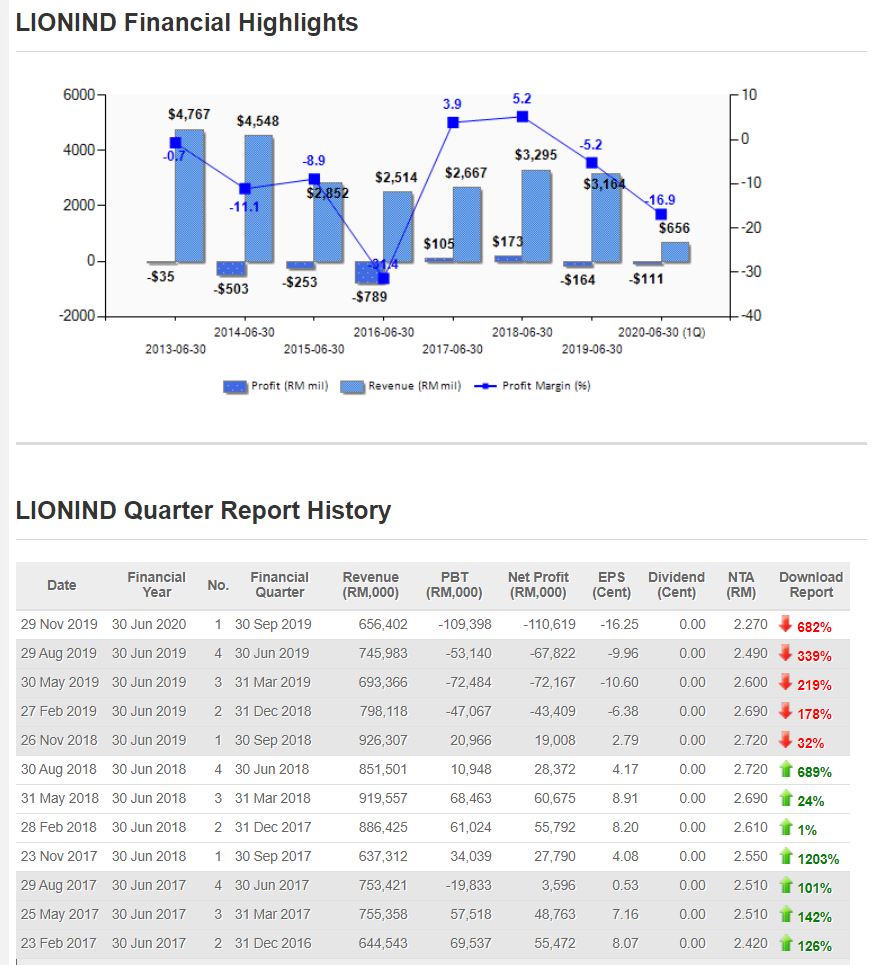

LIONIND's loss in profit last year was mainly due to price falling in

steel and rising in raw materials cost. With the current tough operating

environment, the demand of real estate and infrastructure industries

still remain low. It seems that the management has difficulties to

change the situation and make the company perform better.

In order to make the company profitable, management will look into

other business opportunities, and hoping to reverse the current

difficulties. As for the plant bought for Flat Steel, this acquisition

also has to wait a year before it can begin to contribute to

profitability, and it must produce 50% of its output before it starts to

be profitable.

According to the management, the China-US trade war has caused Chinese

steel manufacturers to sell steel across Asia Pacific, and in which the

steel prices remain volatile in Malaysia. Although Malaysia has a Safe

Guard Tax (Tax for Local Businesses), it doesn't help much for Steel

industry.

https://klse.i3investor.com/blogs/LouisYapInvestment/243261.jsp

Louis Yap

Facebook:

Web Site: