DPIH

DPI Holdings Berhad (DPI) is mainly involved in the development, manufacturing and distribution of aerosol products for the automotive, industrial, and household markets. In addition, the group is also involved in trading of solvents and thinners.

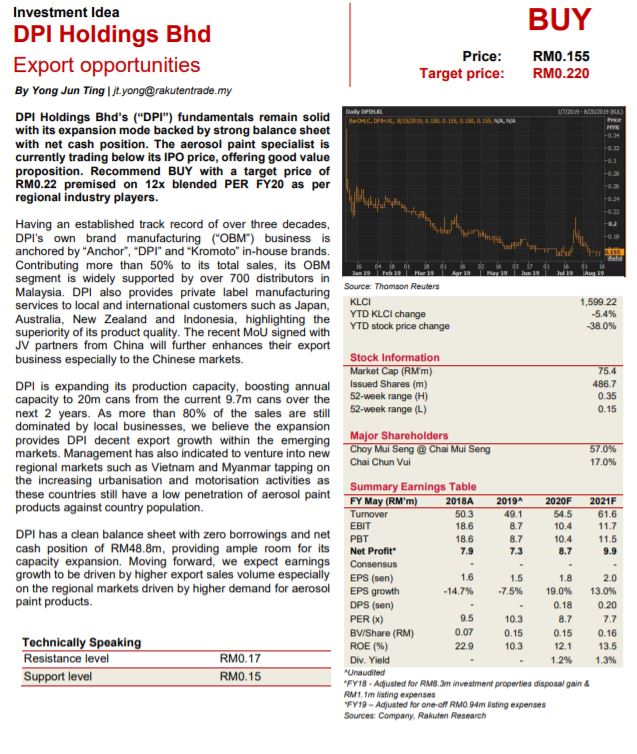

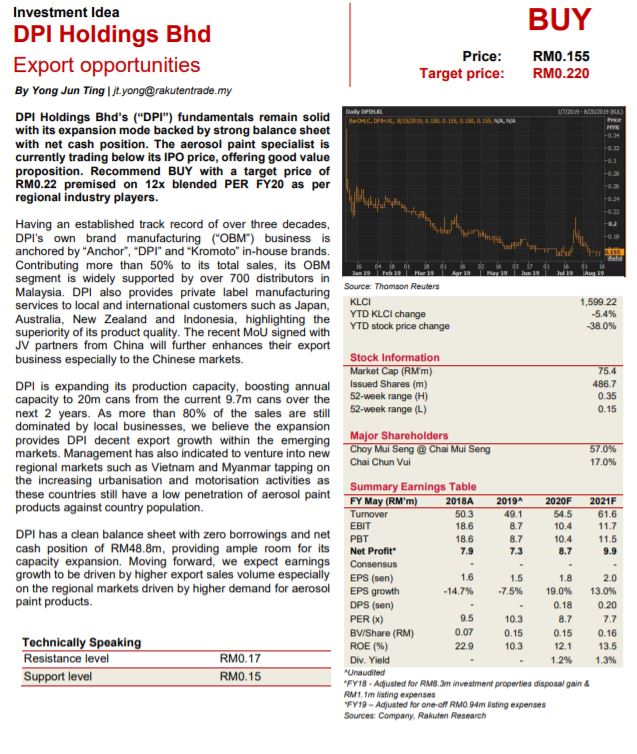

Rakuten Research Report

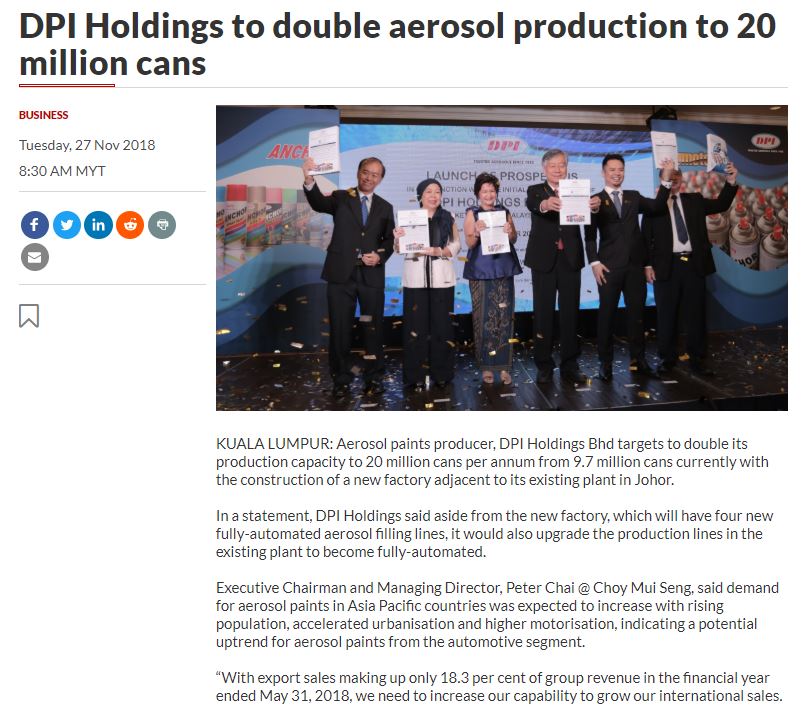

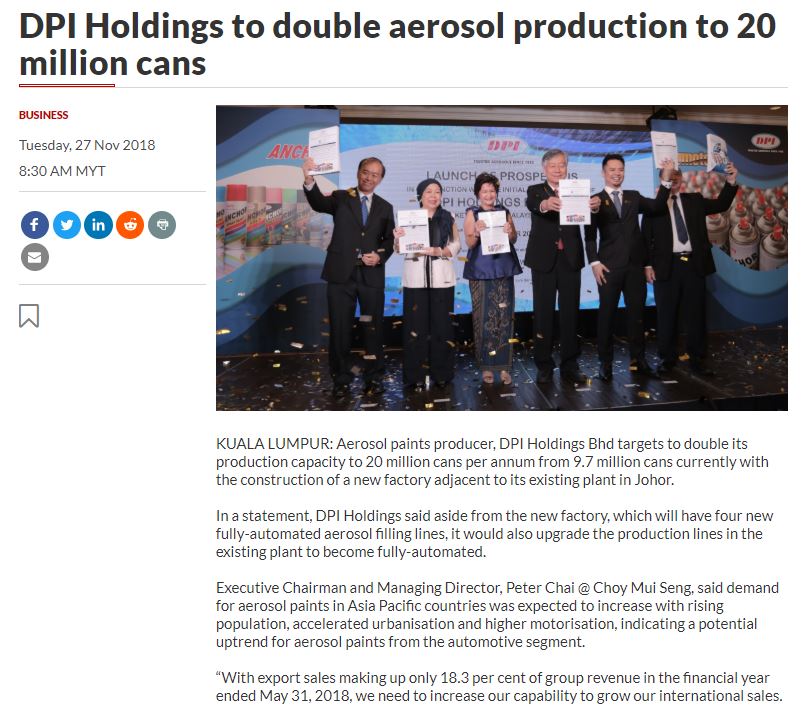

Double aerosol production to 20million cans.

News full link: https://www.thestar.com.my/business/business-news/2018/11/27/dpi-holdings-to-double-aerosol-production-to-20-million-cans

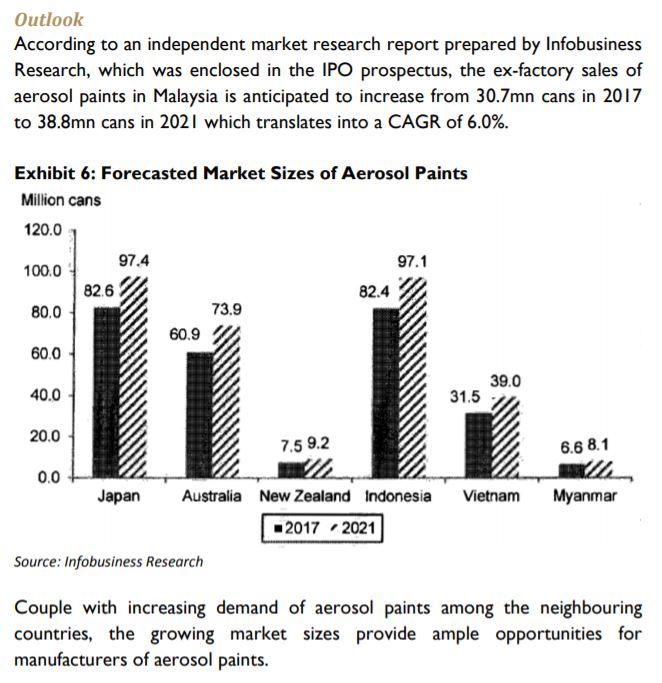

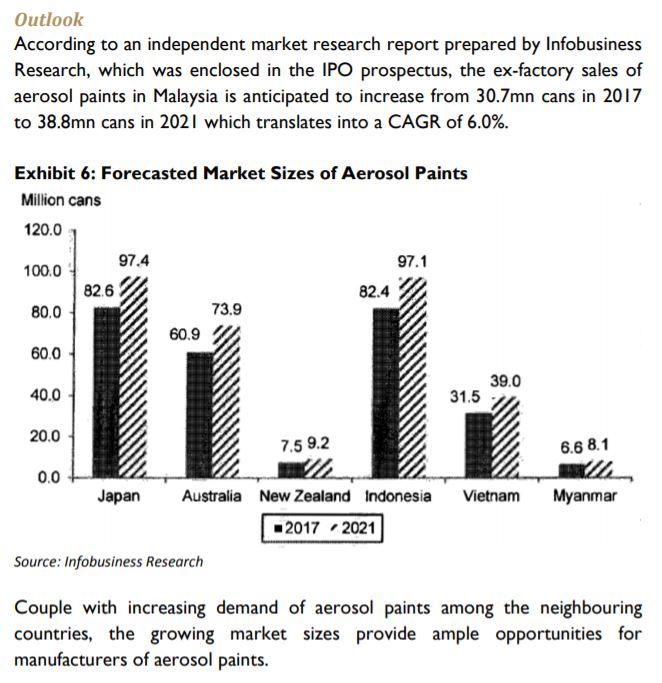

Forecasted Market Sizes of Aerosol Paints

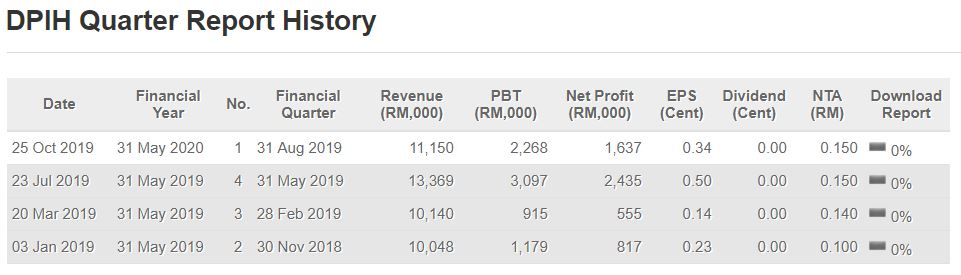

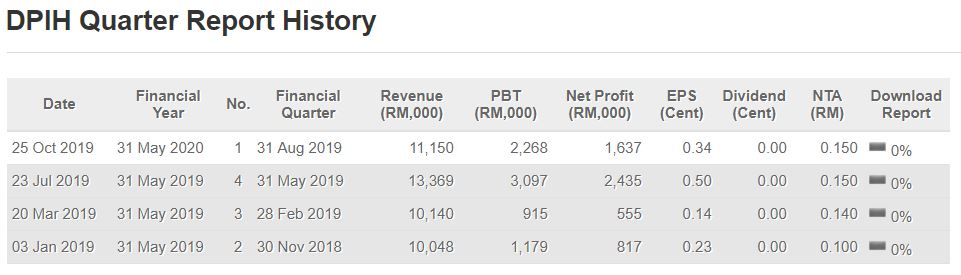

Quarter Results

Based on P/E 15, the share price should be 1.93 X 15= Rm 0.29.

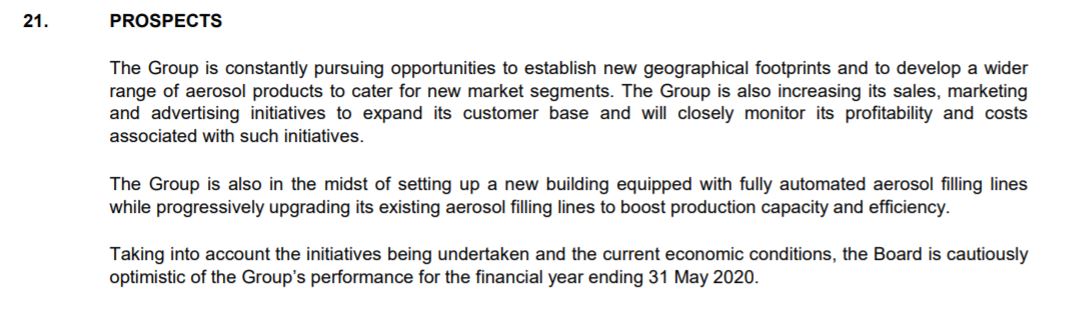

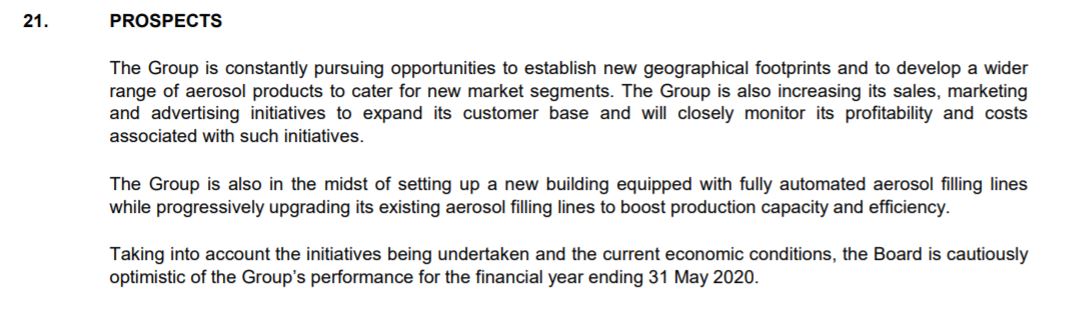

Prospects for DPIH

1) Expansion of Production Capacity

The group plans to construct a new factory and office building at Lot 11078 with scheduled completion by 2H2019. The factory will have 4 fully-automated aerosol filing lines and it is scheduled to commence production in 1H2020. Besides, the group also plans to upgrade existing aerosol filling lines at the K69 Factory. The total annual production capacity will increase from the existing 9.7mn aerosols cans to 20.0mn aerosol cans by 1H2020.

2) Increase in Sales, Marketing and Advertising Initiatives

The group targets to further penetrate into export markets through active marketing initiatives such as participating in international trade fairs and exhibitions in order to gain access to potential customers around the world.

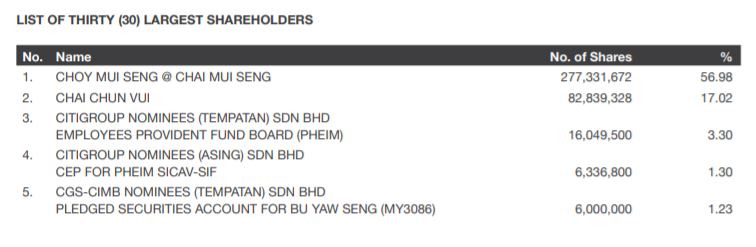

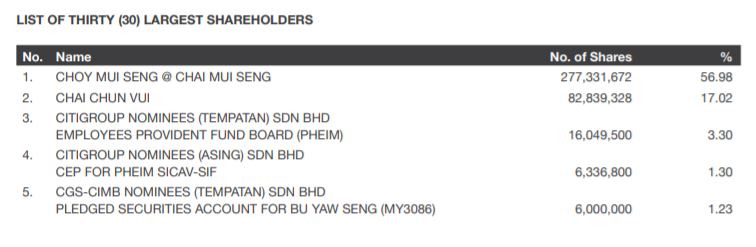

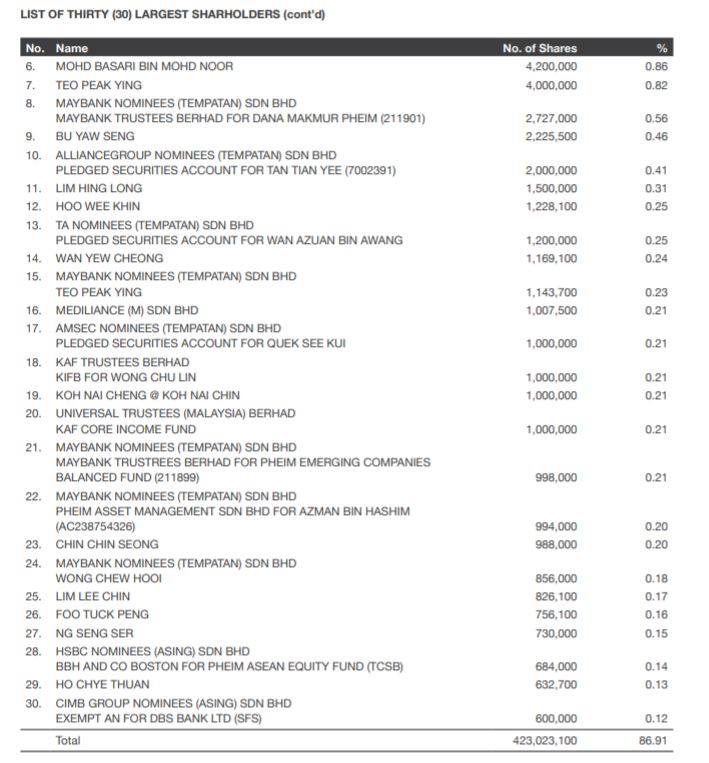

DPIH Top 30 Shareholders

Nearly 87% of shares controlled by Top 30 shareholders. There are so many funds inside DPIH included like EPF as top 3 shareholders of DPIH.

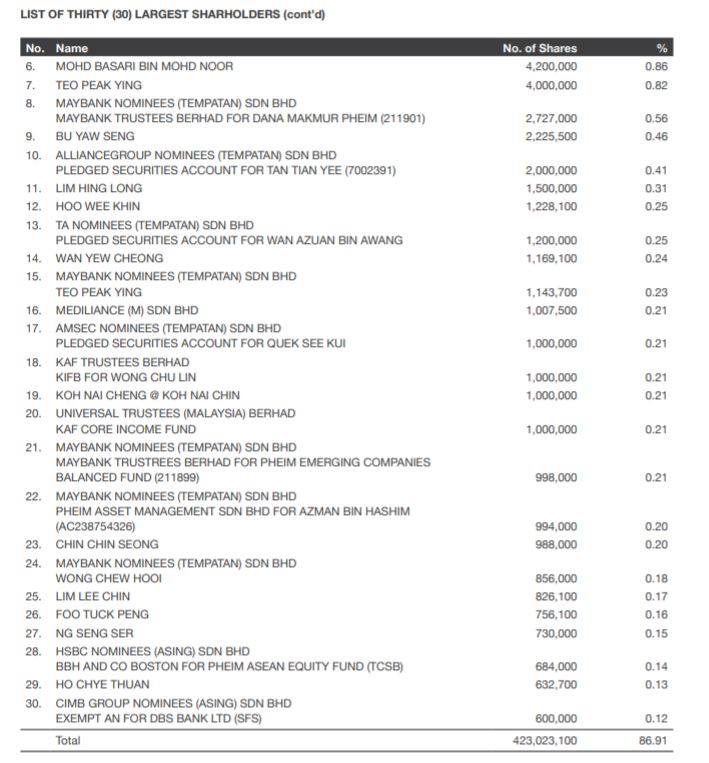

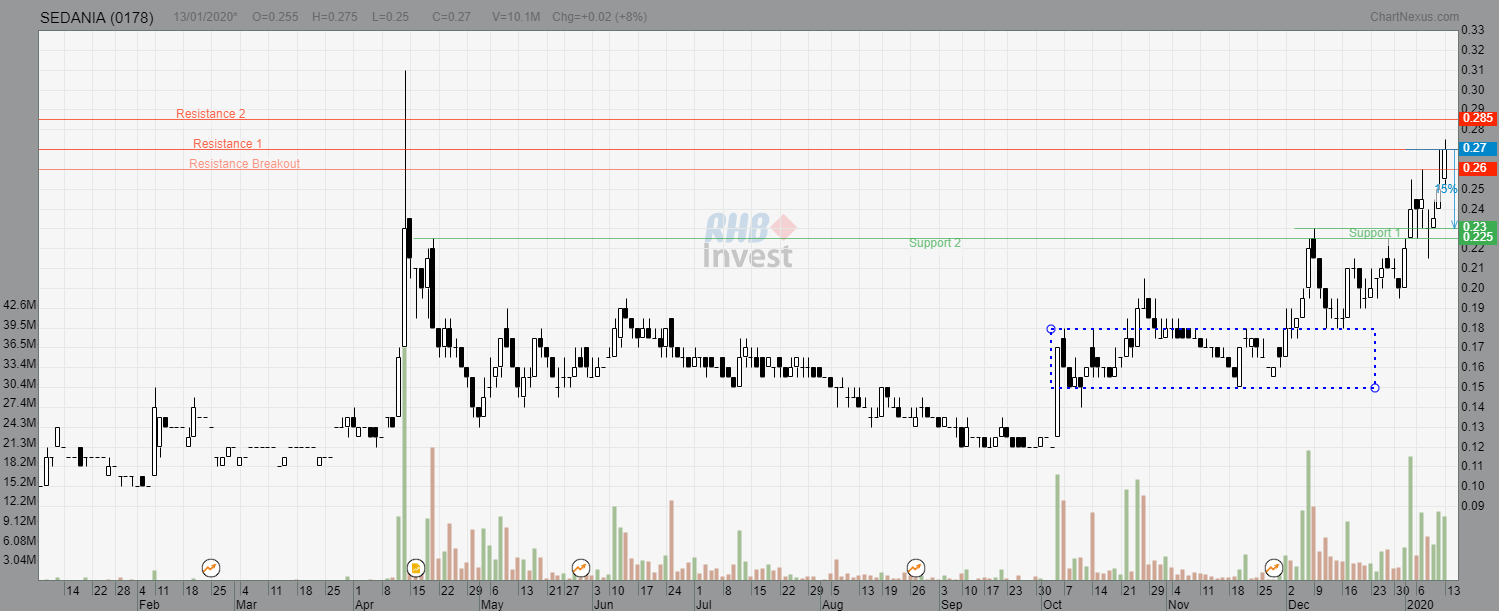

Technical Analysis

High volume appeared again today since previous test 31st December 2019.

Breakout Price will be RM0.20

Target Price 1 will be RM0.24 first level.

Target Price 2 will be RM0.27 second level.

Strong Supported at RM0.17.

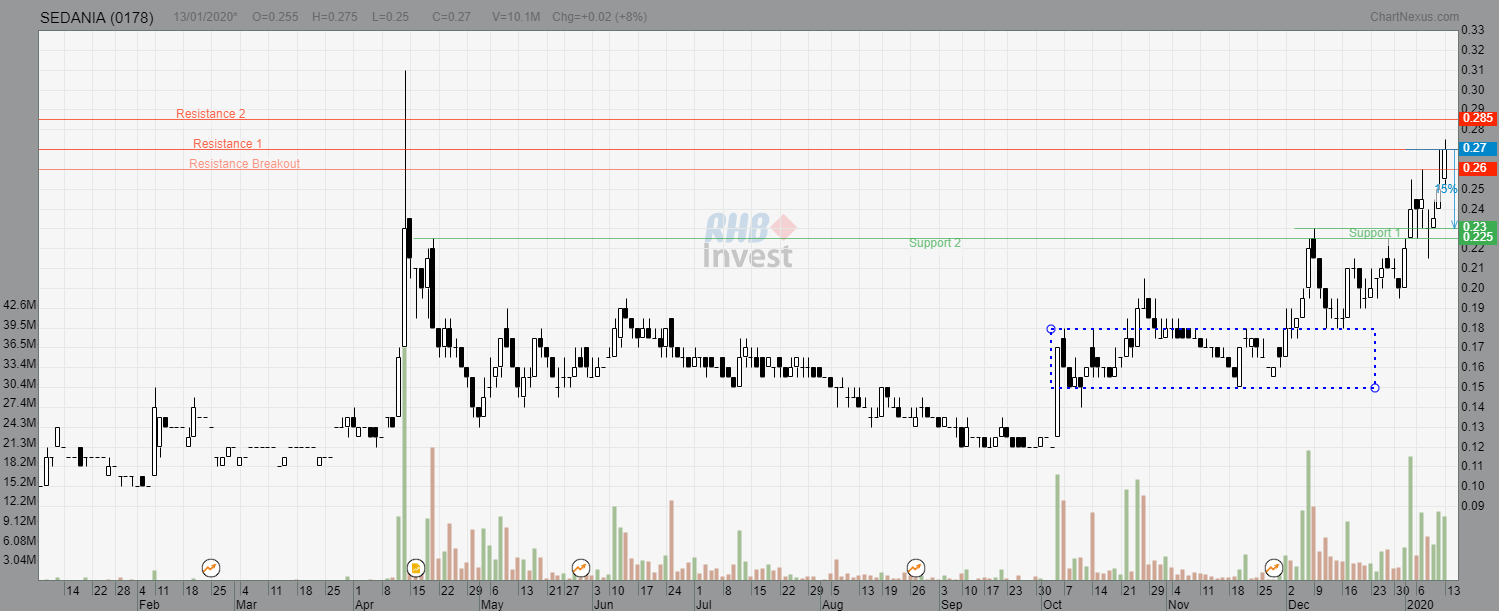

Today nearly 3.3millions volume transacted at RM0.18. Detected huge buyers are watching this stock. Once breakout from RM0.20, DPIH will perform just similar like Sedania.

Sedania Chart

Disclaimer: All the views and opinions expressed in my post are for education and informational purposes only and it should not be considered as professional financial investment advices or buy/sell recommendations. I strongly encourage you to do your own research and take independent financial advice from a professional before you proceed to invest. I make no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on our Facebook Page/Group and will not be liable for any errors, omissions, or delay in this information or any losses and damages arising from its display or usage. All users should read the posts and analysis the information at their own risk and i shall not be held liable for any losses and damages.

DPI Holdings Berhad (DPI) is mainly involved in the development, manufacturing and distribution of aerosol products for the automotive, industrial, and household markets. In addition, the group is also involved in trading of solvents and thinners.

Rakuten Research Report

Double aerosol production to 20million cans.

News full link: https://www.thestar.com.my/business/business-news/2018/11/27/dpi-holdings-to-double-aerosol-production-to-20-million-cans

Forecasted Market Sizes of Aerosol Paints

Quarter Results

Acceleration of Profit Growth

You can see from the above table that its

EPS for the last 4 quarters were 0.23, 0.14, 0.50 and 0.34 sen. Based

on the following facts:

- Double Aerosol production to 20million cans.

- Potential earnings growth from capacity expansion.

- Net Cash of RM48.3millions which equivalent to RM0.10 cash per share (56% of the company is CASH)

- Dominant local player in aerosol paint industry with an estimated domestic market share of 25%.

It is most likely to see that the upcoming quarter result will be better that last year Q2.

It is safe and conservative to assume

that the company can grow for 15% for every each quarter. The earning

per share per quarter will be around 0.39, 0.45, 0.51 & 0.58sen per

share per quarter, in the next 4 quarters for financial year 2020. That

means its annual EPS will be 1.93sen.

Based on P/E 15, the share price should be 1.93 X 15= Rm 0.29.

Based on P/E 20, the share price should be 1.93 x 20 = Rm 0.385.

IPO price at RM0.25, now its even cheaper than u subscribe the IPO.

Prospects for DPIH

1) Expansion of Production Capacity

The group plans to construct a new factory and office building at Lot 11078 with scheduled completion by 2H2019. The factory will have 4 fully-automated aerosol filing lines and it is scheduled to commence production in 1H2020. Besides, the group also plans to upgrade existing aerosol filling lines at the K69 Factory. The total annual production capacity will increase from the existing 9.7mn aerosols cans to 20.0mn aerosol cans by 1H2020.

2) Increase in Sales, Marketing and Advertising Initiatives

The group targets to further penetrate into export markets through active marketing initiatives such as participating in international trade fairs and exhibitions in order to gain access to potential customers around the world.

DPIH Top 30 Shareholders

Nearly 87% of shares controlled by Top 30 shareholders. There are so many funds inside DPIH included like EPF as top 3 shareholders of DPIH.

Technical Analysis

High volume appeared again today since previous test 31st December 2019.

Breakout Price will be RM0.20

Target Price 1 will be RM0.24 first level.

Target Price 2 will be RM0.27 second level.

Strong Supported at RM0.17.

Today nearly 3.3millions volume transacted at RM0.18. Detected huge buyers are watching this stock. Once breakout from RM0.20, DPIH will perform just similar like Sedania.

Sedania Chart

Disclaimer: All the views and opinions expressed in my post are for education and informational purposes only and it should not be considered as professional financial investment advices or buy/sell recommendations. I strongly encourage you to do your own research and take independent financial advice from a professional before you proceed to invest. I make no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on our Facebook Page/Group and will not be liable for any errors, omissions, or delay in this information or any losses and damages arising from its display or usage. All users should read the posts and analysis the information at their own risk and i shall not be held liable for any losses and damages.

https://klse.i3investor.com/blogs/alexchong196/2020-01-13-story-h1482151841-DPIH_Can_i_advice_you_something_please_include_this_as_1H2020_picks.jsp