Future Prospect of Coal Power Plant IPPs in Vietnam

Vietnam rapid growth of electricity production to meet demand

The electricity production in Vietnam more than doubled in the last 10 years and it is projected to double again in the next 10 years to meet annual 10% growth in electricity demand over the same period.

Figure showed electricity production in Vietnam from 2010 to Nov 2019 (in GW)

Vietnam will face severe power shortages from 2021 - Vietnam ministry

https://www.cnbc.com/2019/07/31/reuters-america-vietnam-will-face-severe-power-shortages-from-2021-ministry.htmlHANOI, July 31 2019 (Reuters) - Vietnam will contend with severe power shortages from 2021 as electricity demand outpaces the construction of new power plants in the Southeast Asian country, Vietnam’s Ministry of Industry and Trade told Reuters on Wednesday.

The

lack of energy infrastructure could put the brakes on foreign

investment inflows into one of Asia’s fastest growing economies, and

challenge Vietnam’s position as the top beneficiary of the U.S.-China

trade war.

Vietnam’s

demand for electricity will exceed its supply by 6.6 billion

kilowatt-hours (kWh) in 2021, a figure set to increase to 15 billion kWh

by 2023, equivalent to around 5% of the country’s forecasted demand for

electricity then, the ministry said in an emailed statement.

With

a population of 96 million and annual gross domestic product growth of

about 7% backed by robust foreign investment and exports, Vietnam’s power generation will need to rise from about 48,600 MW currently to 60,000 MW by 2020 and 129,500 MW by 2030, according to government data.

In 2018, the World Bank said Vietnam needs to invest up to $150 billion by 2030, almost twice the $80 billion already spent on its power sector since 2010.

China investment in Vietnam surges amid trade war

https://vietnamnet.vn/en/business/china-investment-in-vietnam-surges-amid-trade-war-592462.html

Direct investment flows from Hong Kong and mainland China to Vietnam increased by 3.9-fold and 2-fold year-on-year in the January – November period, respectively, amid escalation of the ongoing US – China trade tensions , a report of the Foreign Investment Agency (FIA) under the Ministry of Planning and Investment has shown.

Among 60 cities and provinces having received FDI between January and November, Hanoi has attracted the largest portion of capital commitments with over US$6.82 billion, accounting for 21.5% of total commitments in the period.

Such rapid rate of increase in foreign investments puts pressure on electricity supply to meet increase in electricity demand as a result.

Sources of electricity in Vietnam

According to Vietnam Electricity's (EVN) annual report, the main sources of electricity generation in 2017 included:• Hydropower: more than 37% of total generation.

• Coal: more than 34% of total generation.

• Oil and gas: more than 21% of total generation.

• Other sources (including diesel, small hydropower and renewables): 6% of total generation.

The Merit Order

https://en.wikipedia.org/wiki/Merit_order

The merit order is

a way of ranking available sources of energy, especially electrical

generation, based on ascending order of price (which may reflect the

order of their short-run marginal costs of production) together with amount of energy that will be generated. In

a centralized management, the ranking is so that those with the lowest

marginal costs are the first ones to be brought online to meet demand,

and the plants with the highest marginal costs are the last to be

brought on line. Dispatching generation in this way minimizes the

cost of production of electricity. Sometimes generating units must be

started out of merit order, due to transmission congestion, system

reliability or other reasons.

The table shows that coal based power plants have the least marginal costs among fossil-fired power plants.

Peak Demand for Coal ?

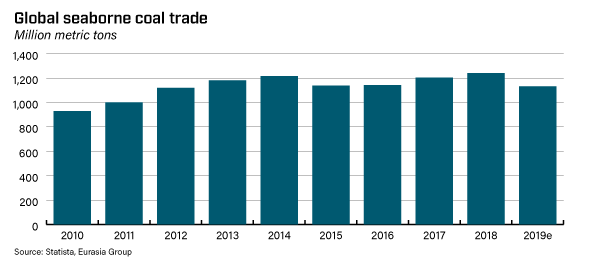

https://www.atlanticcouncil.org/blogs/energysource/what-does-a-sunset-coal-industry-tell-oil-producers-about-peak-demand/Coal has been the main fuel of industrialization over the past century and a half. To this day, it remains a key feedstock for power generation (thermal coal) and in making steel (coking coal). Yet demand for coal appears to be peaking, with seaborne coal trade volumes plateauing at just over 1.2 billion tonnes.

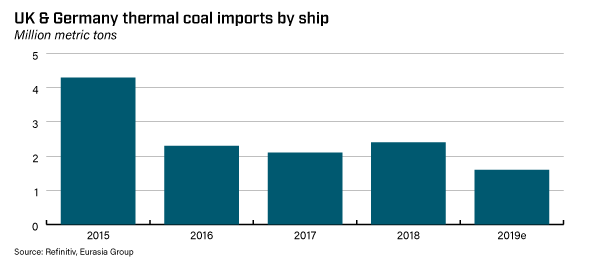

Peak demand in America & Europe

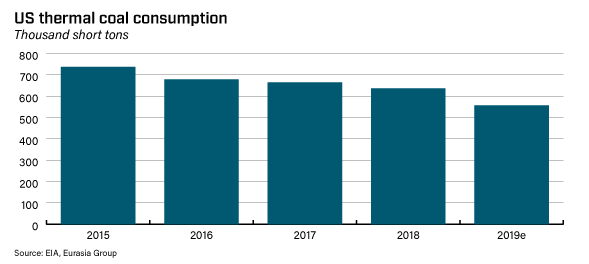

Global coal use may be peaking, but there are big regional differences. In the United States, thermal coal has been steadily pushed out by cheap shale gas and renewables. As a result, thermal coal consumption has been declining for half a decade.

Price chart of Coal

Coal, Australian thermal coal Monthly Price - US Dollars per Metric Ton (2009-2019)

https://www.indexmundi.com/commodities/?commodity=coal-australian&months=120

If demand for coal peaked, the price of coal will remain depressed which keeps the marginal costs for coal power plant low compared to other fuel based power plants.Reduced future contributions from Hydropower In Vietnam

https://en.wikipedia.org/wiki/Renewable_energy_in_VietnamBy the end of 2018, the country had 818 hydropower projects with a total installed capacity of 23,182 MW and 285 small hydropower plants with a total capacity of about 3,322 MW.

Vietnam has an exploitable hydropower capacity of about 25-38 GW. 60% of this capacity is concentrated in the north of the country, 27% in the center and 13% in the south. Large hydropower projects with a capacity of over 100 MW are almost completely exploited.

According to the Revised National Power Development Master Plan for the 2011-2020 Period with the Vision to 2030 (also called PDP 7A/ PDP 7 revised):

- "Total capacity of hydropower sources (including small and medium hydroelectricity, pumped-storage hydropower) is about 21,600 MW by 2020, about 24,600 MW by 2025 ( pumped-storage hydropower is 1,200 MW) and about 27,800 MW by 2030 ( pumped-storage hydropower is 2,400 MW). Electricity production from hydropower sources accounts for about 29.5% in 2020, about 20.5% in 2025 and about 15.5% in 2030."

- "By 2020, the total capacity of power plants will be about 60,000 MW, of which large and medium hydroelectricity and pumped-storage hydropower will be about 30.1%. By 2025, the total capacity will be about 96,500 MW and 49.3% of which will belong to hydropower. By 2030, hydroelectricity will account for 16.9% of the 129,500 MW of total capacity."

The decision to cancel about half of the projects pipeline was motivated by a series of incident with small and medium hydropower, especially in the rainy seasons. The negative outcomes of hydropower development in Vietnam include livelihood disruption and loss of forests, dam failure,unexpected accidental water discharge, perturbation in the downstream water availability and sediment transport, changes in the flood regime, and hydropower reservoirs stimulate small intensity earthquakes.

Southeast Asia is betting on hydropower, but there are risks of economic damage

As

contribution of hydropower in Vietnam is expected to reduce to about

15% in 2030, the bulk of future electricity supply in Vietnam is

expected to be largely met by fossil-fired power plants.

Summary

- Vietnam demand for electricity is expected to grow 10% annually.

- The electricity production in Vietnam more than doubled in the last 10 years and it is projected to double again in the next 10 years.

- Vietnam’s power generation will need to rise from about 48,600 MW currently to 60,000 MW by 2020 and 129,500 MW by 2030.

- Direct investment flows from Hong Kong and mainland China to Vietnam increased by 3.9-fold and 2-fold year-on-year in the January – November period, respectively, amid escalation of the ongoing US – China trade tensions.

- Coal based power plants have the least marginal costs among fossil-fired power plants. Therefore, it ranks before oil & gas power plants in electricity dispatch merit order. The peak demand for coal foresees long term depressed coal prices which helps to keep marginal production cost of coal power plant low.

- Large hydropower projects with a capacity of over 100 MW are almost completely exploited. Electricity production from hydropower sources is expected to reduce to about 15% in 2030. As hydropower becomes less significant in the future, the electricity production from coal power plants become more stable and less affected by high rainfalls.

Conclusions

The strong economic growth rate

and the stong inflow of foreign investment into Vietnam caused by

US-China trade tensions result in high electricity demand which is

anticipated to growth at about 10% annually. As Vietnam anticipates

severe power shortage by 2021, limited room for hydropower expansion

left Vietnam with little choice but to turn to coal as the next cheapest

source of electricity. Electricity powered by coal is projected to

reach 50% of total production by 2030. Therefore, coal power plants IPPs

are expected to play a significant role in shaping vietnam's future.

Happy reading !

DK66

https://klse.i3investor.com/blogs/Jaks%20resources/2019-12-29-story-h1481949253-Jaks_Resources_Why_JHDP_in_Vietnam_has_a_bright_future.jsp

https://klse.i3investor.com/blogs/Jaks%20resources/2019-12-29-story-h1481949253-Jaks_Resources_Why_JHDP_in_Vietnam_has_a_bright_future.jsp