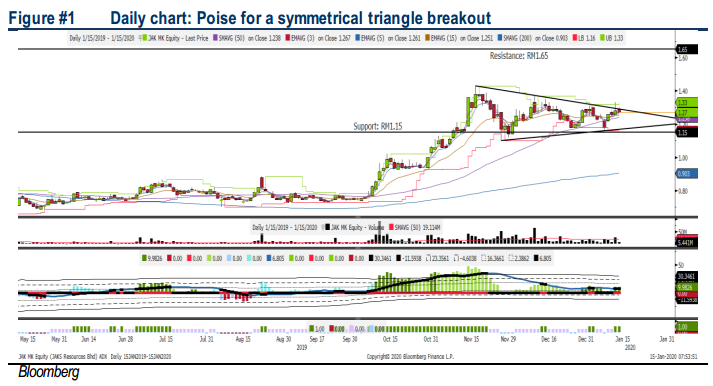

The Hai Duong Vietnam EPC Contract Has Been Progressing Well and the Power Plant Is Reaching the Completion Stage (2Q19: C.82% Vs. 1Q19: 70%) and Likely to be Commencing by Mid-2020. Although Its Construction Orderbook Is Declining and the Property Segment Is Slowing Down, Should the Hai Duong Vietnam Power Start Operation by 2H2020, It Should be Able to Support Its Earnings Moving Forward. Technically, JAKS Could Poise for a Symmetrical Triangle Breakout, Targeting RM1.43-1.50, With a LT TP of RM1.65, While Support Is Located Around RM1.21-1.23, With a Cut Loss Set Around RM1.15.

Power plant is approaching completion. As of 2Q19, its Vietnam EPC contract has been progressing well and it has hit c.82% project completion (vs. 70% in 1Q19. Hence, we believe remaining works will be done in 2020 and the power plant may start commencement by mid-2020.

Declining orderbook and sluggish property segment. However, its orderbook has declined to RM847m in 2Q19 as compared to RM1.07bn a quarter ago. Meanwhile, its property segment could still disappoint given the delay in Pacific Star Tower with completion of the remaining 3 blocks being pushed to 1H2020.

Rising power segment. Nevertheless, should the Hai Duong Vietnam power plant start its operation by 2H2020, this may boost JAKS earnings in the long run.

Poise for symmetrical triangle breakout. JAKS has formed a symmetrical triangle formation over the past two months. The technicals have turned positive and our indicator is suggesting a potential exponential breakout in the near term. Should there be a breakout above RM1.30, next target will be located around RM1.43–1.50, with a LT TP envisaged around RM1.65. Support is pegged along RM1.21-1.23, with cut loss set around RM1.15.

Source: Hong Leong Investment Bank Research - 15 Jan 2020

https://klse.i3investor.com/blogs/hleresearch/2020-01-15-story-h1482158665-JAKS_Power_operations_may_support_earnings_moving_forward.jsp