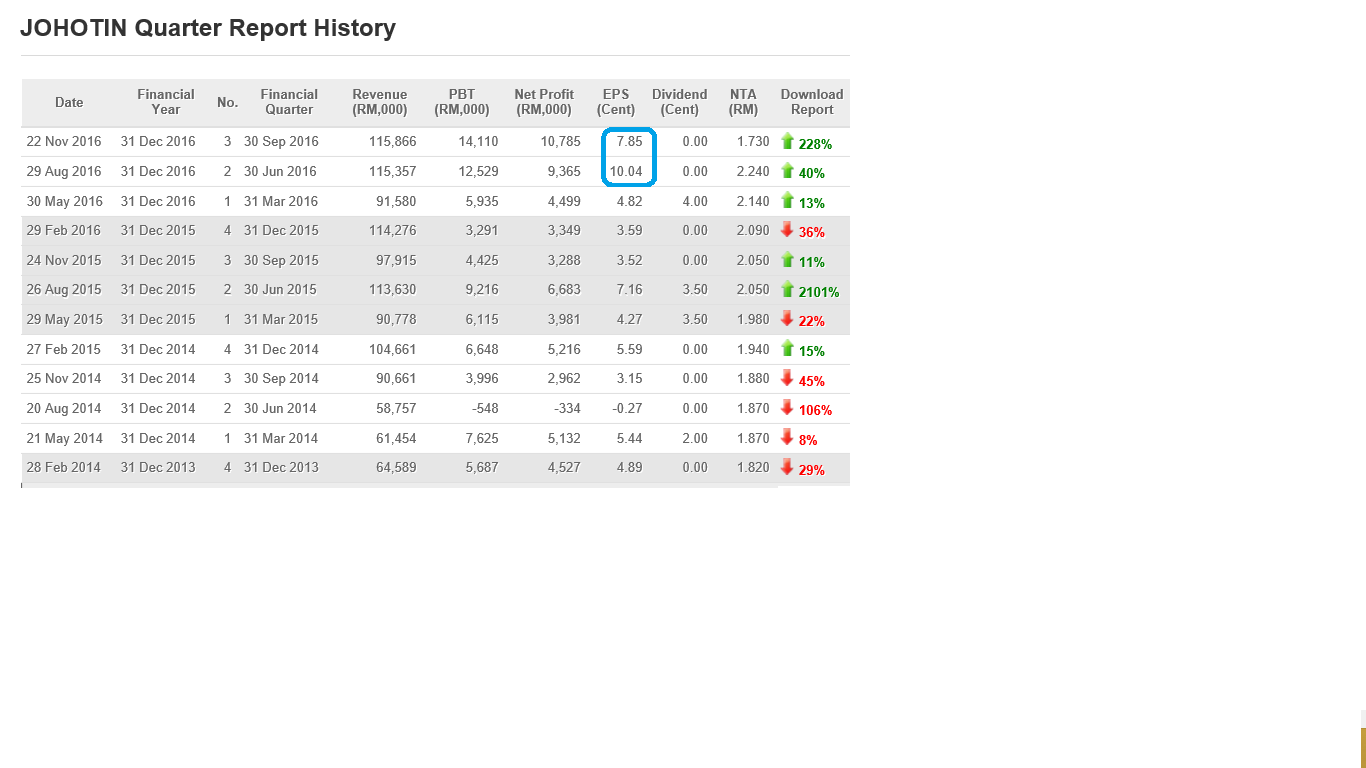

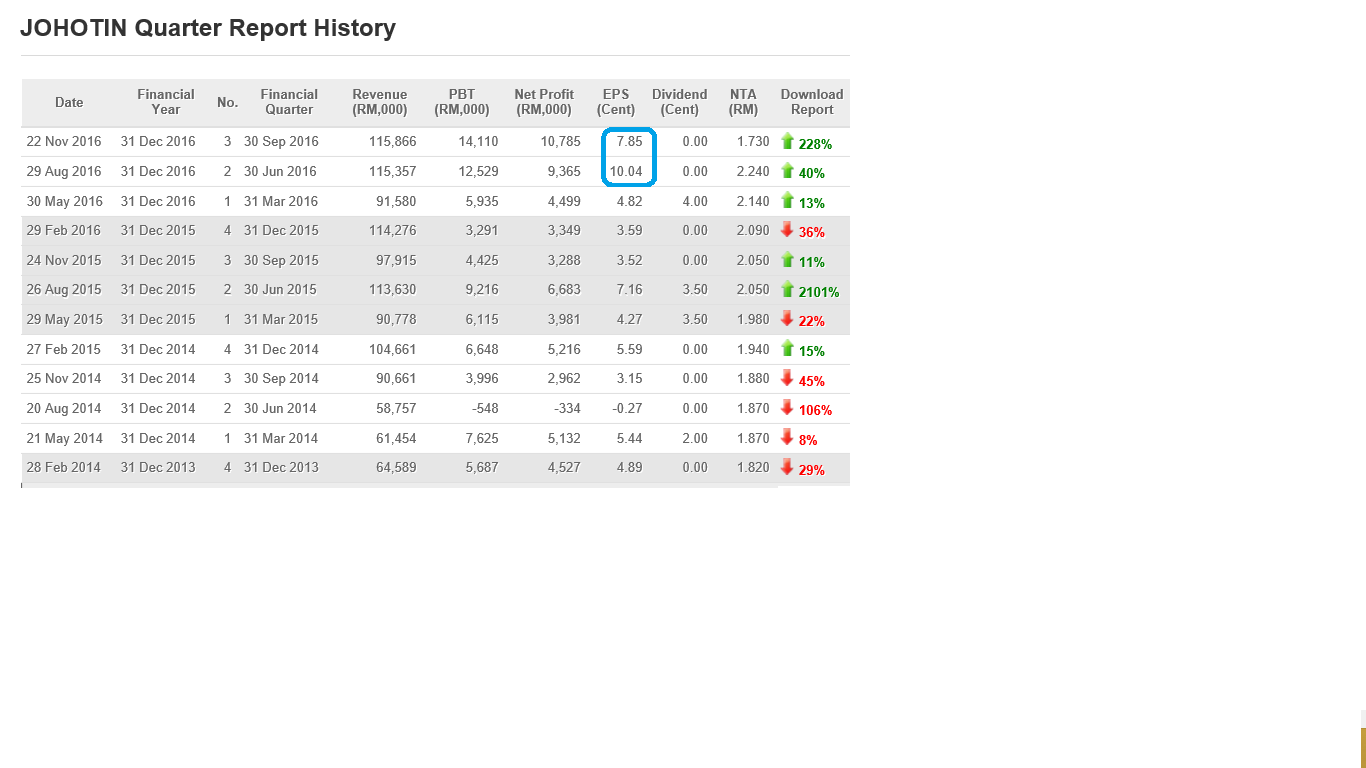

首先讲讲在2014年至2016年的表现。2016年之前的表现是非常不错的,在2016年最后2个季度的盈利还是目前所见的最高!EPS 达 10仙/季度。

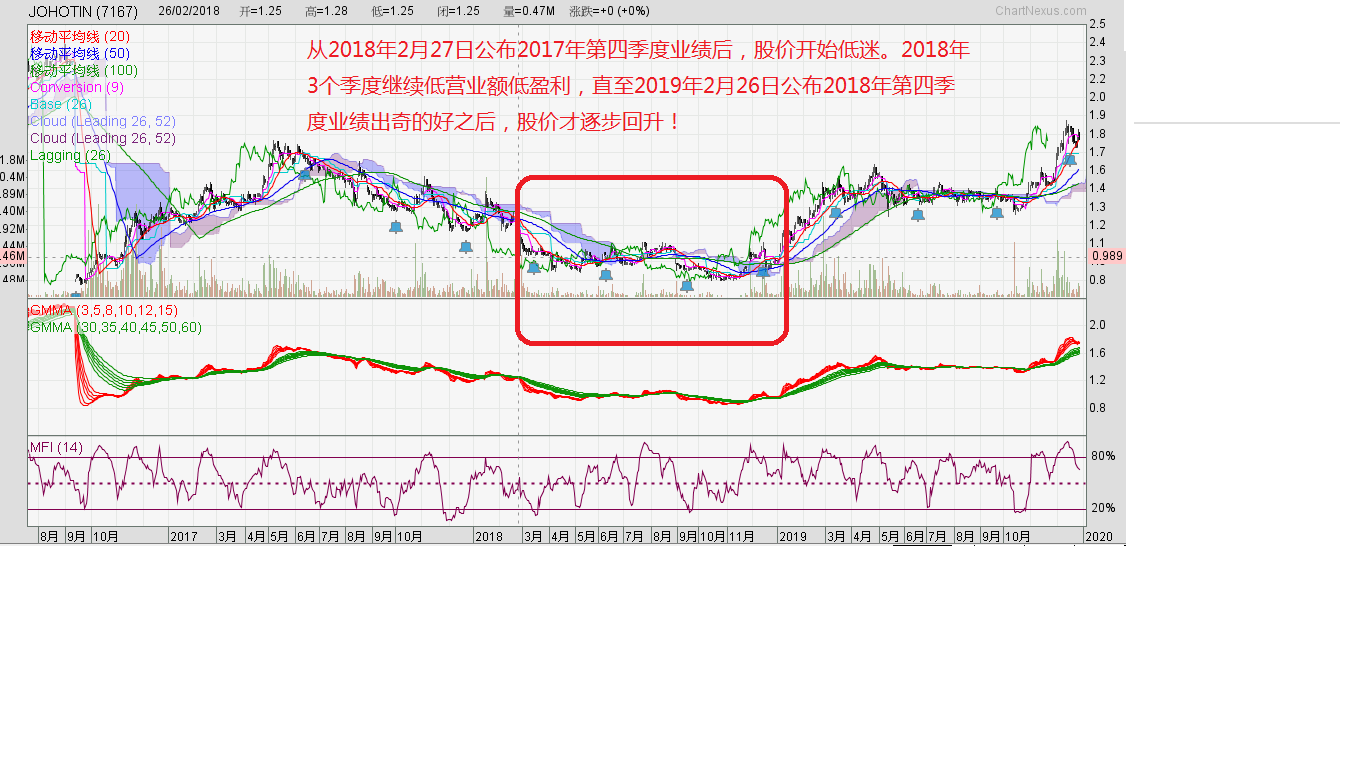

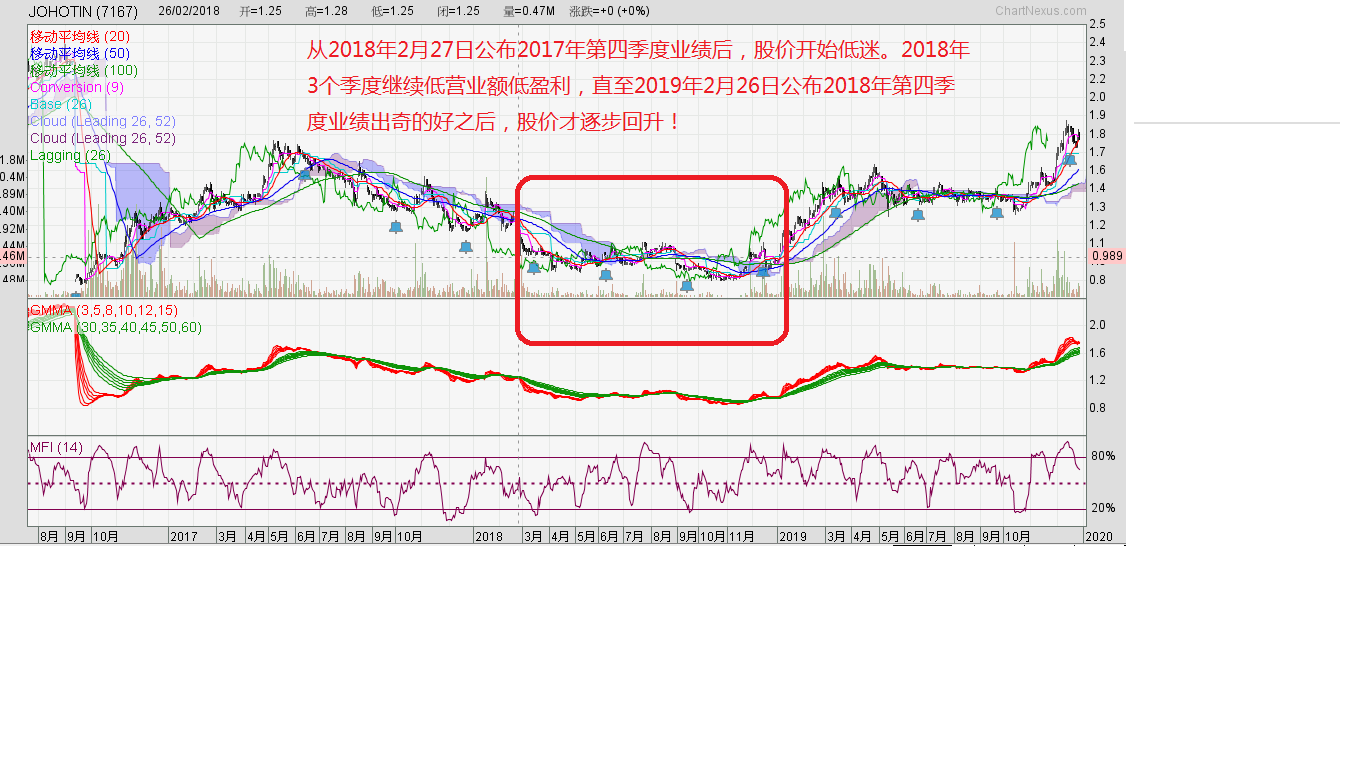

进入2017年业绩盈利开始变样了!股价也进入寒冬,并在10月尾创下低点835。原因有2个,其一,产品污染事件,其二,资本开销!

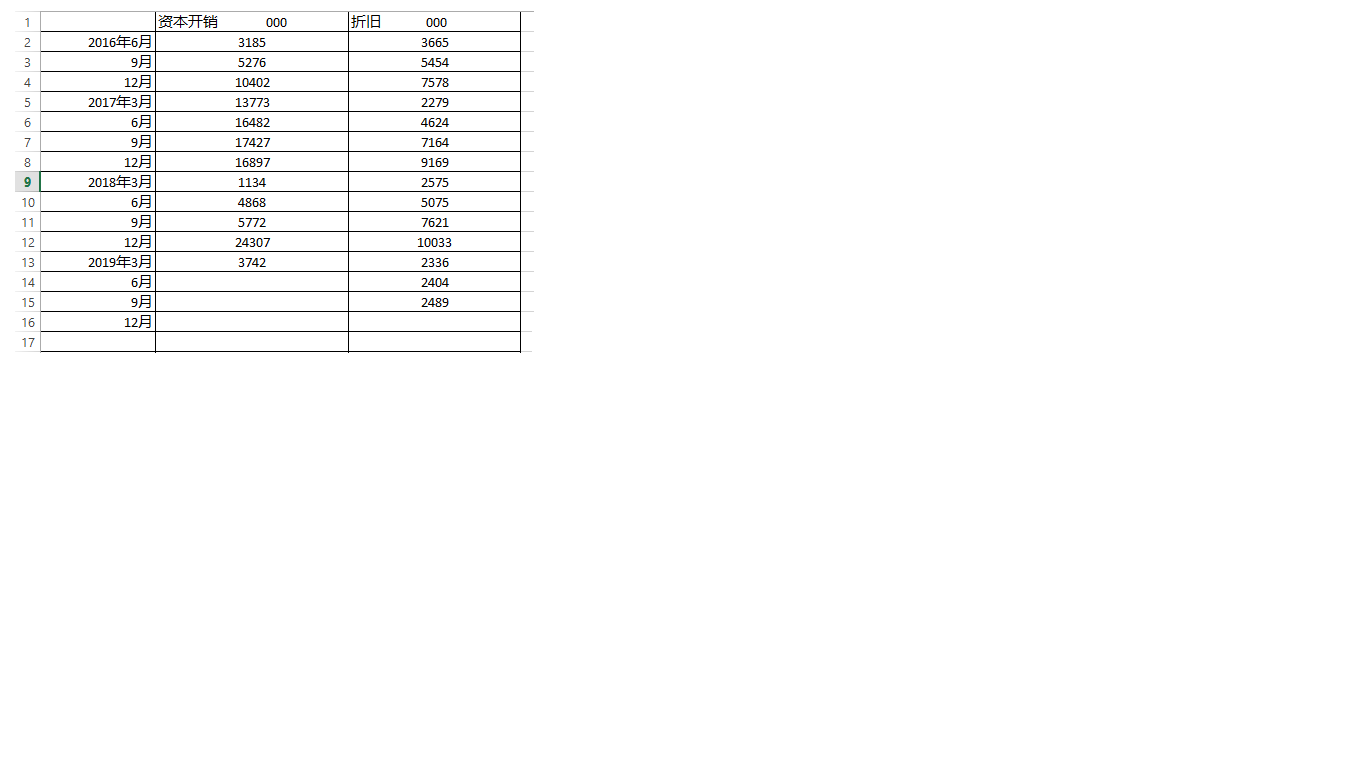

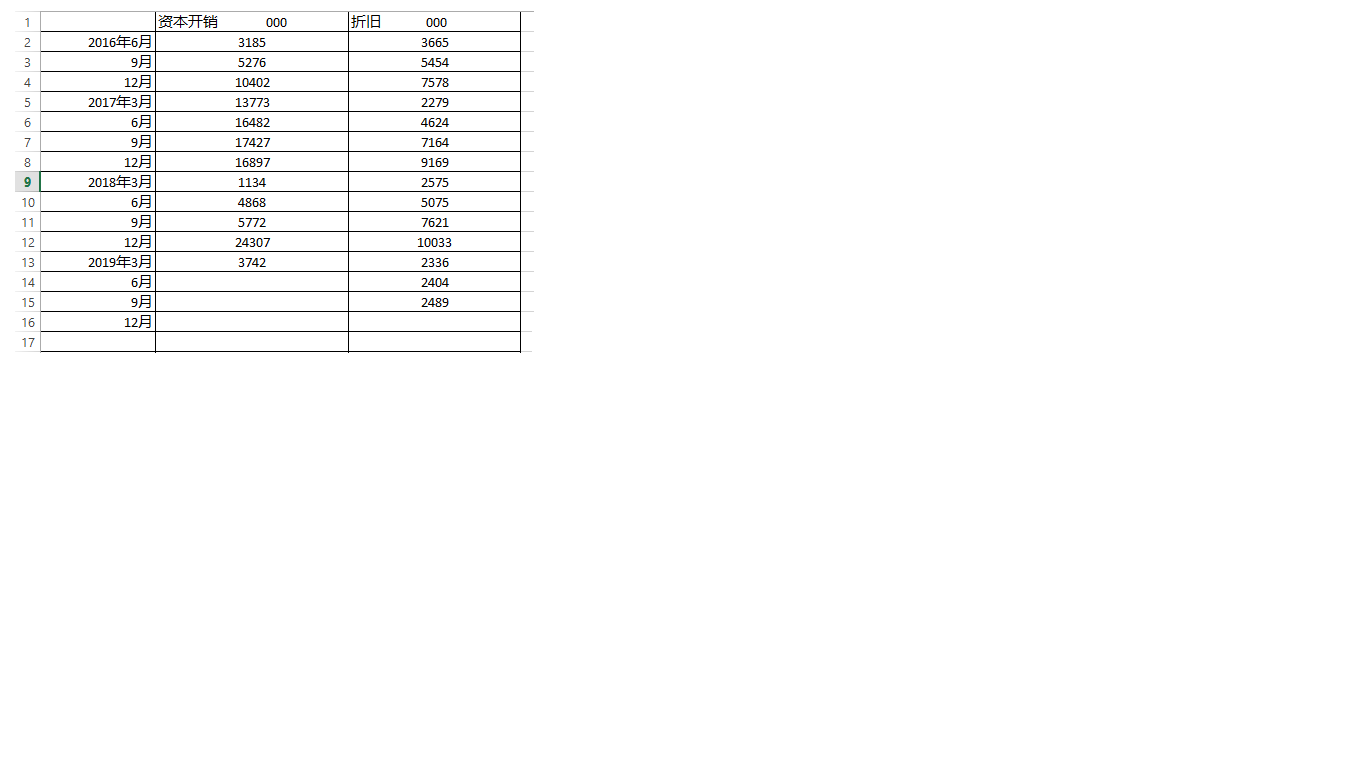

资本开销比较大数目发生在2016年第四季度到2017年第四季度!刚好此段时间与产品污染事件重叠一起,因此这期间盈利大受影响,不过依然可以保持盈利,可见它的创利能力是非常高的。

接下来谈谈2018年的4个季度,相当奇怪2018年前3季度的营业额与前面的相似,变化不大,盈利也逐渐好转,不过第四季度的营业额突然暴升,是目前所见过的最高营业额,而且盈利是非常可怕的!为什么说可怕呢?只要看看那一个季度的资本开销就清除了,除去大资本开销还可以保有高盈利,这季度的盈利非常可能是前面几个季度账目上的盈余结算。大体上第四季度的盈利好转也应该归功于前面5个季度的资本开销。

再往后看,2019年第一季度还有资本开销,不过第二第三季度却找不到了!简而言之,大资本开销已经告一个段落了!这点很重要,因为没有了必须的资本,公司在往后的盈利出现时就会比较慷慨的派发股息了!

2019年的3个季度差别,第三季度营业额只是和前2季度相同,为什么盈利突然好转很多呢?

这是TA 在11月29日的一篇重要分析里有提及:

Favourable Portfolio Shift

Among various factors, we observe geographical exposure of customer is also a major factor that could affects profitability of JTB. Within the recent 3 years, core net margin of JTB was inversely correlated with the proportion of JTB’s African sales. Such observation is in line with management’s explanation that African continent is very sensitive to product pricing, where quality is at times secondary to affordability.

Hence, with the group’s continued efforts in growing its Asian, Central American and Malaysian markets that are conducive for sales of better margin products, we believe favourable product portfolio would provide certain support to the group’s profitability amidst increasing raw material prices. Note that Malaysian, Central American and Asian sales grew 38.4%, 52.7%, and 12.0% YoY in FY18 substituting a huge portion of sales to African continent. Meanwhile, we believe majority of the 28.7% YoY revenue growth recorded by JTB during 1HFY19 is underpinned by the higher margin products thus supportive of the 1.6%-pts increase in core net margin.

在非洲的销售少了,而大马、中美和亚洲销售多了!产品偏好盈利幅度的增加,足以使在原料涨价的情况下继续保持良好的盈利状况!这点足以证明管理层的诚意和努力!这是为什么我相当信任管理层的原因。

最后来谈谈生产能力!初初在墨西哥投资建厂时的目标为80KMT ,而当时占股份为40%,而经过延迟又改变重组后,现在所占股份为43%,而生产能力提高一倍约160KMT了!

而在大马的生产线经过多轮的资本开销后,也由100KMT 增加至160KMT,并已经在下半年开始投入生产了,有路边消息透露,原料经已在11月寄出去墨西哥尝试开动生产,保守计算2020年1月可以正式开始生产。应该开的资本开销都已经开出去了,应该准备的生产机械都准备好了!好日子还远吗?

Progress of Mexico JV

In September 2019, JTB increased its stake in Able Dairies Mexico from 40.0% to 43.13%. Management updated that installation of machineries in its Mexican condensed milk and evaporated milk factory are still on-going but the estimated commercial production date is now postponed to 1QCY20 from 4QCY19 guided previously. We understand that the Mexican plant’s installed production capacity could be on par with the enlarged capacity of Teluk Panglima Garang’s plant (at c.160kMT capacity of evaporated milk and condensed milk) suggesting that JTB remains optimistic, if not more so about the Mexican venture (we understand it initially targeted plant’s capacity of c.80kMT).

As Mexico has formed various free trade agreement with most countries in the Western hemisphere, the new plant will provide JTB a stronger foothold into Mexico itself, alongside Central and South American region through more favourable import duty structure. Besides, Mexican JV’s ability to source dairies supplies domestically and from neighbouring countries, alongside better managed logistics arrangement is expected to result in higher profitability. We also understand that JTB and its JV partner have begun marketing, engaging sales leads and participate in exhibition shows.

瓜子野狼

进入2017年业绩盈利开始变样了!股价也进入寒冬,并在10月尾创下低点835。原因有2个,其一,产品污染事件,其二,资本开销!

资本开销比较大数目发生在2016年第四季度到2017年第四季度!刚好此段时间与产品污染事件重叠一起,因此这期间盈利大受影响,不过依然可以保持盈利,可见它的创利能力是非常高的。

接下来谈谈2018年的4个季度,相当奇怪2018年前3季度的营业额与前面的相似,变化不大,盈利也逐渐好转,不过第四季度的营业额突然暴升,是目前所见过的最高营业额,而且盈利是非常可怕的!为什么说可怕呢?只要看看那一个季度的资本开销就清除了,除去大资本开销还可以保有高盈利,这季度的盈利非常可能是前面几个季度账目上的盈余结算。大体上第四季度的盈利好转也应该归功于前面5个季度的资本开销。

再往后看,2019年第一季度还有资本开销,不过第二第三季度却找不到了!简而言之,大资本开销已经告一个段落了!这点很重要,因为没有了必须的资本,公司在往后的盈利出现时就会比较慷慨的派发股息了!

2019年的3个季度差别,第三季度营业额只是和前2季度相同,为什么盈利突然好转很多呢?

这是TA 在11月29日的一篇重要分析里有提及:

Favourable Portfolio Shift

Among various factors, we observe geographical exposure of customer is also a major factor that could affects profitability of JTB. Within the recent 3 years, core net margin of JTB was inversely correlated with the proportion of JTB’s African sales. Such observation is in line with management’s explanation that African continent is very sensitive to product pricing, where quality is at times secondary to affordability.

Hence, with the group’s continued efforts in growing its Asian, Central American and Malaysian markets that are conducive for sales of better margin products, we believe favourable product portfolio would provide certain support to the group’s profitability amidst increasing raw material prices. Note that Malaysian, Central American and Asian sales grew 38.4%, 52.7%, and 12.0% YoY in FY18 substituting a huge portion of sales to African continent. Meanwhile, we believe majority of the 28.7% YoY revenue growth recorded by JTB during 1HFY19 is underpinned by the higher margin products thus supportive of the 1.6%-pts increase in core net margin.

在非洲的销售少了,而大马、中美和亚洲销售多了!产品偏好盈利幅度的增加,足以使在原料涨价的情况下继续保持良好的盈利状况!这点足以证明管理层的诚意和努力!这是为什么我相当信任管理层的原因。

最后来谈谈生产能力!初初在墨西哥投资建厂时的目标为80KMT ,而当时占股份为40%,而经过延迟又改变重组后,现在所占股份为43%,而生产能力提高一倍约160KMT了!

而在大马的生产线经过多轮的资本开销后,也由100KMT 增加至160KMT,并已经在下半年开始投入生产了,有路边消息透露,原料经已在11月寄出去墨西哥尝试开动生产,保守计算2020年1月可以正式开始生产。应该开的资本开销都已经开出去了,应该准备的生产机械都准备好了!好日子还远吗?

Progress of Mexico JV

In September 2019, JTB increased its stake in Able Dairies Mexico from 40.0% to 43.13%. Management updated that installation of machineries in its Mexican condensed milk and evaporated milk factory are still on-going but the estimated commercial production date is now postponed to 1QCY20 from 4QCY19 guided previously. We understand that the Mexican plant’s installed production capacity could be on par with the enlarged capacity of Teluk Panglima Garang’s plant (at c.160kMT capacity of evaporated milk and condensed milk) suggesting that JTB remains optimistic, if not more so about the Mexican venture (we understand it initially targeted plant’s capacity of c.80kMT).

As Mexico has formed various free trade agreement with most countries in the Western hemisphere, the new plant will provide JTB a stronger foothold into Mexico itself, alongside Central and South American region through more favourable import duty structure. Besides, Mexican JV’s ability to source dairies supplies domestically and from neighbouring countries, alongside better managed logistics arrangement is expected to result in higher profitability. We also understand that JTB and its JV partner have begun marketing, engaging sales leads and participate in exhibition shows.

瓜子野狼

https://klse.i3investor.com/blogs/free/2019-12-31-story-h1481978024.jsp