[Details of Salute (0183) -AGM]

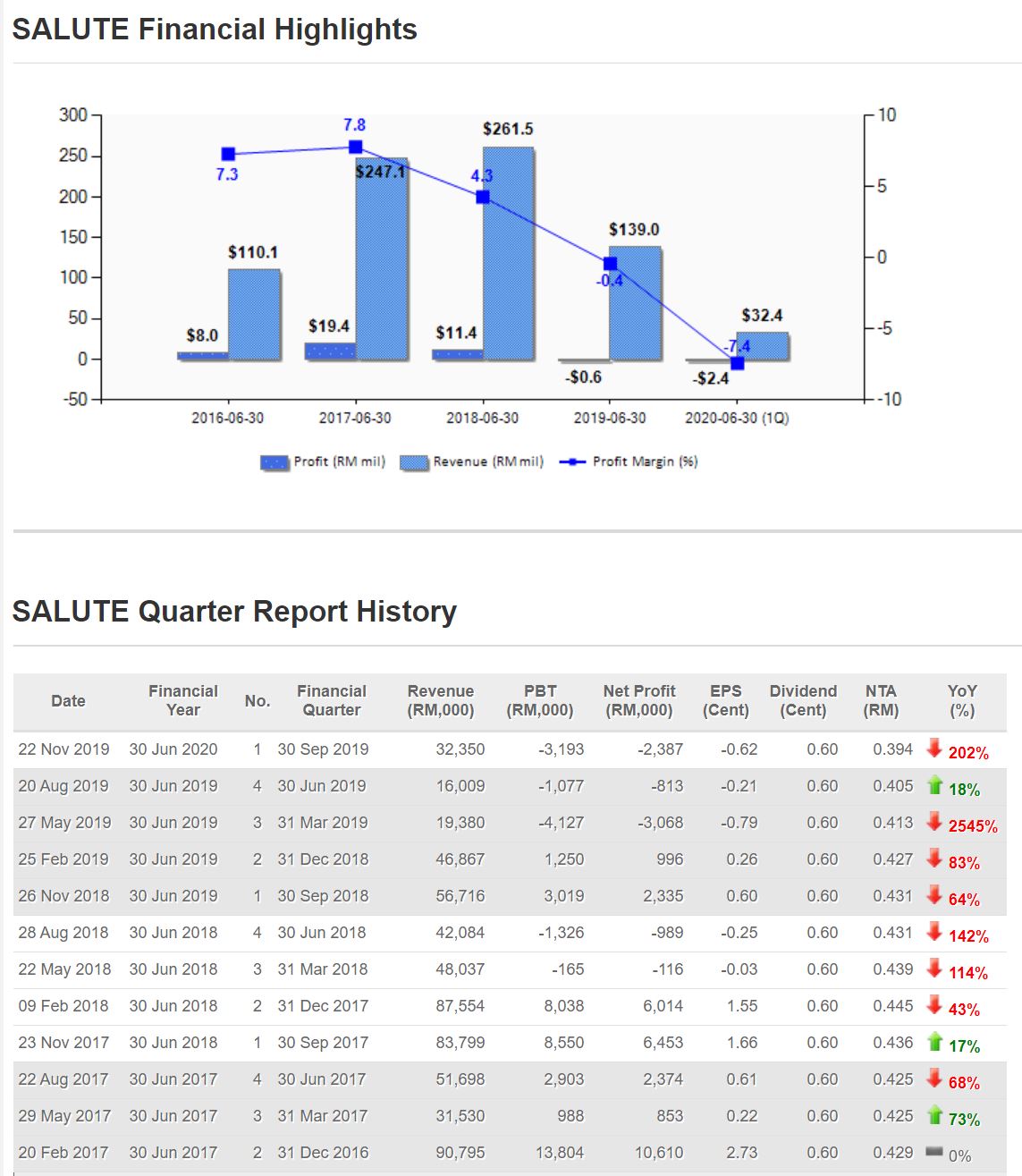

✅ 2019 annual results:

Turnover decreased by RM138.9 mil

LAT (Loss after tax) RM0.55mil

Net Earnings Per Share (EPS) -0.14 sen

Net assets per share (NTA) 40.49 sen

Dividend paid up to RM9.302mil

2FY2019 main factors affected performance:

The China-US trade war weakened market sentiment and led to lower turnover. TWS Bluetooth Headset with European partners takes longer than expected to develop

The China-US trade war weakened market sentiment and led to lower turnover. TWS Bluetooth Headset with European partners takes longer than expected to develop

The current product output is low, resulting in low utilization of the

production line-due to the decline in turnover, the company cannot

effectively absorb fixed operating costs

✅ Current business activities:

The company released its latest product-wireless earbuds-in August 2019. Shopping sites such as Bestbuy and Amazon have had good customer response.

The company released its latest product-wireless earbuds-in August 2019. Shopping sites such as Bestbuy and Amazon have had good customer response.

Continuous production of corded Bluetooth headset

Launch of FOBO Bike 2, its sensor is 50% smaller than the previous generation

Continue sales of FOBO Tire, FOBO Ultra and FOBO Tag 3

Trends in the Production Wireless Mouse Headset Market

The market for traditional corded Bluetooth headsets is gradually crowding

Bluetooth chipset module in the market lowers barriers to competitors

Traditional production technology limits the size, shape and RF performance of TWS (Truly Wireless System)

Research HEARABLE, focusing on microelectronic encapsulation and miniaturization

If successfully reducing the size of the product, HEARABLE products will have more uses and can be used in more ways

The company continuously improves its capabilities and recruits’

talents so that the next generation of HEARABLE can be industrialized

Since 2016, HEARABLE has exploded in the market, and the market size is expected to reach USD 18bil in 2020

In 2019 alone, 120 million HEARABLEs are expected to be sent worldwide

✅ Advent plan:

Sleep science, sleep sensor

Conversation enhancing HEARABLE

Cognitive assessment HEARABLE

Home automation

Sleep science, sleep sensor

Conversation enhancing HEARABLE

Cognitive assessment HEARABLE

Home automation

✅ Q & A session:

Q: The funds of the expansion just mentioned have been accounted for?

A: Yes.

Q: How does SALUTE and partners distribute profits?

A: This is a sensitive question, and we are not convenient to answer it

in too much detail. All we can say is that we have signed some

contracts, the products are sold, they earn their part, and we earn our

part. However, if we develop a new technology together, Salutica

(SALUTE) has the first property right.

Q: How many percent of Q3 and Q4 mouse production accounts for the maximum production capacity?

A: Before this product was just launched, the first batch of goods had

to be transported before it could be sold. Due to the problem of

transportation time, there was an “empty window period”. The subsequent

capacity will be produced at the maximum capacity.

According to the CEO words, SALUTE will still have some fluctuations in

the short term (3 to 4 quarters), but in the long run (beginning in

2021) the company will have very good results. And when the management

presents the company's direction and goals, it is very confident, and

knows exactly what they and the company are doing.

The CEO is even confident that he can take the SALUTICA brand worldwide

and occupy a place in the industry, because they have exclusive

technology on the chip.

Louis Yap

Facebook:

https://klse.i3investor.com/blogs/LouisYapInvestment/2020-01-29-story-h1482961282-Salute_0183_AGM_2019.jsp

Web Site: