Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

SCOPE INDUSTRIES BERHAD or SCOPE (Code 0028, ACE Market, Industrial Products & Services)

SCOPE - THIS COMPANY IS UNDERLOOKED !!! IT HAS A PLANTATION BUSINESS TOO !!!

1. SCOPE Has a PLANTATION Business - Which Should Benefit From the Recent Surge of Price in Crude Palm Oil (CPO)

Recently, CPO prices have shot thru the roof. A lot of CPO counters

have staged a big rally such as FGV, JTIASA, THPLANT, RSAWIT, TDM and

many more just to name a few.

I believe that SCOPE has been underlooked, as they too have a

plantation business. The price of SCOPE has not yet rallied as strong as

the other CPO peer counters.

Below the screenshot of their website.

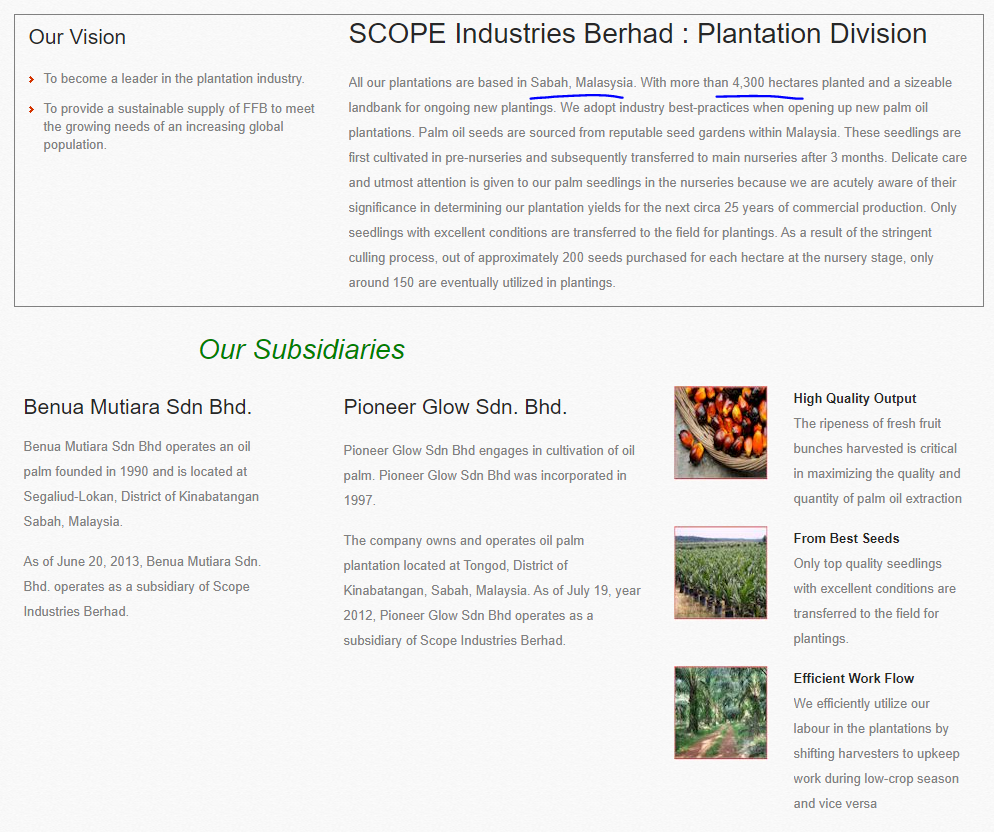

As you can see, SCOPE has about more than 4,300 acres of plantation

land in SABAH. With the recent rally in CPO prices, SCOPE should also be

benefiting from it thru higher revenue from its palm oil business,

which should contribute to better earnings in the near future.

2. FINANCIALS - Worst is Over - Loss is Reducing and Better Earnings Ahead with CPO Price Rally

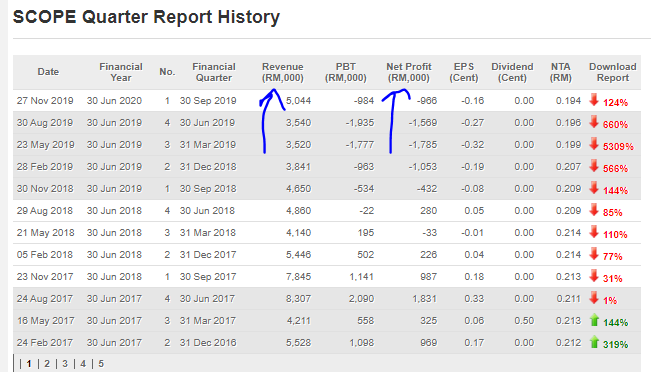

Refer below summary of latest SCOPE quarter resiults summary. The

revenue has improved to a latest of RM 5 million, with the net loss

reducing from -1.7m to -1.55m to -0.97m in the latest quarter.

As the company had commented in its prospects section of the latest QR,

the Plantation segment will be mainly driven by CPO prices movement. As

the CPO price staged a big rally recently, this should be contributing

to better earnings in SCOPE plantation segment in the upcoming quarters,

which should mean a possible turnaround in its quarter losses to

quarter profits.

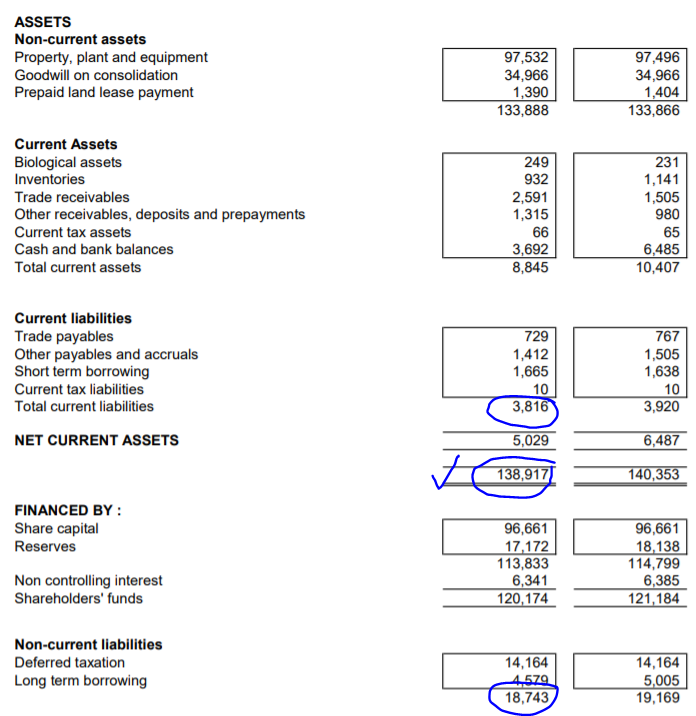

3. FINANCIALS - High Assets Versus Liabilities (RM 138.9m Assets versus RM 22.5m Liabilities)

A further look at the financials in latest quarter results, reveals

that the company is quite lightly geared. With a total Asset value of RM

138.9 million, versus Liabilities of RM 22.5 million (Current

Liabilities RM 3.8 mil + Non Current Liabilities of RM 18.7 mil).

This means that the total assets are about 6 times that of its total liabilities.

4. CHART - Triple Bottom on Monthly Chart, EMA breakout & Volume Building in Daily Chart

Let us first look at the monthly chart of SCOPE. A few observations:

i) A triple bottom pattern is forming, with the support around 12-13c

area. A triple bottom is a bullish pattern (refer below link on

investopedia for the basics on triple bottom pattern)

ii) Currently pending breakout of downtrend at 21c, towards the

important resistance level of 23c. If broken at this level, then the

price should test highest towards 30-33c

iii) Volumes are building up in the past 2 months candle

Let us look at the daily chart. A few observations:

i) Recently, price has broken up above the important EMA200 and EMA365 to indicate a long term change in trend towrads uptrend

ii) Volumes are starting to buildup over the past few days

iii) MACD crossings upwards and indicating uptrend in near future

CONCLUSION

Based on my opinion, I believe SCOPE should be seeing better future ahead, based on below:

i. Having a Plantation Business Besides Its Manufcaturing Business - To Ride on the Recent CPO Price Rally

ii. Financials Improving - Revenue Increase and Loss Reducing

iii. Lightly Geared Company - High Assets Value Versus Liabilities

iii. Chart Shows Triple Bottom Bullish Pattern, With Short Term Momentum Upwards

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-01-04-story-h1482031906-THIS_COMPANY_IS_UNDERLOOKED_IT_HAS_A_PLANTATION_BUSINESS_TOO.jsp