MBM Resources Berhad

I am here to answer one question. Why MBMR?

1) Solid 4 consecutive quarter result

2) Undervalue motor trading company

3) Pure cash company

4) 60% dividend policy

So what is the history of MBMR?

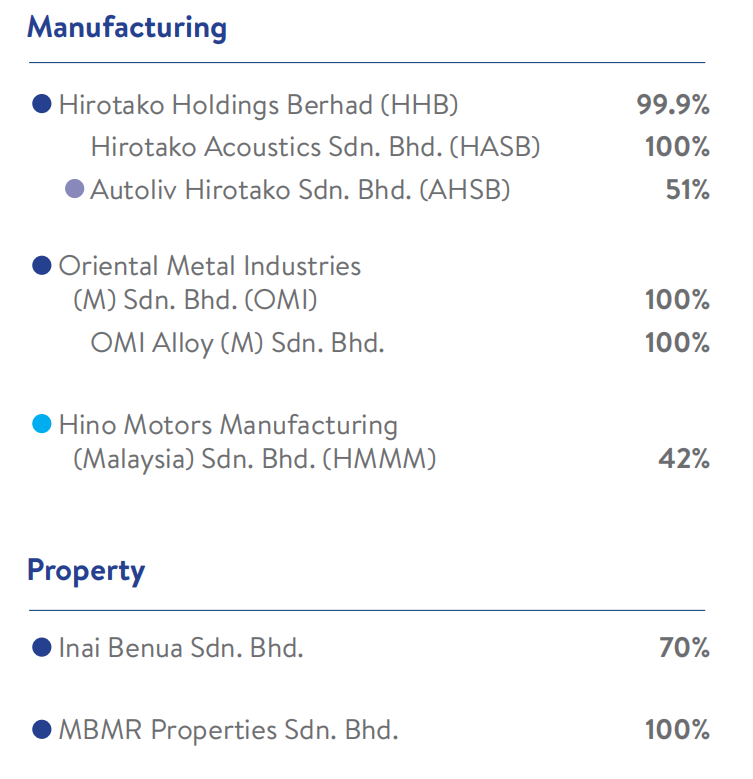

MBM Resources Berhad (MBMR) is an automative Group with diverse investments in the automotive industry. Its two core businesses are:

i) Motor Trading: Distributorship and dealership of major international vehicle brands of vehicles in Malaysia; and

ii) Automotive Parts Manufacturing

Under Motor Trading, the Group is well represented in all segments of the market from light trucks to medium and heavy duty trucks and buses in the commercial vehicle market, and from copact entry level cars to luxury cars in the passenger vehicle market.

Its Automotive Parts Manufacturing Division, consisting of wheels (both steel and alloy wheels), safety restraint products (airbags, seat belts and steering wheels) and noise, vibration and harshness (NVH) products, is a significant supplier to all the major car brands in Malaysia.

Below table showed the subsidiaries and associaties company owned by MBMR. The major profitable company are Perusahaan Otomobil Kedua Sdn Bhd (PERODUA), which is the market leader in Malaysia, Daihatsu (Malaysia) Sdn Bhd and Hino Motors Sales (Malaysia) Sdn Bhd.

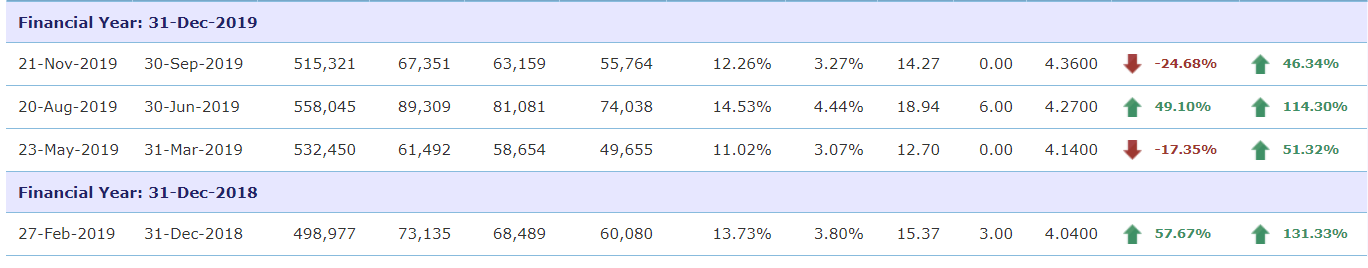

1) Solid 4 consecutive quarter result

The company have posted solid 4 consecutive year-on-year result improvement during last 4 quarter. Total earning per shares are 61.28sen and currently the price earning ratio only as low as 6.3.

The company have 4 consecutive improvement in their profit. The question now can the company continue to grow?

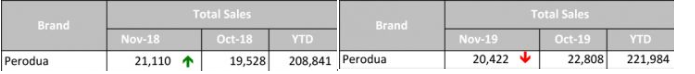

According to famous Paul Tan, who is best known for his website, paultan.org or Paul Tan's Automotive News, a popular news portal which covers the Malaysian & ASEAN automotive scenes, the total sales of PERODUA car have surpass last year sales for the first and second month for last quarter of the year

Oct and Nov 2018 40,638 vs Oct and Nov 2019 43,230

So yes, the company will continue to grow.

2) Undervalue motor trading company

MBM Resources has the lowest PE ratio and better dividend yield among other motor trading company. Below are the PE ratio and dividend yield as per 31 Dec 2019:

a) Bauto PE 11.53 DY 10.0% (high dividend yield but the profit have drop significantly due to significant drop in Mazda sales) ROE 43.76

b) Tchong PE 9.29 DY 3.01% ROE 3.28

c) Umw PE 17.72 DY 1.45% ROE 8.34

d) Drbhicom (join-owned Proton with Geely) PE 16.02 DY 1.26% ROE 4.26

e) Hapseng (part of the company selling Mercedes) PE 39 DY 3.51% ROE 8.95

f) CCB (privatised soon) PE -15.25 DY 0% ROE -5.14

while MBMR PE 6.3 DY 3.11% ROE 14.06

3) Pure cash company

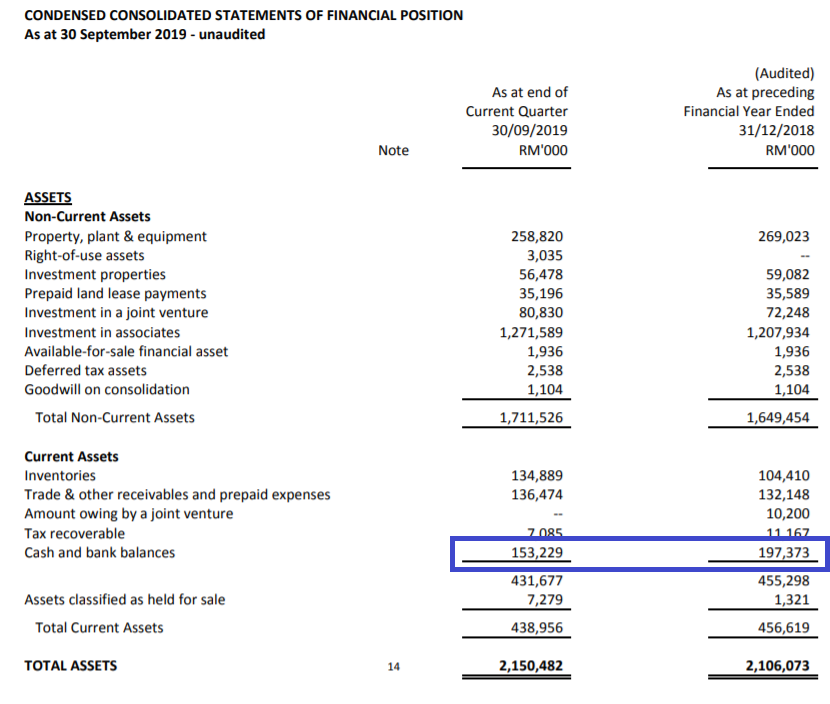

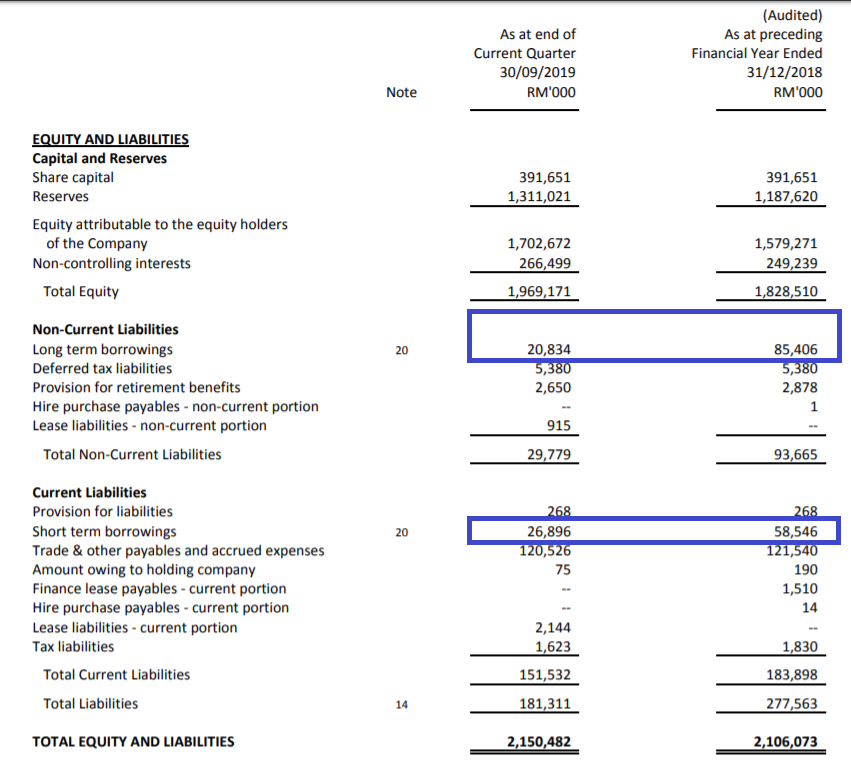

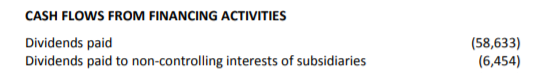

Although the company have made dividend payment during FY2019 (total RM65million), the company's net cash position have improved.

As per 30 September 2019, the company owned RM153million cash and RM47million borrowing compare to 197million cash and 144million borrowing at 31 December 2018.

NET CASH RM106MILLION (30 SEPTEMBER 2019)

VS

NET CASH RM53MILLION (31 DECEMBER 2018)

4) 60% dividend policy

Based on the announcement on 20 August 2019, the Board of MBMR have agreed upon the 60% dividend payout policy. Until today, the dividend declared for FY2019 is only 12sen. With the assumption of final quarter remained the same with last year, there is a potential declaration of final dividend of 24.8sen in the last quarter for financial year ended 31 December 2019!!

Appendix

https://paultan.org/2019/12/19/2019-year-in-review-and-whats-to-come-in-2020-perodua-proton-on-top-new-national-car-announced/

https://paultan.org/2019/12/30/spyshots-perodua-bezza-facelift-sighted-mid-life-refresh-introduces-new-front-and-rear-bumpers/

Thank you for your times.

Please feel free to leave a comment below.

Disclaimer: The aritcle written for sharing purpose. It do not represent any buy or sell call. Please do your research before any investment!!!

Happy new year!!!

https://klse.i3investor.com/blogs/undervalue/2020-01-01-story-h1481974210-Why_MBMR_Solid_pure_cash_company_PERODUA_and_DAIHATSU_with_low_PE_6_3_r.jsp