Investor relations at the time of writing

Stock Name: CapitaLand Malaysia Mall Trust (CMMT) (5180)

- P/E: 23.92

- NTA: 1.24

- DPS: 7.1

- DY: 7.14

A little background about the company. CMMT is a property investment trust that focuses on retail malls in Malaysia. They are basically a Real Estate Investment Trust (REIT) where they invest in shopping malls across multiple cities in Malaysia and also an office building in Tropicana.

Revenue that comes from this company is from leasing properties to tenants which includes restaurants, supermarkets, clothing and accessory stores, grocery stores, leisure venues, cosmetic shops, etc. They have 2 sections of revenue generation, one is from retail generates revenue the most and office building.

Shopping malls they own

- Gurney Plaza

- 3 Damansara & Tropicana City Office Tower

- Sungei Wang

- The Mines

- East Coast Mall

What is the first thing that comes in your mind when you hear about these malls? If your answer is dying malls then you are absolutely correct.

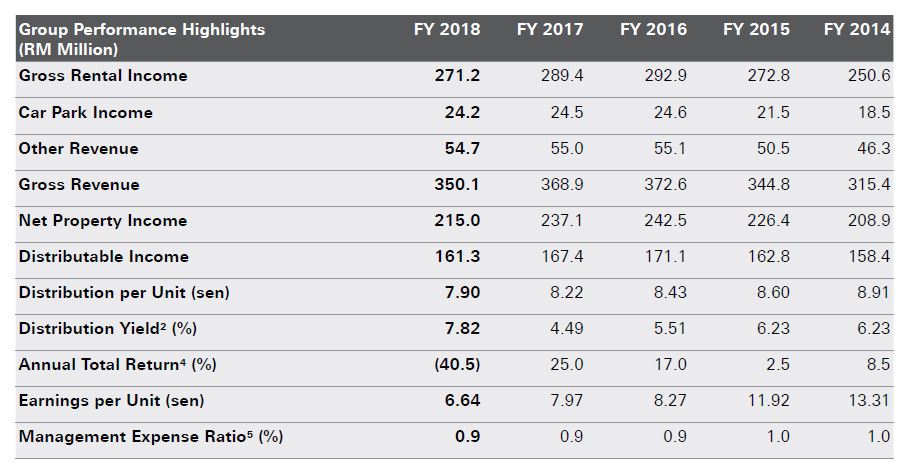

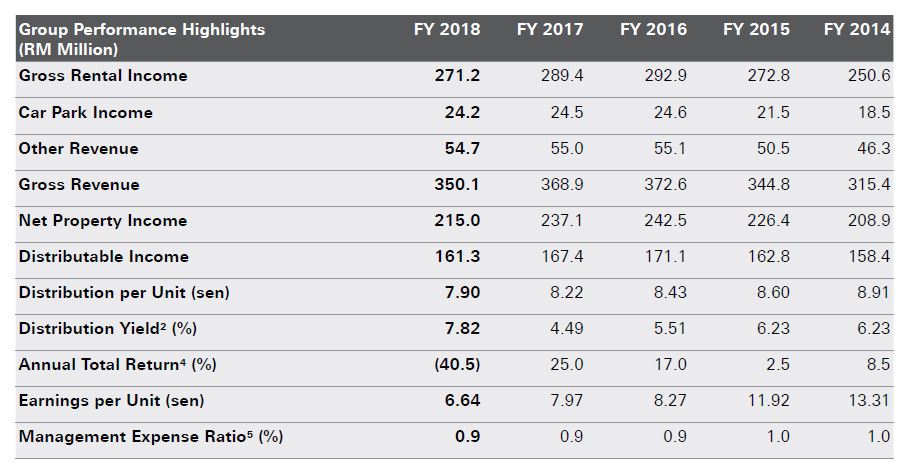

Financial Highlights of FY 2018 AR

- Gross revenue dropped from RM368.9 million in FY 2017 to RM350.1 million in FY 2018 which is a -5.09% drop of gross revenue

- Net property income also plunged from RM237.1 million in FY 2017 to RM215.0 million in FY 2018 equivalent to -9.32% drop in net property income in just 1 year

- Property valuation still stays the same at RM4.0 billion for FY 2017 and FY 2018

- As for their Net Lettable Area, basically the area of a building that can be let to tenants. This has also been decreased by -6.45% from 3.1 million square feet to 2.9 million square feet in FY 2017 and FY 2018 respectively.

- Number of committed leases which are technically tenants has also reduced from 1,333 leases in FY 2017 to 1,292 leases in FY 2018, a mere -3% drop in leasing.

- Portfolio of occupancy rate dropped by 2.2% from 95.4% in FY 2017 to 93.2% in FY 2018, this could be because of tenants are not able to sustain their business or they move to another better mall that has more daily customers or even renovations going on

- Annual shopper traffic reduced as well, could be the reason of the above portfolio of occupancy rate decreased. It is reduced by 1.5 million annual shoppers from year 2017 to 2018

CMMT’s total borrowings stood at RM1,321.9 million, which translated to a gearing level of 32.5% and a debt of RM1.4 billion. At the end of 2018, approximately 86.9% of CMMT’s debt was at fixed interest rates. The average cost of debt for FY 2018 was 4.5% per annum while their FY 2017 was at 4.4% per annum.

Dividend

What’s a REIT without dividend right? Well like most REIT they have a payout policy ratio of 90% of their distributable income of each FY to shreholders and CMMT dividend payout is semi-annually.

CMMT

payout ratio for FY 2018 is 119.07% as compared to their FY 2017 which

is only 103.33%, although they are giving higher DPS of 7.1 sens a share

and also DY of 7.1% for the past 4 quarters which I have to admit its

quite attractive but we also have to see their operating net income

which is lower by -16.32% drop of net income from operations.

There

is only so much that this company can offer in terms of dividend before

they have to reduce their dividend payout, as their net income

continues to decrease most likely their dividend payout will also be

decreased.

Valuation 5 Years CAGR

- Revenue: 2.65%

- Profit Before Tax: -12.96%

- Net Profit: 12.96%

- Dividend: 0.51%

- Net Profit Margin: -15.21%

Okay

conclusion time! As you guys can already tell by the list of shopping

malls they own in Malaysia, those shopping malls are getting outdated

and fewer people are shopping in those malls. Future prospects for this

company may also be “outdated” (pun intended), however their dividend

yield and NTA of 1.24 at the time of writing this is still attractive

for some investors just be aware of their earnings going to the future.

Got something to share or ask about investing? Want extra content that we dont share on our facebook page?

Join our English telegram group!

https://t.me/joinchat/FSnMkBUY-Ni2j2sOmL20jQ

Join our English telegram group!

https://t.me/joinchat/FSnMkBUY-Ni2j2sOmL20jQ

Telegram Chinese Group

https://t.me/public12invest

WEBSITE • @12ingroup

FACEBOOK • @12Invest

INSTAGRAM • @12ingroup

TWITTER • @12_invest

Disclaimer:

All the views and opinions expressed in our post are for education and informational purposes only and it should not be considered as professional financial investment advice or buy/sell recommendations. We strongly encourage you to do your own research and take independent financial advice from a professional before you proceed to invest.

We make no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on our Facebook Page/Group and will not be liable for any errors, omissions, or delay in this information or any losses and damages arising from its display or usage. All users should read the posts and analyze the information at their own risk and we shall not be held liable for any losses and damages.

All the views and opinions expressed in our post are for education and informational purposes only and it should not be considered as professional financial investment advice or buy/sell recommendations. We strongly encourage you to do your own research and take independent financial advice from a professional before you proceed to invest.

We make no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on our Facebook Page/Group and will not be liable for any errors, omissions, or delay in this information or any losses and damages arising from its display or usage. All users should read the posts and analyze the information at their own risk and we shall not be held liable for any losses and damages.

https://klse.i3investor.com/blogs/12stocktalkeng/2020-02-03-story-h1483044769-Things_I_learnt_about_CapitaLand_Malaysia_Mall_Trust_that_everyone_shou.jsp