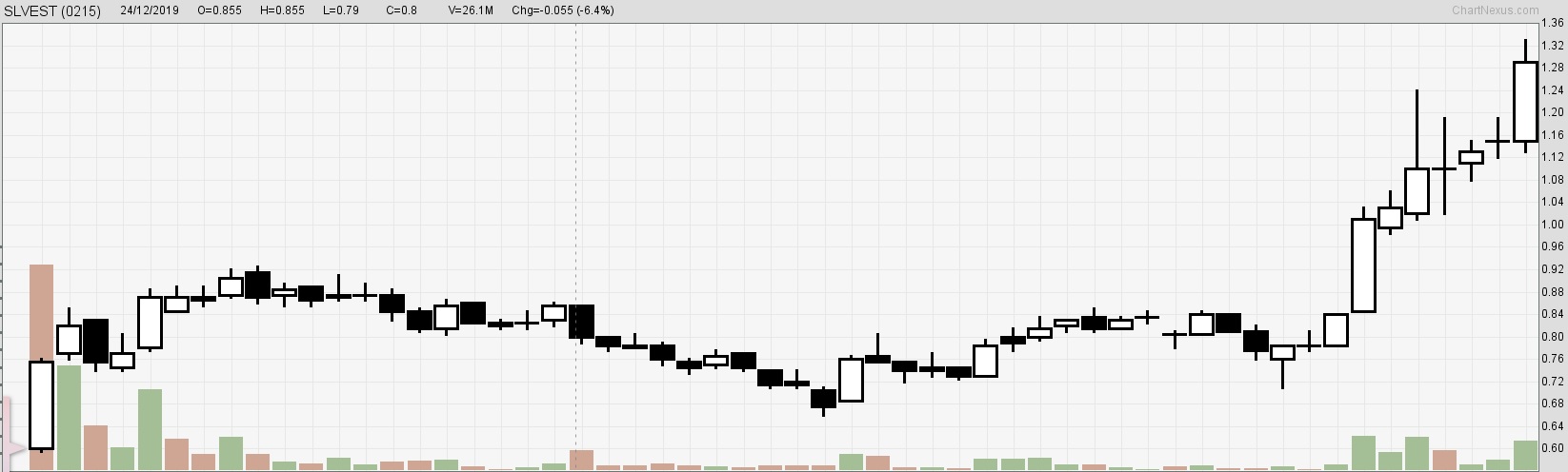

SLVEST continued surging until a high of RM1.33 yesterday before closing at RM1.29. Since its IPO price until now, it’s been almost RM1.00 or 280% of price surge within such a short period of time of less than 3 months.

Its price surge yesterday came directly after the publishing of the below news:

An 'egg-cellent' year for Teo Seng amid stable demand?

https://www.theedgemarkets.com/article/eggcellent-year-teo-seng-amid-stable-demandTeo Seng to raise production of eggs to 4.1 million daily

https://www.thestar.com.my/business/business-news/2020/02/15/teo-seng-to-raise-production-of-eggs-to-41-million-dailyRecall that, SLVEST has entered into a MOA with Teo Seng to install their solar rooftops.

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3022460

The simple logic now is, if Teo Seng is expanding, shouldn’t it be beneficial for SLVEST indirectly too? In the sense that SLVEST also gets more areas to expand the solar rooftops hence getting more profits than initially expected.

Will the price of SLVEST continue moving north, just like UWC and Greattech?

From the chart, it has been a series of white candles since 3rd of Feb. Is something brewing? Will it continue move north? It’s your call.

https://klse.i3investor.com/blogs/changwt/2020-02-15-story-h1483822246-_SOLARVEST_Part_2_Another_UWC_and_Greatech_in_the_making.jsp