With PEx similar to a technology company, YTL Corp need to grow it's earnings fast....SMART Robie think YTL Corp overpriced....

Fundamental for YTL (4677).

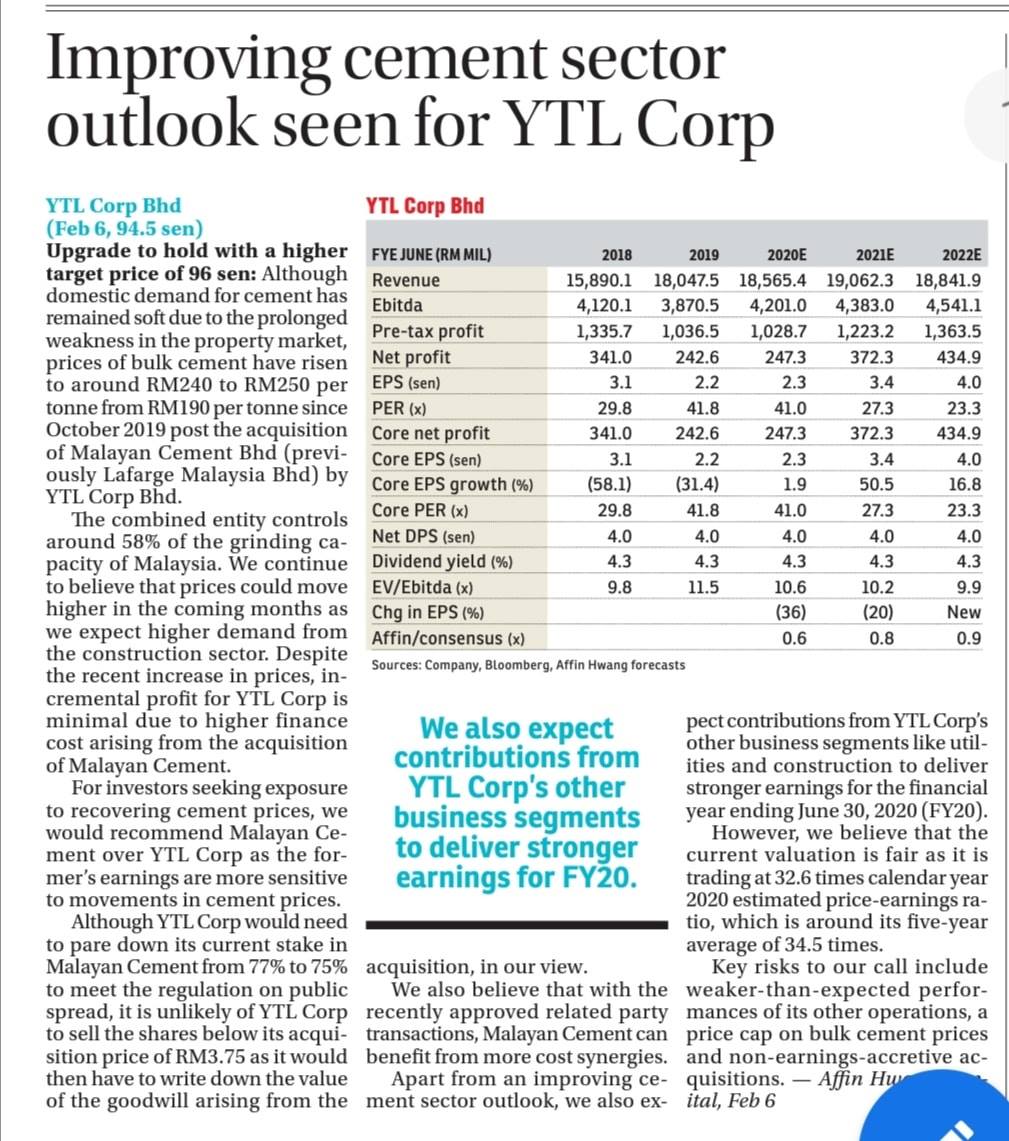

FA Ratings : 2/8*

PE = 70.21

ROE = 1.09 %

DIY = 4.23 % **

Mkt Cap: 10,416.5M (RM) in Large Cap, Utilities, Main Market.

Note: [s] = Syariah, ** = Good.

@ Trading at Overpriced (relative).

*Intrinsic Valuation Desk*

Intrinsic Value @ 10% disc rate = RM 0.01, IV @ 3.6% = RM 0.11, IV @ 7.5% = RM 0.03, IV @ 12% = RM 0.01,

Share is *OverValued *, Safety Margin @ 10% disc rate = -98 % (Sell !).

(Recommend Safety Margin > +40% or higher for undervalued share if negative safety margin, overvalued share.)

Watch tutorial http://bit.ly/2mpnLGx

For FA Ratings (Best=8*), recommend to invest at 3* & above.

SMART Robie, Stock Market Assistant ChatBot

1. Register your Free Access to Robie: https://tradevsa.com/robie/signup

2. Also Watch Install-Robie video

https://youtu.be/c432d75vwZ4

https://youtu.be/c432d75vwZ4

3. Get Telegram Messaging App to talk to Robie. Get from Google Play store or Apple PlayStore.

4. Whatsapp +6010-266-9761 if you need further assistant.

5. Visit fb.com/SmartRobie or tradevsa.com

https://klse.i3investor.com/blogs/tradevsa_smart_robie/2020-02-09-story-h1483732844-With_PEx_similar_to_a_technology_company_YTL_Corp_need_to_grow_it_s_ear.jsp