Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

DAMANSARA REALTY BERHAD or DBHD (Code 3484, MAIN Market, Property)

DBHD - THIS STOCK POISED FOR A (POSSIBLY) V-SHAPED RECOVERY !!!

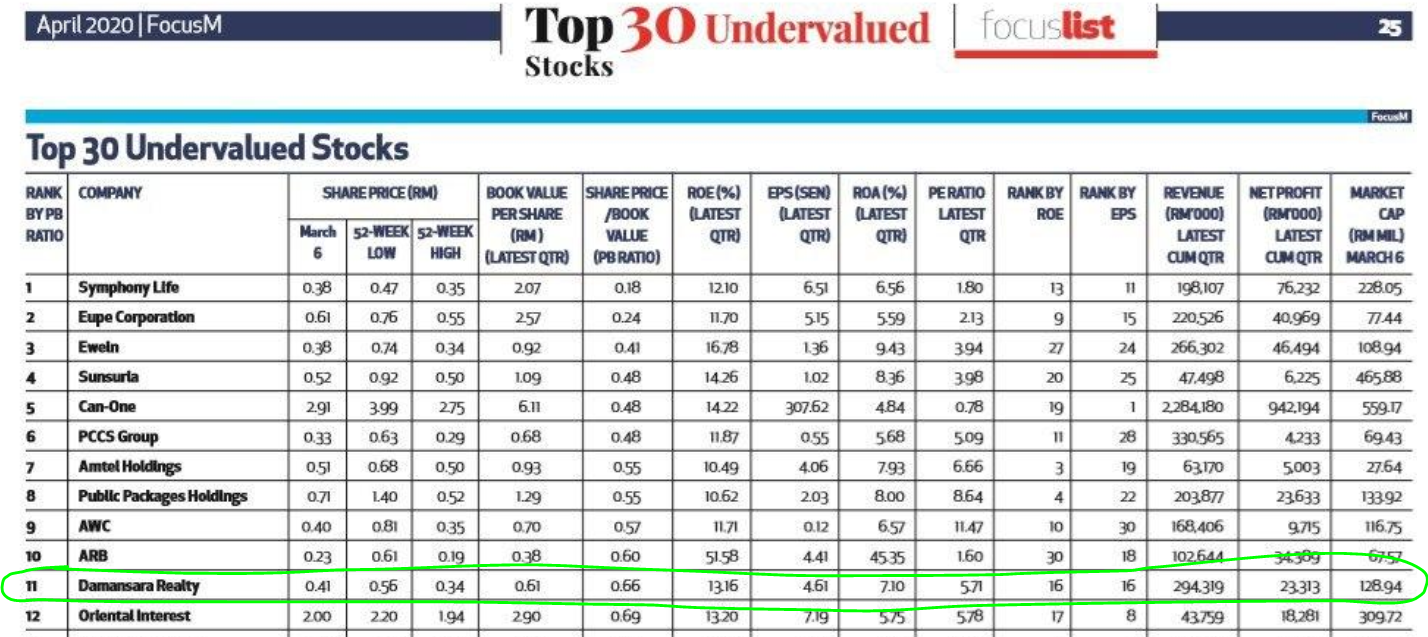

1. Listed in FocusM April 2020 Top 30 Undervalued Stocks

Refer below image extract taken from the recent FocusM Top 30 Undervalued Stocks. DBHD is among listed due to few factors:

i. Huge discount to its NTA of 61c

ii. Full year EPS at 7.53c. Currently only trading at about 3.6X PE Ratio which is considered quite low even at the current sentiment

At a fair 5X PE Ratio considering current state of economies under lockdown, we are looking at a fair price of about 37.5c.

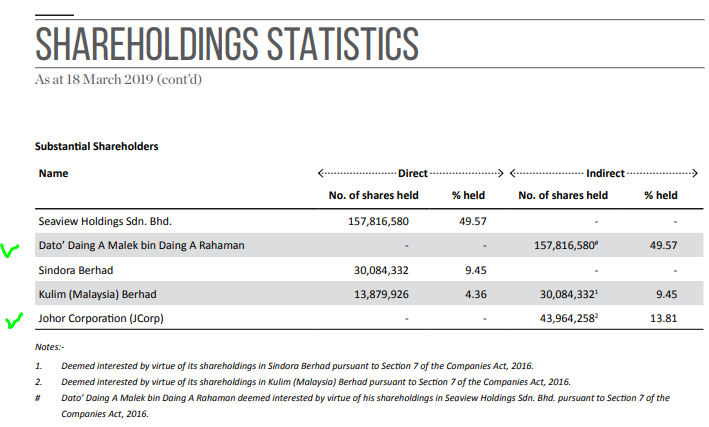

2. Strong Holders Inside - No Forced Selling During Sharp Decline, Capital Strength

Refer latest list of top shareholders as of latest annual report. As we can see this stock has 2 strong holders:

i. Dato' Daing A Malek B Daing A Rahman thru Seaview Holdings Sdn Bhd with 157.8 million shares (49.57%)

ii. Johor Corporation thru Kulim Malaysia Berhad with 43.96 million shares (13.81%)

Recently, we saw DBHD share price fall to a low on the peak fear of the

COVID19 pandemic. I will explain in the chart later on the technicals.

However, we note that there were no forced selling by the major

shareholders during this time, which means the selldown was done from a

weak selling point.

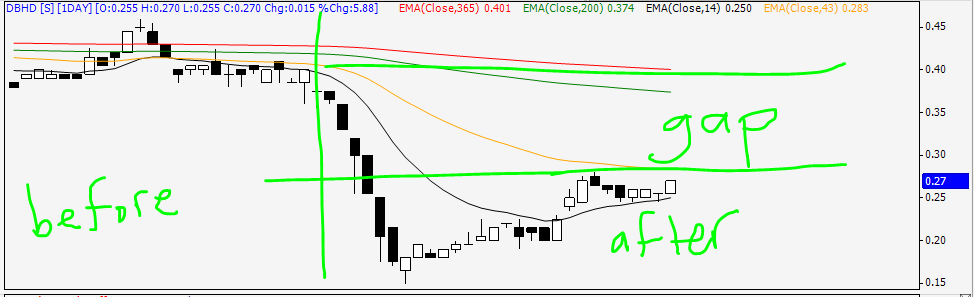

3. TECHNICAL ANALYSIS - Low Volume Selldown, Big Volume Buy Ups, Forming V-Shape Pattern

Let's take a look at the daily chart of DBHD:

A few observations below:

i) Refer Circle Number 1, we notice that during the selldown, the volume was minimum until it hit the recent botom of 15c

ii) From the bottom price, buying volume had significantly increased

showing that buyers are more interested to take control of the counter

iii) Volume of 5.6 million unit which is significant jump in volume

from recent few days, and matching the high volume recently generated in

end March 2020

iv) EMA43 at 28.3c, EMA200 at 37.4c and EMA365 at 40.1c important points to monitor for breakout

v) MACD, stochastics and RSI showing upward momentum

4. TECHNICAL ANALYSIS - Homily Chart - Red Chips Increasing Position

Let's take a look at the 60 minutes chart of DBHD, using Homily software:

A few observations below:

i) Recent retracement had took it back to support line

ii) Red chips had been maintaining position, and green chips reduced to 0 (minimal weak holders inside)

iii) With volume increased in recent few hours, the stock might be on

the way to break its recent high of 28c to head towards EMA200 of 37.5c

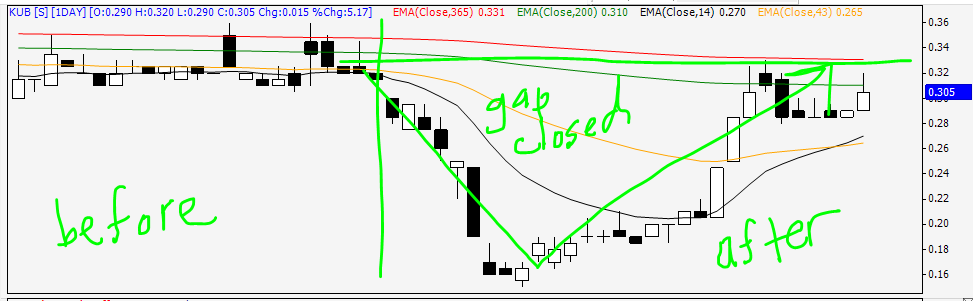

5. Comparison with Its Mirror Counter - KUB - KUB Had Already Achieved V-Shape Recovery

Recently from January 2019, DBHD had been mirroring alot of KUB share

price movements. I can't really explain why, just that the chart shows

so.

Let's see the charts of DBHD & KUB hand in hand, starting from 5

February 2020 till now (to see the before and after crisis movements):

DBHD:

KUB:

A few observations:

i) Before COVID19 crisis brought shares sharply drop, price of DBHD was roughly 40c, and KUB was roughly at 32c

ii) We can see that till now, KUB had made nearly 100% V-Shape Recovery after hitting its lows. The price had closed at 30.5c on Friday 17/4/20.

iii) However, as of Friday, DBHD closing at 27c, is still about 13c from staging a full V-Shape recovery. Therefore, there is still a gap of about 13c to be filled should DBHD decide to follow behind KUB footsteps.

iv) This gap of 13c represents opportunity to buyers looking to buy in at a bargain

CONCLUSION

Based on my opinion, DBHD should be given attention, based on below:

i. Listed in FocusM top 30 Undervalued Stocks

ii. Strong shareholders inside

iii. Low Volume Selldown, Big Volume Buy Ups

iv. Possibly to Mirror KUB in doing a Full V-Shape Recovery

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-04-18-story-h1506020445-THIS_STOCK_IS_POISED_FOR_A_POSSIBLY_V_SHAPED_RECOVERY.jsp

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-04-18-story-h1506020445-THIS_STOCK_IS_POISED_FOR_A_POSSIBLY_V_SHAPED_RECOVERY.jsp