Hi to all investors and traders!

Today I would like to share my thoughts to the following counter:

KONSORTIUM TRANSNATIONAL BERHAD or KTB (Code 4847, Main Market, Consumer Products & Services / Transportation)

1. ABOUT KTB

http://www.ktb.com.my/knowingUs_aboutUs.htm

KONSORTIUM TRANSNASIONAL BERHAD (KTB) made its debut on Bursa Malaysia on June 15, 2007 engages primarily in the bus transportation system comprising stage and express bus operations within Peninsular Malaysia.

The stage and express bus operations provide the most extensive coverage throughout Peninsular Malaysia, covering almost all major cities and towns as well as Singapore. The nationwide network is serviced by a fleet of more than 1,500 buses that covers more than 250 routes, generating more than 1,000 trips daily and this translates to around 60 million passengers a year.

2. Why KTB?

By looking at KTB(4847), which is near historical low, recent price drop due to panic sell cause by PN17 classification, for recent good market, I actually think KTB fulfill the criteria below:

Important sector, similar to Airasia, will impact the public interest if let it goes bankrupt.

Bursa Malaysia temporary suspend PN17 classification, in 2-3 years KTB likely will not delist from bursa Malaysia, and a lot of PN17 counters actually show volume and sign of moving up.

Public transport related stocks show sign of coming up.

Minimum risk but the potential return is very huge.

So KTB(4847) is a very good pick, let me explain.

3(i). Company which will affect public interest as Airasia

First we look at the news regarding Airasia, https://www.thestar.com.my/business/business-news/2019/01/28/airasia-group-records-14pct-increase-in-passengers-in-2018

We can see that Airasia carried 44.43 million passengers whole year, the number is significant, Malaysia population in 2019 estimate at 32 million only. So we got the news below on 17 april,

https://www.thestar.com.my/business/business-news/2020/04/17/airasia-malaysia-airlines-merger-an-option-as-covid-19-hits-industry.

KUALA LUMPUR: Merging money-losing state carrier Malaysia Airlines Bhd(MAB) with low-cost airline AIRASIA group Bhd is one of the options to “save” them as the COVID-19 crisis batters the industry, Malaysia’s second-most senior minister told Reuters on Friday.

Lets come back to KTB, from their website we can see that they carried around 60 million passengers for previous years, so do you think the government will leave it goes bankrupt as Airasia?

3(ii). Bursa Malaysia Temporarily suspend PN17 classification.

Let read a news regarding the suspend of PN17 classification:

https://www.theedgemarkets.com/article/bursa-temporarily-suspend-pn17-and-gn3-classifications

from the news, we extract one of the important message:

“We have already allowed PN17 and GN3 companies up to 24 months to regularise their financials.

So more likely at least 2 years from now the KTB will not be delisted from bursa Malaysia, the previous sell down is just a panic sell.

We can also see that because of the news, a lot of PN17 company stock price show sign of moving, for example big volume for DAYA(0091), Barakah(7251) up from 0.015 to 0.025, Lotus(8303) up 1 sen, and many more... KTB as better stock compare to others PN17 stocks, should not left behind.

3(iii). Public transport related stocks show sign of coming up

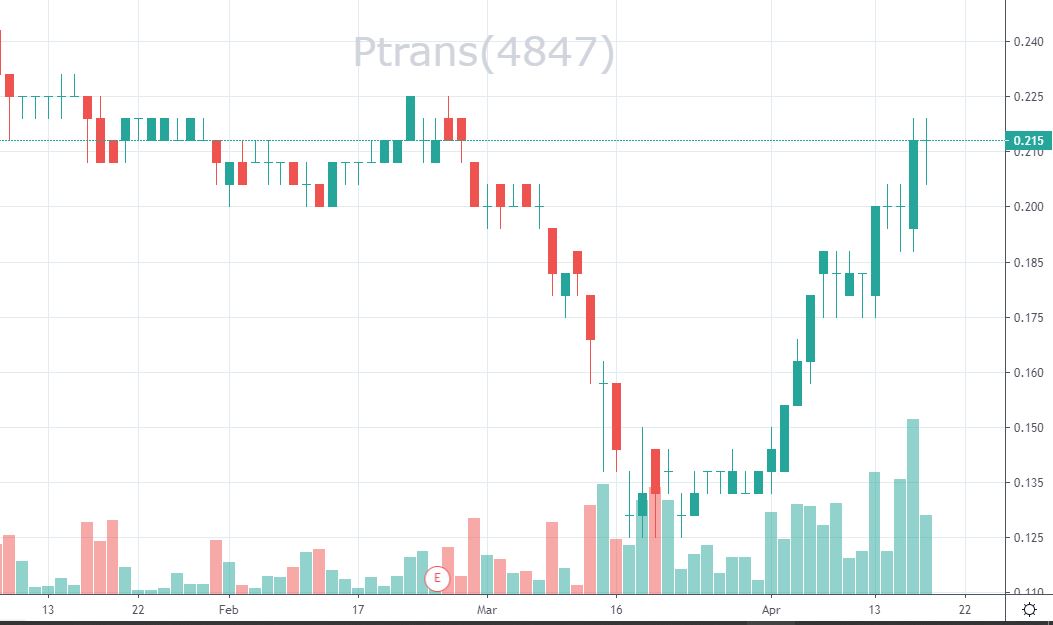

Both Gets(5079) and Ptrans(0186) show price moving up, KTB is yet to move but should move later. Lets us look at the charts for Gets and Ptrans first.

On April 2019, Gets spike from 0.13 to 0.4, KTB spike from 0.08 to 0.2, both reward nearly 300%, they move together as same sector. it will become sector theme and attract the market eye once one of these stocks breakout.

3(iv) Minimum risk with potential huge gain.

From the KTB chart, we can see the price is near the historical low, at the price 0.04 , u can most cut loss and risk only 1 sen, but if the stock moving up, it is more likely huge spike with great reward.

4. CONCLUSION

For all the reasons above, I believe KTB is the best pick for the future(around 2 years safe), it is the big opportunity for all the investors, for short term the TP is 0.1 , once breakout may goes higher.

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Join us on http://t.me/share4yu for latest update