Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

SCOPE INDUSTRIES BERHAD or SCOPE (Code 0028, ACE Market, Industrial Products & Services)

SCOPE - MAJOR SHAREHOLDER(S) PAID 20% PREMIUM TO CONVERT WARRANTS OF THIS STOCK !!!

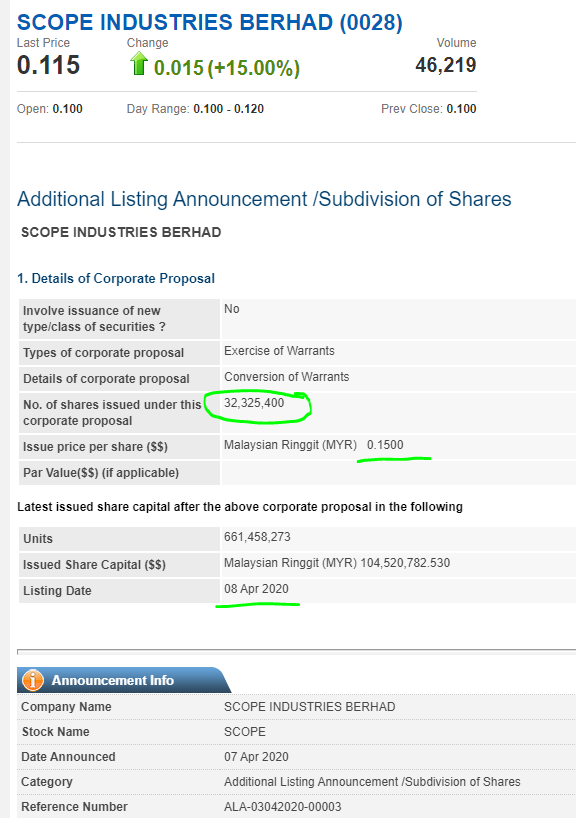

1. Announcement of Conversion of 32.3254 Million Warrants on 7th April 2020

First of all, I'd like to express my dissapointment to media outlets,

as none of them had picked up on this matter and highlighted it to the

public. Anyways, refer to the announcement by the company on 7th April

2020 as below:

As highlighted, there was a conversion

of 32.3254 million units paid at 15c per share (a 20% premium to

today's closing price of 12c) which amounts to RM 4.85 million.

It is interesting to see that they had chosen to pay a premium of 20%

instead of buying shares directly in the open market which would cost

them less money.

The total warrant before conversion was 95.9954 million. After the

conversion of 32.3254 million (33.67% conversion from grand total), now

the balance outstanding warrants is only 63.67 million.

Also, this conversion would give the shareholder a total of 4.89% stake

in the enlarged share float of the company (barely below the 5% mark).

2. Who Had Done The Conversion ???

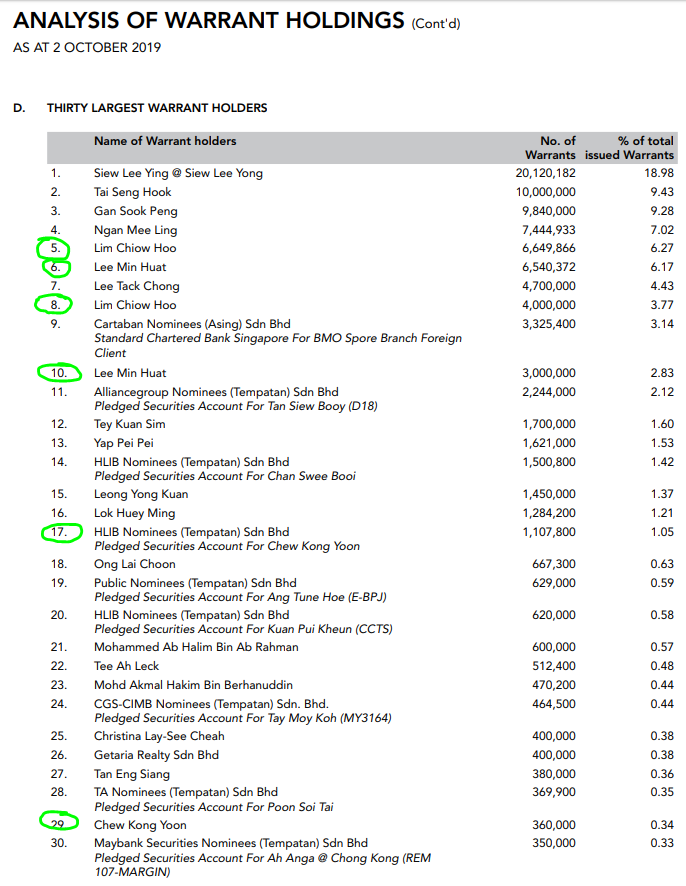

Refer to the latest list of Warrant shareholdings as per the 2019 Annual Report below.

Based on the list, there is no one shareholder holding 32.3254 million shares. The largest warrant holder at No #1 only has 20.12 million (18.98%).

Therefore, at this moment, I can say that maybe a few major warrant holders had come together and made the conversion at about nearly the same time.

3. What Does This Mean ???

We don't really know the intentions behind this conversion. However, we can maybe deduce the following:

i. Conversion by paying 20% premium is maybe as a

show of confidence from an existing major shareholder, via injection of

RM 4.85 million cash. This would boost the other investors' confidence

as well as strengthening the position of the existing major shareholder.

ii. Conversion by paying 20% premium might

be done not by a major shareholder (before conversion), possibly to

make a grand entrance into the company by showing strength in capital

support. Once they had become a major shareholder, then

would be possible to ask position in the board to contribute to company

future decisions

iii. The total float for SCOPE-WA now has been significantly reduced from 96 million to 63.67 million. The less float in the warrants means less resistance for the warrant price to move.

4. TECHNICAL ANALYSIS - Market Picking Up on The Confidence Shown From The Conversion

Let's take a look at the daily chart of SCOPE:

A few observations below:

i) Market start to pickup on the conversion premium on 9th April

ii) This can be seen from the price closing at 12c on 9th April

iii) Volume of 5.6

million unit which is significant jump in volume from recent few days,

and matching the high volume recently generated in end March 2020

iv) EMA43 at 13c and EMA200 at 16c

v) MACD, stochastics and RSI showing upward momentum

5. Analysis on SCOPE-WA

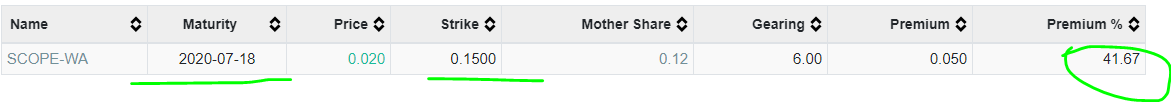

Let's take a look at profile of SCOPE-WA :

A few observations:

i) Maturity in July 2020 (about 3 months life)

ii) Strike price of 15c, which is not too high considering current price of mother share is 12c

iii) Premium of 41.7%

iv) Total Float now 63.67 million

If we look at the mother share price, closing at 12c on 9th April 2020.

Should the mother shares see continuation in price trend above 15c, the

warrants will see active trading as the mother shares trade above the

strike price.

CONCLUSION

Based on my opinion, I SCOPE should be given attention, based on below:

i. Conversion done at 20% premium to mother shares price closing

ii. Conversion was done by a combination of major warrant holders

iii. Show of confidence in capital support via paying premium in conversion

iv. Chart Shows market picking on this premium in conversion

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-04-09-story-h1505896475-MAJOR_WARRANT_HOLDER_S_PAID_20_PREMIUM_TO_CONVERT_WARRANTS_OF_THIS_STOC.jsp