AEM (7146) AE MULTI HOLDINGS BERHAD - HIDDEN DRAGON CROUCHING TIGER

AEM (7146) -Hidden dragon crouching tiger

Main Market

Syariah Status: Yes

Closing Price: 0.10

Expected TP: 0.14/0.17/0.20

Business Background

AE Multi Holdings Bhd is an investment holding company engaged in the provision of management services to its subsidiaries. Its segments include printed circuit boards, electronic products, and investment holding. The printed circuit boards segment is engaged in manufacture and sale of printed circuit boards and related products, and provision of technical services. The electronic products segment is engaged in the assembly and trading of electronic products and telecommunication components, and accessories. The investment holding segment is engaged in investment holding and the provision of management services.

Why AEM?

1. The Group is one of the pioneers in the manufacturing of single-sided PCB in Malaysia.

2. The principal activities of AEM consist of investment holding and the provision of management services to its group of companies. While the principal activities of its subsidiaries primarily engaged in:-

i. manufacture and sale of Printed Circuit Board (“PCB”) and related products;

ii. sourcing and reselling of the PCB and related products, electronic and telecommunication components; and

iii. manufacture of cartridge ink and related products.

3. The Group’s output can segregated into four (4) segments, namely computer peripherals, consumer electronics, telecommunication equipment and office equipment.

Source: 1-3 from http://www.amallionpcb.com/en/About-AE-Multi-Holdings-Berhad.php

4. Healthy Asset versus liability

Refer below latest asset & liability sheet as of February 2020 QR. A few points to note:

i. Total NTA stood at RM 0.20. Current trading price of 10c is a BIG DISCOUNT of about 10c (50% discount).

ii. Strong cash pile of RM 12.8 million comparing to last year same period, where the cash position was only RM 9.3 million.

iii. Total assets stood at RM 111.3 million versus liabilities of RM 51.6 million.

5. Strong Cash flow from operations

Cash flow from operations from the recent quarter stood at RM 10.64 million compared with the same quarter last year which was only RM 0.97 million. This is significant jump as it shows that the company is generating positive cash flow as probably indicated their business is growing.

6. AEM has strong reputable customer base including multiple household multinational companies (MNC) like PANASONIC,SONY, SAMSUNG, LG, NEC and others.

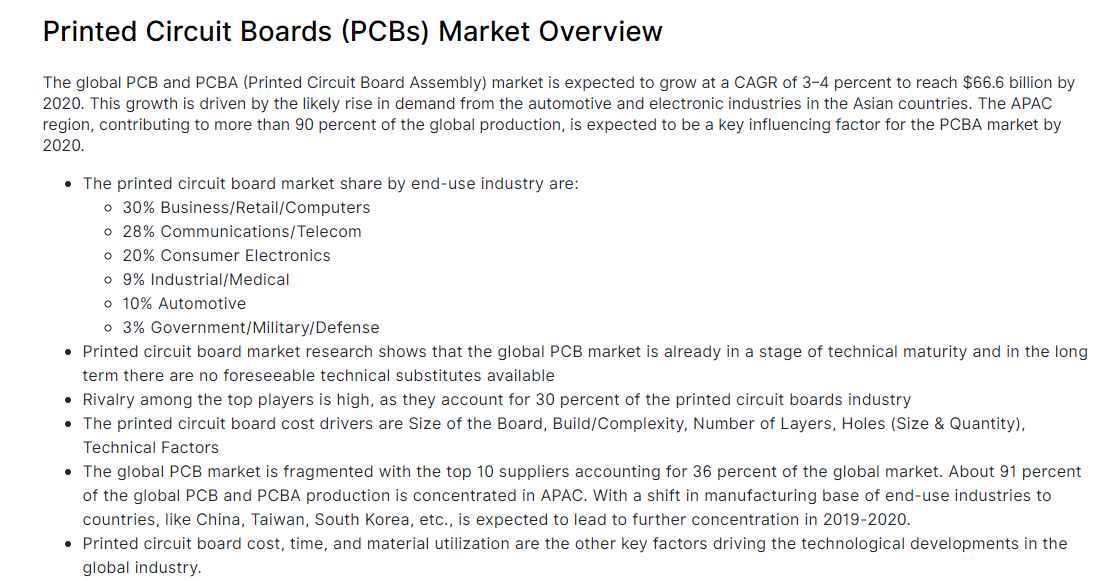

Printed Circuit Board (PCB) business outlook

Source: https://3wnews.org/uncategorised/855492/printed-circuit-board-pcb-connectors-market-to-witness-remarkable-growth-by-2026/

Source: https://3wnews.org/uncategorised/855492/printed-circuit-board-pcb-connectors-market-to-witness-remarkable-growth-by-2026/

Source: https://www.beroeinc.com/category-intelligence/printed-circuit-boards-market/

As we can see the PCB business is expected to have a major uptrend based on the business outlook of the industry.

What makes AEM a hidden GEM?

i. AEM’s MNC clients like SONY, PANASONIC, LG, SAMSUNG are expected to contribute positively towards AEM’s growth as we can see that from the business prospects of PCB it stated that companies such as mentioned is expected to contribute towards the growth of the industry.

ii. AEM is also involved in telecommunication PCB which means that they are most likely involved in the development of 5G related PCB products as the technology is shifting towards 5G in many countries this will definitely increase the demand of PCB.

iii. SONY will be launching PlayStation 5 (PS5) this year which means AEM’s order book from SONY could increase because of the pandemic COVID-19 which means more people will be staying at home and the demand for PS5 could potentially increase.

iv. More medical devices are being produced during this COVID-19 pandemic which essentially increases the number of computers for the medical devices to be connected with as this could be another major key point for AEM’s potential growth as the demand for PCB for computers increases.

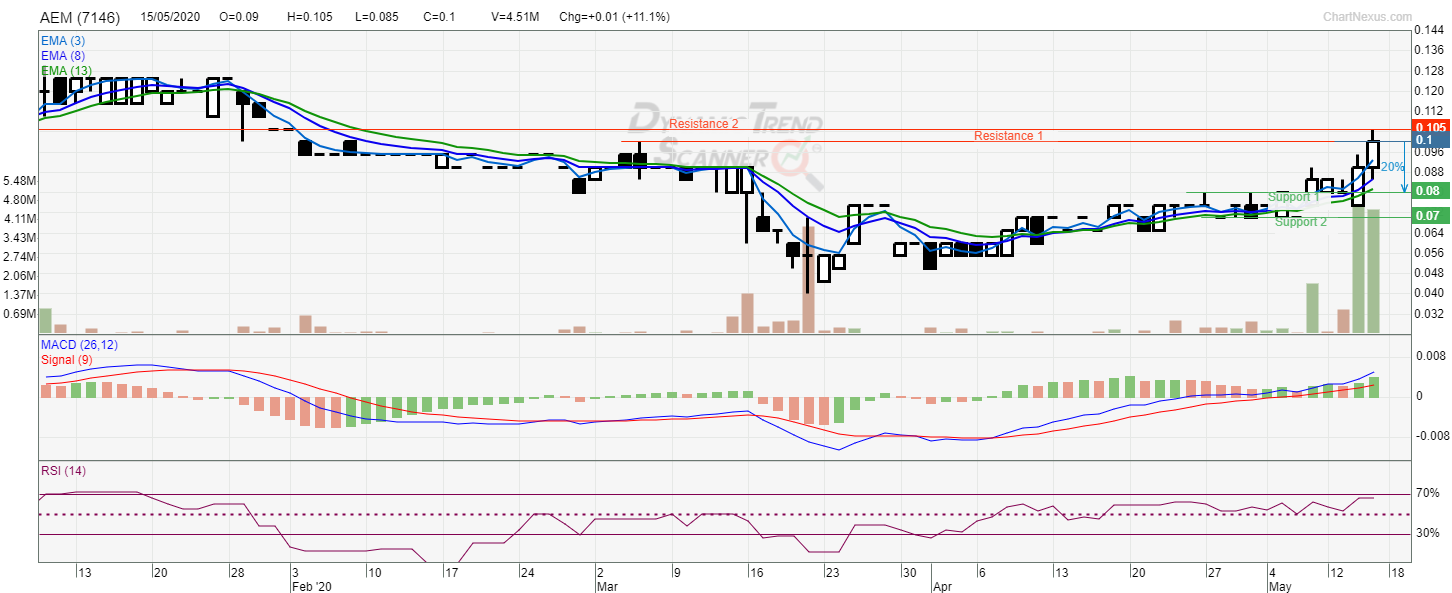

Technical View

Volume just started to kick in on 14/5/2020 which indicates that they are strong buyer coming inside AEM.

AEM major resistance at 0.105 once broken we can probably see AEM to move towards 0.125 first before going to 0.14 and higher.

Support seen at 0.08 and 0.07

MACD and RSI indicating bullish movement.

Let’s do a study on another PCB related stock which is PNEPCB (6637).

PNEPCB share price has gone up more than 100% from the low of 0.36 at 4/3/2020 because of the rumour saying that PNEPCB produces PCB for Medical Ventilators which is demand now due to COVID-19 pandemic.

Conclusion

We strongly believe that AEM is one of the unknown GEM in the PCB business and it’s lagging behind it’s peer PNEPCB by a mile.

AEM is definitely worth a look if you are looking into for another alternative in the PCB related stock because it’s relatively trading at a 50% discount from it’s NTA and the outlook for PCB business looks promising.

Disclaimer: The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

https://klse.i3investor.com/blogs/Innothestar/2020-05-17-story-h1507085171-AEM_7146_HIDDEN_DRAGON_CROUCHING_TIGER.jsp