For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) Why Highways are a Gruesome Industry – WCE Holdings Berhad (3565)

========================================================================Over the last year or so, i’ve gotten relatively familiar with the highway industry in general, and given what I know today, i can’t help but think back to one of my earlier research.

A brief analysis and valuation of WCE Holdings Berhad (WCEHB).

Quite frankly, I couldn’t be more wrong.

Even if one forgave my superficial knowledge of the highway industry then, what was unforgivable in that bit of research, was two things.

- Assumption of a certain IRR without a deep understanding of the factors that need to happen to give rise to that IRR.

- To be a bit laxer in my own research and understanding of the company because people I admire hold some of the shares.

The thing that was really bugging me about that research, is that it was quite frankly one of my more popular pieces, in terms of views, comments, likes etc on the I3 Malaysian Investment Forum. And i therefore felt a certain sense of responsibility to try and remedy that.

Personally, for me, it was one of my bigger mistakes. I can only thank that small part of my brain that refused to take it beyond a minor position in my portfolio.

Now, in order to understand WCE Holdings Berhad, we need to first understand the Highway Industry.

Lets Begin.

Allow me to warn you, this will be a very long piece.

If you want a summary, highway industries is a gruesome business and i think each share is worth around RM0.25.

The main reason for this is that traffic growth for the last 5 years have been extremely low at 1-2%, while when this concession agreement was signed in 2015, it likely projected 3-4%. This severely impaired the economics of the business.

But i am being quite conservative, and there are a multitude of factors that can bring its fair value up very very significantly.

Overview of the Malaysian Highway Industry

One of the biggest misconceptions that people have in terms of the highway industry, is that it is a very lucrative one.A lot of it stems from us constantly seeing the alleged cronies who are usually taking up highway concession contracts, and from the general observation of people paying tolls every day.

I mean, if you see traffic jams every morning and evening, and the long queues in front of the toll plaza.

It only makes sense they are all very profitable right?

Having gone through the 5 year annual reports of every highway concession company in Malaysia, and every major highway company globally (for some companies, I’ve read more than 20 years’ worth of annual reports), this cannot be further from the truth.

Here are some of certain factors and risks, intrinsic on the highway industry.

Huge Initial Capital Expenditure, 10-15 year Gestation Period (Ie, Bleeding Period)

Like most concession type companies, such as power generation etc. Highway concessions require a huge initial capital outlay.During the construction period, retail investors who are not familiar with the accounting standards, would think that it is profitable, and would be profitable when it opens and start toll collections.

This is a very grave misconception.

During the construction period, any interest expense, is capitalized into the balance sheet under the Concession Assets (or any other similar terms). Once the highway is opened and toll collections begin, these interest expense can no longer be capitalized, and will now flow out through the income statements.

For most if not all highways, the initial toll collections will be far from enough to cover the interest expense, resulting in losses in the income statement.

Depending on the highway, for great highways, the losses may only be for 5 years before it makes enough money to pay the interest. For average ones, it may take around 10 years.

For the mediocre ones (which consist of most of them), the losses will never end, the only thing you have ahead of you, is the constantly deteriorating equity and an endless stream of restructurings. (I will expand on the economics of these highway companies in later section)

So how do highways get built?

Government Funding (Implicit & Explicit) and Creative Financing

Like many other public infrastructure works (especially those in the transportation industry), it is almost fundamentally impossible for them to survive without government funding or subsidies (think trains etc)There are some edge cases such as the Hong Kong MTR Train Systems (Read This & This), but these are few and far in between.

So how does these highway projects get funded? They usually consist of a combination of,

- Government Grants (rare);

- Government Supported Loans (more common, with super creative loan repayment schedules);

- Government Shareholding (more uncommon, but the Government usually either hold a Golden Share, or have various clauses in the Concession Agreements that effectively give certain Government Agencies the ability to dictate terms);

- Government Guaranteed Sukuk/Bonds (most popular, you can be very creative with this. For example, make the Guranteed Sukuk junior to the Non-Guaranteed One, and now the implicitly guaranteed by the government, enabling lower interest rates to be obtained, while it stays off the books for the government since its implicit. Really very cute.)

- Nominal investment by Private Party of 0% to 30% (most are in the range of 10-20%)

Now, some of you may think, if highways are not such gruesome business, why on earth would private individual decide to invest in them (short of idiocy, which undoubtedly exists) ?

The Meat is not in the Toll Collection

As stated in the point above, in terms of private money, the amount put up in terms of financing the project, is usually not that much, ranging from 0% (pass the completed highway to the private individual to operate and maintain) to 20 or even 30%.Now often, the reason why private parties are willing to take this on, is because the real meat of the highway business is not in the toll collection, but in the construction of the highway, and its maintenance.

If done right (very rare), you can technically make back your investment even before the highway construction is finished! And after the construction is done, you can now get recurring income from maintaining it.

The trick here is, to have the government and the banks/bond holders, hold most of the debt, while the private individual holds most of the equity (close to 100%), despite only financing 0%-30% of the project.

And because the highway is kept in a separate company, while the construction and maintenance company are held in another company.

This way, you can keep extracting money from that highway concession despite it being loss making entity, via maintenance etc. In fact, companies like UEM Edgenta Berhad and Touch & Go are such companies for the North South Expressway (Though this highway ended up being profitable and turning into the crown jewel then).

And for those who are really smart, they can even structure their investment such that 10% of it is in Ordinary Shares, while the other 90% is in Convertible Preference Shares with a fixed dividend, enabling them to take out any excess cash (even if the Retained earnings is negative, for those who don't know, when a company has negative retained earnings, dividends cannot be paid on the Ordinary Shares.)

For most highway concession companies, the future toll collections are more of a pseudo-lottery ticket. They expect/hope for it to make enough to cover maintenance, and dream that it may actually be successful and take them to the moon. (I will go in depth on traffic projections in my next point).

As the private investor would have close to 100% equity on the project, this means if that if the actual traffic far exceeds the projected traffic, they would have hit the jackpot.

Imagine this, government funds at least 80% of the project (via explicit or implicit guarantees), and their return is capped, while the downside risks belong to the Government and whoever (foolish enough, at least for bonds that are not explicitly guaranteed by the government) buy highway bonds.

As for the upside, they all belong to the private investor.

Ie, privatize the profits, democratize the loss.

This situation is common worldwide. (To be fair, these days governments are a bit smarter and require a profit-sharing clause in their concession agreements. WCE’s concession agreement contains one)

Now, why would any government decide to do this?

The Disincentives of the Highway Concessions Industries

As Charlie Munger always says,“Track the Incentives! Show me the incentive and I’ll show you the outcome”

Incentives are the iron law of nature; at the end of the day you get what you incentivize for. If you put out honey, you get ants.

Most Governments around the are incentivized to show a lighter balance sheet.

However, everyone also wants to do more public infrastructure (Unprofitable but necessary, why else we pay tax for?).

The solution therefore for most governments is to use mostly use implicit guarantees and if necessary government guaranteed loans or explicit guarantees for bonds.

Now, the really cute thing about implicit guarantees is, other than in very select scenarios, where it’s a national asset, or the counter-party is someone who, you simply cannot piss off, the government can often choose to not act on that implicit guarantee.

This is because they are so many things can be done to effectively still hold control of the highway, even if it’s now bankrupt and belongs to the creditors (who usually consist of some random institution or rich individuals elsewhere).

This has happened before elsewhere in the world (I have no idea if it happened in Malaysia before).

However, in most highway concession agreements worldwide, there is a clause allowing the respective country’s Highway Authority to set the toll rate to be charged (this can be different than what is in the concession agreement), effectively still granting control to the government, with the difference to be paid as compensation.

And the compensation usually needs to be jointly certified with the government agency.

Now, if that government agency wants to have you jump through numerous fire hoops, and take their sweet time with the decisions, make last minute changes or requirements that basically require you to redo everything.

What are you going to do?

Are you willing to sue the government and sour this relationship forever (especially applicable in countries where there isn't a strong democratic process)?

In addition, compensation is often capped to a certain traffic amount each year.

If you happened to own a highway that makes super-normal profits and the government did not allow you to increase toll rates (due to political pressure), and instead opt to pay compensation, your compensation will usually be less than what you can collect.

Now, for some of my sharper readers, you will now be thinking,

"You know, government's wanting a lighter balance sheet does not seem like a strong enough argument."

You're right.

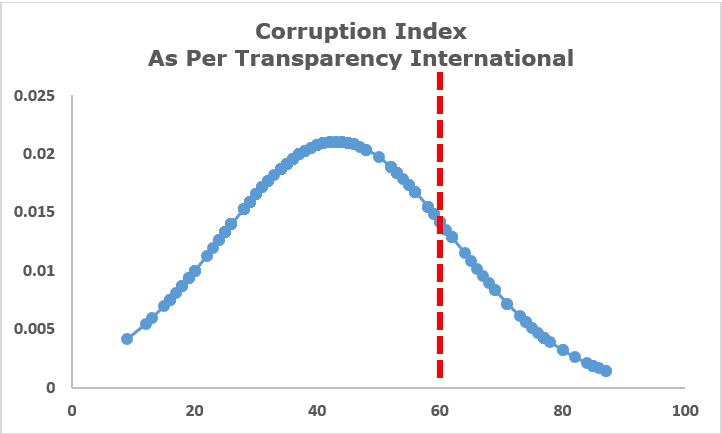

Here is a bell curve of the Corruption Index performed by Transparency International on 180 countries.

It’s not all 500 countries in the world (as stated by one Malaysian Minister), however, it consists of most of them. As for those who are not in the list, chances are, they probably scored extremely low.

The Index scored out of 100 Marks. Assuming the passing mark is 60, about 146 countries would not make the grade, this consist of about 81% of the 180 countries. No prize for guessing which part of the curve Malaysia falls on.

Needless to say, concession agreements like these (especially when structured right) and very lucrative and convenient things to dole out as reward to cronies.

The Lottery Ticket - Traffic Projections

Now, lets talk about traffic projections.Among all type of government concessions (power, telecommunications, highways, petroleum etc), there is particularly lottery like nature when it comes to highway concessions.

Why?

Because everything hinges on the projected demand, which you will not know, other than based off your own gut instinct, or some traffic consultants gut instinct.

(To be frank, traffic consultants are a zero-value add job whose purpose is to put on some veneer of acceptability on traffic projections which will likely be inaccurate to a large degree.

It’s not their fault though, try projecting something for 30 years and see.

Just a matter of supply and demand.)

For example, when it comes to power generation concessions, it is a very clear and flexible commodity, whose supply and demand you can see clearly.

All you need to do is sign a concession agreement with the government who will agree to buy most of your power at market price, build the power plant, and then connect it to the transmission lines.

The only real risk is pricing risk, which can backfire spectacularly, as you can see in Hyflux who did not predict that Natural Gas prices would fall by more than 50%, causing power prices to fall, resulting in their Power Plant which does not use Natural Gas to basically die.

When it comes to traffic projection, the number of factors that impact traffic projections is numerous, and thus its complexity is higher by several orders of magnitude.

The questions consist of,

- What is the impact of GDP to Traffic? How elastic/inelastic is it? What is the local GDP?

- What are the plans for new expressways or roads around your highway, what are the alternative routes?

- What will demographics trends look like?

- What about trains and other modes of transports?

- Cars vs Motorcycles demographics?

- Travelling trends? Saturation points?

- Given the above as well as cost of constructing the highway, what price to charge?

The list of questions goes on and on and on.

To paraphrase Howard Marks,

"Who can respond to this many questions, come up with valid answers, consider their interaction, appropriately weight the various considerations on the basis of their important, process them for a useful conclusion regarding the expected traffic and the right price to charge?"

You are either to going to get it very right or very wrong. And given the economics and history, you will likely get it very very wrong.

However, predict they must.

(At the end of the day, the highway project must go on, as the meat of the highway industry is in the construction and maintenance, not the toll collection.)

Now, for most, including myself it would seem perfectly reasonable for traffic growth to be around 4-5% per year, in line with Malaysia’s GDP.

However, this thought process have stopped holding true since 2015, unless you have a new highway in urban areas or do capacity expansion (extremely expensive).

These days, looking at the Bond Rating Reports from MARC, the North South Expressways (largest highway of Malaysia) is only seeing growth of 1-2% per year. This is not the news any current or future highway concessionaire would like to hear.

Still, a free lottery ticket (depending on which part of the deal you’re at), why not?

And for those who actually get a winning lottery ticket, you now have the opportunity to use these traffic projections to do some financialization, ie borrow more money and take it out as dividends etc.

For the more recent deals, you can look at the RM1.35bil bonds raised by Bright Focus (A Maju Holdings Subsidiary) using Maju Expressways as collateral.

Around of half of the bonds were then paid to the Maju Holdings. The bonds listed at a AA Rating and have since then turned to BB1 Rating (ie Junk Status)

Still, i don’t blame them for wanting to do so.

Top off deteriorating demand and highways being such a politically charged matter in Malaysia, it makes sense to take out as much money from your highway concession as humanly possible.

The Malaysia Political Factor

Why do politics matter so much for the highways industry in Malaysia?Well, unlike in other countries, both our governments have decided to shoot themselves in the foot by making toll roads such a highly charged political issue (this is really quite unique to Malaysia).

Despite having one of the lowest toll rates in the world (back of envelope calculation), the sheer political pressure and attention on this issue have resulted in there being no toll rate increase in all highways in Malaysia since 2011. The government would rather just pay compensation than incur the public wrath.

As a highway toll concessionaire, this is not a good thing.

If you have a highway concession, due to the previously explained traffic caps, the toll compensation you receive is likely to be less than what you can collect.

In addition, you now must go through the process of jointly certifying toll compensation and claiming such compensation, which require additional cost to be borne by you, and if there are any delays through no fault of your own, good luck having the government pay you interest on the toll compensation.

And if you have a bad toll road (which will likely be the case), with huge cash-flow issues, well, good luck to you.

In Malaysia, we are also home to one of the most incredible restructuring deals. Yes, im talking about the planned planned restructuring for PLUS Berhad, whose highways have some of the lowest toll rates on earth (by a wide margin i might add) and in Malaysia.

The toll concession will be increased by 20 years, with no additional increase in toll rates (after the 18% discount).

Well, name me one other product whose prices have not increased in the last 30 years in terms of nominal value (ie, don’t account for inflation). I cannot think of even one thing to be honest.

I'm not privy to the additional details, but if that is all there is to that restructuring, i imagine they would literally rather take the shorter toll concession period and maintain the current toll rate schedule in their concession agreement.

Overview of Malaysian Highway Companies Profits/Losses

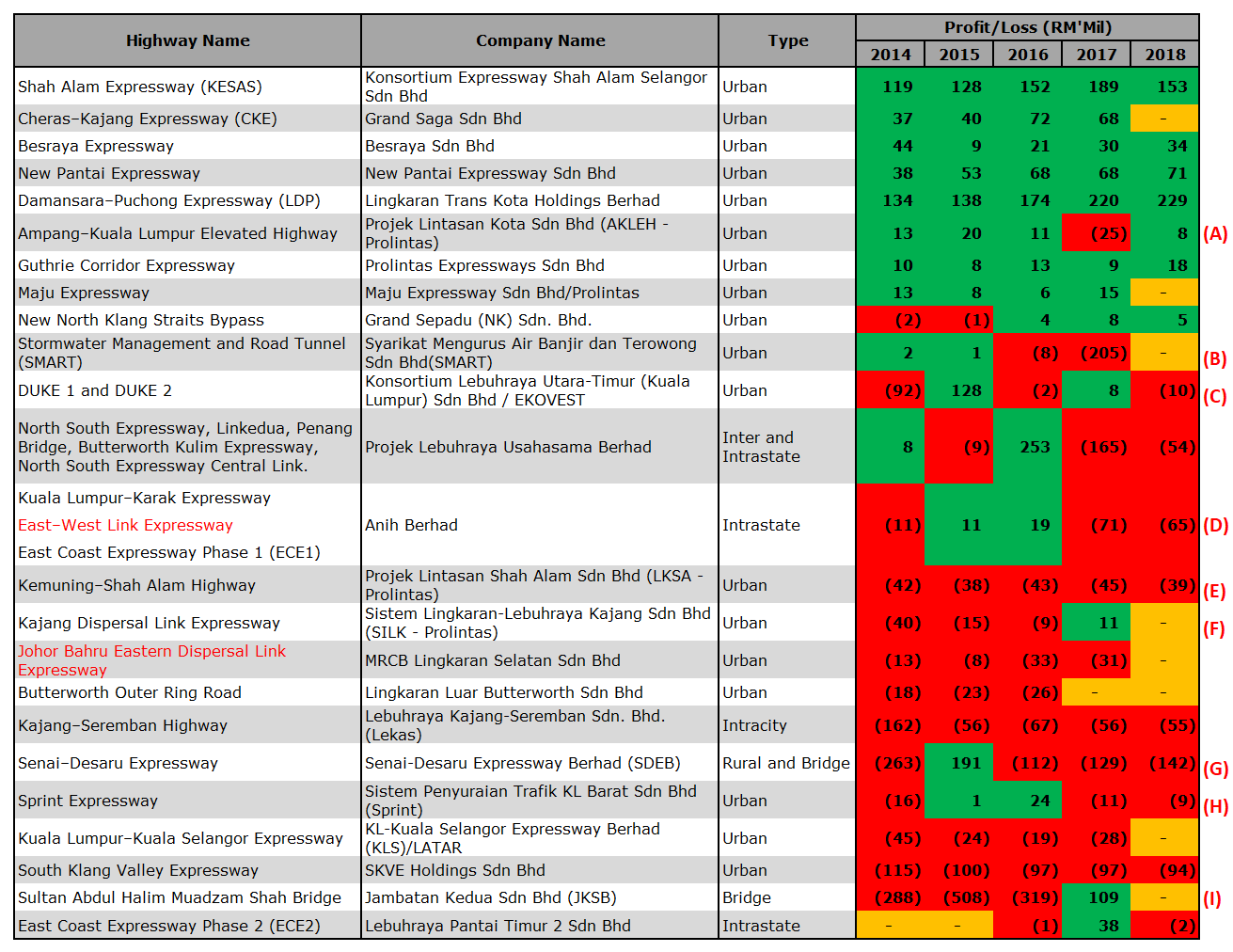

During the year, I had an opportunity to go through the accounts of all the highway companies in Malaysia (I made a friend in SSM who has sadly left the place).Profitable Years are highlighted in “Green”. Loss-making Years are highlighted in “Red”. And as for the cells highlighted in “Orange”, the accounts couldn't be found or was not released at that time.

For the highways in "Red", those concession have ended or have been terminated.

Making sense of the numbers

In order to understand the context of these numbers, we need to be aware of the accounting treatments of certain items that are specific to Highway Concessions.Provision For Heavy Repairs

For highway concession companies, they are required to handover the highways and all associated equipment back to the government at the end of the concession period in good condition.

Therefore, in their accounts, the highway concession companies will make an estimate of all future heavy repairs from now till the end of concession, using current cost estimates, traffic projections and expected inflation.

This amount is then discounted back to present value using the nearest available matching risk free rate.

For example, if you had a concession that is expected end in 10 years, you would use the 10-year MGS interest rate.

Changes in any of the items above, can result in very significant variance when it comes to the profit for the year.

Concession Assets (or other similar terms)

This basically consist of the cost of building the highway. If it was purchased from a third party, you may then have goodwill baked into it as well.

This item sits on the balance sheet and is amortized using a rate which is calculated as follows.

[(Actual traffic for the year) / (Actual Traffic for the year + Projected Future Traffic till end of Concession)] X Concession Asset

Now this is different from the usual straight line or reducing balance method of calculating depreciation.

In a way, this is a utilization kind of amortization. This means that assuming projected future traffic is unchanged, if the traffic this year is less, the amortization is less.

However, every year, the toll companies are required to procure a traffic projection report, which means that the “Projected Future Traffic till End of Concession” also changes from year to year. Which can give rise to a very significant swings in profit.

In addition, a discounted cash-flow needs to be performed each year in order to see if the future earnings can still support the value of this asset on the books. If it is insufficient, an impairment will be needed, which again gives rise to very significant swings in profit.

Restructuring, Restructuring, Restructuring

Being a gruesome business that is subject to a lot of political pressure , there is no surprise that that these companies usually go through plenty of restructuring in their lifetime.

This restructuring also often result in wild swings in the profit numbers.

Cashflow Not Earnings

Now, the 3 items (Restructuring, when it happens) above usually constitute the among the top 3 costs to the company, now as some of you you might have noticed, those are just accounting entries, and not real cash items.

These provisions or changes just move the numbers in the Income Statement but have no real impact on the real cashflow.

This is correct, however, as I am looking at it in terms of the industries economics, all these numbers matter.

If you were to build a new highway, amortization constitutes the worst of expenses, as instead of paying your expenses as you use, you will now need to pay the expenses of the next 30 years today.

Notes on Malaysian Concession Companies

Well, I think the numbers in the table speaks for itself.However, there are a few common trends I think I need to elaborate on.

- Around the word (this also applies to Malaysian ones) the only highways that make money are the ones that are in Urban areas. and except for 1 or 2 exceptions, they are also in high density, high traffic jam areas in Kuala Lumpur or Selangor. Having said that, just because you are in these areas, does not mean you will make money, due to the reason below.

- Elevated Highways, Bridges and Tunnels cost the most money to build, and are therefore extremely unlikely for those companies to ever recoup their investments the usual style (dividends). There isn’t a single bridge in Malaysia that is making money. Not in Penang, not even the Singapore ones that are jammed like crazy every morning and evening. (There is also other problems like soil etc, but not as major)

- For Intercity Highways in Malaysia, only North South Expressways is making money, as it was the first with no viable alternatives as the federal roads usually takes 3 times longer. For a Northern Interstate Highway, Anih Berhad is doing an amazing job though keeping theirs alive for so long.

For some of the highways, there are some differences in the numbers that I feel I should give some color (the favorite "Atas" word of every western investment analyst) on.

(A) Ampang–Kuala Lumpur Elevated Highway - Projek Lintasan Kota Sdn Bhd (AKLEH- Prolintas)

This company is typically profit making, however it made losses in 2017 due to impairments in the Concession Asset.

These things are quite common in highways for the reason described above.

(B) Stormwater Management and Road Tunnel - Syarikat Mengurus Air Banjir dan Terowong Sdn Bhd

It turned to a major loss in 2017 due to impairments in the Concession Asset, again, very common.

Fun fact. It is also the highway with the highest toll rate per km in the Malaysia, as it costs the most money per km to build, with it being located its deep underground and including its famous storm water features etc.

Personally, I'm in awe at Gamuda's ability to build it within budget (mostly) and keep it alive till today.

(C) DUKE 1 and 2 - Konsortium Lebuhraya Utara-Timur (Kuala Lumpur) Sdn Bhd (EKOVEST)

Well, this is still a very young highway, so numbers are a touch lumpy.

Having said that, actual traffic vs traffic projections are quite good, which is why it is able to make a profit much earlier than expected, despite only opening in 2010 or so and have a lot of elevated structures.

(D) Kuala Lumpur–Karak Expressway & East Coast Expressway Phase 1 (ECE1) – Anih Berhad

The year 2015 would be loss-making if not for a bond restructuring.

The income statement remained positive in 2016, before nosediving in 2017 and 2018 as they caught up on their Heavy Repair Provisions (should be this item as its cash-flow did not change much).

(E) Kemuning – Shah Alam Highway - Projek Lintasan Shah Alam Sdn Bhd (LKSA - Prolintas)

Highway was too expensive with a lot of elevated structures, and the multitude of free options available around it, which is why it is loss making despite being in a high-density urban area.

(F) Senai–Desaru Expressway - Senai-Desaru Expressway Berhad

It would still be in loss making in 2015 if not for the restructuring of the ICULS (Basically a loan with equity kicker).

This highway concession is a gigantic elevated structure / Bridge from Senai to Desaru. It was incredibly expensive to build and its basically impossible for it to ever turn over a profit, unless you forgive 80-90% of the debt.

(G) Sprint Expressway - Sistem Penyuraian Trafik KL Barat Sdn Bhd

It turned into a profit in 2015 and 2016, however, there was a strong increase in heavy repair provision (likely due to under-provision in prior years), which resulted it making losses again in 2017 and 2018.

Having said that, it is very close to making a profit, should turn green soon once the loan is low enough.

(H) Sultan Abdul Halim Muadzam Shah Bridge - Jambatan Kedua Sdn Bhd

It would still be loss-making in 2017 if not for Forex gains.

Huh? Why forex gains you ask?

Well this is a very cute company.

I’m not sure which fool or investment banker suggested it, however, it has about RM1.5 billion to RM1.7 billion in USD denominated loans.

This is also the reason behind the huge losses in 2014 to 2016, and the large turnaround in 2017. Given the increase in USD in 2018 and 2019, i expect massive losses for these years.

It also has a very interesting/creative structure.

The government basically told the company that in exchange for building it, they will pay the company RM7.51 billion in 2031, which is why they have unwinding of non-current receivable on their balance sheets.

And this is also why, despite it currently being in negative equity situation, the bond holders have not gone crazy yet, as the loan amount RM6.4bil is technically still below the amount payable by the government by 2031.

I would actually consider taking bets on there being a restructuring on this company within the next 2 years.

WCE Holdings Berhad (WCEHB: 3565)

And so, after the long grandmother stories (Mark Spitznagel of Universa Investments will be proud), we come to the meat of this article.What is the equity of WCE Holdings Berhad worth?

To find out, we have to ask two questions, the first one being,

Do equity holders of WCE Holdings Berhad get to participate in the meat of this highway concession, ie the construction and maintenance of this highway?

Well, the construction is done by IJM, and I would imagine that as the majority shareholder of the highway (Direct 20% stake in the highway, and 28% stake in WCE Holdings Berhad), they would ensure that any major maintenance or upgrading work, is also done by IJM or its subcontractors.

As IJM and WCE Holdings Berhad minority equity holders are very different entities who benefit from this highway very differently, I think the answer is a “No”.

As minority shareholders, you are unlikely to be benefiting from the meat of this investment.

In this case, the second question is this.

What is the value of your WCE Berhad lottery ticket?

The lucky thing minority investors have going for you, is that the Mamee Family and Surin Upatkoon (the father in law of one of the members of the Mamee Family, also owner of Magnum) is in this together with you, in your exact position.Also, as equity holders, you are actually contributing the higher end of the scale in terms of funding for the project (almost 30%).

Both of which seem to indicate that these people have really really done their homework, which helps you chances abit.

Now, lets do our homework.

To do this, we will use a simple and high level discounted cashflow.

They are a multitude of various different factors and scenarios such as,

- The highway opening in stages;

- Duration of concession likely mismatching by one or two years due to opening in stages;

- Increase in opening loan amounts from interest accumulated during the construction stage;

- Changes in maintenance cost % as the highway gets older;

- Expected upgrading works;

- Loan repayment schedules;

- Potential toll compensation issues messing up the cash flow and incurring opportunity cost.

Etc, etc, the list goes on.

However, the goal here is to roughly correct, not to be precisely wrong. As Warren Buffet once said,

“You don’t need to know the weight of a man to know if he’s fat, nor the age of a women to know if she’s old”

The goal here is to be roughly correct, and err on the conservative side.

If the numbers don’t look obviously good when done from this perspective, well, forme i'll throwing it to the too hard pile,and let whoever is left to figure this out.

To calculate this high level discounted cash-flows, we need to come with reasonable estimates and assumptions.

- Expected Operating Costs or EBITDA%

- Expected Financing Cost

- Traffic Projections

- Expected Concession Asset Value and Expected Income Tax

- Dividend and Discount Rate

- Value of Investment

Expected Operating Costs

Depending on the type of highway, geographic profile, the kind of maintenance agreed in the concession agreement, the age of the highway as well as the efficiency of management involved, the cost of operating a highway when translated to EBITDA is usually around 60-90%.For WCE, it is an Intrastate highway, which means that they usually have higher maintenance cost due to lower economies of scale (a long highway means a lot of mobilization costs).

In addition, Intrastate highways tend to have a higher (Class 2 and 3 – Lorries and Trucks) demographic from long distance shipping. According to conversations to various people, despite these two classes being around 20% of the traffic, they contribute to around 80% of damage done to the pavement due to overloading for these lorries and trucks.

Having said that, a young highway is also cheaper to maintain than an old one.

Now, the operators of Interstate Highways in Malaysia are Anih Berhad and PLUS Berhad, the highways are relatively old (20 - 40 years old), and they record EBITDA of around 60-70%.

For reference, top Urban Highways such as DUKE, KESAS etc can record EBITDA of 80-90% relatively easily.

For WCE, we will assume 80% of the first 10 years, 75% for the next 10 years, and 70% till the end of concession.

This is somewhere in higher end as the other two highways usually use subcontractors to maintain their high. IJM should be able to get the cost slightly lower in view of their deep expertise in construction and road maintenance.

Expected Financing Costs

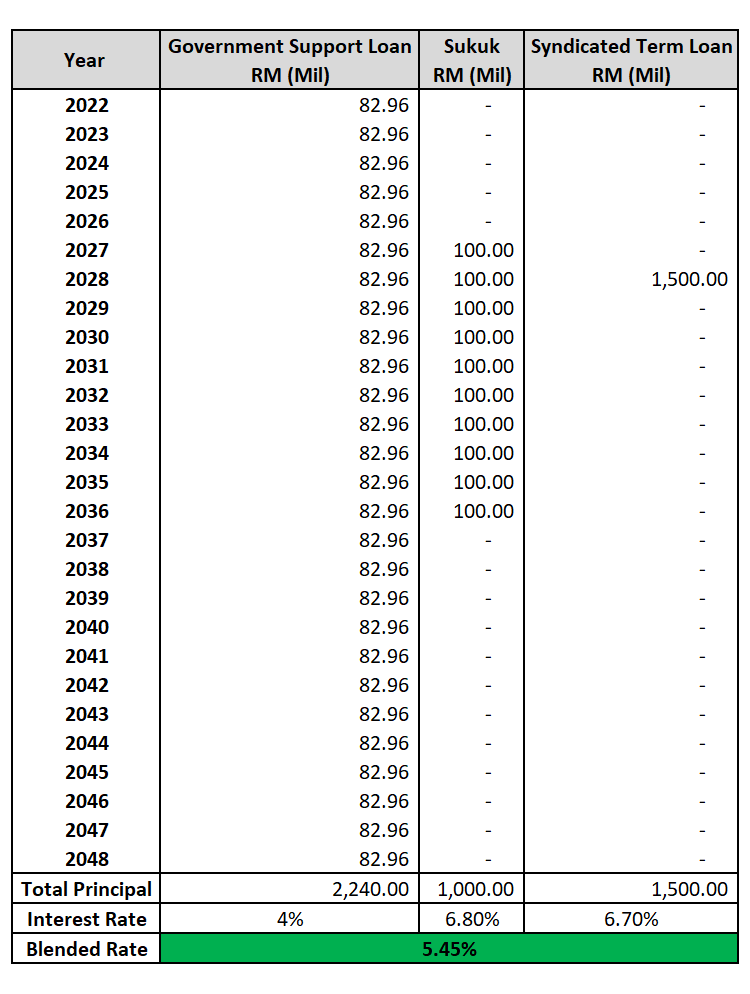

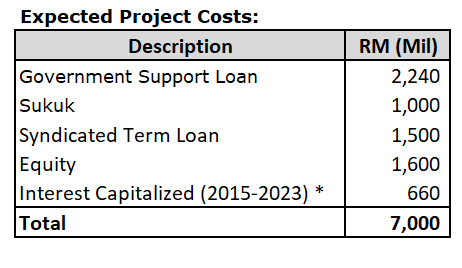

From what I can see in the latest annual reports and right issue documents, by the time the highway is completed, WCE would have used up a borrowing facility amounting to RM4.74 billion.This consist of 3 kinds of loans,

- RM2.24 bil Government Soft Loan (“GSL”) at 4% per annum. Repayment starts 6 years from first drawdown, in 108 equal quarterly installments. First Drawdown was in 2016. Therefore first repayment will be in 2022.

- RM1.00 bil Sukuk issued in 2015. Interest rate is around 6.8%. Repayment starts 12 years from first drawdown, in 10 equal yearly installments.

- RM1.50 bil Syndicated Term Loan. Interest is around 6.7%. Repayment is in 2028 bullet style.

This translates to the table below and a blended rate of 5.45%

Looking at the table above, considering that interest expense is likely to be around RM 290 million per year, i don't think they will generate enough cash flow to meet interest cost for at least the first 10 years.

However, given the long concession period, refinancing is probably possible as long as the traffic is not too bad (we will go into this later).

To make things simple, we will ignore the schedule above, and just assume that all excess cash would go to interest and principal payments (after accounting for a reasonable dividend policy) and that any lumps in the cash-flow will be handled while refinancing.

The goal is to completely repay the borrowings by the last year of the concession period.

Do note, they are also a multitude for covenants (FSCR Ratios, Debt to Equity Ratios etc), as well as making sure the equity is positive in order to pay dividends etc.

But these would really massively complicate things, as i will then need to create a sample balance sheet. Therefore i decided to go with the above method.

Having said that, if the final numbers looked fantastic and it looks viable investment, i would probably proceed to do a full fledged discounted cash-flow, with a balance sheet component in order to better understand the numbers. In this case however, it did not.

Traffic Projections

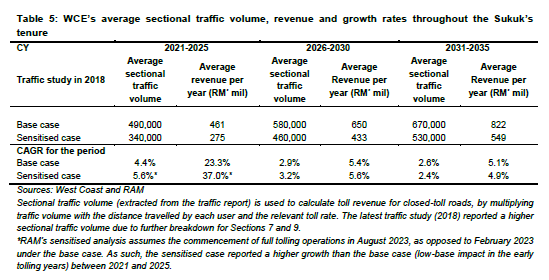

In WCE’s latest Bond Rating Report by RAM Rating, they provided some information on the traffic projections used by WCE Holdings Berhad. (If you want one you need to pay RM500 for one copy, i happened to have a friend, so that helps).

Looking at the numbers, they appear to be projecting a long-term traffic growth of around 2.4 – 3.2%.

If you notice, revenue growth is actually about double that of projected traffic growth, this is likely due to toll rate increase. Using some back of envelope calculation, it appears that the toll rates are increased by 10% every 5 years. Initial revenue is expected to be between RM275 million to RM461 million.

Do these numbers look accurate?

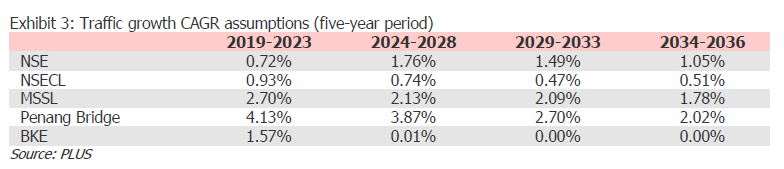

Well, lets compare them with North South Expressways, whose highway is parallel to WCE's.

Looking at PLUS Berhad’s projected traffic growth, as per their latest MARC Bond Rating Report (Again RM 500 to buy, I love my friends), for the North South Expressways, traffic growth for 2019 is only 1%.

As I understand, the 2019-2023 traffic projections is lower as it includes impact from the West Coast Expressways (WCE). Looking at the rest of the years, it looks like 1.5% is probably a reasonable long-term estimate for North South Expressways.

Now, just by comparing the traffic projections for both WCE and PLUS, there is clearly a huge difference.

There both used different traffic consultants, this means one of these consultants is much more wrong than the other.

Why is this the case you may ask?

Because in truth, projections says more about the people projecting it than that of the underlying reality.

Again, listen to Charlie Munger, track the incentives.

Traffic consultants are not governed by any strict supervisory body (unlike Auditors) and they are hired by the management.

Whose bread I eat, his song I sing (to a point, in general).

Having said that, North South Expressway's traffic projection is backed by 20 years of traffic data, while WCE’s is basically castle on the clouds.

Therefore, we will be using North South Expressway's traffic projections as a base.

Now, it is important to note that this 1.5% traffic growth, includes Selangor, Kuala Lumpur, as well as Johor Bahru, which are likely have traffic growth that is higher than the average for North South Expressways.

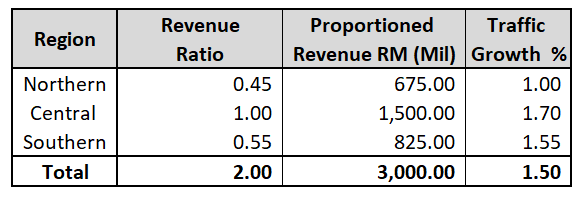

To simplify things, we will just split the highway into three portions, called Northern, Southern and Central.

In addition, in PLUS’s annual report (they are not listed by the way), they announced RM3.7 billion in toll revenue (excluding toll compensations), as the revenue is not split by concession (they own 5 highways altogether), we need to think of a reasonable estimate.

As two of the concessions are basically intertwined (North South Expressway & North South Expressway Central Link.), I’m just going to make a high level projection, and say that both of them amount is about RM3 billion (this proportion also makes sense in terms of what was seen in terms of traffic volumes stated in the report).

Now, we will now do a high-level estimate and try to obtain the growth and revenue by region. This is where it becomes more speculative, but we will try to be as reasonable as we can, and err on the side of conservatism.

We start by identifying the characteristics of each region, before coming up with some assumptions and estimates.

Characteristics of Each Region.

Central Region

This region holds the bulk of Malaysia’s economic development and thus should logically have the highest traffic growth and toll revenue.

Look at it from economic development wise, car ownership in each region etc, it would be reasonable to say it’s toll revenue is the combined of both Southern and Northern Regions.

Northern Region

Other than Penang, which is a really small island, in terms of economic development, it should be the lowest of all regions.

Perak, Kedah, Kelantan etc are not known for their economic prowess after all. Therefore, we can say that traffic growth and toll revenue should be the lowest among the 3.

Southern Region

This area includes Johor Bahru, which due to its closeness with Singapore, should do better.

However, it also includes areas like Negeri Sembilan and Melaka and the other parts of Johor, which are not exactly economic powerhouses.

On net basis, it should at minimum do better than the Northern Region, but not by much. Let’s say 20% better.

All this translates to the following assumptions.

I think this is a relatively reasonable one and if it errs, its probably on the side of conservatism.

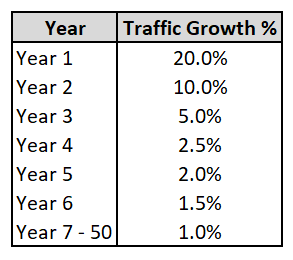

Now that we have our long-term growth, we now need to really think about its initial growth rates (as a new highway grows faster at the first few years before stabilizing), as well as the Initial Revenue.

For Initial Traffic Growth, I decided to use the following,

Again, it seems conservative enough for me, i think a stronger initial pop may happen as it is about 50km from NSE, despite being parallel, however, again we strive to err on the side of conservatism.

What about the Initial Revenue then?

Well, as per the table above, Northern Revenue for North South Expressways is around RM675 million per year.

According to RAM Rating, WCE’s traffic consultants projected RM471 million (RAM sensitized it to RM 275 million) in revenue per year.

This represents somewhere between 40% (RAM Sensitized) - 70% of North South Expressways Northern Revenue.

Since WCE is expected to take away some traffic from North South Expressways, this amount seems a little high to me, especially since PLUS have lowered the toll rates by 18%, bringing it to around 11.45 sen per km in the article above.

How much is WCE’s toll rate then?

The information is not public, however, according to the article above, it is estimated to be 13.7 sen to 15.53 sen per km.

This appears to be corroborated by this article at the end of 2018, stating that it should be in line with PLUS’s 13.96 sen per km, according to a minister.

My guess is that it’s probably somewhat higher that North South Expressways. As if it was lower, they would have answered it clearly.

This is not good news.

However, to be fair, WCE is also banking on vehicles that uses the free federal roads to use their highways as well, as its likely to be more convenient and a better drive.

However, one should also note that the Northern Federal Roads are actually quite well maintained, without much traffic jam, in which case i'm not sure how much traffic will transition to WCE's more expensive highway.

So, what’s the right number?

I have no idea, but if I to put some money on it, a predict a number that is within 30% lower of the actual future traffic, i would say around RM 200 million, which is far lower than what was represented by management and sensitized by RAM Rating.

Expected Concession Asset Value and Expected Income Tax

Now back to the other assumptions, we also need to calculate the Expected Income Tax. As the income tax is likely to be determined by the profit for the year, which will need to include the expected amortization rate, we will need to derive it by identifying the Expected Concession Asset Value.And then amortize it using the revenue for the year, against the total projected revenue.

For the project cost/ highway cost, i'll be using this amount. The interest capitalized is around 3% of the entire project cost from 2015 to 2023. This is about half of the current interest rate.

I did this to account for the fact that the loan is progressively drawn down.

For the tax rate, we will use the current corporate income tax, which is 24%.

For losses brought forward (to be used to reduce tax), i will assume that the current 7 year law applies till the end of concession.

Dividend and Discount Rate

For the dividend, we will just massage it to have it fit such that the all borrowings is paid off at the end of the concession period.Discount rate of 4% is used. This is the current 30 year MGS (not sure if it changed with).

Some will think its a little, low, but for me, i am already adjusting in the margin of safety via all the other assumptions, and we will also compared it against the current share price later (difference is the margin pf safety).

I'd rather do it this way than make my life unnecessarily complicated.

Value of Investment

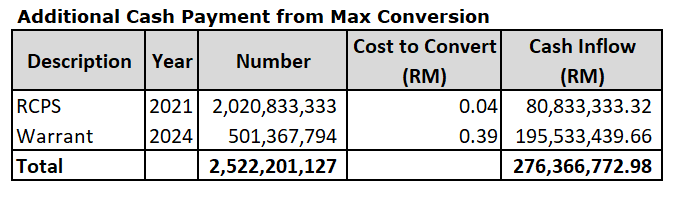

Now for value of investment, this is to identify out what is will be the NPV per share. Again for this, we will go the most conservative route.To identify our number of shares, we refer to the right issue prospectus. According to the prospectus, under the maximum scenario, the maximum number of shares is ~3,509,575,000 shares.

This assumes that all RCPS currently held by shareholders will be fully converted to new WCE Holdings Berhad shares, by surrendering one RCPS together with the required cash payment, for one new share of WCE Holdings Berhad.

It also assumes that the Warrants currently held by the shareholders will be fully exercised in the First Exercise Period at RM0.39 per warrant.

This expands the number of shares to ~3,509,575,000 shares from the current ~1,297,000,000 shares.

This expands the number of shares by around 171%. Dropping the final valuation by that amount.

In any event, if as an investor you think the shares are valuable, you would want to exercise the warrants, and in this case, all of them thought so and did so.

I accounted for the cash inflow as a positive in the Cash-flow workings, as we are already dividing it over the maximum number of shares.

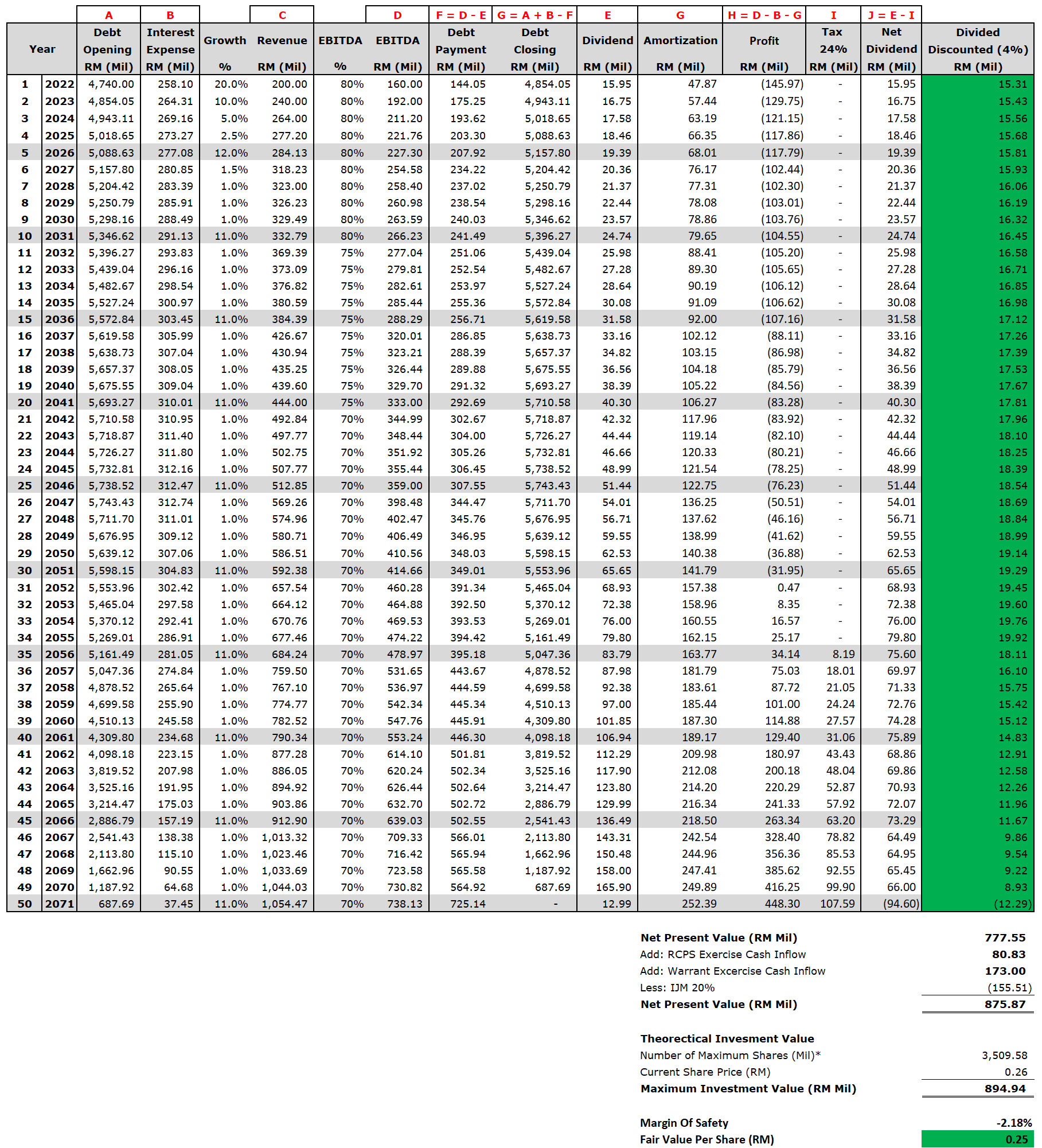

WCE Highway High Level Cashflow

Given all of the above assumptions, what does the cash-flow look like?

Using realistic assumptions (that err somewhat on the side of being conservative, in terms of your Initial Revenue and Number of Shares), your lottery ticket is worth about RM0.25 sen per share.

This is about 2.18% lower than the current market price.

Having said that, these numbers hinges on one very important thing, which is that toll rate increases at 10% every 5 years. I think this accurate, but we need actual confirmation on this.

Even then, it does not look that attractive to me.

Also, remember, these numbers does not consider the possibility of toll compensations being lower than what is supposed to be received (traffic caps) and delays in toll compensation etc.

Having said that, my guess is that the traffic caps will not come into play when toll compensation is calculated as my projected traffic used is so much lower than that of management’s, which would have been used in negotiating the toll concession.

I think considering the conservatism I took in calculating this, this fair value should more than account for toll compensation delays etc.

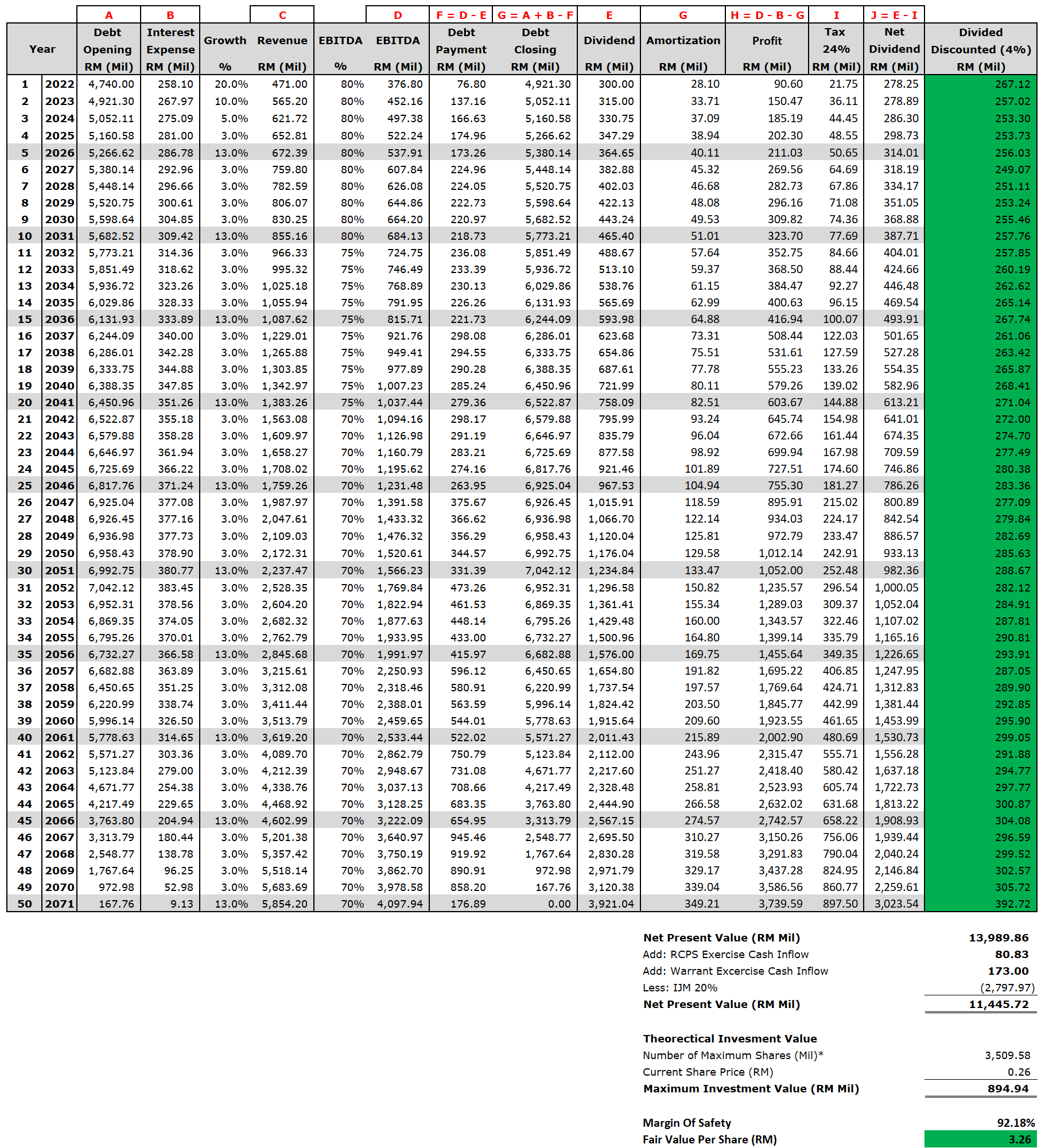

Now, if you were to decide to use managements traffic projection, and instead of RM200 million and 1% growth, and replace it with RM471 million and 3% growth.

Your lottery ticket will be worth about 13 times more or RM3.26.

But these numbers would be a real stretch and quite frankly, I don’t think it’s possible in this world.

If this was another reality where for some reason, Singapore did not separate from Malaysia, and this new Malaysia was didn't have Race, Religion and Royalty completely baked into our culture, enabling the kind of economic development across the Northern Region that can give rise to this kind of traffic growths, this may be possible.

But there is a price for everything.

Conclusion

With that i end this piece.Having said that, for the current shareholders, my assumptions are probably quite conservative, and if its only 2% below market price given these very strong assumptions, its not all bad.

In addition, you have a relatively decent property development arm in WCE Holdings Berhad.

With some luck, the RCPS will not be fully converted, enabling the fair value per share to go up. And that the warrant expire in 2024 and 2029 mostly unconverted, enabling your per share value to increase significantly.

Of course, this is all predicated the current cash being sufficient, and that there is no additional cash calls.

I hope this is the case.

One thing i did find particular impressive about when writing this article, is the fact that this highway concession is not completely underwater when using my assumptions. It's actually still likely to be profitable, just severely impaired.

This for me speaks volume about how good a deal this was back in 2015.

Of course, an alternative explanation is that the low traffic growth for the last 4-5 years is just cyclical.

Though i would struggle to think of any reason why its mostly cyclical, as we've had boom years in that period.

If i had to make a guess, i would say that this is from income for the middle and bottom half of society having not as grown much in the last 5-10 years.

This resulted in many people deciding to use Motorcycles instead of Cars. (In exchange, this particular trend gave rise to companies like AEON Credit, who are now recording super-normal profits)

As always, if you feel i'm wrong, or missed out on anything, please let me know.

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Website: www.choivocapital.com

Email: choivocapital@gmail.com

https://klse.i3investor.com/blogs/PilosopoCapital/2020-05-25-story-h1507833761-_CHOIVO_CAPITAL_Why_Highways_are_a_Gruesome_Industry_WCE_Holdings_Berha.jsp